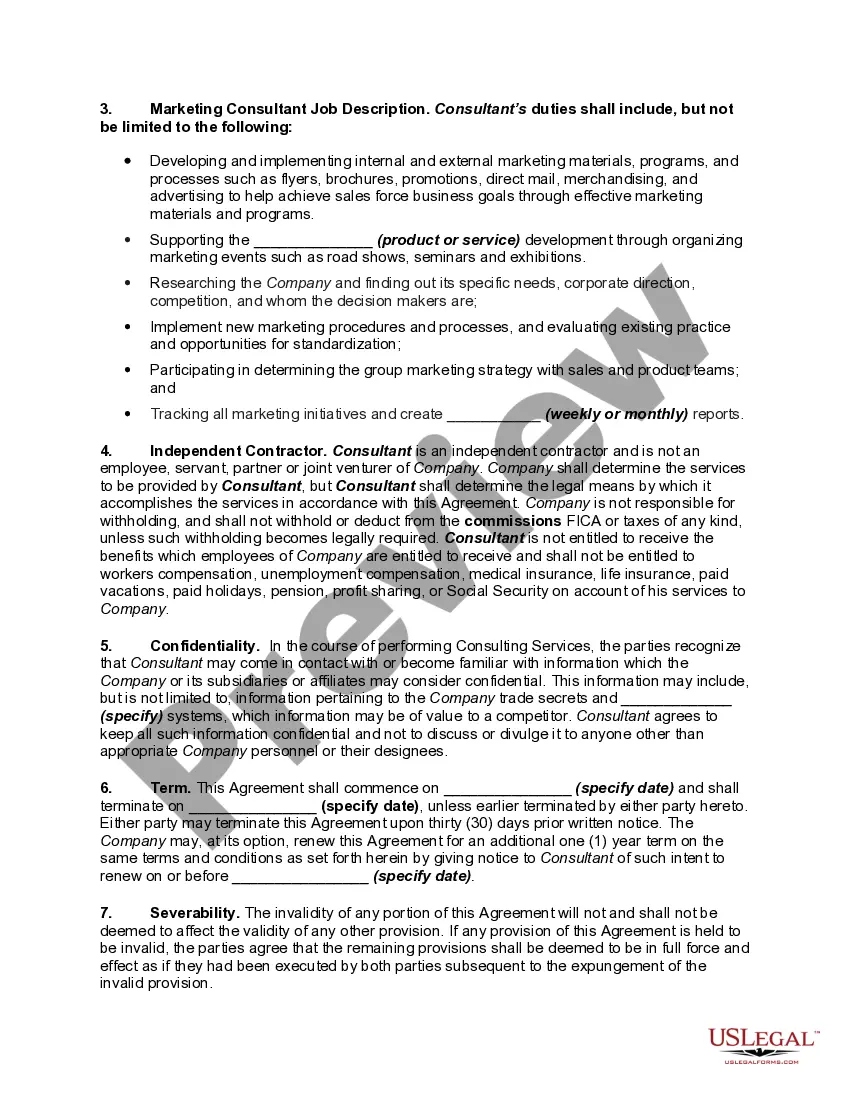

A Missouri Marketing Consultant Agreement — Self-Employed is a legally binding document that outlines the terms and conditions between a marketing consultant and their client in the state of Missouri. This agreement serves as a contract that solidifies the working relationship between the consultant and the client, ensuring clear expectations and protection for both parties involved. The Missouri Marketing Consultant Agreement — Self-Employed typically includes key elements such as: 1. Scope of Work: This section provides a detailed description of the services the marketing consultant will provide to the client. It outlines the specific tasks, deliverables, and goals that the consultant will aim to achieve. 2. Compensation: The agreement clearly states the terms of payment for the marketing consultant's services. It outlines the agreed-upon fee structure, such as hourly rate, retainer, or project-based pricing. It may also include details about expenses and reimbursements. 3. Term and Termination: This section defines the duration of the agreement and specifies the conditions under which either party can terminate the contract. It may include provisions for termination due to breach of contract or unsatisfactory performance. 4. Confidentiality: To protect both parties' proprietary information, the agreement often includes a confidentiality clause. This ensures that any sensitive or confidential information shared during the engagement remains private and cannot be disclosed to third parties. 5. Intellectual Property: In cases where the consultant creates original content, branding, or marketing materials, the agreement should address the ownership and usage rights of intellectual property. It may stipulate that the client retains ownership or that the consultant grants a license for their work. 6. Independent Contractor Relationship: As a self-employed consultant, it is important to clarify the nature of the working relationship. This section establishes that the consultant is an independent contractor and not an employee of the client, highlighting the absence of benefits and tax withholding. 7. Dispute Resolution: The agreement may include a provision outlining how disputes between the consultant and the client will be resolved. This could involve mediation, arbitration, or court litigation. Different types of Missouri Marketing Consultant Agreements — Self-Employed may exist depending on the industry or specific services provided. Some examples include: 1. Digital Marketing Consultant Agreement: Specializes in digital marketing strategies, online advertising, search engine optimization (SEO), content marketing, social media management, etc. 2. Branding Consultant Agreement: Focuses on developing and enhancing a client's brand identity, market positioning strategies, brand messaging, and visual branding elements. 3. Sales and Lead Generation Consultant Agreement: Aims to improve a client's sales performance, lead generation strategies, sales funnel optimization, and training for sales teams. 4. Market Research Consultant Agreement: Provides expertise in market research and analysis, customer insights, competitor analysis, and market trend identification. 5. Public Relations Consultant Agreement: Offers services related to public relations, reputation management, media relations, press releases, crisis communication, and stakeholder engagement. Regardless of the specific type, a Missouri Marketing Consultant Agreement — Self-Employed is crucial for establishing a clear understanding between the consultant and the client, protecting both parties' rights and responsibilities throughout their collaboration.

Missouri Marketing Consultant Agreement - Self-Employed

Description

How to fill out Missouri Marketing Consultant Agreement - Self-Employed?

If you want to full, download, or print out legitimate papers themes, use US Legal Forms, the biggest variety of legitimate types, that can be found online. Make use of the site`s simple and handy lookup to obtain the documents you want. Different themes for company and individual uses are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the Missouri Marketing Consultant Agreement - Self-Employed within a few mouse clicks.

If you are already a US Legal Forms buyer, log in to the bank account and click the Acquire switch to get the Missouri Marketing Consultant Agreement - Self-Employed. You can also accessibility types you formerly delivered electronically in the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate city/country.

- Step 2. Utilize the Review choice to look over the form`s content material. Do not forget about to learn the description.

- Step 3. If you are not satisfied with all the form, make use of the Lookup field on top of the display screen to discover other versions from the legitimate form web template.

- Step 4. When you have identified the form you want, select the Acquire now switch. Opt for the costs strategy you choose and add your qualifications to register for the bank account.

- Step 5. Process the purchase. You may use your charge card or PayPal bank account to finish the purchase.

- Step 6. Choose the format from the legitimate form and download it on the system.

- Step 7. Complete, modify and print out or signal the Missouri Marketing Consultant Agreement - Self-Employed.

Every single legitimate papers web template you get is yours permanently. You have acces to each form you delivered electronically in your acccount. Click on the My Forms segment and select a form to print out or download again.

Contend and download, and print out the Missouri Marketing Consultant Agreement - Self-Employed with US Legal Forms. There are thousands of professional and state-distinct types you can utilize for your personal company or individual demands.

Form popularity

FAQ

An independent consultant is a professional who offers specialized services on a contract basis rather than as an employee. They bring expertise and impartiality to projects, allowing flexibility in hiring practices. In the context of a Missouri Marketing Consultant Agreement - Self-Employed, this role offers businesses targeted strategies to enhance their marketing efforts.

Using an independent contractor agreement clarifies the expectations between the client and the contractor. It outlines the scope of work, payment details, and deadlines, reducing the risk of misunderstandings. This is particularly important when working under a Missouri Marketing Consultant Agreement - Self-Employed, where specificity can lead to successful outcomes.

In Missouri, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the management structure and operational procedures of the LLC. Having a clear operating agreement can prevent disputes among members, especially when entering into contracts like a Missouri Marketing Consultant Agreement - Self-Employed.

A consulting agreement typically involves providing expertise or advice on a project, while an independent contractor agreement centers on completing specific tasks or services. Both agreements define the nature of the work and payment, but they vary in the level of involvement and the relationship dynamic. Understanding this distinction is crucial when drafting a Missouri Marketing Consultant Agreement - Self-Employed.

An independent consultant agreement outlines the terms of the working relationship between a consultant and a client. It specifies the scope of work, payment terms, and duration of the contract. This agreement protects both parties and ensures clarity, making it essential for those engaging in a Missouri Marketing Consultant Agreement - Self-Employed.

Setting up a consulting agreement involves outlining your services, fees, and terms clearly. Start by detailing the scope of work, deliverables, and timelines. Utilizing a Missouri Marketing Consultant Agreement - Self-Employed can simplify this process, as it offers a structured template that ensures all critical aspects are covered and protects both parties involved.

Yes, a consultant is typically classified as an independent contractor. This means they operate their own business, manage their work schedules, and are responsible for their taxes. By defining your role in a Missouri Marketing Consultant Agreement - Self-Employed, you can establish clear boundaries and protect your rights as an independent contractor.

The primary purpose of a consulting agreement is to establish clear expectations and responsibilities between the consultant and the client. It outlines the scope of work, payment terms, confidentiality, and other essential details. Using a Missouri Marketing Consultant Agreement - Self-Employed ensures both parties understand their roles, leading to smoother interactions and better outcomes.

A consulting agreement is a type of contract that specifically pertains to the advisory services a consultant provides. In contrast, a general contract can cover a wide range of services, from completed projects to ongoing arrangements. By using a Missouri Marketing Consultant Agreement - Self-Employed, you can ensure that the terms are tailored to consulting relationships, highlighting your expertise.

While both contractors and consultants operate independently, they have different roles. A contractor usually executes specific tasks or projects, whereas a consultant provides expert guidance or strategies. When entering into a partnership, it's essential to clarify your position with a Missouri Marketing Consultant Agreement - Self-Employed to avoid misunderstandings.

More info

I hereby agree to abide by and be bound by the terms and conditions as set forth by the sender and the sender's respective agent, agent for service or his or her successors in interest. I understand that the document is provided as a convenience and that it is provided as a reference only and does not constitute an agreement. Furthermore, I agree also that if I am represented by an attorney, a notary, a judge, a lawyer, or an agent of an attorney or by an attorney or notary appointed by a court of law, I understand and consent to the documents provided by the sender, the sender's respective agent, agent for service or his or her successors in interest and the procedures used to process and receive documents and information. Furthermore, I hereby authorize and accept my electronic submission to the documents provided by said sender, the sender's respective agent, agent for service or his or her successors in interest.