Dear [Recipient], I am writing to bring to your attention the Missouri Free Port Tax Exemption program and provide you with a detailed description of its benefits and the different types of sample letters available for your convenience. The Missouri Free Port Tax Exemption program is a valuable initiative aimed at promoting economic growth and supporting businesses involved in international trade. This program allows eligible businesses to avoid property taxes on goods held temporarily in the state of Missouri before being exported to another country. There are several types of Missouri Sample Letters concerning Free Port Tax Exemption that can be utilized depending on the nature and needs of your business. These letters serve as official documentation to request or notify relevant authorities about your intention to claim the tax exemption. The different types are: 1. Request for Free Port Tax Exemption: This letter is used to formally request the Free Port Tax Exemption for specific goods held temporarily in Missouri. It includes necessary information such as the description and value of the goods, intended export destination, and supporting documents. 2. Lease Agreement Notification: In some cases, businesses may lease or rent space in a designated free port area. This letter is used to notify the authorities of the lease agreement and the goods that will be stored temporarily, ensuring compliance with the Free Port Tax Exemption program. 3. Change of Goods Notification: If there are any changes in the nature or quantity of goods originally requested for tax exemption, this letter is used to inform the authorities about the modifications. 4. Termination of Tax Exemption Agreement: Should your business decide to terminate the tax exemption agreement or no longer require the services of the designated free port area, this letter is used to formalize the termination process. It is crucial to ensure that all required information is included in your sample letter to maximize the chances of successfully obtaining the Free Port Tax Exemption. Accuracy and completeness are vital to comply with the regulations and avoid any potential penalties or delays. Remember to consult with an attorney or tax specialist to determine your eligibility and ensure compliance with the Missouri Free Port Tax Exemption program's guidelines. Additionally, you can find templates and further guidance on the official Missouri Department of Revenue website. We hope that this detailed description and information regarding the different types of Missouri Sample Letters concerning Free Port Tax Exemption will assist you in navigating the tax exemption process smoothly. Thank you for your attention, and please feel free to reach out if you have any further questions or require assistance. Sincerely, [Your Name] [Your Title/Organization] [Contact Information]

Missouri Sample Letter concerning Free Port Tax Exemption

Description

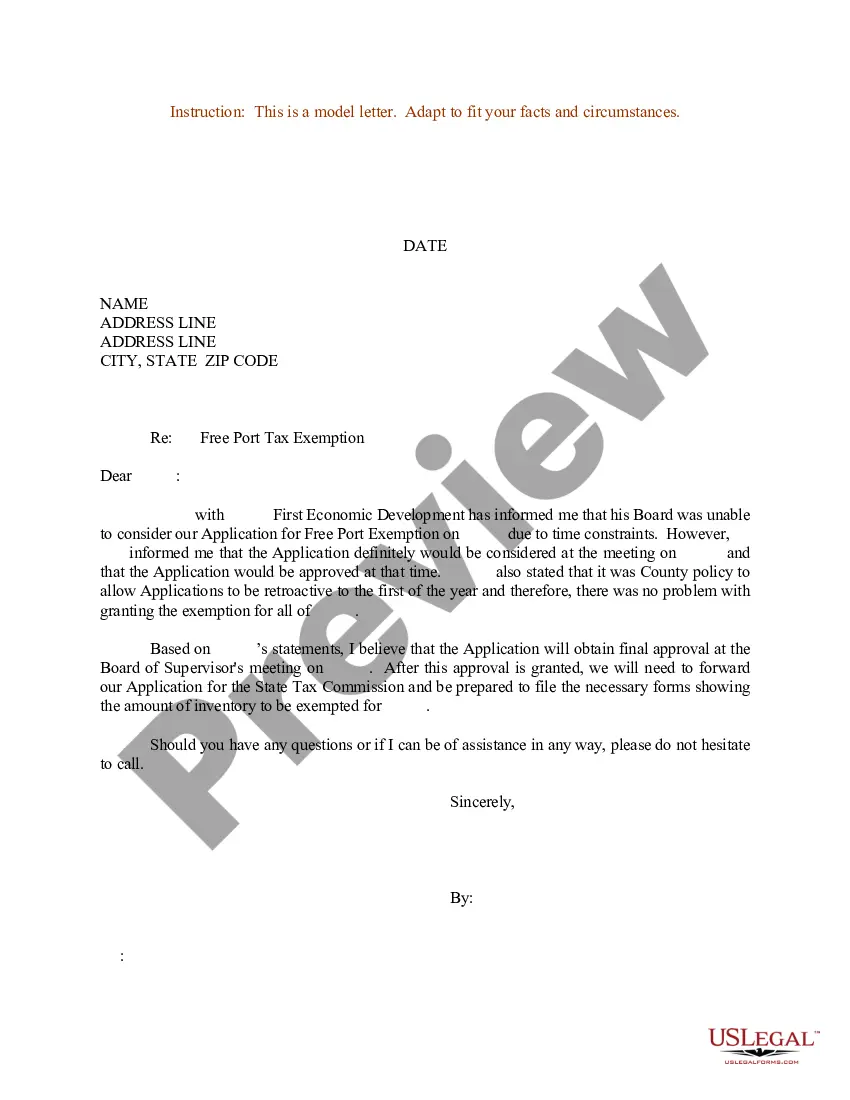

How to fill out Missouri Sample Letter Concerning Free Port Tax Exemption?

Finding the right legal record design might be a struggle. Needless to say, there are plenty of layouts available online, but how can you find the legal form you want? Utilize the US Legal Forms site. The assistance provides a large number of layouts, for example the Missouri Sample Letter concerning Free Port Tax Exemption, which you can use for company and private requirements. All of the varieties are examined by professionals and meet state and federal needs.

In case you are already signed up, log in to your profile and then click the Acquire option to have the Missouri Sample Letter concerning Free Port Tax Exemption. Utilize your profile to check with the legal varieties you have ordered formerly. Visit the My Forms tab of your profile and get another backup of your record you want.

In case you are a brand new end user of US Legal Forms, listed below are straightforward guidelines that you can stick to:

- First, make certain you have chosen the appropriate form for your personal area/area. You are able to look over the form making use of the Review option and browse the form information to guarantee this is basically the best for you.

- In the event the form will not meet your expectations, use the Seach area to discover the proper form.

- Once you are certain the form is suitable, click on the Get now option to have the form.

- Pick the pricing program you would like and enter the necessary details. Create your profile and purchase your order using your PayPal profile or bank card.

- Select the submit file format and down load the legal record design to your product.

- Complete, edit and printing and sign the attained Missouri Sample Letter concerning Free Port Tax Exemption.

US Legal Forms is definitely the biggest collection of legal varieties in which you will find numerous record layouts. Utilize the service to down load expertly-produced papers that stick to express needs.