Missouri Sample Letter for Tax Exemption — Discussion of Office Equipment Qualifying for Tax Exemption Dear [Tax Authority's Name], I am writing to request tax exemption for certain office equipment purchased by our organization, [Company/Organization Name]. We believe that these items meet the criteria outlined in the Missouri Tax Exemption regulations and are entitled to tax exemption status. Please find below a detailed description of the office equipment in question and our reasoning for seeking tax exemption. 1. Computers and Laptops: We have purchased several computers and laptops necessary for our day-to-day business operations. These devices are used by our employees to carry out essential tasks such as data processing, communication, and file storage. They are an indispensable part of our organization's functioning and are directly used for our core activities. 2. Printers, Scanners, and Copiers: Furthermore, we have acquired printers, scanners, and copiers to facilitate our documentation and administrative needs. This equipment plays a vital role in our processes, allowing us to produce essential documents, make copies for distribution, and digitize paper-based records. As a result, they directly contribute to our efficiency and productivity. 3. Office Furniture: Our organization has purchased office furniture such as desks, chairs, cabinets, and shelving units. These items are essential for creating a comfortable workspace for our employees and ensuring a well-organized office environment. Ergonomic furniture enhances productivity and overall well-being, making them crucial for our operations. 4. Telecommunication Equipment: To effectively communicate with our clients, partners, and stakeholders, we have invested in telecommunication equipment, including landline phones, mobile devices, and communication software. These tools enable us to maintain effective communication channels, fostering collaboration and ensuring smooth business operations. We firmly believe that the items mentioned above qualify for tax exemption under the Missouri Tax Exemption regulations [include specific citations if applicable]. They are necessary for our organization to function efficiently and fulfill our mission. As an exempt organization under section [insert relevant section number] of the Internal Revenue Code, we request that our tax-exempt status be extended to cover the aforementioned office equipment. We have attached copies of the purchase receipts, highlighting the eligible items and their cost, for your reference. We are ready to provide any additional documentation or answer any questions you may have regarding our request. Your timely consideration of this matter would be greatly appreciated. Thank you for your attention to this request. We look forward to your positive response, granting tax exemption for the mentioned office equipment. Should you require any further information, please do not hesitate to contact me at [Phone Number] or [Email Address]. Sincerely, [Your Name] [Your Title] [Company/Organization Name]

Missouri Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

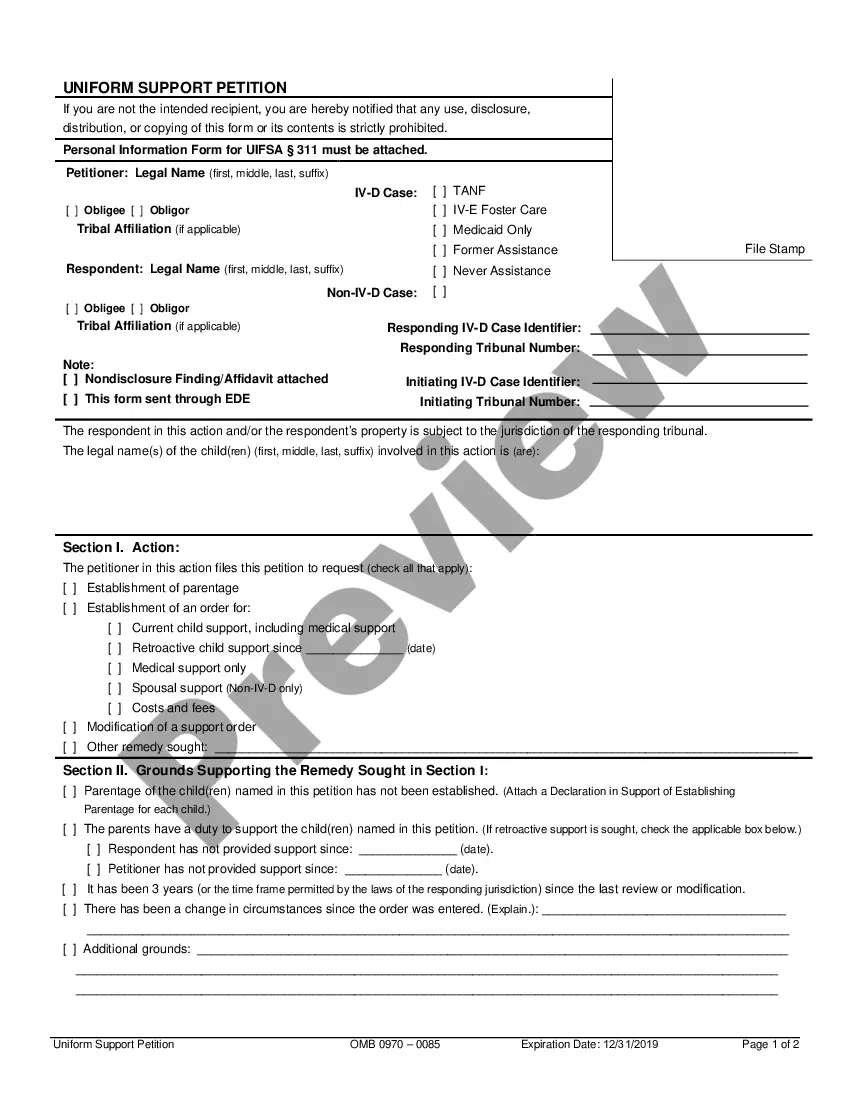

Description

How to fill out Missouri Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

Are you presently within a place where you will need files for possibly enterprise or personal uses just about every day time? There are a variety of legitimate record web templates available on the net, but locating kinds you can rely on is not effortless. US Legal Forms delivers a large number of form web templates, such as the Missouri Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption, that are composed to satisfy state and federal needs.

Should you be currently knowledgeable about US Legal Forms site and possess a merchant account, simply log in. After that, it is possible to download the Missouri Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption format.

Unless you have an accounts and would like to start using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is for your right area/state.

- Utilize the Preview button to examine the form.

- Read the outline to actually have selected the right form.

- When the form is not what you are looking for, use the Lookup industry to find the form that fits your needs and needs.

- When you get the right form, simply click Get now.

- Pick the rates strategy you want, fill out the specified information to generate your bank account, and buy your order using your PayPal or credit card.

- Select a practical paper format and download your backup.

Get all of the record web templates you possess purchased in the My Forms menus. You may get a extra backup of Missouri Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption any time, if required. Just click the needed form to download or print out the record format.

Use US Legal Forms, by far the most extensive collection of legitimate varieties, in order to save efforts and avoid mistakes. The services delivers skillfully created legitimate record web templates which can be used for an array of uses. Create a merchant account on US Legal Forms and begin producing your life a little easier.