A Home Owners Association (HOA) is an organization of homeowners of a particular subdivision, condominium or planned unit development. The purpose of a home owners association is to provide a common basis for preserving maintaining and enhancing their homes and property. Most homeowners' associations are non-profit corporations. They are subject to state statutes that govern non-profit corporations and homeowner associations. The associations provide services, regulate activities, levy assessments, and impose fines. Usually, each member of a homeowners association pays assessments. Those assessments or dues are used to pay for expenses that arise from having and maintaining common property.

Missouri Assessment Fee Notice of Homeowner's Association

Description

How to fill out Assessment Fee Notice Of Homeowner's Association?

Finding the right authorized document design can be a have difficulties. Needless to say, there are tons of templates available online, but how can you obtain the authorized type you require? Utilize the US Legal Forms site. The services delivers 1000s of templates, including the Missouri Assessment Fee Notice of Homeowner's Association, which can be used for enterprise and private needs. Every one of the types are checked by pros and meet up with state and federal specifications.

When you are currently authorized, log in in your account and then click the Down load button to find the Missouri Assessment Fee Notice of Homeowner's Association. Make use of your account to check through the authorized types you might have bought previously. Check out the My Forms tab of your own account and obtain yet another duplicate of the document you require.

When you are a fresh user of US Legal Forms, listed below are easy directions that you should follow:

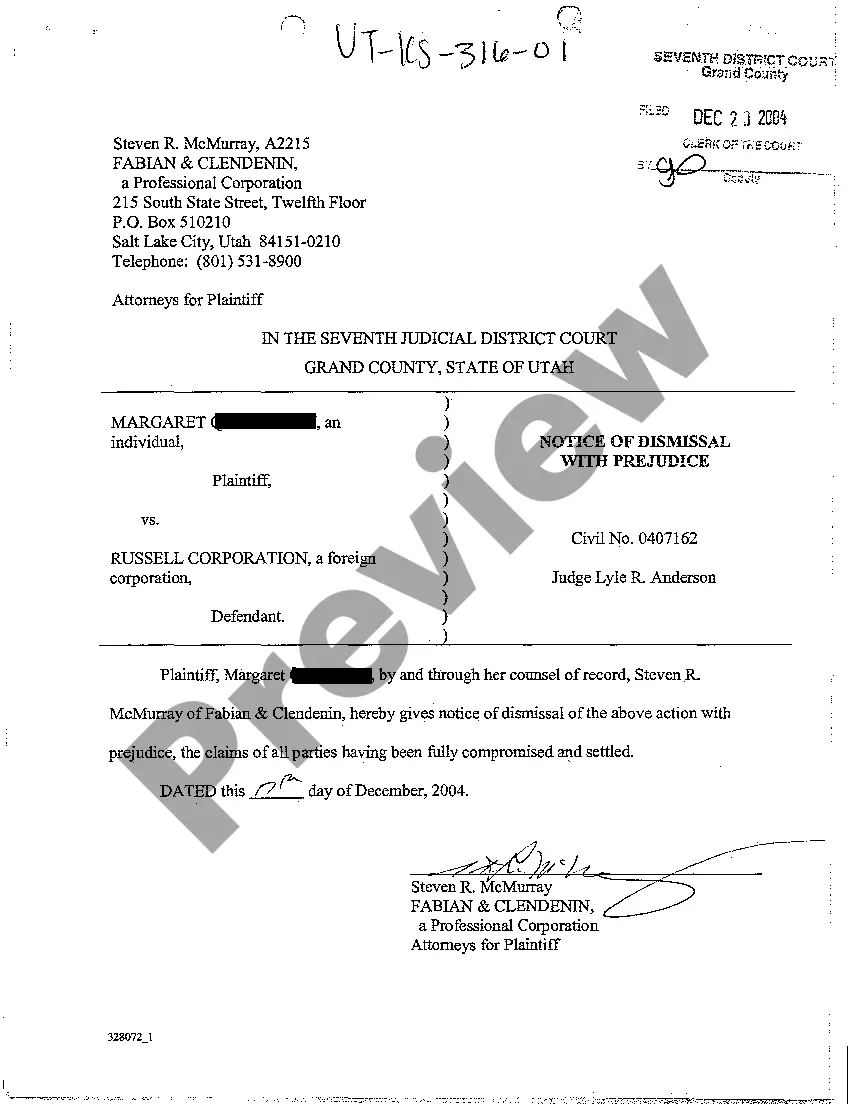

- First, make certain you have selected the correct type for the metropolis/state. You are able to look over the shape utilizing the Review button and browse the shape explanation to make sure it is the right one for you.

- In case the type does not meet up with your needs, make use of the Seach industry to find the appropriate type.

- Once you are certain that the shape is proper, go through the Get now button to find the type.

- Select the costs plan you need and enter in the needed info. Make your account and buy an order with your PayPal account or Visa or Mastercard.

- Choose the file formatting and obtain the authorized document design in your system.

- Complete, edit and print and sign the received Missouri Assessment Fee Notice of Homeowner's Association.

US Legal Forms is definitely the greatest catalogue of authorized types in which you can find different document templates. Utilize the service to obtain appropriately-produced papers that follow status specifications.

Form popularity

FAQ

The process for dissolution of an HOA in Missouri may be outlined in the HOA's governing documents. If it is not, members of the HOA must cast a vote of at least ? in favor of dissolution. If HOA members vote for dissolution, a plan for dissolution must be drafted to distribute assets and debts. Missouri HOA Laws (2023): State Rules & Regulations for HOAs iPropertyManagement.com ? laws ? missouri-h... iPropertyManagement.com ? laws ? missouri-h...

HOAs are required to register with the State of Missouri. To register or update your information with the state, view the Missouri Secretary of State website. You can also contact the state via email or by calling 573-751-4153.

In other words, HOA rules cannot override state or federal laws, nor can they contradict the city or county ordinances that govern the area in which the HOA is located. Do Local Laws Supersede HOA Rules? - LS Carlson Law lscarlsonlaw.com ? articles ? local-laws-supersede-... lscarlsonlaw.com ? articles ? local-laws-supersede-...

The average monthly HOA fee in Missouri ($469) is nearly $200 higher than in Wisconsin ($277). The average monthly HOA fee ranges from $300 to $400 in 43 states.

Homeowners Association's Rights and Responsibilities Homeowners' associations have the right to collect assessments ing to community regulations. If an account becomes overdue, the board of directors can place liens on property or, in extreme cases, foreclose on the property despite on-time mortgage payments. Missouri HOA Laws & Regulations - Clark Simson Miller Clark Simson Miller ? missouri-hoa-laws-and... Clark Simson Miller ? missouri-hoa-laws-and...

Liens: Rather than pursuing a lawsuit, the HOA may issue a lien on your property. This means that the HOA can use your home as collateral for your unpaid dues. In order to remove the lien, you must pay any overdue HOA assessments plus late fees, interest, and other related charges. What Happens if you Don't Pay HOA Fees? - Kuester kuester.com ? what-happens-if-you-dont-pay-hoa... kuester.com ? what-happens-if-you-dont-pay-hoa...

Missouri does not have government regulations that apply specifically to homeowners associations. But, there are still a few state laws that can impact HOAs.