Missouri General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Are you presently situated in a situation where you require documents for either organizational or personal purposes on a daily basis.

There are numerous legal document templates accessible online, yet locating ones you can rely on is not easy.

US Legal Forms offers a vast array of form templates, such as the Missouri General Form of Factoring Agreement - Assignment of Accounts Receivable, which are drafted to comply with federal and state regulations.

When you find the appropriate form, simply click Get now.

Select the pricing plan you desire, provide the requested information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Missouri General Form of Factoring Agreement - Assignment of Accounts Receivable at any time if necessary. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterwards, you can acquire the Missouri General Form of Factoring Agreement - Assignment of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/region.

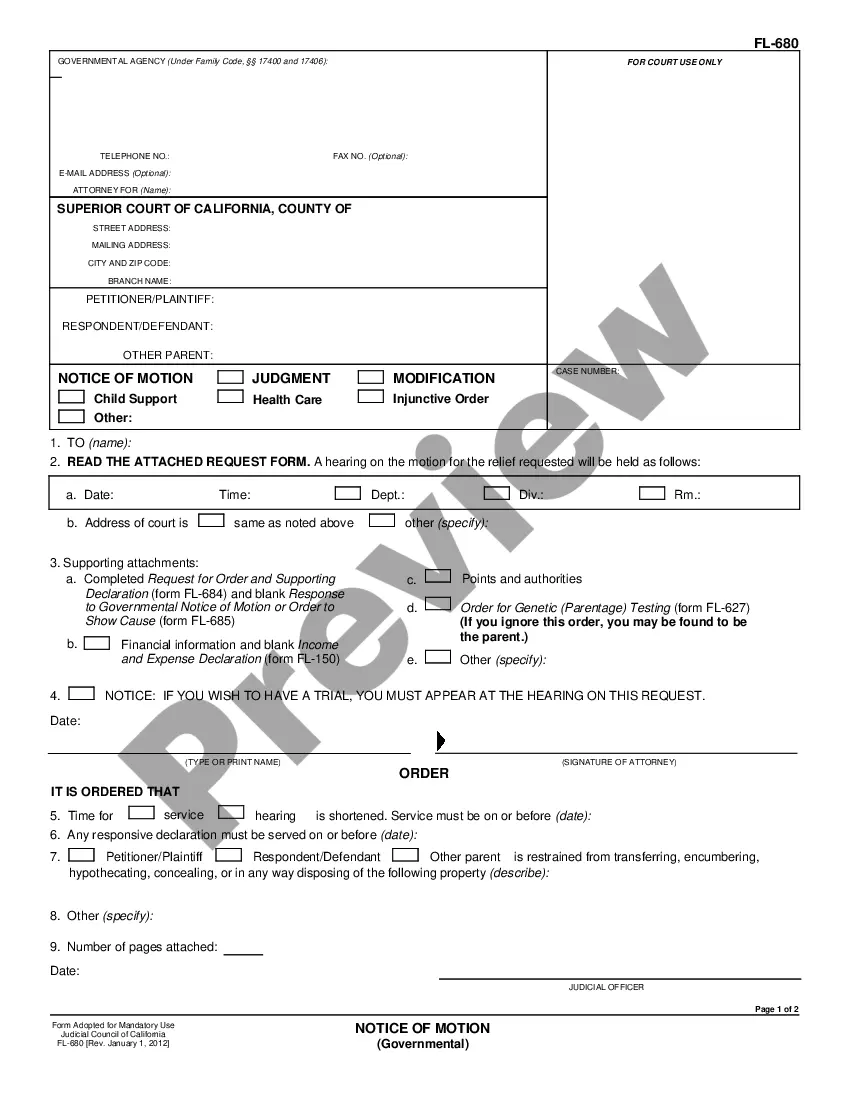

- Use the Preview button to view the form.

- Review the description to ensure that you have selected the correct form.

- If the form is not what you are searching for, utilize the Search field to find the form that meets your demands and specifications.

Form popularity

FAQ

In factoring, a Notice of Assignment (NoA) is a document that informs your customers that their invoices have been assigned to a factoring company. This document serves to notify them that the factor now holds the right to collect payments. The NoA protects both parties and ensures transparency in the process. Utilizing the Missouri General Form of Factoring Agreement - Assignment of Accounts Receivable can help you create proper NoA documentation.

The factoring process generally includes identifying eligible invoices, selecting a suitable factoring company, and completing the necessary documentation. After submitting your invoices, the factor evaluates your customers' credit and determines the advance rate. Once approved, funds are advanced to your business, and your customers will be contacted for payment collection. Understanding the Missouri General Form of Factoring Agreement - Assignment of Accounts Receivable streamlines these steps.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

A Notice of Assignment is used to inform debtors that a third party has 'purchased' their debt. The new company (assignee) takes over collection procedures, but can sometimes hire a debt collection agency to recover the money on their behalf. There are two types of debt assignment: Legal Assignment. Equitable

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward.

For example, if you sell $100,000 worth of accounts receivables and get a 90 percent advance, you will receive $90,000. The accounts receivable factoring company holds the remaining 10-percent or $10,000 as security until the payment of the invoice or invoices have been received.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Factoring allows companies to immediately build up their cash balance and pay any outstanding obligations. Therefore, factoring helps companies free up capital. that is tied up in accounts receivable and also transfers the default risk associated with the receivables to the factor.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.

How to Record Invoice Factoring Transactions Without RecourseRecord the amount sold as a credit in accounts receivable.Record the cash received as a debit in the cash account.Record the paid factoring fee as a debit loss.Record the amount the factoring company retained in the debit-due account.