Missouri Angel Investor Agreement is a legal contract that establishes the terms and conditions of investment between an angel investor and a startup or early-stage company located in the state of Missouri. This agreement outlines the rights, obligations, and expectations of both parties involved in the investment relationship. An angel investor is an individual who provides capital to startups in exchange for ownership equity or convertible debt. Missouri boasts a vibrant angel investor community that plays a crucial role in driving economic growth by funding innovative companies and fostering entrepreneurship in the region. The Missouri Angel Investor Agreement typically covers various aspects of the investment, including the amount of investment, ownership stake, valuation of the company, investor rights, terms of repayment or conversion, use of funds, and anticipated exit strategies. These agreements are vital for ensuring a clear understanding between the investor and the startup, minimizing conflicts and risks associated with the investment process. In Missouri, like in other states, there may be different types of Angel Investor Agreements based on the specific terms negotiated by the parties involved. Some common variations include: 1. Equity-based Angel Investor Agreements: This type of agreement involves the investor acquiring a certain percentage of ownership in the startup through the investment. The terms of equity-based agreements can vary, including issues like voting rights, board representation, and anti-dilution provisions. 2. Convertible Debt Angel Investor Agreements: In this type of agreement, the investment is made in the form of debt that can be converted into equity at a later stage, typically during a subsequent funding round or upon achieving predefined milestones. Convertible debt agreements often include a conversion price, interest rates, maturity dates, and conversion triggers. 3. SAFE (Simple Agreement for Future Equity) Angel Investor Agreements: SAFE shave gained popularity in recent years and are an alternative to traditional convertible debt. It allows the investor to provide funding in exchange for the right to obtain equity in future priced financing rounds, eliminating the need to determine a valuation at the time of investment. 4. State-Specific Angel Investor Agreements: Missouri may have its own state-specific variations of Angel Investor Agreements, which can include additional provisions or considerations unique to the state's legal and business environment. It is critical for both the investor and the startup to carefully draft and review the Angel Investor Agreement, seeking legal counsel if necessary, to ensure that the terms align with their respective needs and expectations. These agreements establish the foundation for a fruitful partnership, fueling the growth and success of innovative ventures in Missouri.

Missouri Angel Investor Agreement

Description

How to fill out Missouri Angel Investor Agreement?

Choosing the best lawful papers template can be a battle. Obviously, there are plenty of themes available on the net, but how do you get the lawful type you will need? Utilize the US Legal Forms website. The service offers a huge number of themes, for example the Missouri Angel Investor Agreement, which can be used for enterprise and private requires. Every one of the types are examined by pros and meet up with state and federal specifications.

Should you be presently signed up, log in to your profile and click on the Obtain key to have the Missouri Angel Investor Agreement. Make use of your profile to appear throughout the lawful types you may have ordered in the past. Check out the My Forms tab of your own profile and obtain an additional copy in the papers you will need.

Should you be a whole new customer of US Legal Forms, allow me to share simple guidelines so that you can stick to:

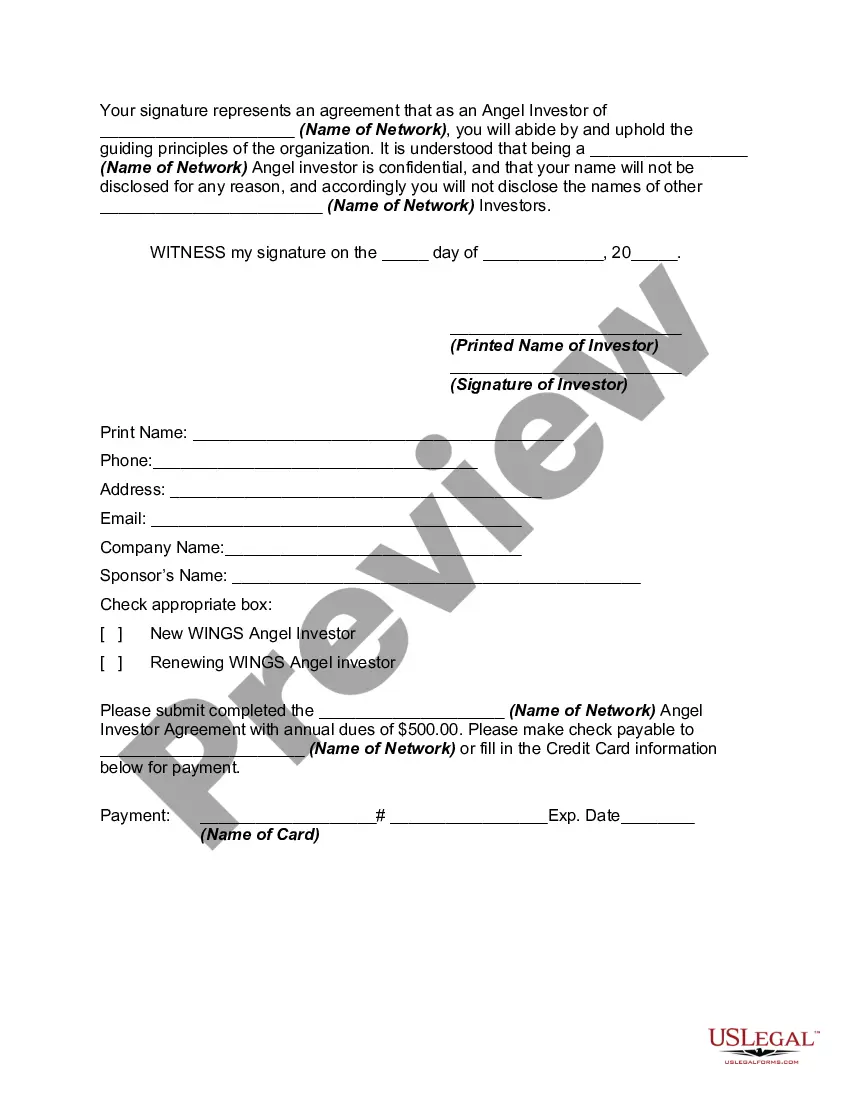

- First, be sure you have chosen the proper type for your city/county. You can examine the form utilizing the Review key and read the form information to ensure this is basically the best for you.

- If the type will not meet up with your requirements, take advantage of the Seach discipline to get the correct type.

- When you are certain that the form is suitable, select the Acquire now key to have the type.

- Pick the rates plan you need and type in the essential details. Create your profile and purchase the transaction utilizing your PayPal profile or Visa or Mastercard.

- Choose the file formatting and download the lawful papers template to your product.

- Full, modify and produce and sign the attained Missouri Angel Investor Agreement.

US Legal Forms will be the most significant local library of lawful types where you can discover numerous papers themes. Utilize the service to download expertly-produced documents that stick to status specifications.