If you want to total, obtain, or printing legal record templates, use US Legal Forms, the greatest variety of legal types, that can be found on-line. Use the site`s simple and hassle-free research to discover the documents you need. Different templates for enterprise and individual reasons are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the Missouri Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with a couple of mouse clicks.

Should you be presently a US Legal Forms customer, log in to the accounts and click on the Down load key to have the Missouri Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act. You may also entry types you in the past saved inside the My Forms tab of your respective accounts.

If you use US Legal Forms initially, follow the instructions listed below:

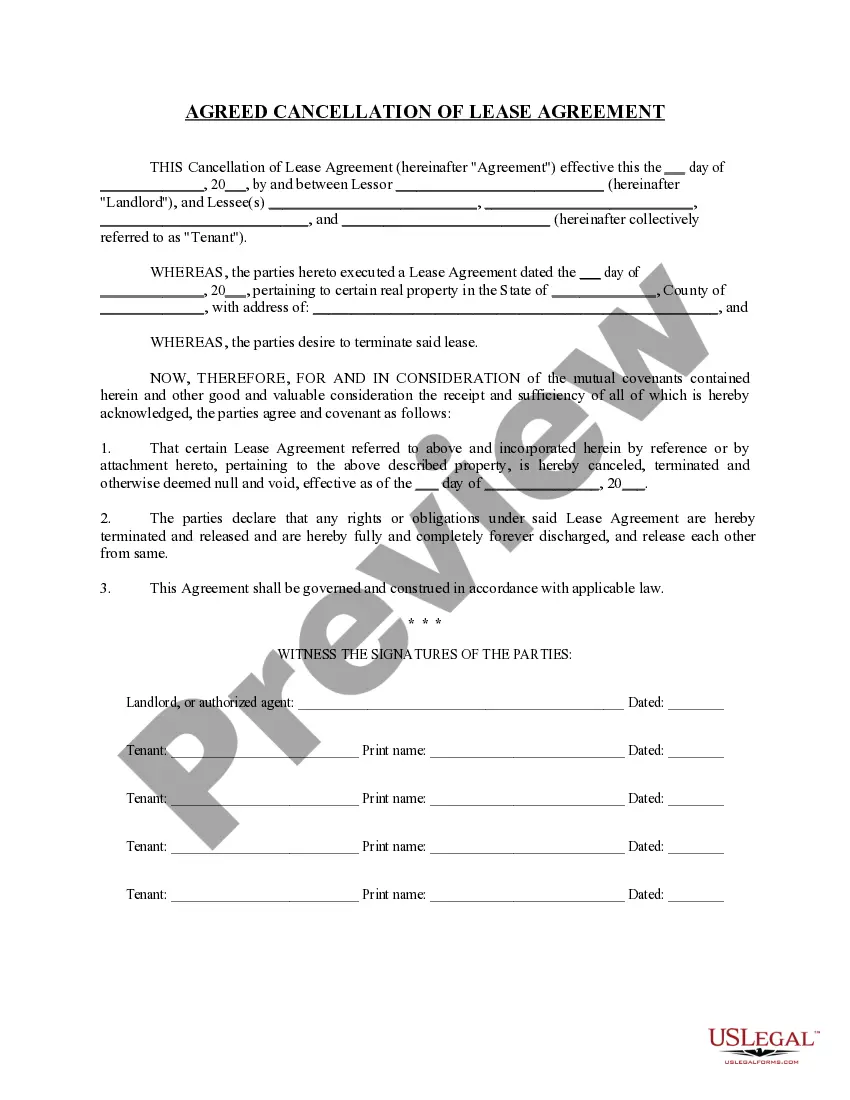

- Step 1. Be sure you have chosen the shape for that correct city/region.

- Step 2. Utilize the Review solution to check out the form`s information. Never forget about to read through the outline.

- Step 3. Should you be unsatisfied using the kind, utilize the Search field towards the top of the monitor to find other variations in the legal kind design.

- Step 4. When you have identified the shape you need, click on the Acquire now key. Opt for the costs prepare you favor and put your references to sign up on an accounts.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Choose the structure in the legal kind and obtain it on your system.

- Step 7. Comprehensive, change and printing or signal the Missouri Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Each and every legal record design you get is yours for a long time. You possess acces to each kind you saved inside your acccount. Click on the My Forms area and pick a kind to printing or obtain yet again.

Be competitive and obtain, and printing the Missouri Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms. There are millions of expert and express-specific types you can utilize for your personal enterprise or individual needs.