Title: Missouri Checklist — Key Record Keeping: A Comprehensive Guide for Effective Data Management Introduction: In Missouri, maintaining accurate records is crucial for businesses, organizations, and individuals alike. The Missouri Checklist — Key Record Keeping serves as a practical reference guide to help ensure regulatory compliance, efficient business operations, and the protection of vital information. In this article, we will explore the essential components of record keeping in Missouri and highlight different types of record keeping processes frequently encountered. 1. Business Records: Proper record keeping is essential for businesses of all sizes. Key record keeping responsibilities include documenting financial transactions, tax records, employee records, contracts, licenses, permits, and more. Businesses must adhere to specific regulations, such as the Missouri Business Records Act, which outlines the required duration and format for maintaining records. 2. Tax Records: Missouri businesses must maintain accurate and complete tax records to meet their tax obligations. This includes keeping track of income statements, expense receipts, sales records, payroll records, and financial statements. Effective tax record keeping helps avoid penalties, supports accurate tax reporting, and facilitates audits, if necessary. 3. Employee Records: Employers are required by law to maintain employee records in Missouri. These records encompass personal information, employment contracts, wages, benefits, tax withholding forms, performance evaluations, attendance records, and disciplinary actions. Thorough employee records facilitate smooth human resources administration, assist in disputes resolution, and aid compliance with labor laws. 4. Legal and Compliance Records: Missouri businesses often deal with various legal and compliance requirements. This includes maintaining permits, licenses, regulatory documentation, insurance policies, contracts, copyrights, patents, and any litigation-related records. Properly organized legal and compliance records protect a business's interests, demonstrate compliance with regulations, and aid in resolving legal disputes. 5. Health Records: For healthcare providers, maintaining accurate and up-to-date medical records is vital. In Missouri, health records must comply with federal regulations (e.g., HIPAA) and State laws. Proper record keeping includes patient demographic information, medical histories, lab results, treatment plans, prescription records, and billing information. These records ensure the provision of quality care, facilitate medical research, and support insurance claims. 6. Educational Records: Missouri educational institutions must maintain comprehensive student records. These records include admission forms, academic transcripts, attendance records, disciplinary actions, evaluations, and any special education documentation. Effective record keeping in the education sector aids student support, enables accurate transfer of credits, and supports accountability of educational programs. Conclusion: The Missouri Checklist — Key Record Keeping provides a valuable resource for organizations and individuals who seek to comply with regulations, manage their operations effectively, and safeguard critical information. By understanding the various types of record keeping requirements in Missouri, businesses, educational institutions, healthcare providers, and individuals can establish robust record management practices ensuring compliance, operational efficiency, and sound decision-making.

Missouri Checklist - Key Record Keeping

Description

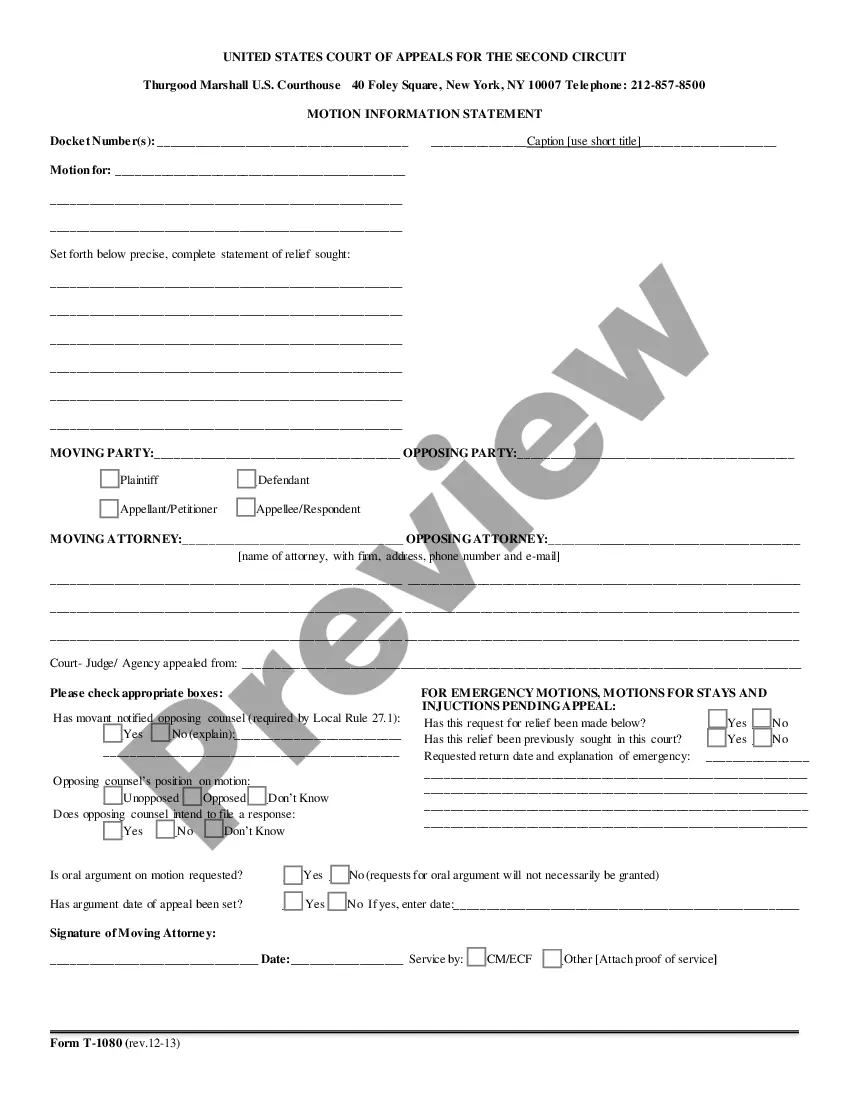

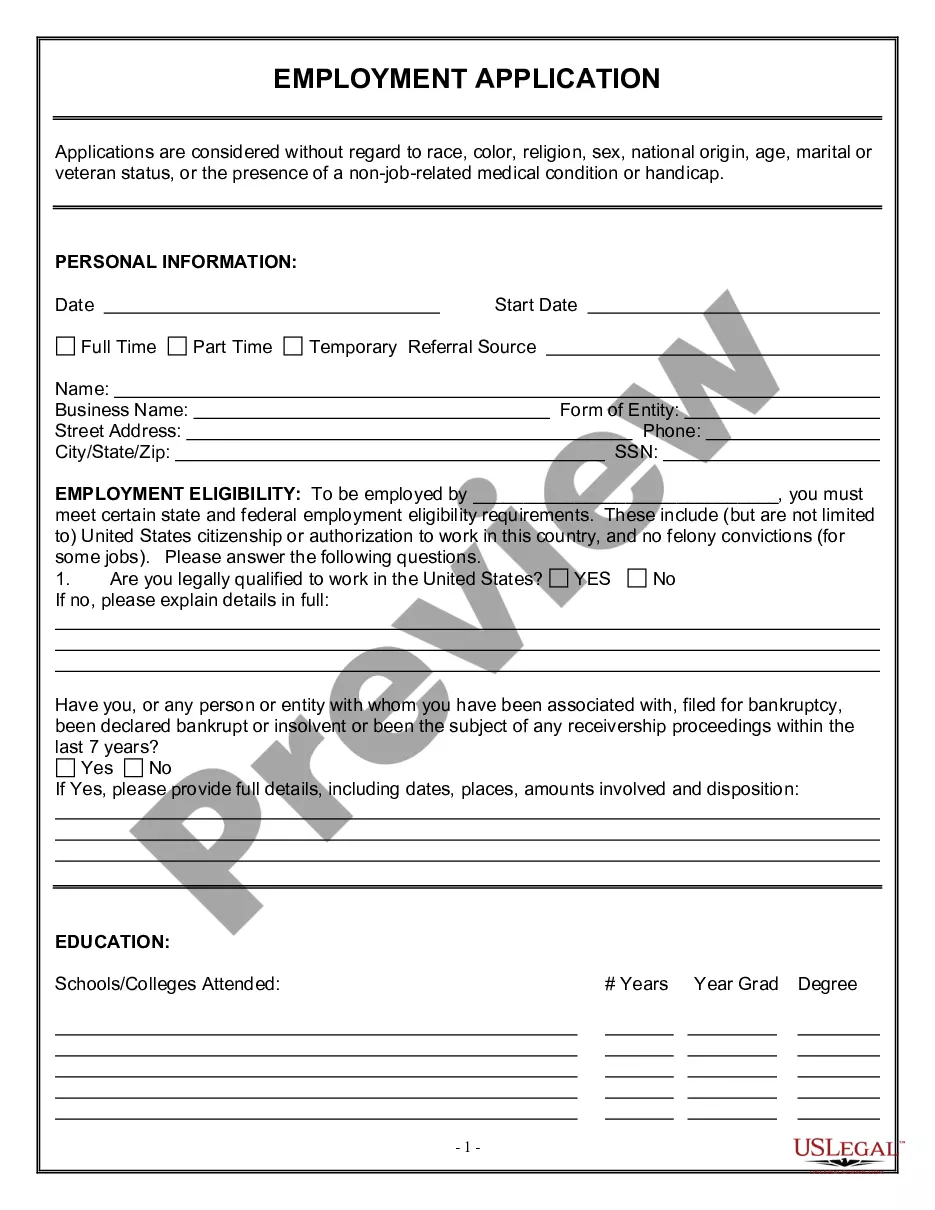

How to fill out Missouri Checklist - Key Record Keeping?

US Legal Forms - one of the biggest libraries of authorized types in the USA - provides an array of authorized record web templates you may download or produce. Using the internet site, you can find thousands of types for business and person reasons, categorized by groups, states, or keywords and phrases.You can find the latest models of types much like the Missouri Checklist - Key Record Keeping in seconds.

If you already possess a registration, log in and download Missouri Checklist - Key Record Keeping in the US Legal Forms library. The Download option will appear on each kind you view. You have accessibility to all in the past saved types within the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, listed below are straightforward instructions to obtain began:

- Make sure you have selected the correct kind for your personal metropolis/region. Click on the Preview option to examine the form`s information. Look at the kind description to ensure that you have selected the correct kind.

- If the kind doesn`t satisfy your specifications, take advantage of the Lookup discipline on top of the display to get the one who does.

- If you are satisfied with the shape, affirm your decision by visiting the Get now option. Then, select the rates program you favor and give your qualifications to sign up on an account.

- Approach the transaction. Utilize your credit card or PayPal account to complete the transaction.

- Find the structure and download the shape on your device.

- Make adjustments. Load, modify and produce and indicator the saved Missouri Checklist - Key Record Keeping.

Every single web template you included with your money does not have an expiry date and it is the one you have eternally. So, if you would like download or produce another version, just go to the My Forms segment and click about the kind you will need.

Get access to the Missouri Checklist - Key Record Keeping with US Legal Forms, one of the most extensive library of authorized record web templates. Use thousands of specialist and express-distinct web templates that satisfy your small business or person requirements and specifications.