Missouri Investment Letter is an important document that provides detailed information about an Intrastate Offering within the state of Missouri. Intrastate offerings are securities offerings that are sold only to residents of a specific state, in this case, Missouri. This letter is a crucial source of information for potential investors who are interested in participating in the Intrastate Offering. It outlines all the essential details about the investment opportunity, including the terms and conditions, potential risks involved, financial projections, and any legal considerations associated with the offering. The Missouri Investment Letter regarding Intrastate Offering aims to provide transparency and protection for investors while ensuring compliance with state laws and regulations. It serves as a means to inform and educate investors about the investment opportunity and encourages them to make well-informed decisions. Some relevant keywords associated with the Missouri Investment Letter and Intrastate Offering include: 1. Intrastate offering: This refers to the sale of securities exclusively to residents of a specific state, such as Missouri. These offerings are regulated at the state level and must comply with the state's securities laws. 2. Securities: This term encompasses various financial instruments, such as stocks, bonds, and debentures, that represent ownership or debt in a company. In the context of the Missouri Investment Letter, it refers to the investment opportunity being offered. 3. Investment opportunity: This refers to the chance for individuals to invest their money in a particular project, company, or venture with the expectation of earning a return on their investment. 4. Terms and conditions: These are the specific provisions and requirements that govern the investment opportunity, including the investment amount, minimum investment thresholds, investment duration, and any associated fees or expenses. 5. Risks: This includes the potential hazards or uncertainties surrounding the investment opportunity, such as market volatility, regulatory changes, and economic factors. The Missouri Investment Letter must clearly outline these risks to help investors assess the potential downside of their investment. 6. Financial projections: These are forecasts or estimates about the future financial performance of the investment opportunity. They may include projected revenues, expenses, profits, and other relevant financial indicators. 7. Legal considerations: This refers to the legal requirements and restrictions associated with the Intrastate Offering. The Missouri Investment Letter must provide information on legal compliance, registration with regulatory bodies, and any necessary disclosures. It's worth noting that there may not be different types of Missouri Investment Letters regarding Intrastate Offering. However, the content of the letter may differ depending on the nature of the investment opportunity, such as whether it involves a startup, real estate project, or an established business.

Missouri Investment Letter regarding Intrastate Offering

Description

How to fill out Missouri Investment Letter Regarding Intrastate Offering?

Choosing the right legitimate record format can be a have a problem. Of course, there are a variety of themes available on the net, but how would you obtain the legitimate develop you will need? Utilize the US Legal Forms site. The services provides a huge number of themes, such as the Missouri Investment Letter regarding Intrastate Offering, which you can use for enterprise and personal requires. Every one of the forms are inspected by professionals and meet up with state and federal needs.

Should you be presently signed up, log in for your account and click the Acquire switch to get the Missouri Investment Letter regarding Intrastate Offering. Utilize your account to check with the legitimate forms you may have acquired in the past. Visit the My Forms tab of the account and get an additional duplicate from the record you will need.

Should you be a brand new end user of US Legal Forms, allow me to share simple instructions that you can adhere to:

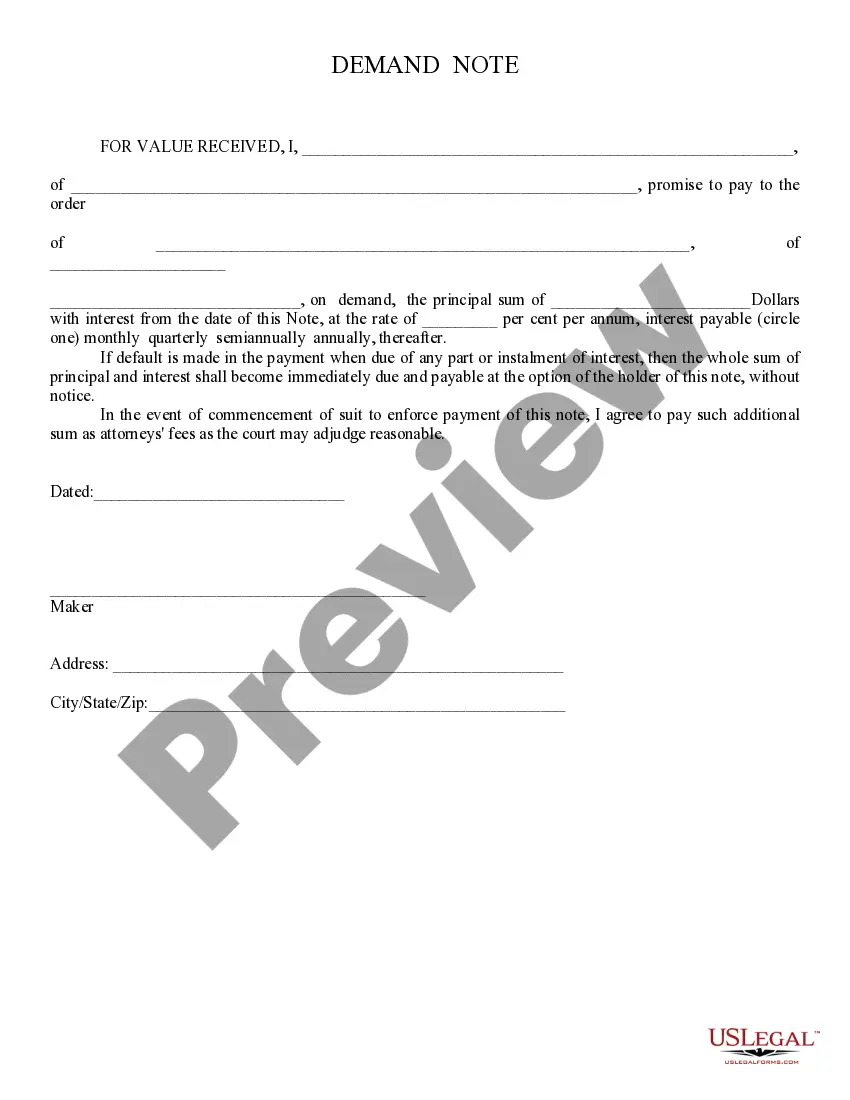

- Initially, make sure you have selected the right develop for your town/state. You may check out the form while using Review switch and look at the form description to make sure this is the right one for you.

- In the event the develop fails to meet up with your preferences, take advantage of the Seach field to find the proper develop.

- When you are certain the form is suitable, click on the Get now switch to get the develop.

- Pick the costs strategy you would like and type in the necessary information. Build your account and pay money for your order using your PayPal account or bank card.

- Select the submit file format and download the legitimate record format for your system.

- Complete, change and print out and indication the acquired Missouri Investment Letter regarding Intrastate Offering.

US Legal Forms is the biggest catalogue of legitimate forms for which you can see numerous record themes. Utilize the service to download professionally-produced papers that adhere to state needs.

Form popularity

FAQ

Filling out a Missouri bill of sale involves several key steps. Begin with the correct title at the top of the document, such as 'Bill of Sale for Vehicle' or 'Personal Property Bill of Sale.' Next, fill in the seller's details, the buyer's details, and clear item descriptions. Lastly, sign the document to finalize the sale. If you're venturing into investments, consider a Missouri Investment Letter regarding Intrastate Offering for added protection.

In Missouri, blue laws regulate certain business activities, especially concerning the sale of securities. These laws are designed to protect investors and maintain market integrity. The Missouri Investment Letter regarding Intrastate Offering serves as a valuable tool to navigate these regulations, helping businesses comply while accessing local investment capital.

Yes, intrastate offerings are usually exempt from federal registration requirements, given they meet specific criteria set by state regulations. For example, a Missouri Investment Letter regarding Intrastate Offering can facilitate access to local investment without needing extensive federal compliance. However, it is crucial for investors to consult legal experts to ensure all requirements are met, optimizing these beneficial exemptions.

Certain securities are exempt from blue sky laws, which include specific intrastate offerings that comply with state regulations. Investors often benefit from a Missouri Investment Letter regarding Intrastate Offering, allowing them to participate in opportunities without the heavy restrictions usually imposed by these laws. It's important for businesses and investors alike to understand which offerings qualify for these exemptions, as they can provide greater access to local investment opportunities.

The limited offering exemption is designed to streamline the process for smaller issuers when selling securities to a select group of investors. This exemption reduces the regulatory burden, making it easier for businesses to raise capital. Companies should consult with legal experts to understand all requirements to successfully utilize this exemption. A Missouri Investment Letter regarding Intrastate Offering can provide valuable guidance through this process.

The Missouri limited offering exemption allows companies to offer securities to a specific, limited number of investors without a full registration process. This provision aims to simplify fundraising efforts for small businesses while protecting investors. It's crucial for companies to adhere to specific criteria to qualify for this exemption. Using a Missouri Investment Letter regarding Intrastate Offering can assist businesses in understanding their options.

In Missouri, the agricultural exemption exists to facilitate investments in agricultural projects and farming operations. This exemption can cover various offerings, including bonds and certain investments, promoting agricultural growth within the state. Investors interested in supporting the agricultural sector can benefit from this exemption. A Missouri Investment Letter regarding Intrastate Offering outlines how to navigate this exemption effectively.

The accredited investor exemption allows certain investors to participate in investment opportunities without the usual regulatory requirements. To qualify, an individual typically must have a net worth exceeding $1 million or an annual income of $200,000 for the past two years. This exemption offers opportunities primarily to high-net-worth individuals, thus facilitating private investments. Obtaining a Missouri Investment Letter regarding Intrastate Offering can further guide potential investors.

The limited use exemption in Missouri allows businesses to offer securities without the extensive registration process, provided certain conditions are met. This exemption can expedite the fundraising process for small businesses and startups. Eligible companies should ensure they understand the requirements to utilize this exemption effectively. A Missouri Investment Letter regarding Intrastate Offering can provide the necessary insights.

The blue sky law in Missouri governs the sale of securities to protect investors from fraud. It requires that securities offered for sale in the state must be registered unless they qualify for an exemption. Understanding these regulations is essential for anyone considering an investment in Missouri. Accessing a Missouri Investment Letter regarding Intrastate Offering can help clarify your obligations.

More info

Cations Missouri Protects Investors Enforcement Registration Investor Education Check Your Broker Adviser Retirement Plan Investor Protection File Complaint When Video Series Statutes Regulations Contact Securities email protected.