Missouri Release of Liability Form for Homeowner

Description

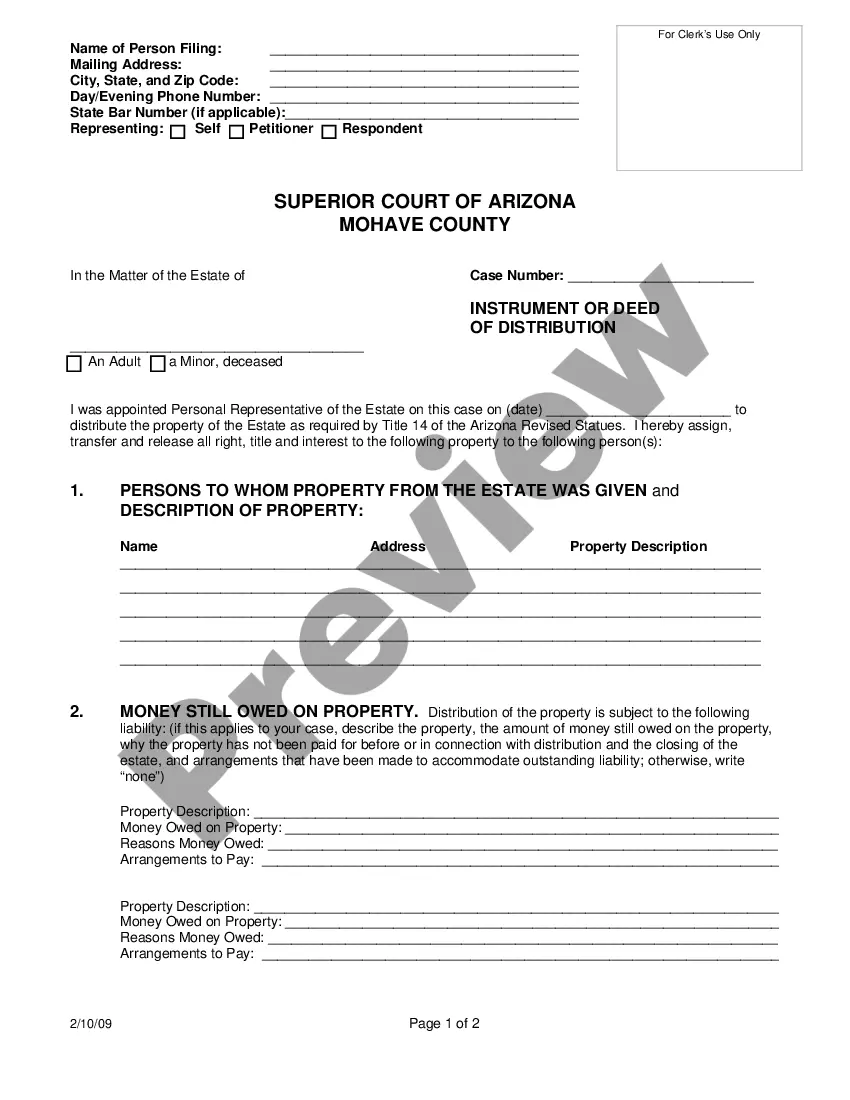

How to fill out Release Of Liability Form For Homeowner?

Have you ever found yourself in a situation where you frequently require documents for either business or personal purposes almost every day.

There are numerous authentic document templates accessible online, but locating ones you can rely on isn’t simple.

US Legal Forms offers thousands of form templates, including the Missouri Release of Liability Form for Homeowner, designed to comply with federal and state regulations.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a suitable document format and download your copy. You can retrieve all the form templates you have purchased in the My documents section. You can download or print the Missouri Release of Liability Form for Homeowner anytime you need it. Click on the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Missouri Release of Liability Form for Homeowner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for the correct city/state.

- Utilize the Preview button to review the form.

- Examine the details to ensure you have selected the right form.

- If the form isn’t what you’re searching for, use the Lookup section to find the form that suits your needs.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

You can obtain a Missouri Release of Liability Form for Homeowner easily through various online platforms, including USLegalForms. This platform offers a wide range of customizable waiver forms tailored to meet your specific needs. Simply visit the site, select your required form, and follow the instructions for download and completion. Using USLegalForms ensures you have access to vetted and legally compliant documents.

The Missouri Release of Liability Form for Homeowner does not generally require notarization to be effective. However, having the document notarized can add an extra layer of security, especially if you plan to enforce it in court. Notarization helps verify the identities of the parties involved, which strengthens the validity of the agreement. Always consult a legal expert to ensure you meet all requirements for your specific situation.

The time it takes to obtain a mortgage lien release can vary based on lender policies and state regulations. Typically, it may take anywhere from a few weeks to a couple of months. If you have a Missouri Release of Liability Form for Homeowner completed, it may expedite the review process. Working with US Legal Forms can provide essential guidance and pre-prepared forms to help facilitate this request.

Removing someone from your mortgage without refinancing typically requires a process known as a 'mortgage release' or 'novation.' You need to contact your lender, explain your situation, and request the removal. Having a Missouri Release of Liability Form for Homeowner drafted can help protect both parties as you navigate this process. US Legal Forms offers resources to assist you in preparing the necessary documentation.

Obtaining a release of liability on your mortgage involves submitting a written request to your lender, specifying your situation. They may require documents proving you’ve met the obligations outlined in the original mortgage agreement. It's crucial to have the Missouri Release of Liability Form for Homeowner ready, as it may be requested during the process. Consulting with US Legal Forms can help you draft the necessary documents correctly.

To create a Missouri Release of Liability Form for Homeowner, start by identifying the parties involved and the specifics of the situation. Clearly outline the activities covered by the form and include a statement of assumption of risk. It's advisable to have the form reviewed by a legal professional for compliance and effectiveness. You can also use platforms like US Legal Forms, which provide templates that simplify the process.

Release of liability forms do not always need to be notarized in Missouri, but it is good practice to have them notarized for added authenticity. Notarization can provide a greater level of assurance that all parties are fully aware and agree to the terms outlined in the Missouri Release of Liability Form for Homeowner. While notarization is not a strict requirement, it can enhance the document's legal standing. When in doubt, consulting a legal professional can offer guidance tailored to your specific situation.

An example of a liability clause can be: 'The homeowner shall not be liable for any injuries sustained during the event, regardless of the cause.' This clause emphasizes that the homeowner does not assume responsibility for accidents. It is a vital component of the Missouri Release of Liability Form for Homeowner, clearly communicating risks to participants. Using this clause effectively minimizes the homeowner's exposure to legal claims.

A typical example of a release of liability clause could state: 'I, the undersigned, voluntarily accept and assume all risks related to the activity and release the homeowner from all claims.' This type of clause is crucial for protecting homeowners from unexpected legal actions. Incorporating this clause into your Missouri Release of Liability Form for Homeowner not only safeguards your interests but also informs participants about their responsibilities.

An example of a release clause might read: 'The participant acknowledges the risks involved in the activity and hereby releases the homeowner from any liability for injury or damage.' This clause ensures that the participant accepts responsibility for any potential accidents. Including this type of language in your Missouri Release of Liability Form for Homeowner provides clarity and protection for both parties. Make sure your example fits the specific context of your situation.