Missouri Employment Agreement with Chief Financial Officer

Description

How to fill out Employment Agreement With Chief Financial Officer?

Are you in a position where you need documents for occasional business or personal use almost every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides thousands of form templates, including the Missouri Employment Agreement with Chief Financial Officer, designed to meet state and federal standards.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can always retrieve another copy of the Missouri Employment Agreement with Chief Financial Officer as needed. Click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service offers expertly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Employment Agreement with Chief Financial Officer template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

- Utilize the Review button to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you're seeking, use the Search field to find the form that meets your needs.

- When you find the right form, click Acquire now.

- Select the payment plan you want, fill out the required information to create your account, and complete your purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

An employment agreement and an employment contract essentially serve the same function: outlining the terms of employment. However, an employment agreement often refers to informal understandings while an employment contract is more formal and legally binding. In the context of a Missouri Employment Agreement with Chief Financial Officer, it's vital to ensure you have a solid contract in place to safeguard your interests. Choosing the right document can prevent misunderstandings and disputes down the line.

In Missouri, continued employment can be considered sufficient consideration for an employment agreement. This means that staying employed acts as compensation for agreeing to the contract. However, for the Missouri Employment Agreement with Chief Financial Officer, additional terms may be required to ensure fairness and protection for both parties involved. Consulting legal resources can provide insights into how to structure these agreements effectively.

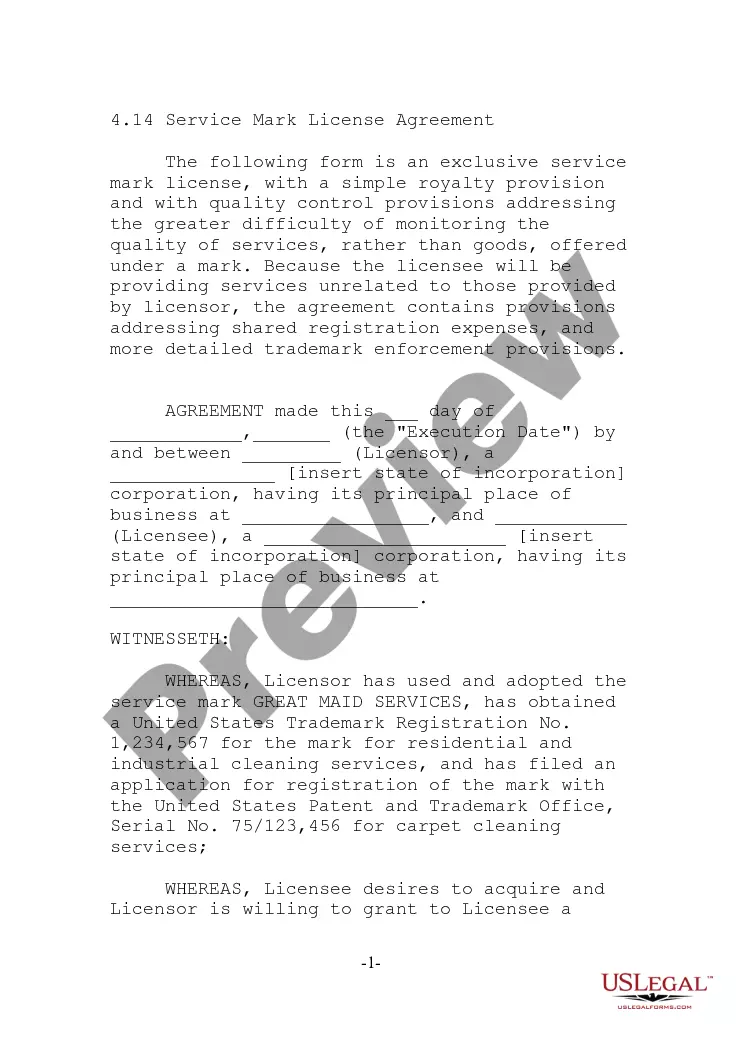

The Missouri employment contract is a legal agreement between an employer and an employee that outlines the terms of employment. It specifies roles, responsibilities, salary, and other conditions, including any unique provisions relevant to positions such as the Chief Financial Officer. A well-drafted Missouri Employment Agreement with Chief Financial Officer clarifies expectations, promotes understanding, and minimizes disputes. Engaging with uslegalforms can help you create a robust contract tailored to your needs.

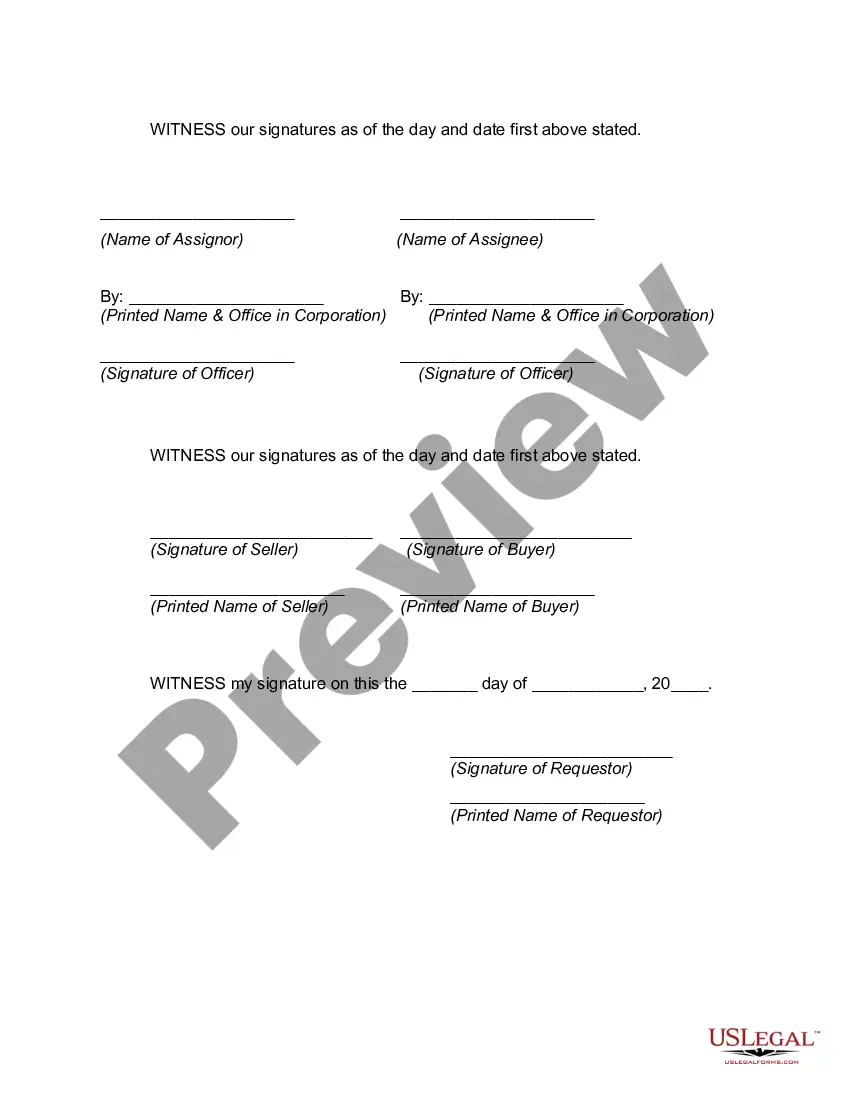

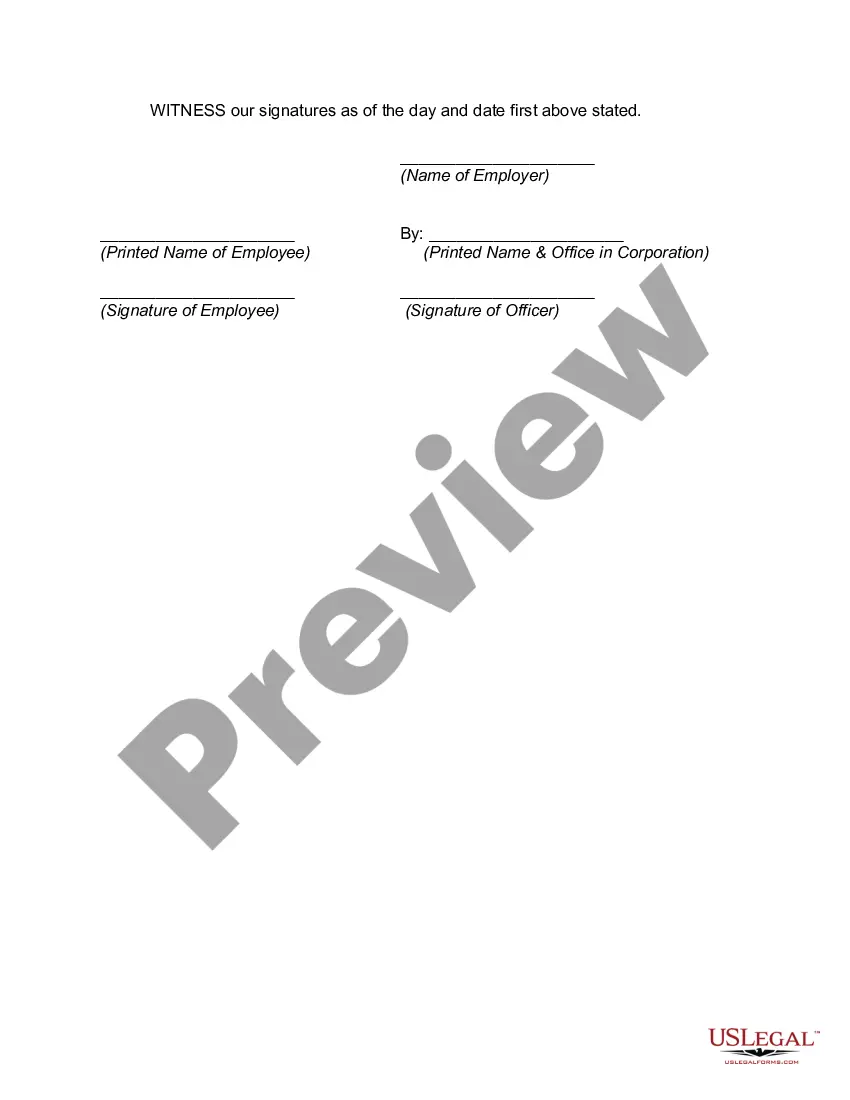

Typically, the board of directors or a designated representative signs the CEO employment agreement. This is also applicable for a Missouri Employment Agreement with Chief Financial Officer, as it represents a formal hiring process. Both the employer and the employee must sign to make the agreement legally binding. Ensuring all signatures are obtained is crucial for the contract's validity.

In Missouri, there is no legal requirement for employees to provide two weeks' notice before resigning. However, it is standard practice and considered professional courtesy. The Missouri Employment Agreement with Chief Financial Officer may outline specific notice requirements that both parties should respect for a smooth transition. Reviewing your agreement can clarify expectations for leaving or terminating employment.

In Missouri, contract law governs agreements made between parties, including employment agreements. To be enforceable, a contract must have clear terms, mutual consent, and consideration. The Missouri Employment Agreement with Chief Financial Officer must comply with specific regulations to ensure it is valid and binding. Understanding these laws helps protect both the employer and employee.

Typically, individuals such as financial analysts, accountants, and finance managers work under the Chief Financial Officer. These professionals assist in implementing the financial strategies set by the CFO, ensuring that financial reporting and budgeting align with the company’s objectives. Understanding the hierarchy is essential when drafting a Missouri Employment Agreement with Chief Financial Officer, as it sets the stage for clear expectations.

Creating an employment agreement starts with outlining the job's scope and details regarding roles and responsibilities. Next, include sections that cover salary, benefits, confidentiality, and duration of the employment. Utilizing platforms like US Legal Forms can simplify this process by offering templates tailored for a Missouri Employment Agreement with Chief Financial Officer roles.

An employment agreement is a specific type of contract that details the terms of employment for a particular role, such as a Chief Financial Officer. While all employment agreements are contracts, not every contract serves as an employment agreement. Understanding this distinction is essential when drafting a Missouri Employment Agreement with Chief Financial Officer, as it highlights the unique relationship between employer and employee.

An employment contract must include an offer, acceptance, and consideration to be legally binding. These elements establish the terms of employment and illustrate that both parties understand and agree to these terms. In the context of a Missouri Employment Agreement with Chief Financial Officer, you should also incorporate confidentiality clauses, especially when sensitive financial information is involved.