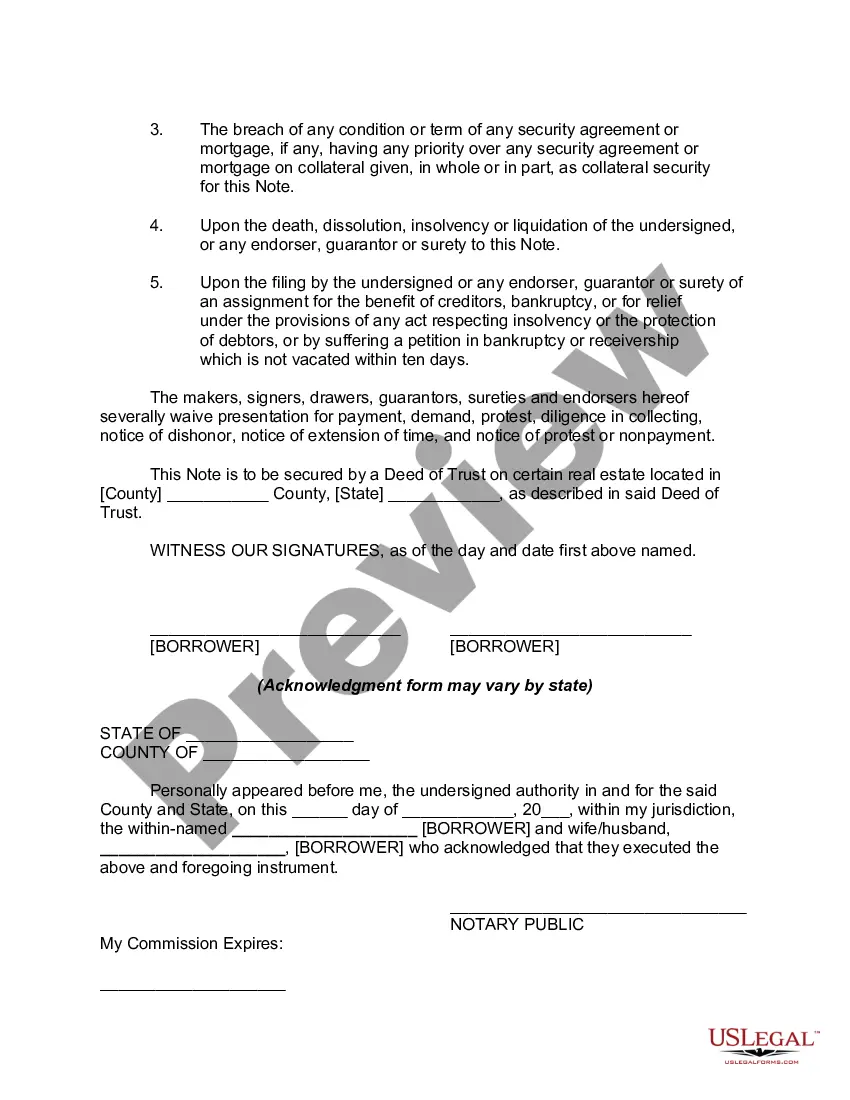

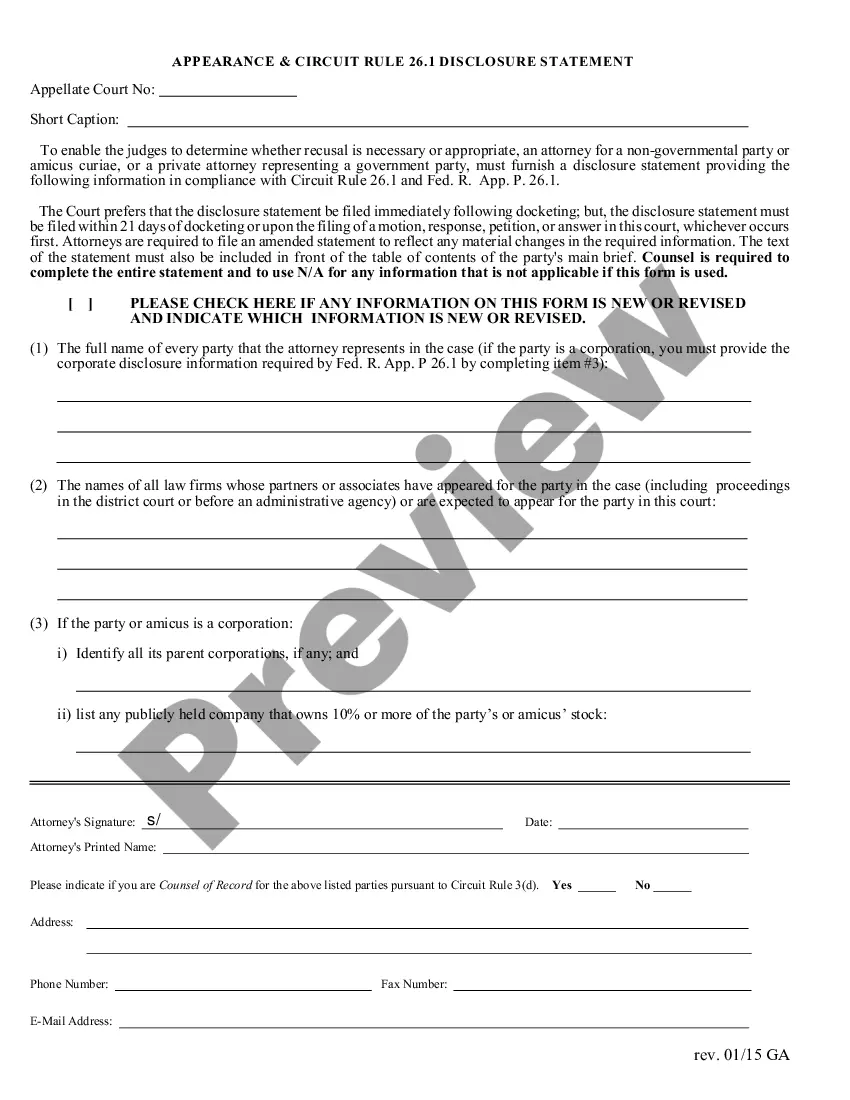

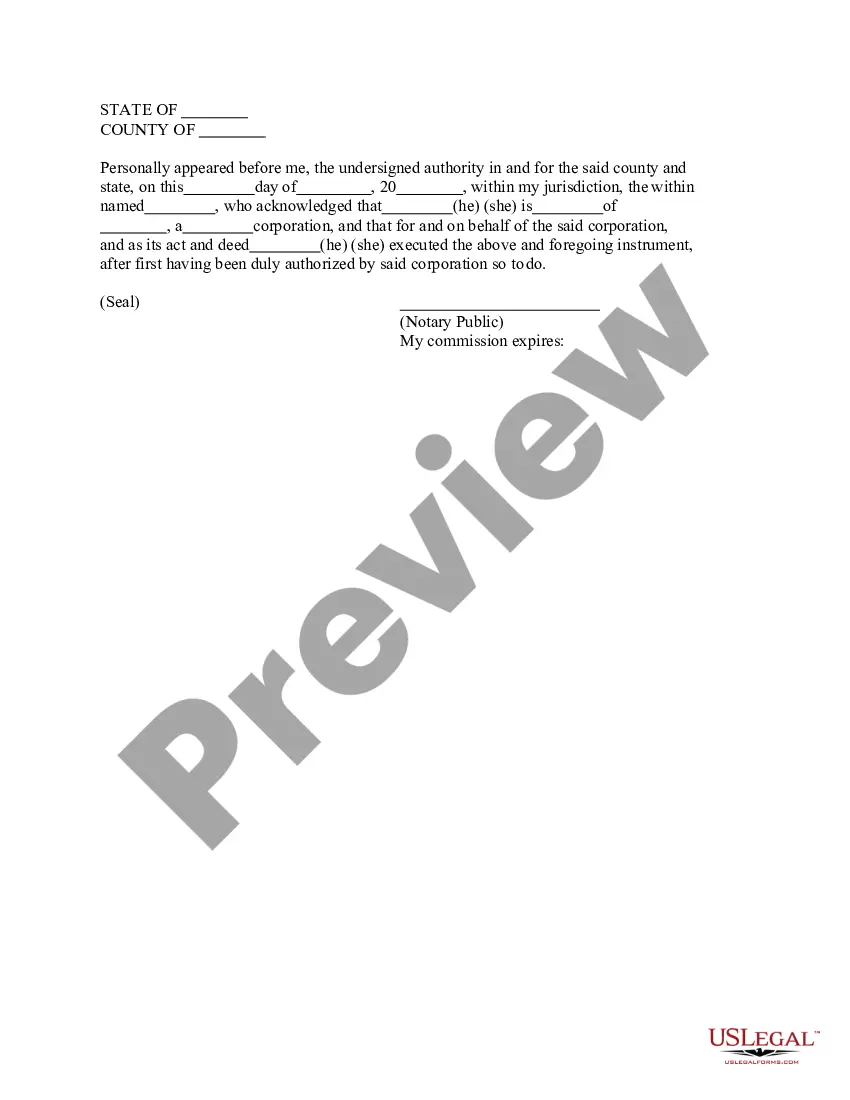

The acknowledgement is the section at the end of a document where a notary public verifies that the signer of the document states he/she actually signed it. Typical language is: "State of ______, County of ______ (signed and sealed) On ____, 20__, before me, a notary public for said state, personally appeared _______, personally known to me, or proved to be said person by proper proof, and acknowledged that he executed the above Deed." Then the notary signs the acknowledgment and puts on his/her seal, which is usually a rubber stamp, although some still use a metal seal. The person acknowledging that he/she signed must be prepared to verify their identity with a driver's license or other accepted form of identification, and must sign the notary's journal. The acknowledgment is required for many official forms and vital for any document which must be recorded by the County Recorder or Recorder of Deeds, including deeds, deeds of trust, mortgages, powers of attorney that may involve real estate, some leases and various other papers.

Acknowledgments may also be drafted to affirm a variety of matters, acting in effect as a written confirmation of an act such as receipt of goods, services, or payment.

A Missouri Promissory Note — With Acknowledgment is a legally binding document used in the state of Missouri to outline the terms of a loan between a lender and a borrower. This document serves as a written agreement that details the amount of money borrowed, the interest rate and payment schedule, and any other conditions or terms specific to the loan. In Missouri, there are various types of Promissory Notes — With Acknowledgment that cater to different loan scenarios and purposes. Some of these include: 1. Secured Promissory Note: This type of Promissory Note includes collateral that the borrower pledges to the lender to secure the loan. If the borrower fails to repay the loan according to the agreed-upon terms, the lender has the right to seize the collateral to recover their losses. 2. Unsecured Promissory Note: Unlike a secured Promissory Note, this type of note does not require collateral to secure the loan. Instead, the lender relies solely on the borrower's promise to repay the loan as agreed upon. 3. Installment Promissory Note: This type of note outlines a loan that will be repaid in fixed, periodic payments over a set period of time. Each payment includes a portion of the principal amount borrowed as well as the accrued interest. 4. Balloon Promissory Note: This note is structured so that the borrower makes smaller monthly payments over a specific period, but a larger, "balloon" payment is due at the end of the term. This allows borrowers to have smaller monthly financial obligations during the loan term but requires a significant final payment. 5. Interest-Only Promissory Note: With this type of note, the borrower is only obligated to make interest payments on the loan for a specified period. Once the interest-only period ends, the borrower must start making principal and interest payments. A crucial component of a Missouri Promissory Note — With Acknowledgment is the acknowledgment section, where a notary public or authorized officer confirms the identities of the parties involved in the loan agreement. The acknowledgment section adds an extra layer of authenticity to the document and prevents disputes regarding the validity of the signatures. It is important to note that a Missouri Promissory Note — With Acknowledgment should always be drafted and executed in accordance with Missouri state laws to ensure its legality and enforceability. Seeking the guidance of a legal professional is advisable when creating or signing any legal document, including a Promissory Note, to avoid any potential issues in the future.