A Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank is a legal contract that establishes the terms and conditions of a financial arrangement between a business entity and a bank in the state of Missouri. This agreement outlines the rights, responsibilities, and obligations of both parties involved. Keywords: Missouri, line of credit, loan agreement, corporate borrower, business borrower, bank 1. Overview: The Missouri Line of Credit or Loan Agreement is a legally binding document that governs the credit or loan arrangement between a corporate or business borrower and a bank in the state of Missouri. It serves as a guide to ensure transparency and clarity in the financial relationship. 2. Purpose: The primary purpose of this agreement is to outline the terms and conditions for the bank's provision of funds to the corporate or business borrower. It establishes the maximum loan amount, interest rates, repayment schedules, and any other relevant financial obligations. 3. Types of Missouri Line of Credit or Loan Agreement: There are various types of credit or loan agreements that can be established between a corporate or business borrower and a bank in Missouri. Some common types include: — Business Line of Credit Agreement: This type of agreement allows the borrower to access a predetermined credit limit, which can be drawn upon as needed. Interest is typically charged only on the amount utilized. — Term Loan Agreement: This type of agreement provides the borrower with a lump sum of money for a specific purpose. The borrower repays the loan, along with interest, in regular installments over a set period. — Revolving Credit Agreement: This agreement works similarly to a line of credit, allowing the borrower to access funds as needed, repay them, and access them again without the need for a new loan application. 4. Key Provisions: a. Loan Amount and Purpose: The agreement specifies the maximum amount the bank is willing to lend and the purpose for which the funds may be used. b. Interest Rates: The interest rate or rates applicable to the loan are outlined, including any potential fixed rates or variable rates. c. Repayment Terms: This section details the repayment schedule, including the frequency of payments, the duration of the loan, and any balloon payment provisions. d. Collateral and Guarantees: The agreement determines whether collateral, such as assets or property, must be pledged to secure the loan. It may also require personal guarantees from the business owners or directors. e. Default and Remedies: This section identifies the events that constitute defaults and outlines the consequences, including potential penalties or legal actions, in case of default. f. Amendment and Termination: The agreement may provide guidelines on how it can be amended or terminated, including any fees or penalties associated with early repayment or renegotiation. In conclusion, a Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank is a crucial document that specifies the terms and conditions of a financial arrangement. Businesses seeking capital from a bank in Missouri must carefully consider the different types of agreements available and understand the implications of the provisions before entering into such an agreement.

Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

How to fill out Missouri Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

If you want to comprehensive, acquire, or produce legitimate document layouts, use US Legal Forms, the biggest selection of legitimate varieties, that can be found on-line. Use the site`s simple and practical search to obtain the paperwork you want. Various layouts for business and specific reasons are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank with a couple of mouse clicks.

If you are presently a US Legal Forms consumer, log in for your accounts and then click the Obtain key to have the Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank. Also you can access varieties you formerly downloaded within the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the correct city/country.

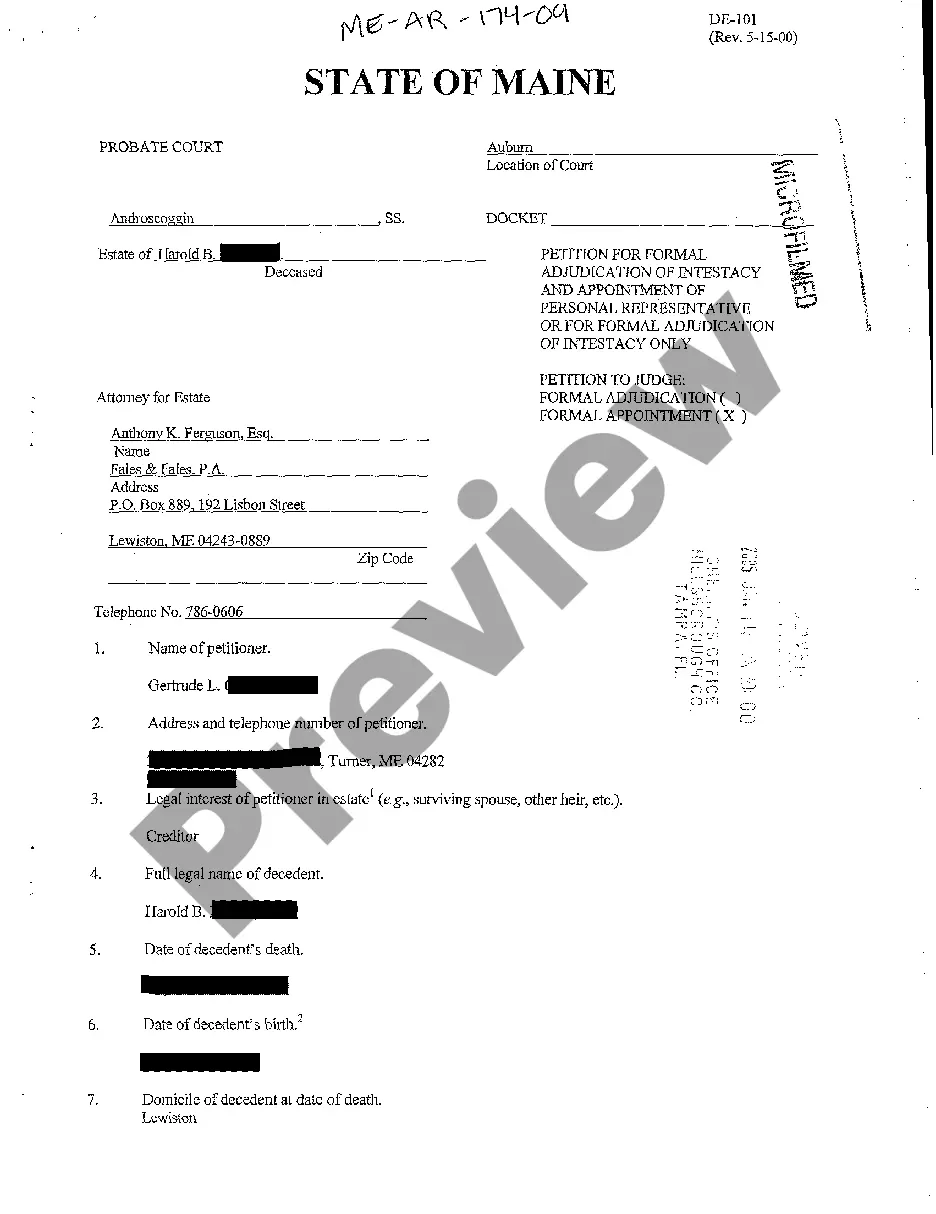

- Step 2. Utilize the Review method to look through the form`s content material. Never forget about to read through the description.

- Step 3. If you are unsatisfied with all the develop, utilize the Lookup discipline near the top of the monitor to get other models of the legitimate develop format.

- Step 4. Once you have discovered the shape you want, click on the Get now key. Pick the prices strategy you like and add your qualifications to register for the accounts.

- Step 5. Procedure the transaction. You can utilize your charge card or PayPal accounts to finish the transaction.

- Step 6. Select the file format of the legitimate develop and acquire it on your own product.

- Step 7. Complete, revise and produce or indicator the Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank.

Each and every legitimate document format you buy is your own permanently. You have acces to each and every develop you downloaded with your acccount. Click the My Forms segment and select a develop to produce or acquire once more.

Remain competitive and acquire, and produce the Missouri Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank with US Legal Forms. There are millions of specialist and express-specific varieties you can use to your business or specific demands.