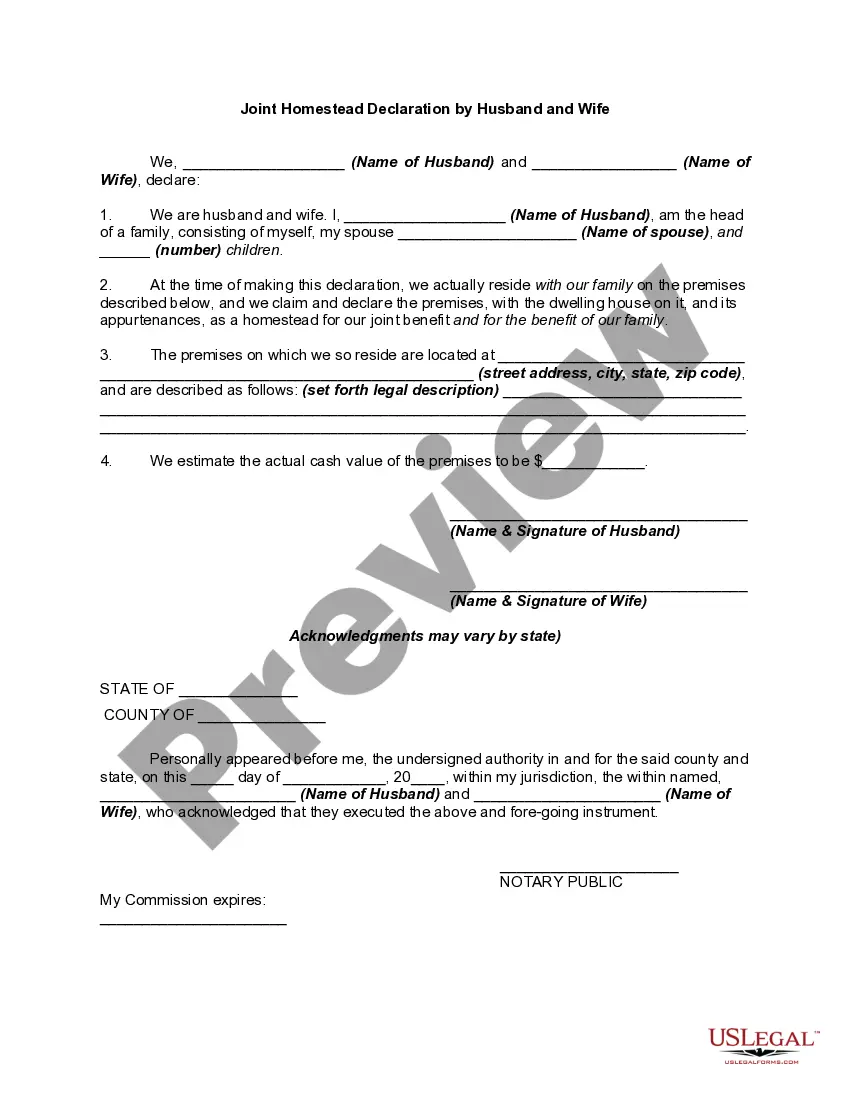

Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

The Missouri Joint Homestead Declaration by Husband and Wife is a legal document that allows married couples to declare their property as a homestead. This declaration provides certain protections and benefits for homeowners in Missouri. A homestead is a primary residence that is protected from creditors and provides various exemptions under the law. By filing a Joint Homestead Declaration, married couples can establish their property as a homestead and benefit from these legal protections. This declaration is applicable for married couples who own a primary residence in Missouri and wish to safeguard their home from potential creditors. It is important to note that both spouses must sign the Joint Homestead Declaration for it to be valid. Benefits of filing a Missouri Joint Homestead Declaration by Husband and Wife include: 1. Protection from creditors: Once the declaration is filed, the homestead property is protected from certain debts and judgments. Creditors will have limitations on their ability to force the sale of the property to satisfy outstanding debts. 2. Exemptions in bankruptcy: The filing of a Joint Homestead Declaration can provide additional exemptions for couples filing for bankruptcy. This can help protect a portion of the home's equity from being liquidated to pay off debts. 3. Marital property protection: By declaring their property as a homestead, both spouses ensure that their home cannot be sold or encumbered without the consent of both parties. This protects the overall interests of both individuals in the marriage. There are different types of Joint Homestead Declarations available in Missouri based on the circumstances of the homeowners: 1. Joint Homestead Declaration by Husband and Wife — Regular: This is the standard declaration applicable to most married couples who jointly own and reside in their primary residence. 2. Joint Homestead Declaration by Husband or Wife — Widow/Widower: This declaration is applicable to a surviving spouse who wishes to protect their primary residence after the death of their partner. 3. Joint Homestead Declaration by Husband and Wife — Divorced: This type of declaration is used when a previously married couple, who both still have ownership rights to the home, wish to establish it as a homestead. It is important to consult with an attorney or legal professional to determine which type of Joint Homestead Declaration is most appropriate for individual circumstances. By utilizing this legal tool, married couples in Missouri can secure and protect their primary residence from potential creditors and financial hardships.The Missouri Joint Homestead Declaration by Husband and Wife is a legal document that allows married couples to declare their property as a homestead. This declaration provides certain protections and benefits for homeowners in Missouri. A homestead is a primary residence that is protected from creditors and provides various exemptions under the law. By filing a Joint Homestead Declaration, married couples can establish their property as a homestead and benefit from these legal protections. This declaration is applicable for married couples who own a primary residence in Missouri and wish to safeguard their home from potential creditors. It is important to note that both spouses must sign the Joint Homestead Declaration for it to be valid. Benefits of filing a Missouri Joint Homestead Declaration by Husband and Wife include: 1. Protection from creditors: Once the declaration is filed, the homestead property is protected from certain debts and judgments. Creditors will have limitations on their ability to force the sale of the property to satisfy outstanding debts. 2. Exemptions in bankruptcy: The filing of a Joint Homestead Declaration can provide additional exemptions for couples filing for bankruptcy. This can help protect a portion of the home's equity from being liquidated to pay off debts. 3. Marital property protection: By declaring their property as a homestead, both spouses ensure that their home cannot be sold or encumbered without the consent of both parties. This protects the overall interests of both individuals in the marriage. There are different types of Joint Homestead Declarations available in Missouri based on the circumstances of the homeowners: 1. Joint Homestead Declaration by Husband and Wife — Regular: This is the standard declaration applicable to most married couples who jointly own and reside in their primary residence. 2. Joint Homestead Declaration by Husband or Wife — Widow/Widower: This declaration is applicable to a surviving spouse who wishes to protect their primary residence after the death of their partner. 3. Joint Homestead Declaration by Husband and Wife — Divorced: This type of declaration is used when a previously married couple, who both still have ownership rights to the home, wish to establish it as a homestead. It is important to consult with an attorney or legal professional to determine which type of Joint Homestead Declaration is most appropriate for individual circumstances. By utilizing this legal tool, married couples in Missouri can secure and protect their primary residence from potential creditors and financial hardships.