This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Missouri Agreement between Mortgage Brokers to Find Acceptable Lender for Client

Description

How to fill out Agreement Between Mortgage Brokers To Find Acceptable Lender For Client?

Choosing the best authorized record design might be a struggle. Obviously, there are plenty of templates available on the Internet, but how will you obtain the authorized type you want? Use the US Legal Forms website. The service delivers a huge number of templates, for example the Missouri Agreement between Mortgage Brokers to Find Acceptable Lender for Client, which you can use for business and private demands. Every one of the varieties are checked out by specialists and meet state and federal requirements.

Should you be previously listed, log in in your account and click the Acquire key to have the Missouri Agreement between Mortgage Brokers to Find Acceptable Lender for Client. Make use of your account to check with the authorized varieties you may have ordered earlier. Check out the My Forms tab of the account and have another backup of the record you want.

Should you be a whole new user of US Legal Forms, allow me to share straightforward instructions for you to comply with:

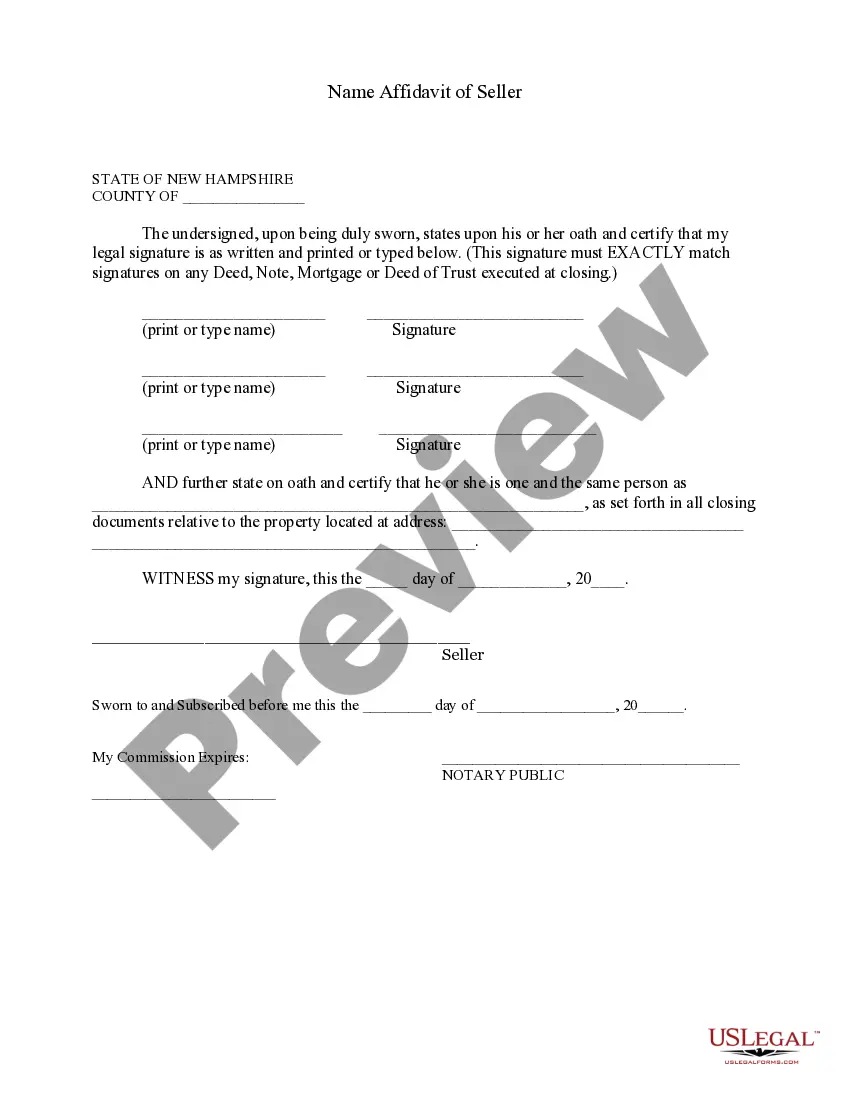

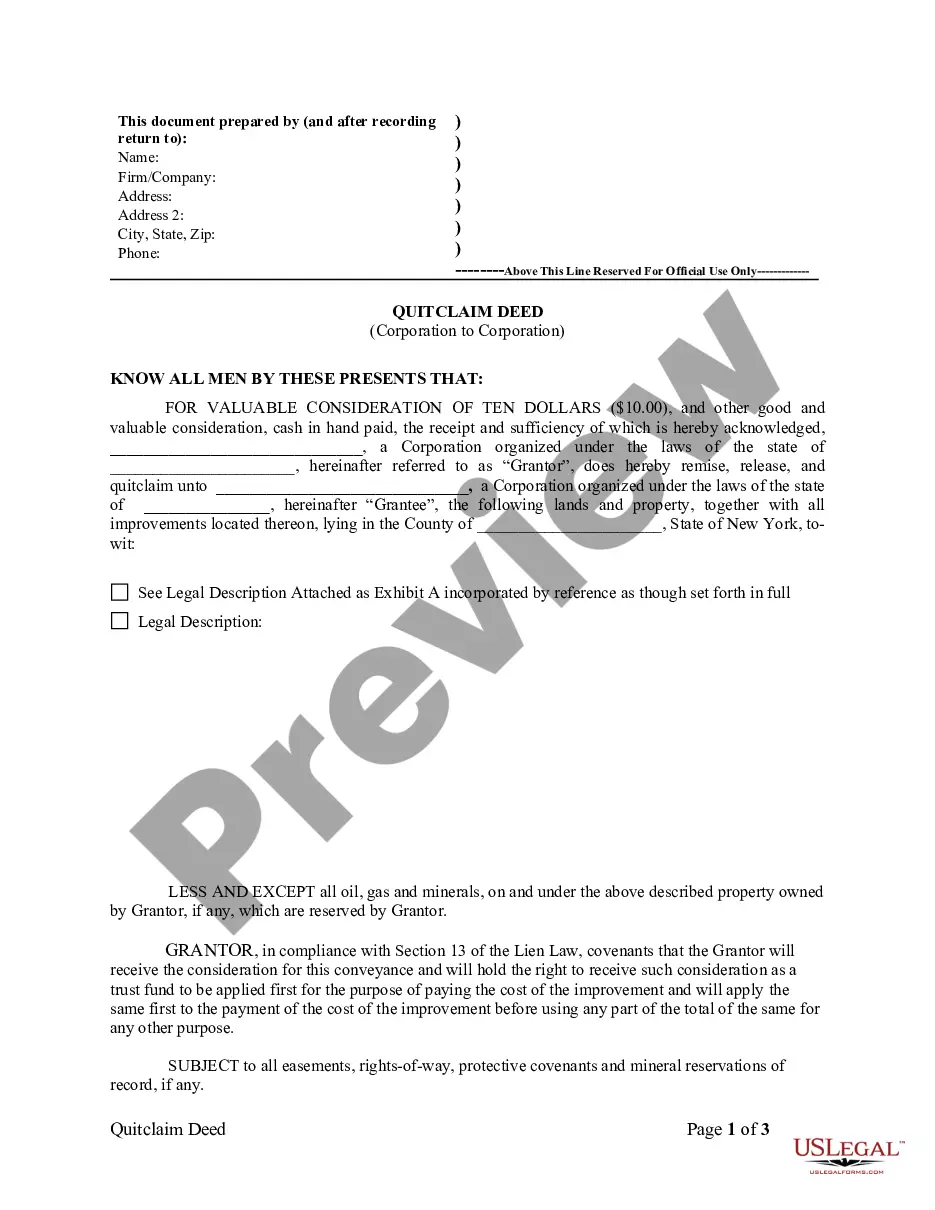

- Very first, make certain you have selected the proper type for the town/area. It is possible to look over the shape while using Review key and look at the shape outline to make sure this is the best for you.

- In the event the type will not meet your preferences, make use of the Seach area to obtain the right type.

- When you are certain that the shape is proper, select the Purchase now key to have the type.

- Choose the rates program you desire and enter in the required information. Create your account and buy your order making use of your PayPal account or Visa or Mastercard.

- Select the data file structure and acquire the authorized record design in your gadget.

- Full, modify and print out and signal the obtained Missouri Agreement between Mortgage Brokers to Find Acceptable Lender for Client.

US Legal Forms will be the biggest local library of authorized varieties that you can find different record templates. Use the service to acquire professionally-produced paperwork that comply with state requirements.

Form popularity

FAQ

A mortgage broker is a third party who will act on your behalf to arrange your home loan application. Instead of working directly with a bank or financial institution, a mortgage broker can work with various lenders to find the right home loan for you. What is a mortgage broker & what do they do mortgagechoice.com.au ? guides ? what-is-a... mortgagechoice.com.au ? guides ? what-is-a...

Using a mortgage broker to take out a mortgage can be quicker and easier than comparing deals and applying for a mortgage directly with a mortgage lender. This is particularly true if your financial situation means you risk being turned down for a mortgage by certain lenders.

"A mortgage broker, essentially, is a conduit between the buyer and the bank. Instead of someone going straight to the bank to get a loan, they can go to a mortgage broker who will have access to a whole lot of different lenders - quite often a panel of up to 30 different lenders.

Lack of familiarity: You'll need to deal with a new person during your application. Free: Brokers are paid by lenders, not by you. No access to some lenders: Not all lenders work with brokers.

Using multiple brokers can be advantageous especially if you have already used a broker that isn't whole of market and they're struggling to provide you with a mortgage. But, in most cases it is best to vet your broker upfront and use a whole of market broker with an exemplary reputation. Can I Work with Two or More Mortgage Brokers at the Same Time? boonbrokers.co.uk ? multiple-mortgage-brokers boonbrokers.co.uk ? multiple-mortgage-brokers

A mortgage broker acts as an intermediary by helping consumers identify the best lender for their situation, while a direct lender is a bank or other financial institution that decides whether you qualify for the loan and, if you do, hands over the check.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances. What Is a Credit Agreement? Definition, How It Works, Example investopedia.com ? terms ? creditagreement investopedia.com ? terms ? creditagreement