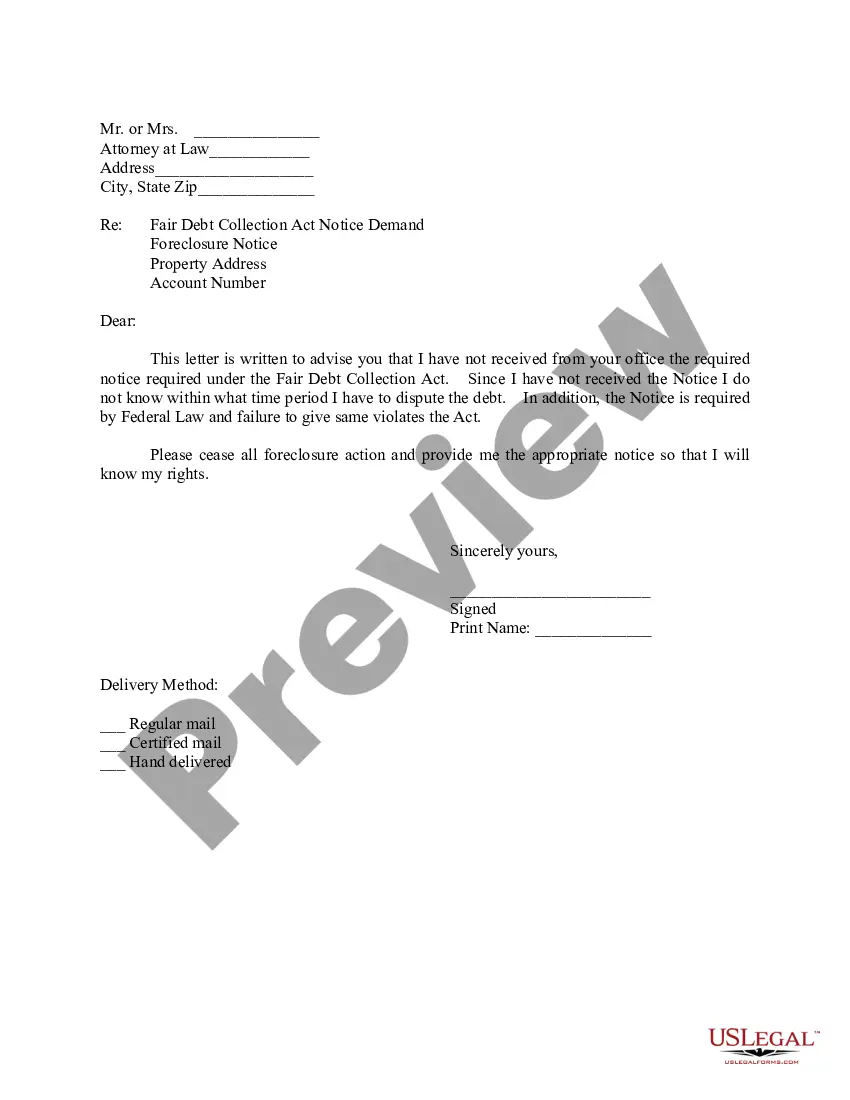

Missouri Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons

Description

How to fill out Letter To Foreclosure Attorney - General Demand To Stop Foreclosure And Reasons?

You may devote several hours on-line looking for the legitimate record design that meets the state and federal requirements you require. US Legal Forms gives a huge number of legitimate forms which are reviewed by specialists. You can actually obtain or print the Missouri Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons from your services.

If you have a US Legal Forms bank account, you can log in and then click the Down load option. After that, you can total, edit, print, or indication the Missouri Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons. Every single legitimate record design you get is yours for a long time. To get yet another version of any acquired kind, visit the My Forms tab and then click the related option.

If you are using the US Legal Forms website the first time, stick to the simple directions under:

- Very first, make sure that you have chosen the right record design for that area/city of your choosing. Read the kind explanation to ensure you have picked the correct kind. If readily available, take advantage of the Review option to look throughout the record design also.

- In order to locate yet another version from the kind, take advantage of the Research field to get the design that fits your needs and requirements.

- Once you have discovered the design you would like, simply click Purchase now to continue.

- Choose the pricing program you would like, type your references, and sign up for an account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal bank account to fund the legitimate kind.

- Choose the file format from the record and obtain it for your gadget.

- Make adjustments for your record if necessary. You may total, edit and indication and print Missouri Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons.

Down load and print a huge number of record layouts using the US Legal Forms Internet site, that provides the biggest selection of legitimate forms. Use professional and status-particular layouts to handle your small business or personal demands.

Form popularity

FAQ

In Missouri, redemption can take place for up to one year after the sale of the property if it was bought at auction by the lender. However, if the property is bought by a third party, there is no redemption phase.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

How Can I Stop a Foreclosure in Missouri? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before or after the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

Non-Judicial Foreclosure in Missouri: What to Expect Lenders send a breach letter to borrowers who miss a payment. Borrowers must be delinquent for 120 days before a Notice of Sale can be issued, and the sale is to occur forty to fifty days after the notice.

Under the PTFA, the lease survives foreclosure. You may stay in the property for the entire term of your lease or 90 days, whichever is longer. The only exception to this rule is if the new owner wants to live in your unit, in which case you are still entitled to 90 days before you can be forced to move.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

Borrowers must be delinquent for 120 days before a Notice of Sale can be issued, and the sale is to occur forty to fifty days after the notice. Lenders must give at least a twenty-day notice of the sale. They must publish the foreclosure in a newspaper in the county where the property is located.