Title: Missouri Sample Letter for Reporting Fraudulent Charges against Client's Account Introduction: In the realm of financial security, it is essential for individuals and businesses to promptly address any instances of fraudulent charges on their accounts. For those based in Missouri, having a proper template for reporting such occurrences can be immensely helpful. This article presents a comprehensive guide for drafting a Missouri Sample Letter for Fraudulent Charges against Client's Account, supplying you with the necessary keywords and information to effectively communicate your concerns. Main Body: [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Recipient's Name] [Bank or Financial Institution] [Address] [City, State, ZIP] Subject: Report of Fraudulent Charges on My Account Dear [Recipient's Name], I am writing to bring to your immediate attention the occurrence of fraudulent charges on my account held with your esteemed institution. I have recently discovered unauthorized transactions on my account, affecting my financial security and potentially violating consumer protection laws. Account Details: Account Holder Name: [Your Name] Account Number: [Your Account Number] Date(s) of Unauthorized Transaction: [Specify dates if known] Description(s) of Unauthorized Transaction: [Provide specific details regarding the fraudulent activities] I want to emphasize that I have taken all necessary precautions to safeguard my account's information, including regularly monitoring my transactions, maintaining secure passwords, and never sharing sensitive financial data. Hence, I strongly believe that this unauthorized activity has resulted from external sources or individuals attempting to compromise my account. To ensure the veracity of my claim, I have taken the following steps: 1. Immediately contacted your customer service helpline to report the fraudulent transactions. 2. Filed a police report with the [Name of Local Law Enforcement Agency]. 3. Requested credit reporting agencies such as [Experian, TransUnion, or Equifax] to place initial fraud alerts on my credit files. I am kindly requesting your immediate assistance in investigating these unauthorized transactions and taking appropriate actions to rectify the situation. It is of utmost importance that my account be thoroughly reviewed, and any unauthorized charges be credited back to my account in a timely manner. Furthermore, I kindly ask your support in providing me with a detailed report outlining the progress of your investigation, anticipated resolution timeline, and any additional steps I should take to ensure the security of my account. In Missouri, legal statutes explicitly protect consumers from fraudulent activities, including the unauthorized use of a person's financial resources. I kindly request that you comply with your obligations under these laws and regulations as you address this matter promptly and effectively. Please find attached all relevant supporting documents, including copies of the unauthorized transactions, my government-issued identification, and any other paperwork required for a thorough investigation. I expect a swift resolution to this distressful matter. Your prompt attention is highly appreciated. Reaffirming my commitment to cooperating fully with your investigation, I remain at your disposal for any additional information or documentation you may require. Please do not hesitate to contact me at the provided phone number or email address. Thank you for your immediate attention to my case, and I anticipate a satisfactory resolution that restores my account's integrity and secures my financial well-being. Sincerely, [Your Name] Types of Missouri Sample Letters for Fraudulent Charges against Client's Account: 1. Missouri Sample Letter for Reporting Fraudulent Charges on Personal Bank Account 2. Missouri Sample Letter for Reporting Fraudulent Charges on Business Bank Account 3. Missouri Sample Letter for Reporting Fraudulent Charges on Credit Card Account 4. Missouri Sample Letter for Reporting Fraudulent Charges on Investment Account 5. Missouri Sample Letter for Reporting Fraudulent Charges on Loan Account.

Missouri Sample Letter for Fraudulent Charges against Client's Account

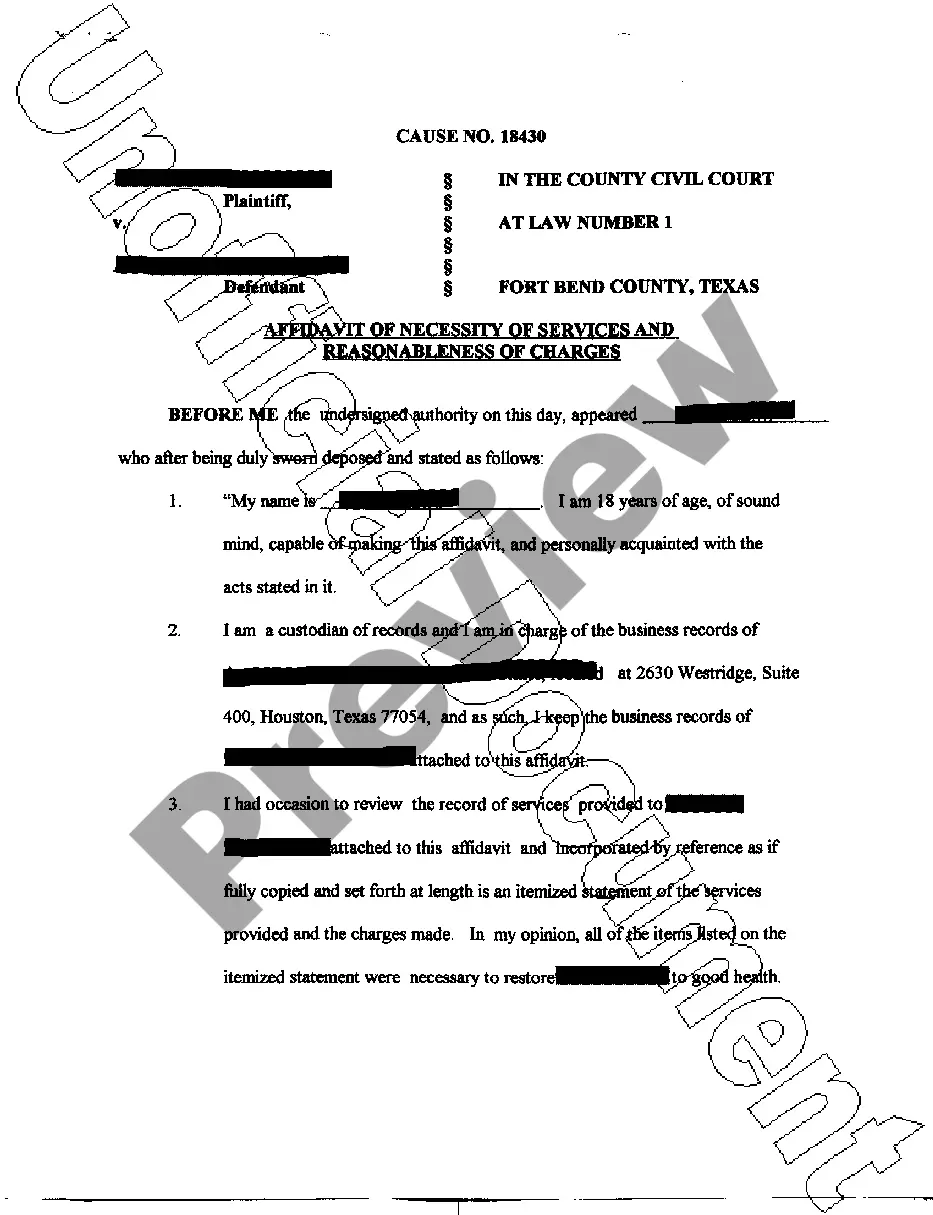

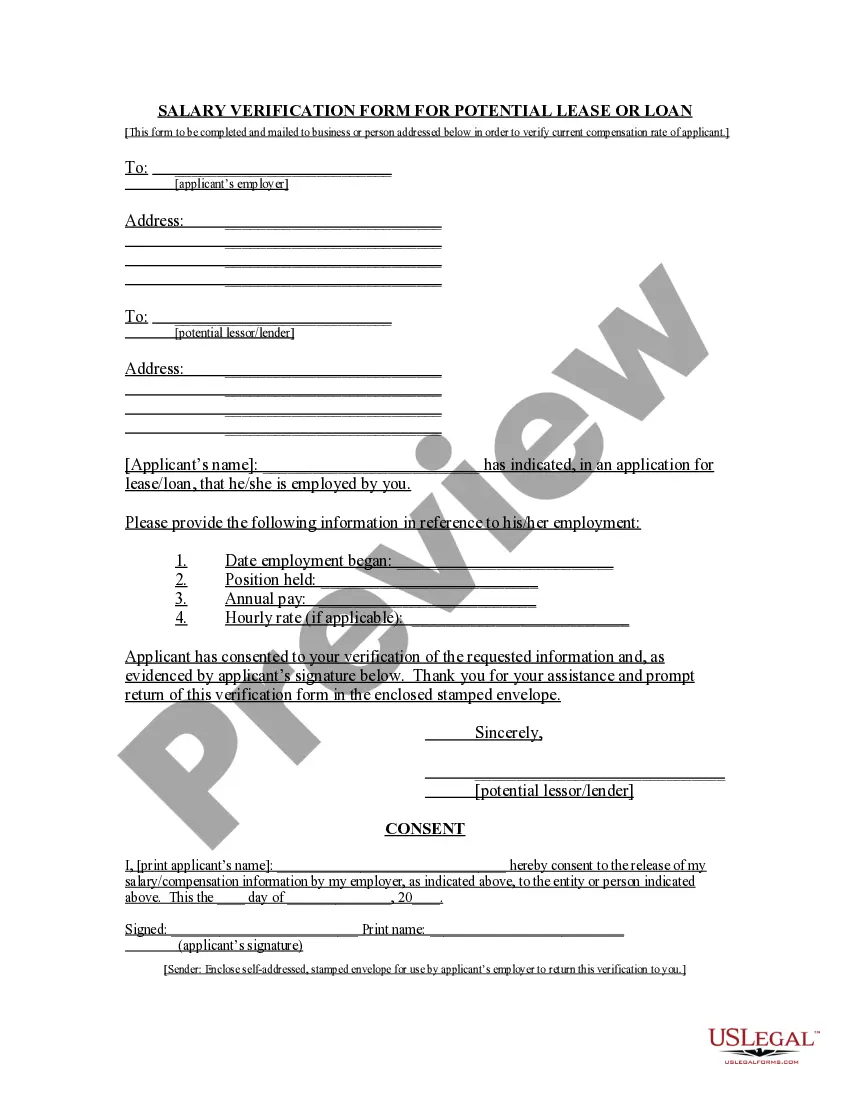

Description

How to fill out Missouri Sample Letter For Fraudulent Charges Against Client's Account?

If you have to comprehensive, download, or produce legitimate document web templates, use US Legal Forms, the biggest selection of legitimate kinds, which can be found on the Internet. Take advantage of the site`s simple and handy look for to get the files you need. A variety of web templates for company and individual functions are categorized by classes and suggests, or keywords. Use US Legal Forms to get the Missouri Sample Letter for Fraudulent Charges against Client's Account within a handful of mouse clicks.

In case you are presently a US Legal Forms consumer, log in to your profile and click on the Download switch to get the Missouri Sample Letter for Fraudulent Charges against Client's Account. You may also gain access to kinds you formerly saved from the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape for that correct metropolis/land.

- Step 2. Make use of the Review solution to look through the form`s information. Don`t overlook to read the outline.

- Step 3. In case you are not satisfied with the kind, utilize the Lookup discipline near the top of the display screen to find other types of the legitimate kind design.

- Step 4. Upon having located the shape you need, select the Purchase now switch. Select the rates program you favor and include your references to register for an profile.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal profile to complete the financial transaction.

- Step 6. Pick the file format of the legitimate kind and download it in your device.

- Step 7. Full, change and produce or indicator the Missouri Sample Letter for Fraudulent Charges against Client's Account.

Each legitimate document design you purchase is your own eternally. You may have acces to every single kind you saved within your acccount. Select the My Forms portion and select a kind to produce or download once more.

Remain competitive and download, and produce the Missouri Sample Letter for Fraudulent Charges against Client's Account with US Legal Forms. There are millions of skilled and express-distinct kinds you can use to your company or individual needs.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

The details of the transaction are as follows: ? Date of transaction: [INSERT DATE OF TRANSACTION] ? Amount of transaction:[INSERT AMOUNT OF TRANSACTION] ? Name of merchant: [INSERT NAME OF SELLER] ? Reasons for the request for chargeback: [FOR EXAMPLE you did not receive the goods, they were faulty etc] Please let me ...

Under the rules of the FDCPA, you must receive a written notification of a debt. After that, you have 30 days to contact the debt collector ? also by letter ? and give your reasons why you don't owe the debt or why the amount is incorrect.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

Fortunately, most major card networks have a ?zero liability? policy that ensures you will not be held responsible for fraudulent charges. And federal law limits your losses for unauthorized credit card use to $50.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

A dispute is appropriate if you have hard evidence that clearly shows the debt doesn't belong to you, was already paid, or if the amount due is incorrect. The more information you can provide to the debt collection agency concerning the dispute, the better.

What should I do if there are unauthorized charges on my credit card account? Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.