Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

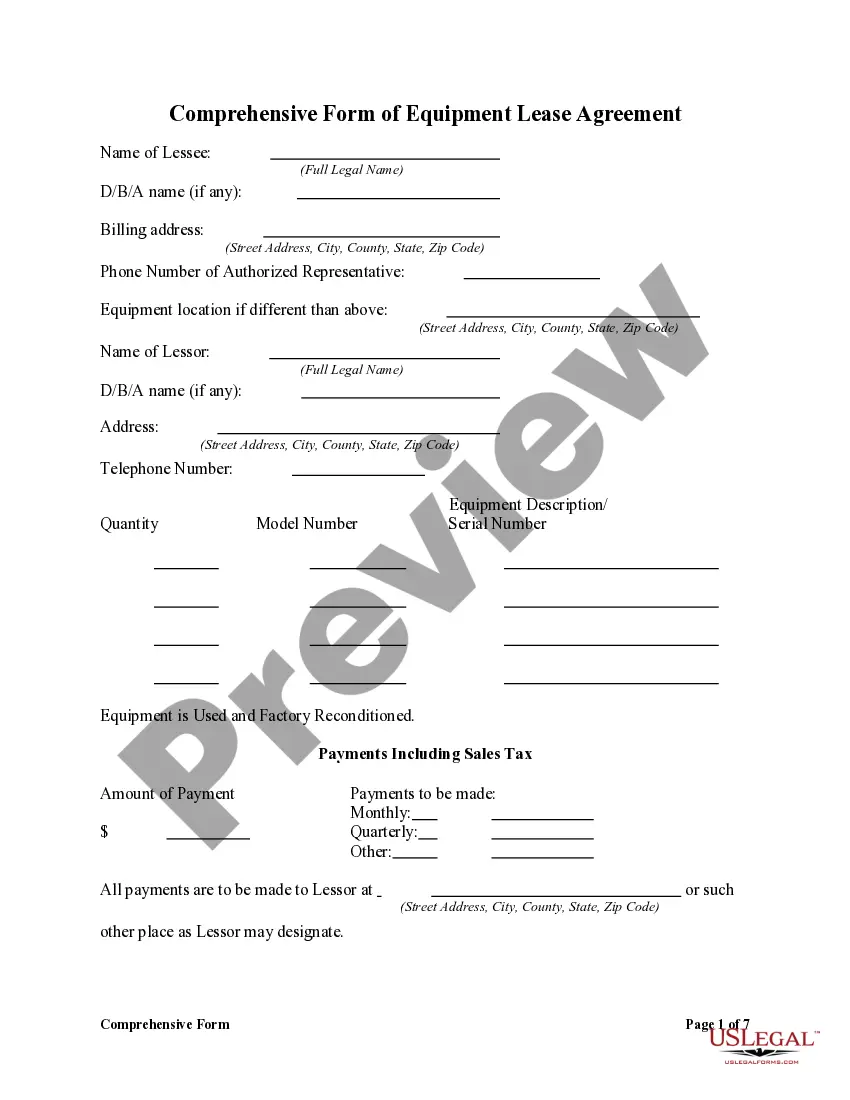

How to fill out Comprehensive Equipment Lease With Provision Regarding Investment Tax?

Identifying the suitable legal document format can be challenging.

Of course, there are numerous templates available online, but how will you find the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, which can be utilized for both business and personal needs.

First, make sure you have selected the appropriate form for your area/state. You can review the form using the Review button and read the form summary to confirm it is suitable for you.

- All of the forms are vetted by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

Form popularity

FAQ

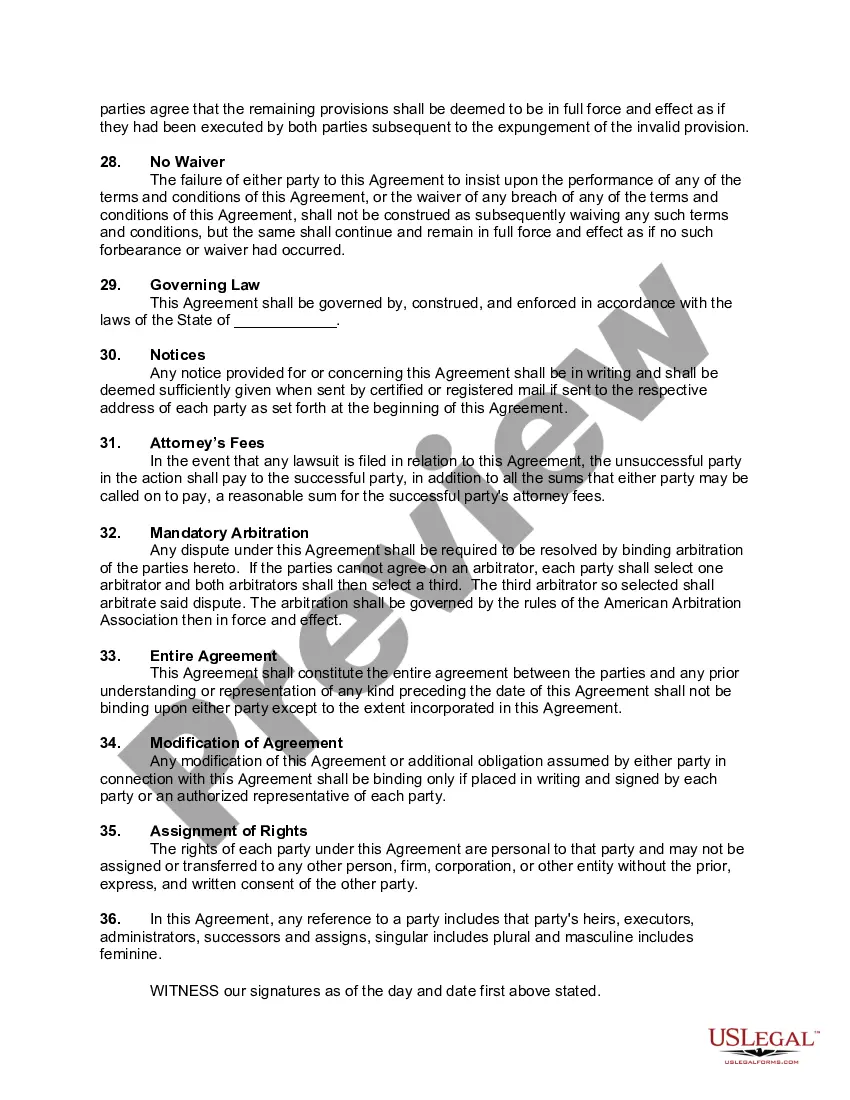

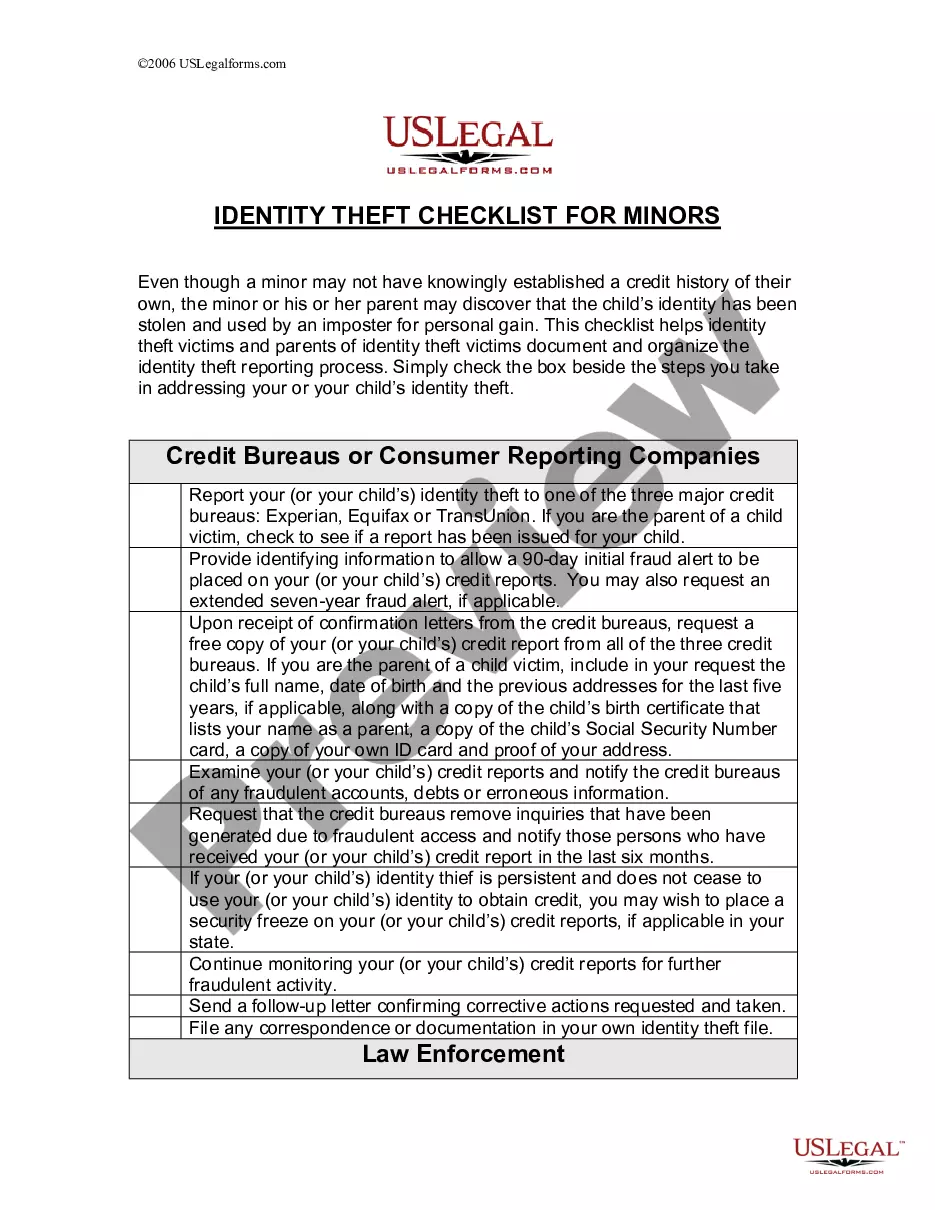

Missouri Chapter 100 bonds provide financial assistance to businesses looking to invest in equipment or facilities. These bonds allow local governments to issue debt to fund projects, making it easier for companies to access capital. With a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, businesses can potentially benefit from tax incentives while financing essential equipment. This arrangement helps stimulate local economic growth while providing businesses with the necessary resources.

Income from equipment rental should be reported on your federal income tax return. If you have a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, you typically report this income as part of your business income on Schedule C or Schedule E, depending on your business structure. Keep thorough documentation to support your reported income.

In Missouri, equipment rentals are generally subject to sales tax unless an exemption applies. When entering into a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, you should consider the local regulations and potential tax implications. Understanding these rules can help you make informed decisions about your equipment needs.

Yes, equipment rental can be tax deductible under certain circumstances. If you enter into a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, you may be eligible to deduct your rental payments from your taxable income. However, it's crucial to keep accurate records and consult a tax professional to ensure compliance with tax laws.

Leased equipment is often considered differently for tax purposes than owned equipment. Typically, lease payments are deductible as business expenses, providing tax relief throughout the lease term. Using a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax helps ensure that businesses maximize their tax benefits while maintaining compliance.

As mentioned, equipment rental is typically subject to sales tax in Missouri. Nevertheless, some exemptions may apply depending on the equipment type and its use. Utilizing a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax can offer clarity and guidance on navigating these sales tax requirements.

Yes, equipment rental is generally subject to sales tax in Missouri. However, different regulations may apply based on the type of equipment and its intended use. By leveraging a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, businesses can clarify tax obligations related to their equipment rental agreements.

Certain business equipment can be tax-exempt in Missouri, especially if it qualifies under production and manufacturing criteria. This exemption can provide substantial savings for businesses when structured through a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax. It's important to consult tax professionals to confirm your equipment's eligibility.

Leased vehicles in Missouri are generally subject to sales tax. However, the specific tax implications depend on the leasing agreement and the nature of the vehicle. Using a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax allows businesses to navigate these tax implications effectively and optimize their leasing options.

Items that are typically tax-exempt include certain machinery, software, and equipment used for manufacturing or production. In Missouri, a Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax may help businesses identify which items qualify for tax exemption. Understanding these exemptions can significantly reduce operational costs for various industries.