Missouri Aging of Accounts Payable refers to a common financial practice used by businesses in the state of Missouri to track and manage their outstanding payment obligations. It involves categorizing and analyzing accounts payable based on their age, indicating how long invoices or bills have remained unpaid. The Missouri Aging of Accounts Payable process typically involves assigning invoice or bill payments to specific time periods or buckets, also known as aging brackets. These brackets are commonly classified as 30 days, 60 days, 90 days, and over 90 days. Each bracket represents a different age range, allowing businesses to identify and monitor the timeliness of their payment collections. By employing the Missouri Aging of Accounts Payable technique, companies gain better visibility into their outstanding liabilities and can effectively prioritize their payment activities. By doing so, businesses can efficiently manage their cash flow, maintain positive vendor relationships, and identify potential issues or delays in the payment process. Different types of Missouri Aging of Accounts Payable can be classified based on the level of granularity or the specific accounting methods used. These may include: 1. Basic Aging: This traditional method categorizes accounts payable into general aged brackets. It provides a high-level overview of outstanding payments and allows businesses to identify any significant delays or bottlenecks. 2. Detailed Aging: This method provides a more granular view of accounts payable by breaking down the aging brackets further. For example, instead of having a single over 90 days bracket, it may include sub-brackets such as 91-120 days, 121-180 days, and over 180 days. This level of detail enables deeper analysis and facilitates targeted action for resolving long-overdue payments. 3. Vendor-Specific Aging: In this approach, accounts payable are analyzed based on the specific vendors or suppliers. It allows companies to assess and manage their payment obligations to individual vendors, ensuring timely payments and nurturing strong partnerships. 4. Aging by Invoice Type: This method categorizes accounts payable based on the type of invoice or bill. It helps businesses identify patterns or trends in different invoice types, such as recurring bills or one-time expenses, and helps in better budgeting and forecasting. Effective utilization of Missouri Aging of Accounts Payable can significantly benefit businesses in terms of maintaining positive relationships with vendors, improving cash flow, identifying potential financial risks, and strategically managing working capital. By implementing a systematic and detailed analysis of accounts payable aging, businesses in Missouri can enhance their financial management practices and ensure the smooth operation of their day-to-day financial activities.

Missouri Aging of Accounts Payable

Description

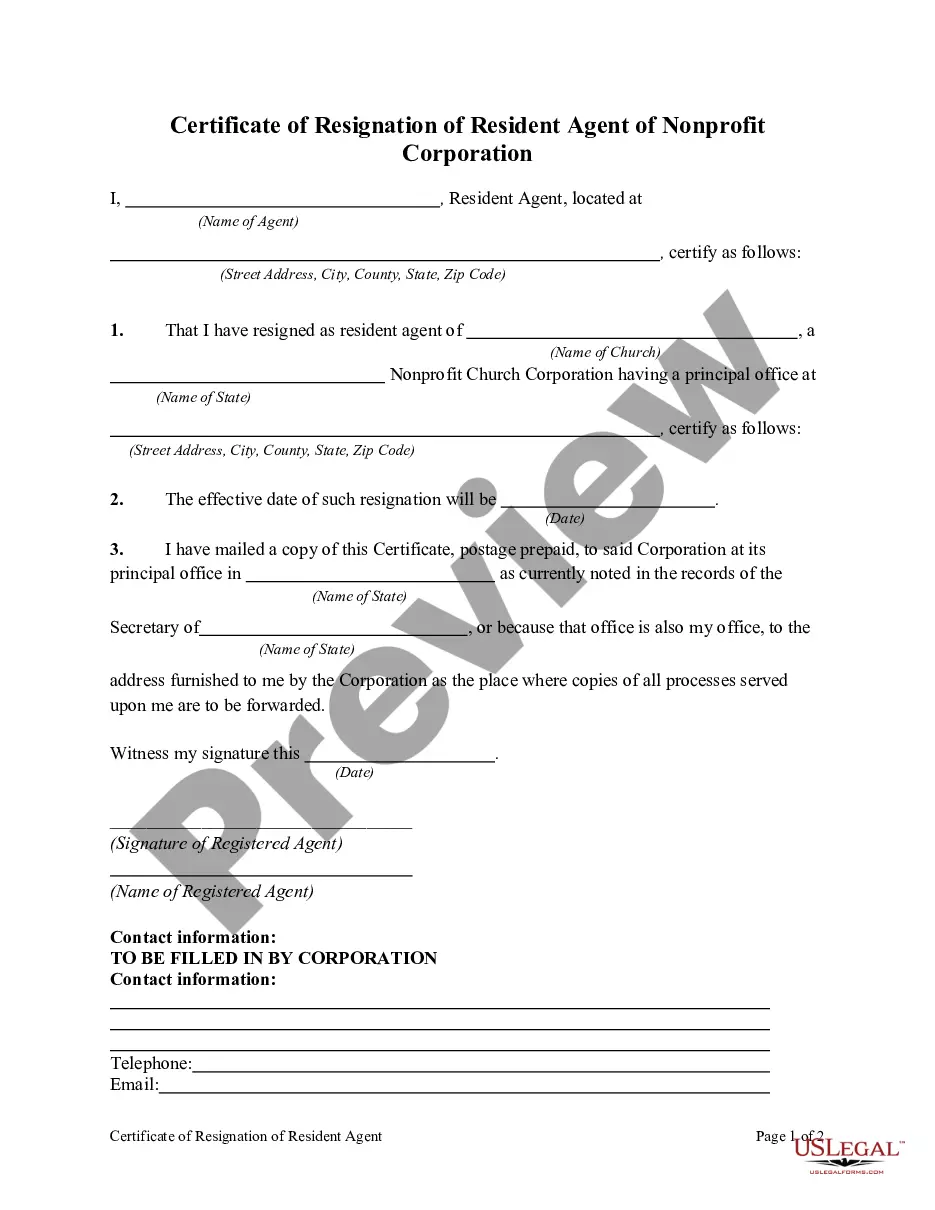

How to fill out Missouri Aging Of Accounts Payable?

If you must finish, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and titles, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You may use your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Missouri Aging of Accounts Payable with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to access the Missouri Aging of Accounts Payable.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative models in the legal form category.

Form popularity

FAQ

To report accounts receivable aging in Quickbooks, start by generating an Aged Receivables report from the reports menu. Ensure all accounts are up to date, and categorize them based on overdue periods. By integrating the Missouri Aging of Accounts Payable concepts, you can enhance your financial oversight within Quickbooks.

To record aging accounts receivable, document each outstanding invoice along with its due date and status. Regularly update this information so that you reflect accurate aging periods. Tools and platforms, particularly those focusing on the Missouri Aging of Accounts Payable, can significantly assist in maintaining organized records.

To write an accounts receivable aging report, begin by compiling outstanding invoices and their due dates. Next, organize the data into categories over specified time intervals. Using the Missouri Aging of Accounts Payable can enhance the clarity and effectiveness of your report, ensuring that you prioritize collections effectively.

The formula for aging accounts receivable involves listing the total amounts due and their corresponding due dates. Next, categorize these amounts into time frames, such as current, 1-30 days, 31-60 days, etc. By applying the Missouri Aging of Accounts Payable framework, you can create a visual representation that simplifies account management.

To calculate accounts payable aging, gather outstanding liabilities and categorize them based on how long each has been overdue. This involves creating intervals, such as 30, 60, and 90 days, from the due date. Utilizing effective tools like the Missouri Aging of Accounts Payable can streamline this process and provide greater insight into financial obligations.

An aging schedule generally displays accounts payable organized by the length of time invoices have been unpaid. Common formats include columns for vendor names, invoice amounts, and aging periods such as 0-30 days, 31-60 days, and beyond. Creating a clear Missouri Aging of Accounts Payable schedule helps businesses identify overdue payments easily. Uslegalforms offers customizable templates to streamline this process.

In Missouri, the senior age is generally considered to be 65 years old. This age is significant as it indicates eligibility for various benefits and programs designed for older adults. Many seniors in Missouri are looking for resources to manage their finances, including the Missouri Aging of Accounts Payable. Utilizing tools available through uslegalforms can help seniors stay organized with their financial responsibilities.

To obtain an accounts payable aging report in QuickBooks, navigate to the 'Reports' menu, then select 'Vendor Reports' and choose 'Aging Summary'. This report provides a snapshot of unpaid invoices, organized by age. QuickBooks simplifies the process and keeps your Missouri Aging of Accounts Payable overview clear and manageable.

To conduct aging of accounts payable, compile a list of all outstanding invoices from your vendors and categorize them by age. This categorization often includes sections such as current, 1-30 days overdue, 31-60 days overdue, and so on. Regularly reviewing your Missouri Aging of Accounts Payable will help ensure timely payments and sustain healthy vendor relationships.

Creating an aging report in accounts payable starts with gathering all unpaid invoices and their due dates. Input this data into a spreadsheet or accounting software, organizing it into categories based on age. Utilizing tools like US Legal Forms can streamline this process while providing valuable templates and organizational resources for managing Missouri Aging of Accounts Payable.