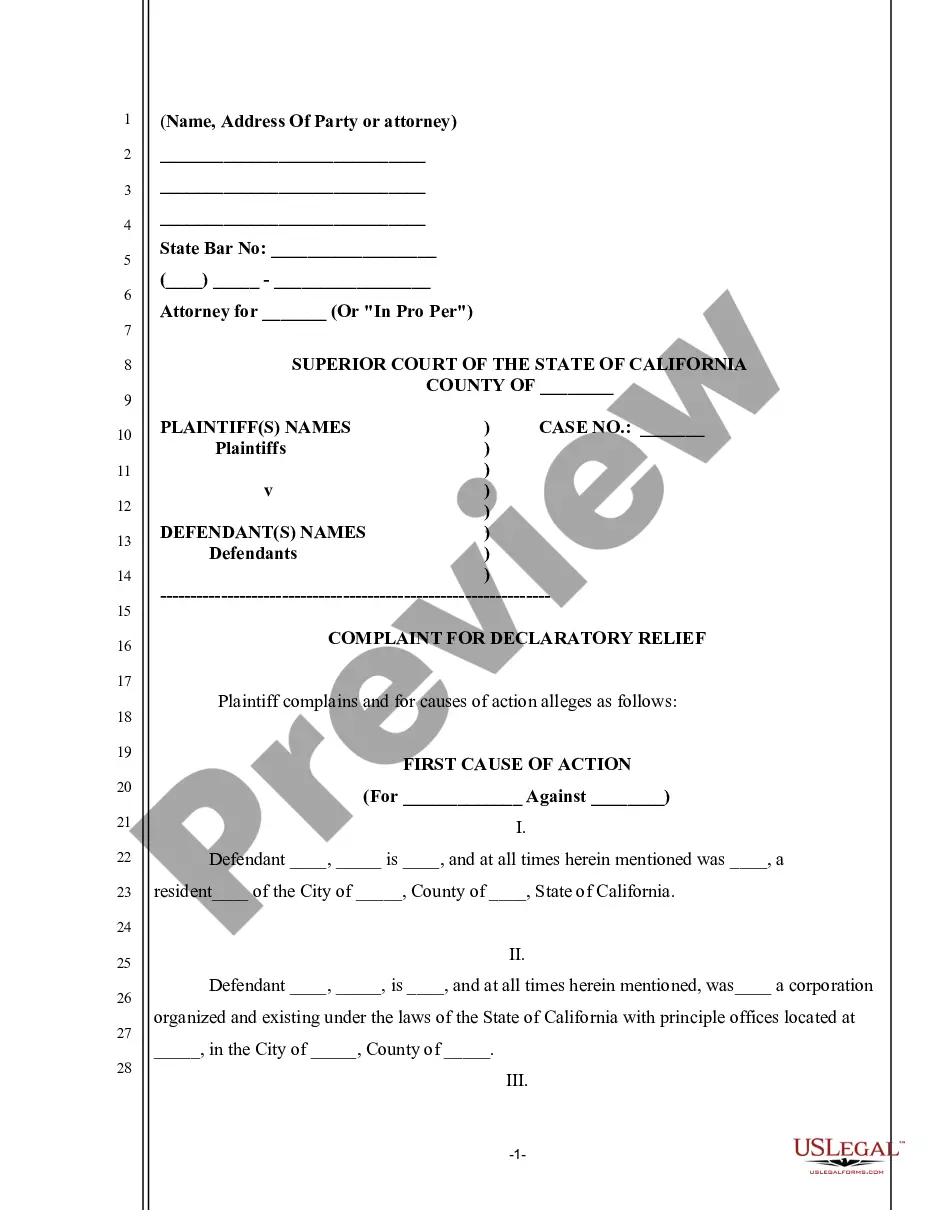

Missouri Letter to Confirm Accounts Receivable is a formal document used by businesses to verify the outstanding accounts receivable balances owed by their customers. This letter serves as a written request to confirm the accuracy of the stated accounts and ensure that both parties have a clear understanding of the financial obligations. The purpose of a Missouri Letter to Confirm Accounts Receivable is to ensure that the information recorded by the business matches the customer's records accurately. It helps prevent discrepancies, billing errors, or misunderstandings that may arise from the differences in documenting financial transactions. There are generally two main types of Missouri Letter to Confirm Accounts Receivable: 1. Initial Accounts Receivable Confirmation: This type of letter is sent by the business to its customers at the beginning of a new financial period. It requests customers to review the provided account balances and confirm their accuracy. This letter also emphasizes the importance of prompt acknowledgment to ensure a smooth financial relationship. 2. Periodic Accounts Receivable Confirmation: This letter is typically sent periodically, such as quarterly or annually, to reconfirm the customer's outstanding balances. It aims to update and validate the account information, ensuring that any necessary adjustments or corrections can be made in a timely manner. Keywords: Missouri, Letter to Confirm Accounts Receivable, business, verification, outstanding balances, customers, formal document, financial obligations, discrepancies, billing errors, misunderstandings, financial transactions, initial confirmation, periodic confirmation, accuracy, prompt acknowledgment, smooth financial relationship, update, validate, adjustments, corrections.

Missouri Letter to Confirm Accounts Receivable

Description

How to fill out Missouri Letter To Confirm Accounts Receivable?

Are you in the placement where you need to have papers for possibly organization or individual uses nearly every day? There are a lot of legal papers layouts accessible on the Internet, but locating versions you can rely on isn`t easy. US Legal Forms offers a huge number of form layouts, just like the Missouri Letter to Confirm Accounts Receivable, that are composed to fulfill federal and state specifications.

In case you are already informed about US Legal Forms web site and get a free account, simply log in. Afterward, you may download the Missouri Letter to Confirm Accounts Receivable design.

Unless you provide an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for that appropriate town/county.

- Make use of the Preview option to examine the shape.

- Browse the outline to actually have selected the appropriate form.

- In the event the form isn`t what you`re looking for, utilize the Search discipline to discover the form that meets your needs and specifications.

- Whenever you get the appropriate form, just click Acquire now.

- Choose the costs strategy you want, submit the specified info to make your account, and pay money for an order using your PayPal or Visa or Mastercard.

- Decide on a convenient document format and download your backup.

Find all of the papers layouts you may have bought in the My Forms food selection. You may get a additional backup of Missouri Letter to Confirm Accounts Receivable at any time, if required. Just go through the needed form to download or print out the papers design.

Use US Legal Forms, by far the most comprehensive variety of legal types, in order to save efforts and avoid faults. The support offers expertly manufactured legal papers layouts that can be used for a range of uses. Make a free account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Thus, there is a presumption that the auditor will request the confirmation of accounts receivable during an audit unless one of the following is true: Accounts receivable are immaterial to the financial statements. The use of confirmations would be ineffective.

With my solid experience in accounts receivable and collections, coupled with keen financial acumen and dedication to quality customer service, I am confident that I could quickly exceed your expectations in this role. I look forward to discussing the position in further detail. Thank you for your consideration.

Normally, account payable confirmation is used to verify the accuracy and existence of account payable at the end of the accounting period that claims to be existing by the client.

RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial, the use of confirmations would be ineffective or combined inherent risk and control risk are low and analytics or other substantive tests would detect misstatements.

How to Audit Accounts ReceivableTrace receivable report to general ledger.Calculate the receivable report total.Investigate reconciling items.Test invoices listed in receivable report.Match invoices to shipping log.Confirm accounts receivable.Review cash receipts.Assess the allowance for doubtful accounts.More items...?15-May-2017

What is an Accounts Receivable Confirmation? When an auditor is examining the accounting records of a client company, a primary technique for verifying the existence of accounts receivable is to confirm them with the company's customers. The auditor does so with an accounts receivable confirmation.

Is the confirmation of cash and accounts receivable required according to auditing standards? Yes, usually required by auditing standards but auditors can choose not to in certain situations. It then becomes the auditors responsibility to gather evidence which can take much more time.

Once the confirmation is ready to be sent, the auditor is the one who sends the confirmation to the client's customers. The confirmation should not send by the client to its customer. This is to confirm that evidence that is collected from the confirmation is considered third-party information.

The auditor does so with an accounts receivable confirmation. This is a letter signed by a company officer (but mailed by the auditor) to customers selected by the auditors from the company's accounts receivable aging report.

Accounts receivable confirmation is a technique used in the auditing process to verify a company's records. The auditor sends communications directly to customers, asking them to confirm the records maintained by the company.