A Missouri Loan Agreement between Stockholder and Corporation is a legally binding contract that outlines the terms and conditions under which a stockholder provides a loan to a corporation based in the state of Missouri. This agreement sets forth the rights and obligations of both parties involved in the loan transaction. Keywords: Missouri, loan agreement, stockholder, corporation, terms, conditions, rights, obligations, contract In Missouri, there are different types of Loan Agreements between Stockholder and Corporation that may be utilized depending on specific circumstances. Some of these agreements include: 1. Secured Loan Agreement: This type of agreement requires the corporation to provide collateral, such as assets or properties, as security for the loan. The stockholder will only recoup the loan amount if the corporation fails to repay the borrowed funds. 2. Unsecured Loan Agreement: In contrast to a secured loan, an unsecured loan agreement does not require any collateral from the corporation. The stockholder trusts the corporation's financial standing and reputation to repay the loan without any security. 3. Convertible Loan Agreement: This agreement allows the stockholder to convert the loan into stock or equity in the corporation at a later date. It provides the stockholder with an opportunity to become a shareholder in the corporation based on the terms agreed upon. 4. Demand Loan Agreement: In this type of agreement, the stockholder has the right to demand repayment of the loan amount at any time, regardless of the agreed-upon repayment schedule. This gives the stockholder flexibility in case of unforeseen circumstances or changes in their financial requirements. 5. Promissory Note Loan Agreement: A promissory note is a legal document that confirms the corporation's promise to repay the loan according to specified terms, including interest rates and repayment period. Regardless of the type of Loan Agreement between Stockholder and Corporation used in Missouri, it is essential that the agreement includes comprehensive details about the loan amount, interest rate, repayment schedule, default provisions, and any other relevant terms and conditions mutually agreed upon by both parties. It is highly recommended that both the stockholder and the corporation seek legal counsel to draft and review this loan agreement, ensuring compliance with Missouri state laws and regulations.

Missouri Loan Agreement between Stockholder and Corporation

Description

How to fill out Missouri Loan Agreement Between Stockholder And Corporation?

Are you in the situation that you require files for either organization or personal functions nearly every day? There are a lot of lawful record templates available online, but finding versions you can depend on is not effortless. US Legal Forms delivers a huge number of form templates, much like the Missouri Loan Agreement between Stockholder and Corporation, that are written in order to meet federal and state demands.

If you are currently familiar with US Legal Forms site and also have a merchant account, basically log in. Following that, it is possible to download the Missouri Loan Agreement between Stockholder and Corporation design.

Unless you come with an profile and wish to begin using US Legal Forms, abide by these steps:

- Obtain the form you want and make sure it is for your correct metropolis/county.

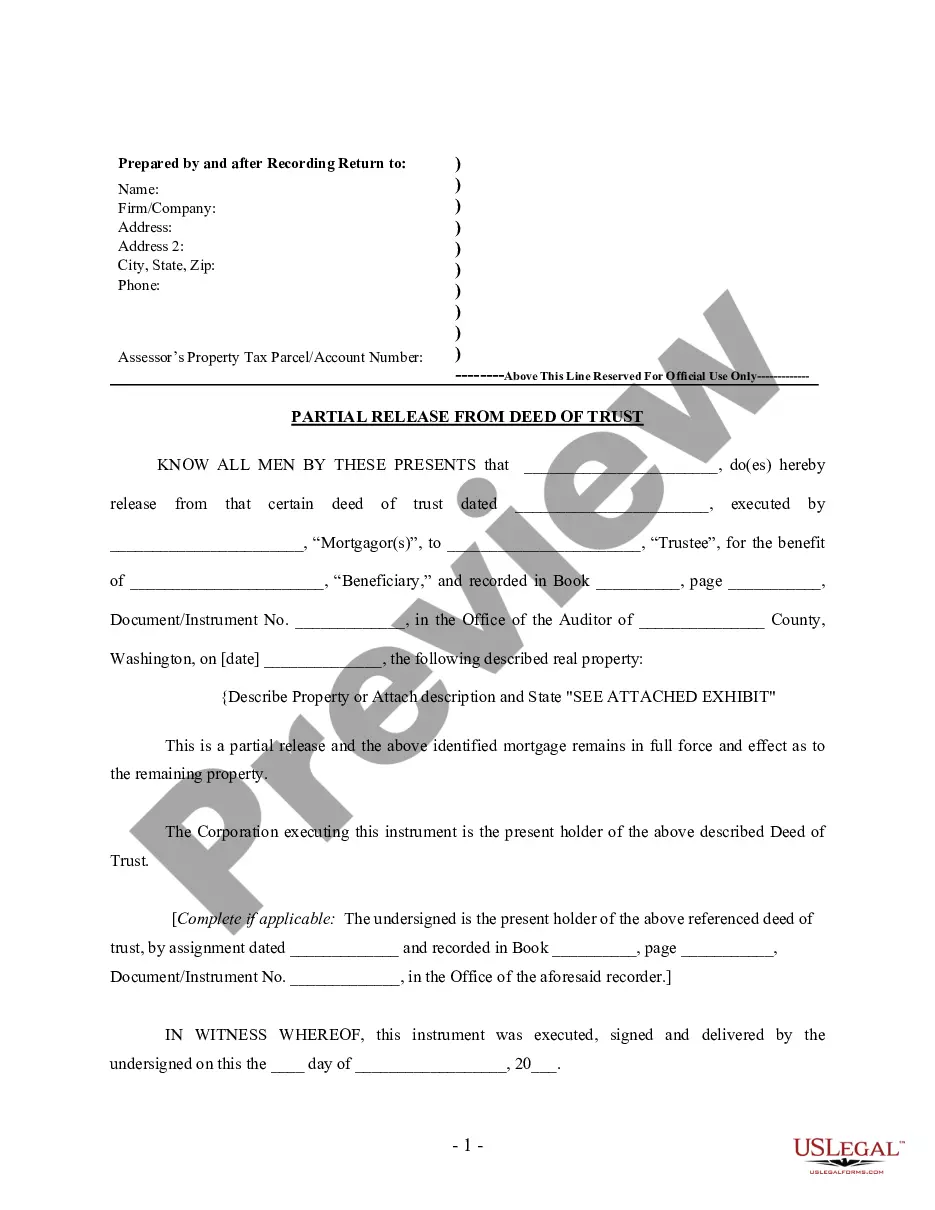

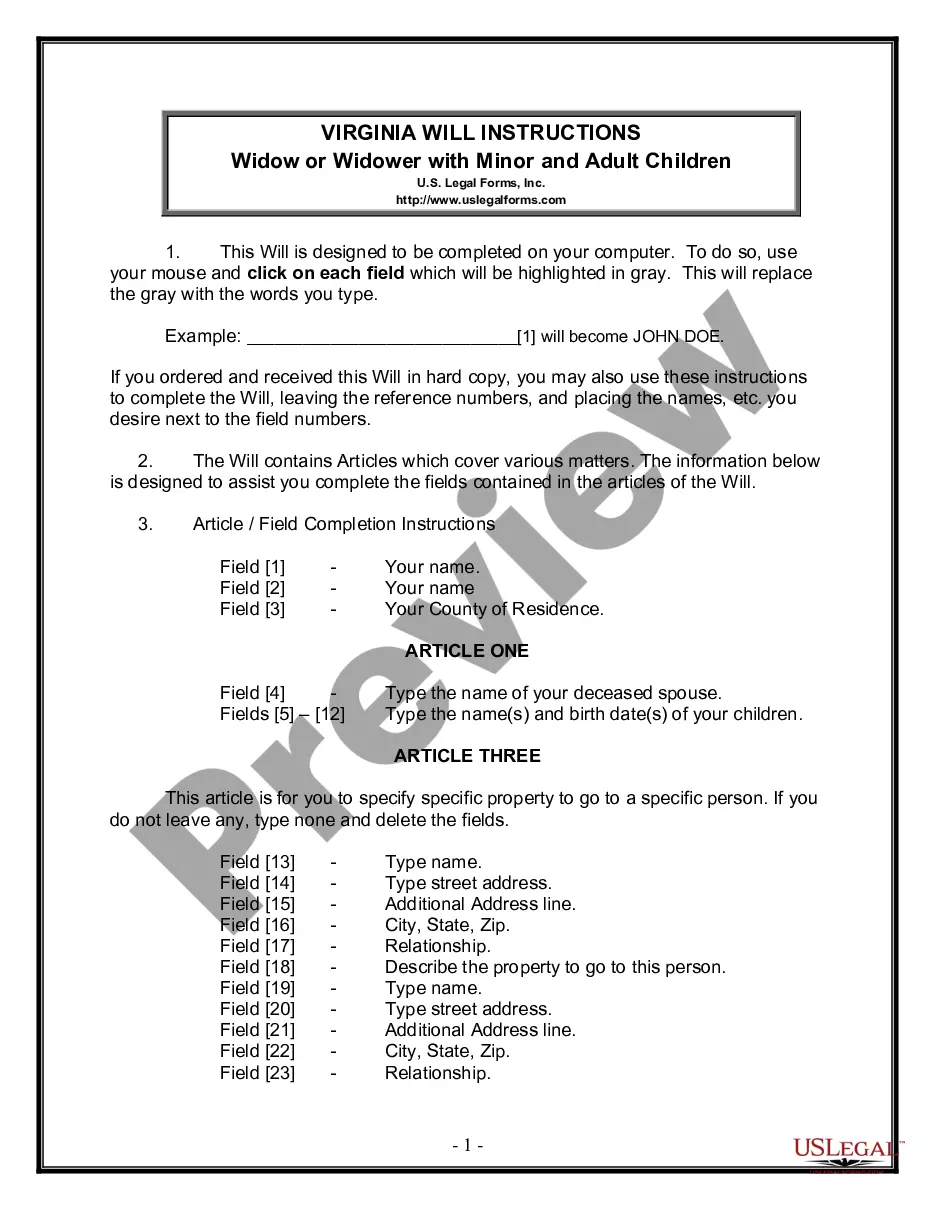

- Use the Review option to check the form.

- Read the outline to ensure that you have selected the proper form.

- In case the form is not what you are trying to find, use the Lookup field to find the form that meets your requirements and demands.

- If you get the correct form, click Acquire now.

- Opt for the costs prepare you would like, complete the required information and facts to make your money, and buy your order using your PayPal or bank card.

- Pick a convenient document structure and download your duplicate.

Get all the record templates you may have bought in the My Forms food selection. You can aquire a additional duplicate of Missouri Loan Agreement between Stockholder and Corporation whenever, if possible. Just select the necessary form to download or printing the record design.

Use US Legal Forms, by far the most extensive selection of lawful types, to save lots of time as well as stay away from errors. The support delivers professionally made lawful record templates which you can use for a variety of functions. Create a merchant account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

Shareholders often loan money to a corporation in order to keep the business operating, but be aware there are rules and regulations, which must be adhered to, so the loan is treated as a loan, and not reclassified as an equity contribution.

Generally, an LLC can borrow money from any individual; however, there can be ancillary restrictions and concerns if the lender is also a member of the company.

There is a correct process to go through if you want to lend money to a corporation. First, you must properly document the transaction. If you give money to your business to purchase inventory and the company defaults on the loan, you may qualify to write off the loan as a business bad debt versus an investment loss.

IFRS 9 requires the discount rate to be the loan's effective interest rate. FAQ 45.59. 5 in chapter 45 of PwC's Manual of accounting explains that intercompany loans which are interest free and repayable on demand have an effective interest rate of 0%.

Shareholder loan balances The loan must also not be considered to be a series of loans and repayments eg. Repaying an amount at the end of 2019 only to borrow again in early 2020. The best way to clear out a shareholder loan balance is to pay a salary, bonus or dividend.

Shareholders often loan money to their corporation in order to keep the business operating. There are rules and regulations in the Internal Revenue Code (IRC) that must be adhered to in order for loans to be treated as such, and not an equity contribution.

Terms. Shareholder loans do not have a maturity and they do not pay cash interest but rather PIK. The interest, unlike PIK interest on mezzanine, is not tax deductible. In order to not be capped by the return on the loan, sponsors will all invest in the common or ordinary equity of the company as well.

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.

If you own an S corporation, consider lending funds rather than contributing to capital. Loans you make to the business can increase your basis for purposes of deducting losses passed through to you, and the repayment of the principal back to you isn't taxable.