Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

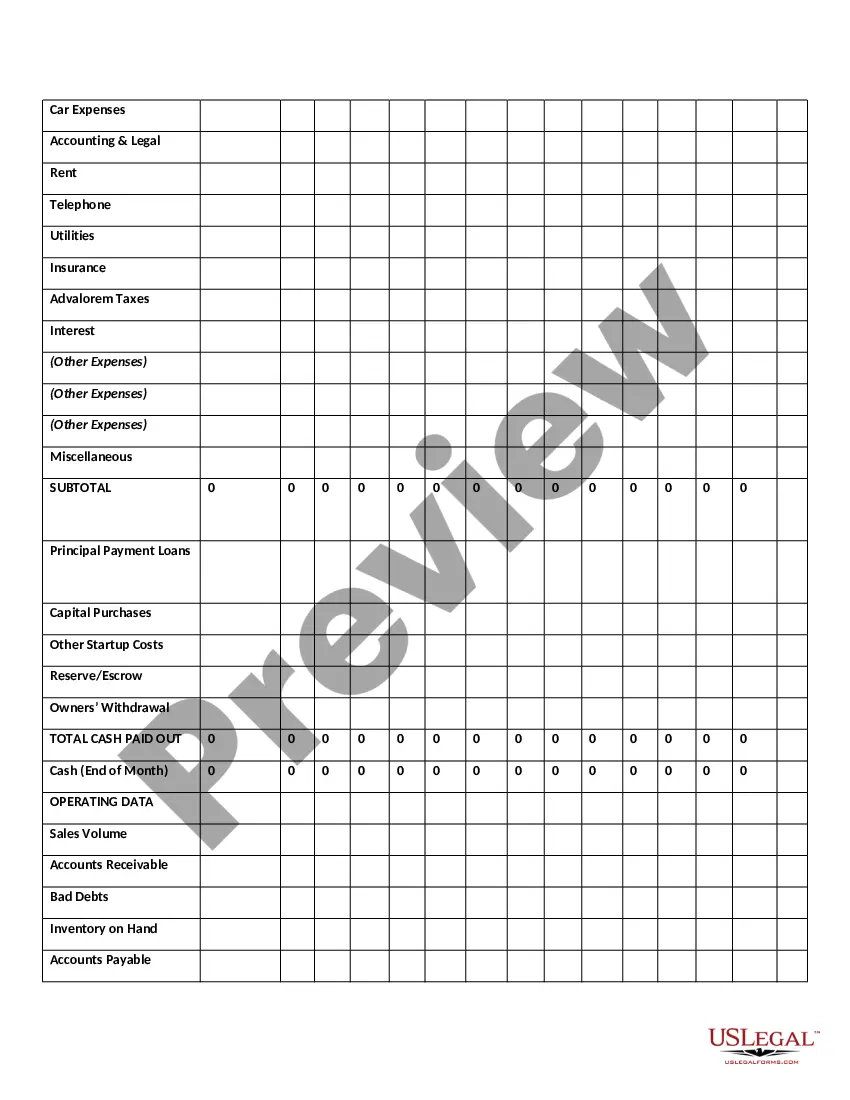

Missouri Twelve-Month Cash Flow refers to a financial statement that assesses the incoming and outgoing cash within a Missouri-based business or organization over a span of twelve months. This comprehensive financial document allows business owners, investors, and lenders to understand the cash flow trends, predict future profitability, and make strategic decisions accordingly. The Missouri Twelve-Month Cash Flow statement encompasses various key components, including income from sales, investments, and financing activities, as well as expenses such as wages, inventory costs, debt payments, and operating expenses. By analyzing this statement, businesses can evaluate their ability to generate sufficient cash to cover operational costs, pay off debts, and fund their expansion plans. There are different types of Missouri Twelve-Month Cash Flow statements tailored to specific sectors or industries, which include: 1. Retail Twelve-Month Cash Flow Statement: This statement is specifically designed for retail businesses, considering factors such as inventory turnover, seasonal fluctuations, and consumer buying patterns. 2. Manufacturing Twelve-Month Cash Flow Statement: Geared towards manufacturing companies, this statement takes into account the production cycles, raw material costs, inventory management, and equipment maintenance. 3. Service-Based Twelve-Month Cash Flow Statement: Service-oriented businesses, such as consulting firms or healthcare providers, rely on this statement to analyze billable hours, service contracts, and customer payment cycles. 4. Non-Profit Twelve-Month Cash Flow Statement: Non-profit organizations utilize this statement to understand their donation patterns, program expenses, government grants, and fundraising activities. 5. Startup Twelve-Month Cash Flow Statement: Startups often create this statement to present their projected cash flow based on anticipated sales, funding rounds, and initial investments. Constructing an accurate and detailed Missouri Twelve-Month Cash Flow statement requires meticulous bookkeeping and precise financial analysis. Businesses often employ accounting software or enlist the services of professional accountants to compile and organize the necessary data. By leveraging the insights provided in these cash flow statements, businesses can make informed decisions and devise effective strategies to ensure financial stability and growth in the state of Missouri.Missouri Twelve-Month Cash Flow refers to a financial statement that assesses the incoming and outgoing cash within a Missouri-based business or organization over a span of twelve months. This comprehensive financial document allows business owners, investors, and lenders to understand the cash flow trends, predict future profitability, and make strategic decisions accordingly. The Missouri Twelve-Month Cash Flow statement encompasses various key components, including income from sales, investments, and financing activities, as well as expenses such as wages, inventory costs, debt payments, and operating expenses. By analyzing this statement, businesses can evaluate their ability to generate sufficient cash to cover operational costs, pay off debts, and fund their expansion plans. There are different types of Missouri Twelve-Month Cash Flow statements tailored to specific sectors or industries, which include: 1. Retail Twelve-Month Cash Flow Statement: This statement is specifically designed for retail businesses, considering factors such as inventory turnover, seasonal fluctuations, and consumer buying patterns. 2. Manufacturing Twelve-Month Cash Flow Statement: Geared towards manufacturing companies, this statement takes into account the production cycles, raw material costs, inventory management, and equipment maintenance. 3. Service-Based Twelve-Month Cash Flow Statement: Service-oriented businesses, such as consulting firms or healthcare providers, rely on this statement to analyze billable hours, service contracts, and customer payment cycles. 4. Non-Profit Twelve-Month Cash Flow Statement: Non-profit organizations utilize this statement to understand their donation patterns, program expenses, government grants, and fundraising activities. 5. Startup Twelve-Month Cash Flow Statement: Startups often create this statement to present their projected cash flow based on anticipated sales, funding rounds, and initial investments. Constructing an accurate and detailed Missouri Twelve-Month Cash Flow statement requires meticulous bookkeeping and precise financial analysis. Businesses often employ accounting software or enlist the services of professional accountants to compile and organize the necessary data. By leveraging the insights provided in these cash flow statements, businesses can make informed decisions and devise effective strategies to ensure financial stability and growth in the state of Missouri.