Missouri Assignment and Transfer of Stock

Description

How to fill out Assignment And Transfer Of Stock?

Are you in a situation where you frequently need documentation for various company or specific reasons almost every workday.

There is an assortment of valid document templates accessible online, but finding reliable ones can be challenging.

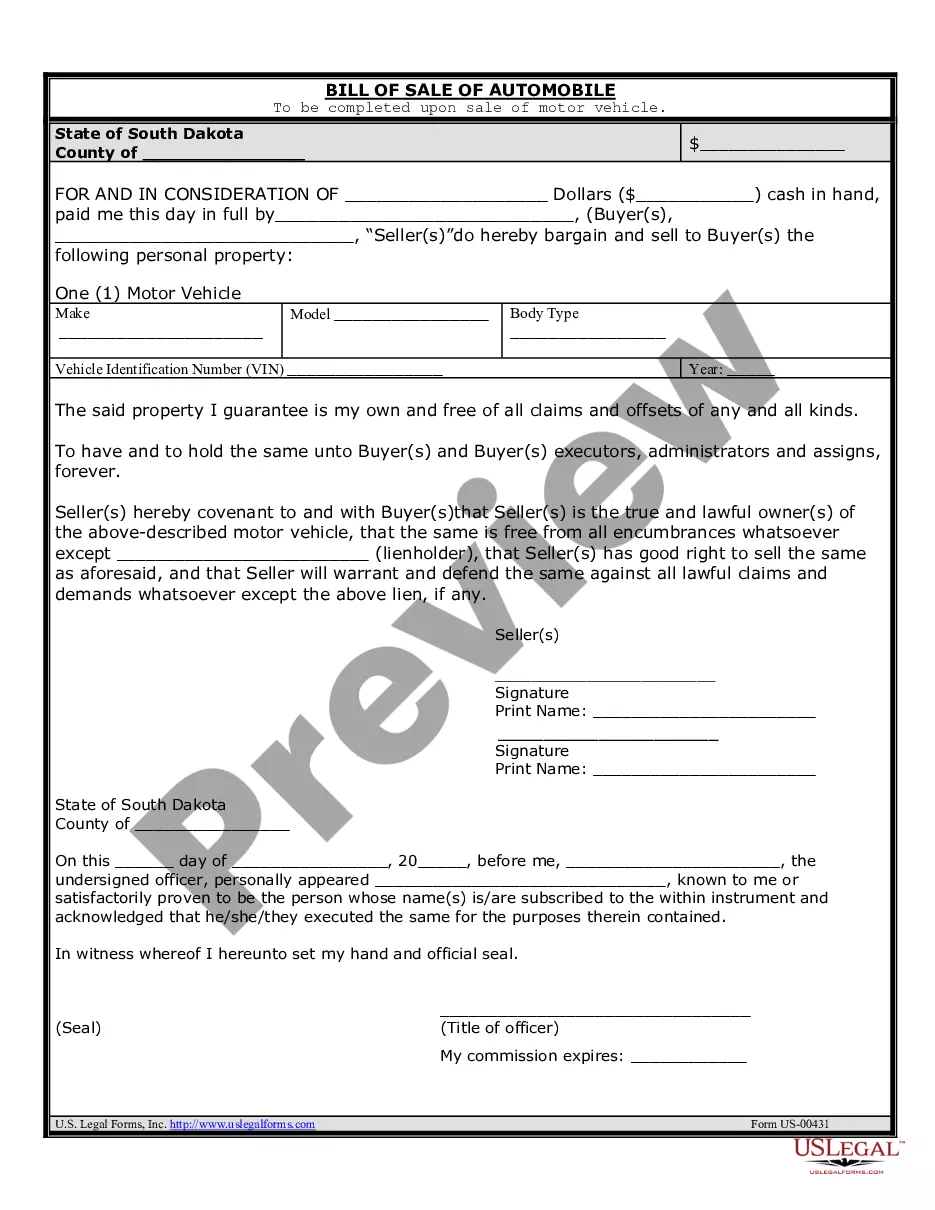

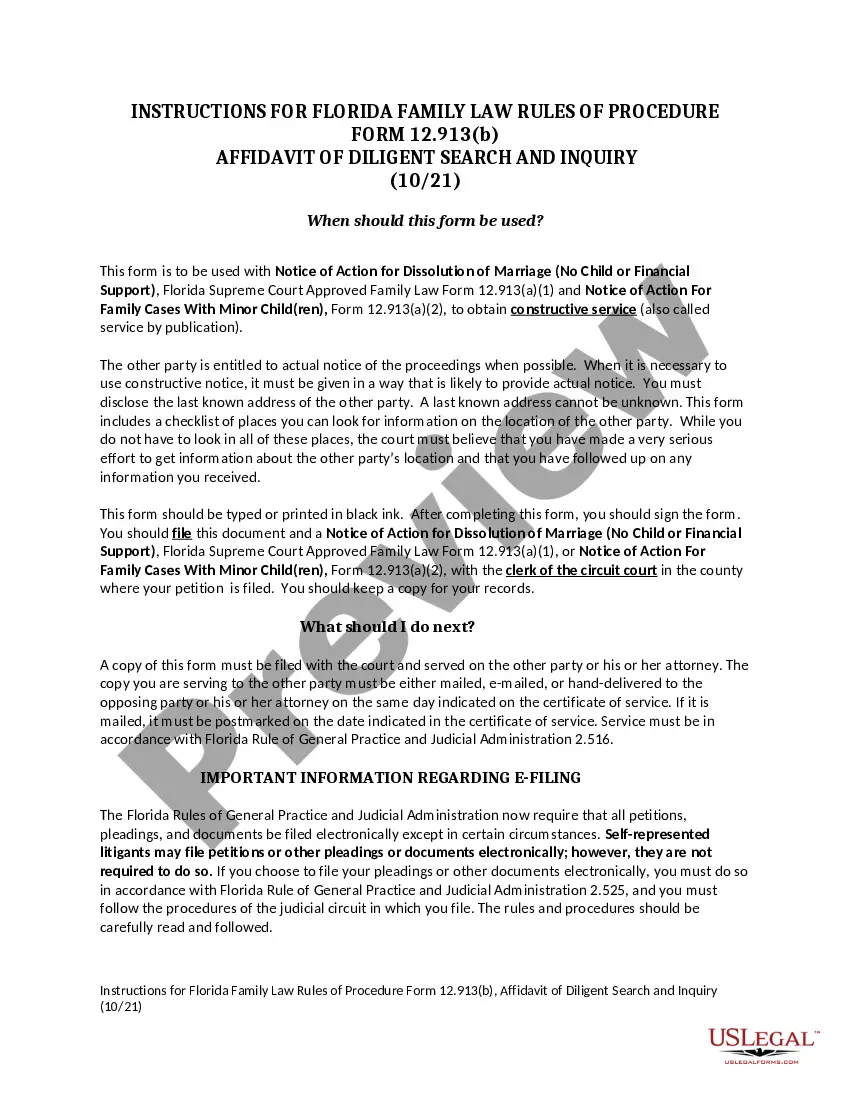

US Legal Forms provides numerous form templates, including the Missouri Assignment and Transfer of Stock, designed to meet federal and state requirements.

Once you find the appropriate form, just click Purchase now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Missouri Assignment and Transfer of Stock template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/state.

- Utilize the Preview button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form does not meet your needs, take advantage of the Search area to find a form that suits your requirements.

Form popularity

FAQ

An assignment of rights causes the designated party to gain new legal benefits from a stock, which may include voting rights and dividends. This shift can impact the management and financial possibilities of both the assignor and assignee. To manage these changes correctly, utilizing platforms like USLegalForms can provide the necessary resources and guidance for a smooth transition.

Consideration in the assignment of rights refers to what one party receives in exchange for transferring their rights, such as stock ownership or financial compensation. This aspect is vital in ensuring that the assignment adheres to legal standards in Missouri Assignment and Transfer of Stock. It helps validate the agreement and prevents future disputes over fairness or intent.

The assignment of rights operates by allowing one party to transfer their benefits from a stock, including dividends or voting rights, to another party. This transfer generally requires documentation and consent to ensure it aligns with legal regulations. In Missouri, it's essential to follow the correct procedures to avoid complications, and tools like USLegalForms can assist you in navigating this process effectively.

The Assignment of rights in Missouri pertains to the legal allowance for individuals to delegate their benefits or interests in a stock to another party. This process must adhere to Missouri law and often involves specific documentation to ensure clarity and legality. Engaging with platforms like USLegalForms can streamline this process by providing the necessary forms and guidance.

In the context of Missouri Assignment and Transfer of Stock, assignment refers to the process of transferring rights to receive dividends or vote, while transfer commonly denotes the actual exchange of stock ownership. An assignment usually maintains the original holder’s title, whereas a transfer entirely shifts the ownership to a new party. Understanding this distinction is crucial for anyone involved in stock transactions.

Consent to assignment of rights is an essential step in the Missouri Assignment and Transfer of Stock process. It involves obtaining permission from the relevant parties before transferring their rights related to stock. Without this consent, the assignment may be considered invalid. Therefore, ensuring proper consent protects all involved parties and upholds legal agreements.

Transferring property from an LLC to a person involves drafting a transfer deed outlining the transaction. This deed must be executed correctly and filed with the appropriate County Recorder's Office. It is essential to follow state laws to ensure the transfer is valid. The Missouri Assignment and Transfer of Stock resources can simplify this process and help you stay compliant.

To change the owner of your LLC in Missouri, start with the operating agreement, outlining the transfer process. You will then need to file any necessary forms with the Secretary of State's office, including the Statement of Change. Keeping records of this transfer is crucial for legal compliance, and the Missouri Assignment and Transfer of Stock can guide you through this journey.

Yes, you can transfer a liquor license in Missouri, but the process requires adherence to specific regulations. Typically, you need to submit a form to the local governing authority along with the required fees. Additionally, the new owner may need to undergo a background check. The Missouri Assignment and Transfer of Stock can help manage related paperwork effectively.

To change the ownership of a company, you should first create a written agreement between the current and new owners. You will often need to update the company's records and notify the appropriate state authorities. Filing the correct documents, such as the Missouri Assignment and Transfer of Stock, ensures that the change is recorded and legally binding.