Missouri Vendor Evaluation

Description

How to fill out Vendor Evaluation?

If you wish to complete, acquire, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Utilize the site's straightforward and convenient search to locate the documents you need.

Various templates for business and personal applications are categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

Step 6. Choose the format of the legal form and download it to your device.

- Utilize US Legal Forms to locate the Missouri Vendor Assessment with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Missouri Vendor Assessment.

- You can also access documents you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find alternate versions of the legal form format.

- Step 4. Once you have found the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for the account.

Form popularity

FAQ

The vendor's use tax in Missouri is imposed on sales of tangible personal property and certain services when sales tax is not collected by the seller. This tax applies to businesses and individuals alike, ensuring fair taxation across transactions. Being aware of vendor's use tax obligations is critical for compliance. Exploring tools for Missouri Vendor Evaluation can help streamline your processes.

To file MO 941, you need to complete the form detailing your employee wages and applicable taxes. You can file it electronically or by mail, depending on your preference. Ensure that you have accurate payroll records ready to facilitate a smooth filing process. Having a clear understanding of this process will benefit your Missouri Vendor Evaluation.

To obtain your Missouri 1099-G, you can visit the Missouri Department of Revenue's online portal. This form details any amounts issued to you, such as tax refunds or unemployment benefits. After providing your personal information, you can easily download or print your 1099-G. Keeping track of these forms is essential for accurate Missouri Vendor Evaluation.

Yes, Missouri provides electronic filing options for several tax forms, making the process more convenient for taxpayers. The state encourages the use of e-file forms for speed and efficiency. You can easily access these e-file forms through the Missouri Department of Revenue website. Utilizing these resources can enhance your experience with Missouri Vendor Evaluation.

In Missouri, vendors who sell tangible personal property or taxable services are subject to vendor tax. This tax applies to businesses and individuals engaged in sales transactions. When businesses collect vendor tax, they act as intermediaries who remit this tax to the state. Understanding Missouri Vendor Evaluation can help you navigate these obligations seamlessly.

Vendor performance evaluation is an ongoing process that assesses how well a vendor meets the agreed-upon terms and conditions. In the context of Missouri Vendor Evaluation, this includes regular reviews of delivery times, product quality, and responsiveness. Organizations use tools and metrics to track vendor performance, ensuring that they maintain high standards. By frequently evaluating vendor performance, businesses can identify areas for improvement and strengthen their partnerships.

The system of vendor evaluation in Missouri typically includes a structured process that assesses vendors based on defined criteria. This process often includes qualitative reviews, performance metrics, and continuous monitoring. A well-defined system helps organizations make informed decisions, fostering competitive advantages. Additionally, services like those offered by uslegalforms can streamline the evaluation process with tailored templates and resources.

When focusing on Missouri Vendor Evaluation, it is vital to consider reliability and communication. Reliability ensures that vendors consistently meet quality and delivery expectations. Effective communication fosters strong relationships, enabling timely updates and problem resolution. Both attributes greatly affect overall satisfaction and success in vendor partnerships.

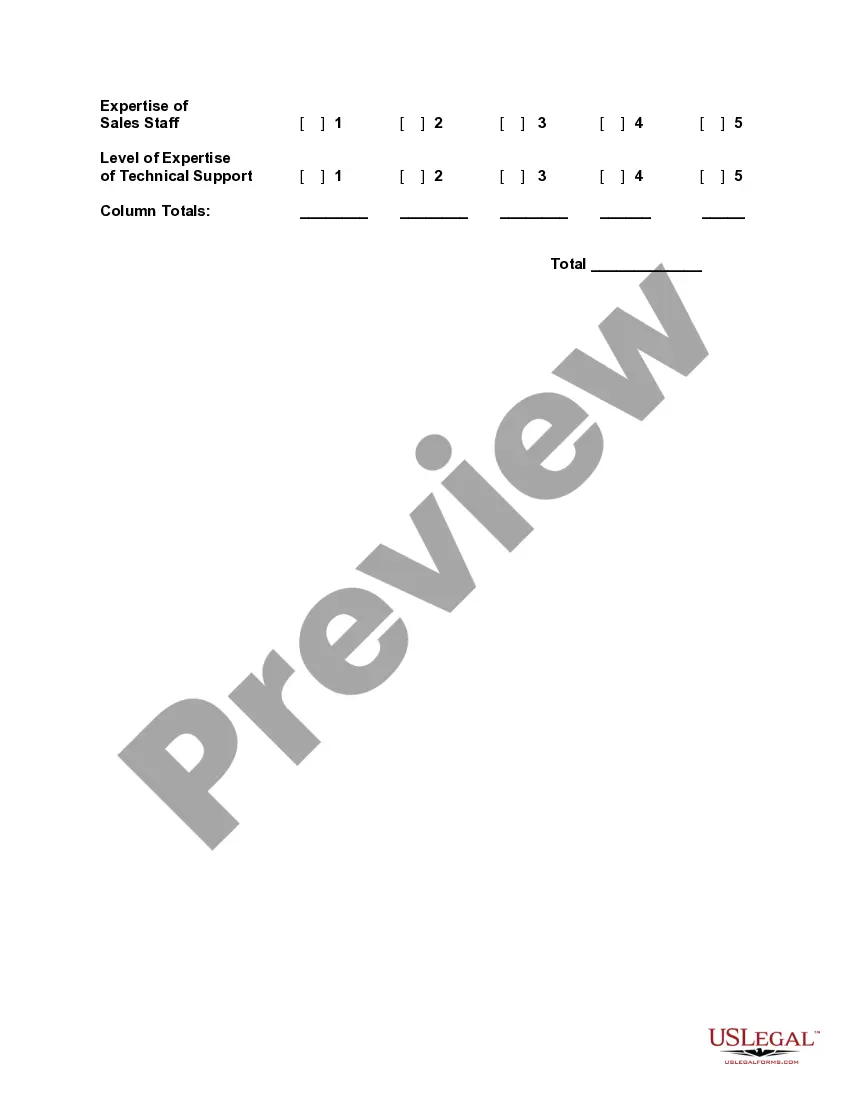

To conduct a Missouri Vendor Evaluation, start by gathering relevant data about potential vendors. This includes their past performance, financial stability, and customer feedback. Next, set up a scoring system based on your evaluation criteria and score each vendor accordingly. In addition, consider conducting site visits or interviews to gain deeper insights into their operations and practices.

To perform a vendor assessment, begin by gathering relevant data on vendor performance and reliability. Use surveys and past performance metrics to evaluate their track record. This thorough analysis allows you to identify strengths and weaknesses, enabling a comprehensive Missouri Vendor Evaluation. Platforms like US Legal Forms can assist you in documenting findings for future reference.