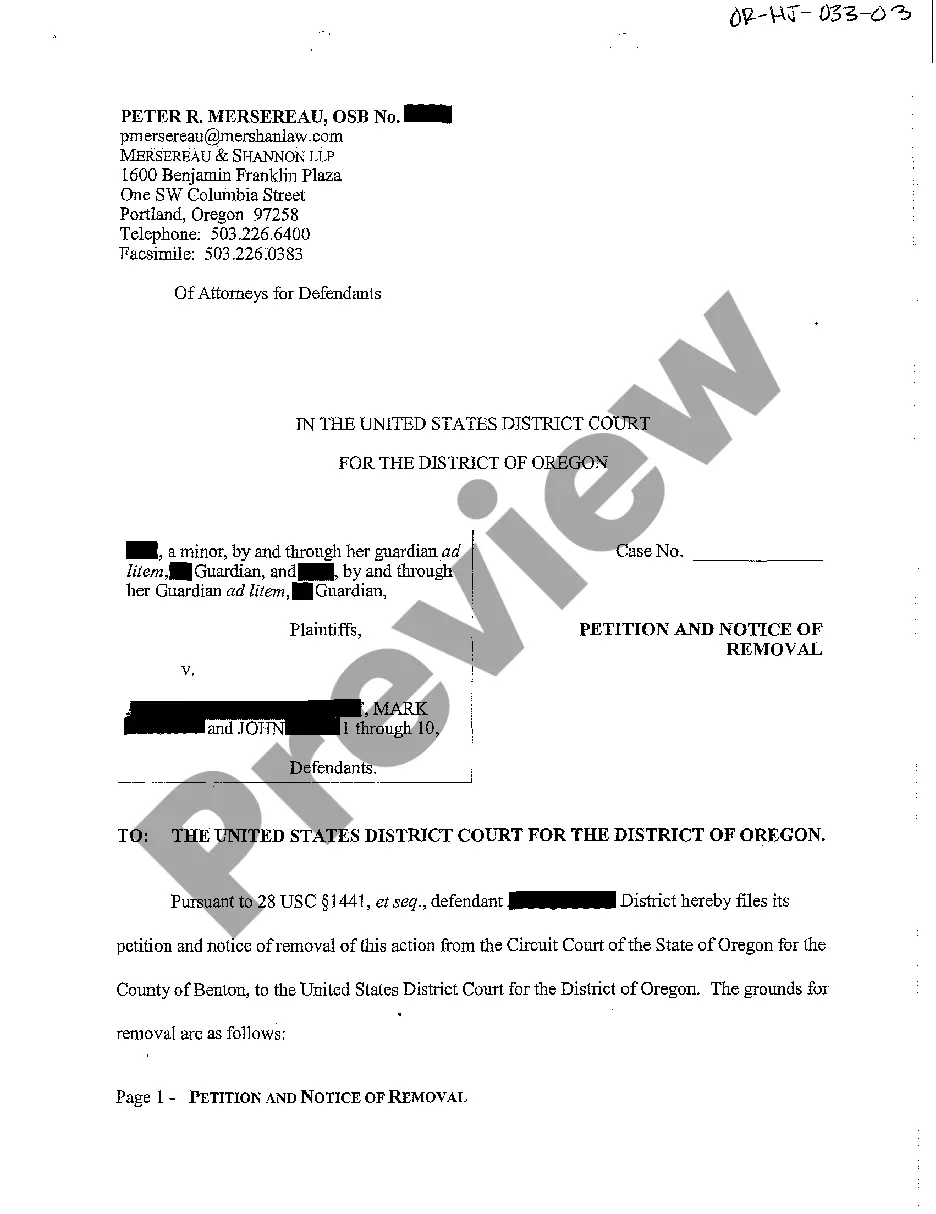

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Missouri Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for both business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms such as the Missouri Notice of Default in Payment Due on Promissory Note in mere moments.

Review the form details to confirm that you have selected the right form.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the appropriate one.

- If you already hold a subscription, Log In and retrieve the Missouri Notice of Default in Payment Due on Promissory Note from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously obtained forms via the My documents section of your account.

- If you are looking to use US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your location.

- Click on the Preview button to review the content of the form.

Form popularity

FAQ

Yes, a promissory note can hold up in court if it meets specific legal requirements. When properly drafted, it serves as a binding agreement enforceable with a Missouri Notice of Default in Payment Due on Promissory Note. Courts recognize these documents as valid when clear terms are established, including the amount owed and repayment schedule. To strengthen your position, ensure you retain a copy of the note and any related communications.

If someone defaults on a promissory note, you should first review the terms outlined in the note. It’s essential to send a Missouri Notice of Default in Payment Due on Promissory Note to formally notify the borrower of their default status. This document acts as a crucial step in protecting your rights and may initiate negotiation discussions. If resolution is not reached, consider consulting a legal professional to explore further actions.

Yes, there is a time limit on promissory notes, primarily defined by the applicable statute of limitations, which is generally five years for written promissory notes in Missouri. This duration starts from the due date of the payment. If you're issued a Missouri Notice of Default in Payment Due on Promissory Note, it’s essential to respond promptly. Utilizing resources like US Legal Forms can help you manage these time-sensitive matters effectively.

The statute of limitations on a written contract in Missouri is typically five years from the date of the breach. This means that a party has five years to file a lawsuit after the contract terms have not been honored. If you receive a Missouri Notice of Default in Payment Due on Promissory Note, knowing this time frame can be crucial in making informed decisions. Legal guidance might be beneficial during these circumstances.

A notice of default in Missouri is a formal declaration that a borrower has not met the payment obligations outlined in their promissory note. The Right to Cure allows borrowers a specific period to rectify their payment deficiencies, preventing further legal action. Understanding the implications of a Missouri Notice of Default in Payment Due on Promissory Note can help you navigate these situations. It ensures that you are well-informed about your rights and responsibilities.

Writing a notice of default involves outlining the details of the defaulted promissory note clearly. Start by including the borrower's information, the amount owed, and the specific terms that have been violated. Be sure to mention that this is a Missouri Notice of Default in Payment Due on Promissory Note, and indicate any timeframes for remedying the default. Clear communication can lead to a quicker resolution.

Yes, it is possible to default on a promissory note if the borrower fails to make scheduled payments. This can lead to serious consequences, including legal action. If you find yourself in such a situation, consider consulting with a legal professional for guidance. Additionally, sending a Missouri Notice of Default in Payment Due on Promissory Note may help clarify obligations.

When someone defaults on a promissory note, your first step should be to reach out to the borrower to discuss the issue. If informal communication does not yield results, send a Missouri Notice of Default in Payment Due on Promissory Note to formally address the default. If the borrower still does not respond, you may need to explore legal options to recover the owed amount.

To legally enforce a promissory note, you must ensure that it is valid and properly executed. If the borrower defaults, you can issue a Missouri Notice of Default in Payment Due on Promissory Note. If the situation remains unresolved, consider filing a lawsuit to seek a court order for repayment. Always maintain clear documentation of all interactions and agreements.

Collecting on a default promissory note involves several steps. Begin by reaching out to the borrower to discuss repayment options. If communication fails, draft and send a Missouri Notice of Default in Payment Due on Promissory Note to inform them of the situation. Depending on the response, you may need to escalate the matter legally.