An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Missouri General Form of Irrevocable Trust Agreement

Description

How to fill out General Form Of Irrevocable Trust Agreement?

If you need to finish, obtain, or print legal document templates, use US Legal Forms, the largest selection of legal forms, which are accessible online.

Utilize the site’s simple and user-friendly search to locate the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Missouri General Form of Irrevocable Trust Agreement within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Missouri General Form of Irrevocable Trust Agreement.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

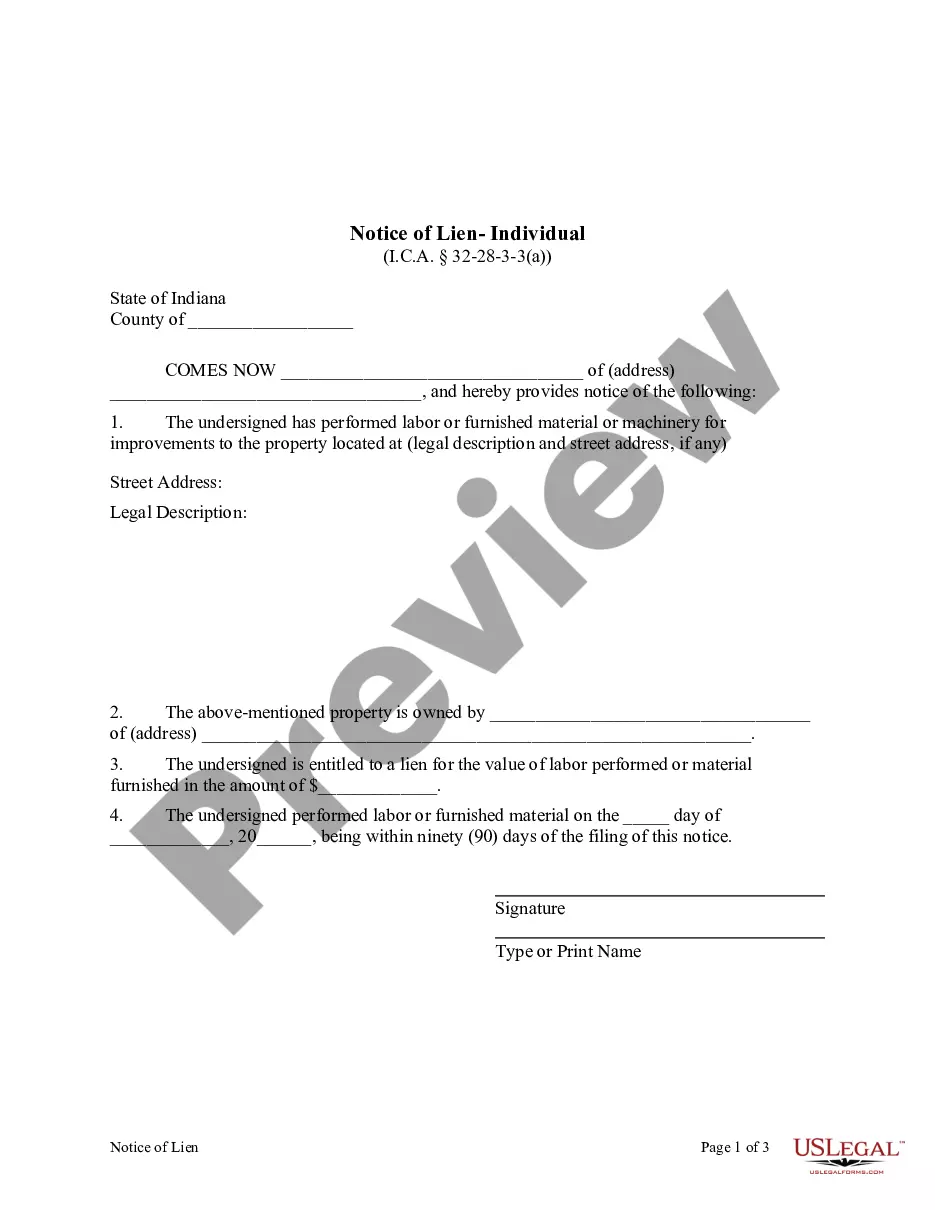

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

When the grantor of an irrevocable trust dies, the trust typically remains intact and continues to operate according to its terms. The successor trustee steps in to manage the trust assets and distribute them to the beneficiaries as outlined in the trust document. Utilizing the Missouri General Form of Irrevocable Trust Agreement ensures that these processes are clearly defined, providing peace of mind.

Yes, you can write your own trust in Missouri, but it is crucial to ensure that it meets the state’s legal requirements. Using a reliable resource like US Legal Forms can guide you in drafting a comprehensive instrument, such as the Missouri General Form of Irrevocable Trust Agreement, to avoid legal complications down the line.

Individuals may choose an irrevocable trust for various reasons, including asset protection, tax benefits, and ensuring specific distributions to beneficiaries. This trust type often helps in Medicaid planning and reducing the taxable estate. By utilizing the Missouri General Form of Irrevocable Trust Agreement, you can create a solid plan that aligns with your long-term goals.

In an irrevocable trust, the trust itself owns the assets, not the grantor. Once the grantor transfers assets into the trust, they relinquish control over those assets. This structure is beneficial for estate planning, as outlined in the Missouri General Form of Irrevocable Trust Agreement, allowing for effective tax management and asset protection.

An irrevocable trust document is a legal arrangement that cannot be altered or terminated by the grantor once it is created. This document outlines the management and distribution of assets within the trust. The Missouri General Form of Irrevocable Trust Agreement serves as a standard template that helps individuals set up this type of trust securely.

To obtain a copy of a trust document in Missouri, you typically need to contact the trustee or the individual who created the trust. If the trust is irrevocable, the trustee is responsible for managing it and providing any necessary documents to beneficiaries. Additionally, you can use platforms like US Legal Forms for templates and guidance on trust documentation, including the Missouri General Form of Irrevocable Trust Agreement.

Yes, in Missouri, a trust generally needs to be notarized to be valid, especially a Missouri General Form of Irrevocable Trust Agreement. Notarization helps to verify the identity of the parties involved and confirms that the trust document is signed willingly and without coercion. This added step adds a layer of security and legitimacy to the trust. Always check with a legal professional or use resources from uslegalforms to ensure compliance with necessary legal standards.

One of the most significant mistakes parents often make is failing to communicate their wishes effectively with their children. When setting up a trust fund, clarity about the trust's purpose and the distribution criteria is crucial. Additionally, not regularly reviewing or updating the trust can lead to unforeseen complications. A well-prepared Missouri General Form of Irrevocable Trust Agreement can avoid these issues by establishing clear intentions and guidelines.

To fill out a Missouri General Form of Irrevocable Trust Agreement, start by gathering all necessary information about the trust, including details of the grantor, trustee, and beneficiaries. Next, clearly outline the terms of the trust, specifying how and when assets will be distributed. It’s important to review the document thoroughly and ensure all sections are complete before signing. Utilizing a trusted platform like uslegalforms can help simplify this process and ensure all legal requirements are met.

The governing document for a trust is the trust agreement itself, as it dictates how the trust operates. This document outlines the roles of the trustee and the beneficiaries, as well as the rules for managing the assets. By employing the Missouri General Form of Irrevocable Trust Agreement, you can create a comprehensive governing document that protects your wishes. A solid governing document is vital for the effective administration of any trust.