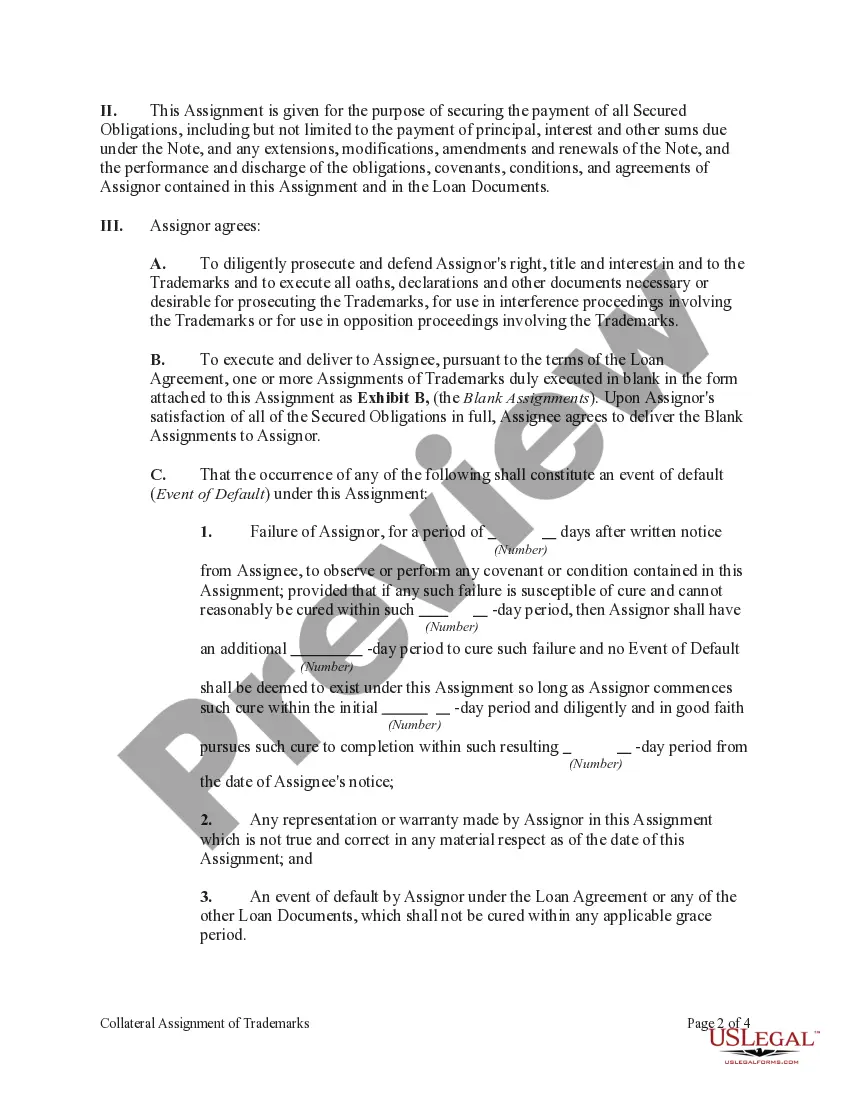

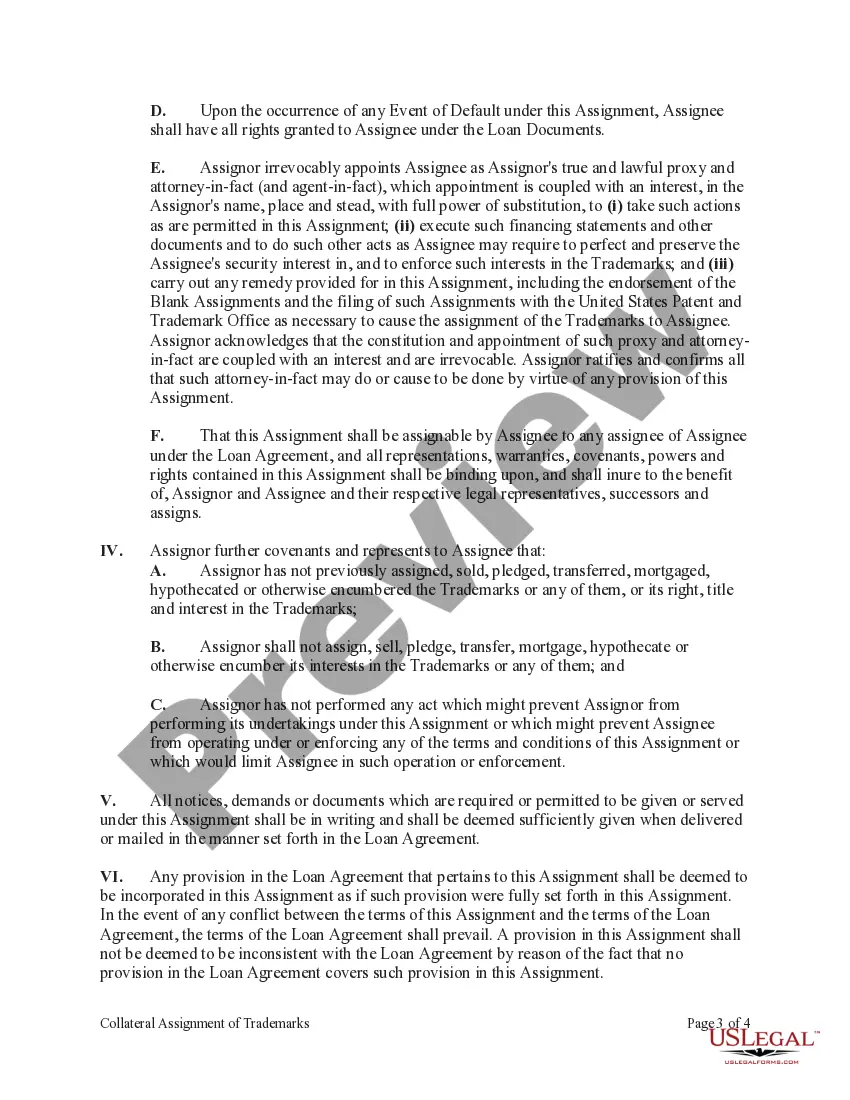

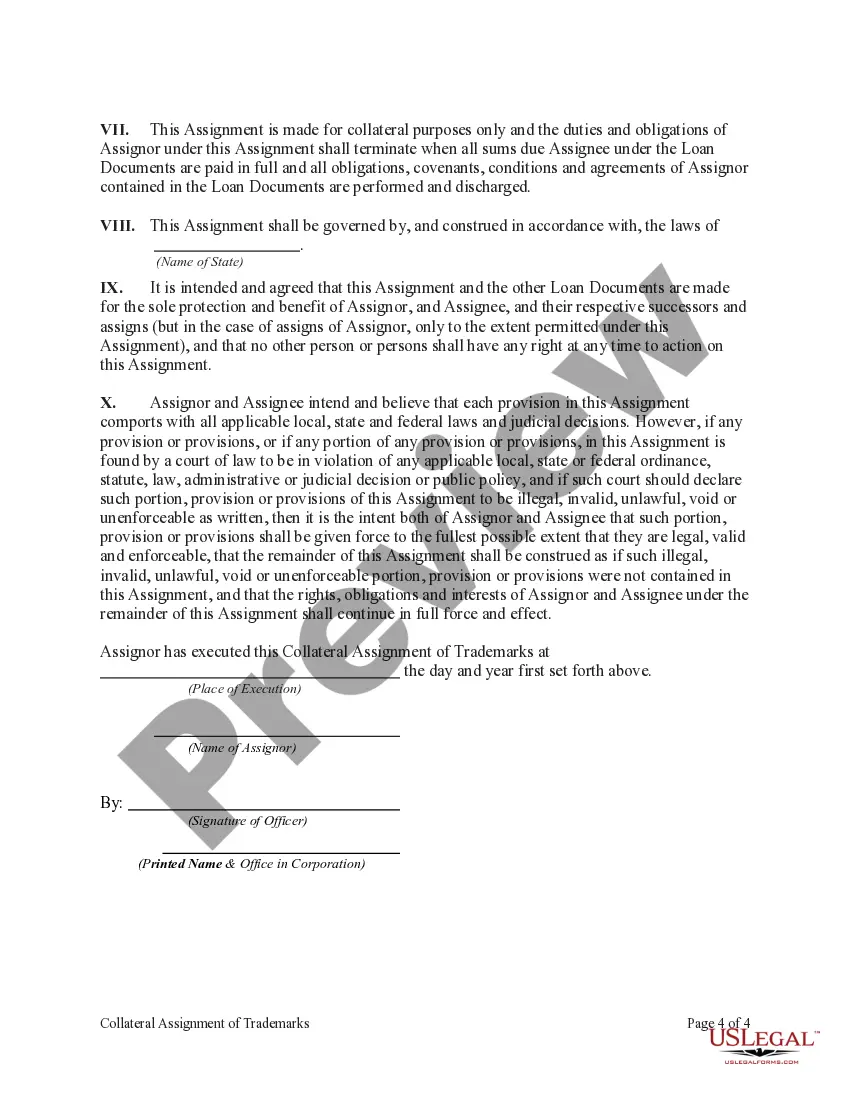

A Missouri Collateral Assignment of Trademarks is a legal document used to secure a loan by transferring ownership rights of a trademark to the lender as collateral. This assignment gives the lender the ability to seize and sell the trademark in the event the borrower defaults on the loan. Keywords: Missouri Collateral Assignment of Trademarks, legal document, secure a loan, ownership rights, trademark, lender, collateral, borrower, default, seize, sell. There are two types of Missouri Collateral Assignment of Trademarks: 1. Absolute Assignment: This type of assignment is a complete transfer of ownership rights of a trademark from the borrower to the lender. The lender becomes the new owner and can freely use, sell, or license the trademark. In case of default, the lender has full control to enforce the rights associated with the trademark. 2. Security Assignment: A security assignment grants the lender a security interest or lien on the trademark rather than full ownership. In this type of assignment, the borrower retains ownership of the trademark but gives the lender the right to seize and sell the trademark to recover the outstanding debt in case of default. Both types of assignments provide legal protection for lenders against borrowers who fail to repay their loans. They provide an additional layer of security as the trademark holds value and can be monetized to offset losses incurred by the lender. Note that the specific terms and conditions of a Missouri Collateral Assignment of Trademarks may vary depending on the agreement between the lender and borrower. It is important to consult with a qualified attorney and ensure compliance with relevant laws and regulations.

Missouri Collateral Assignment of Trademarks

Description

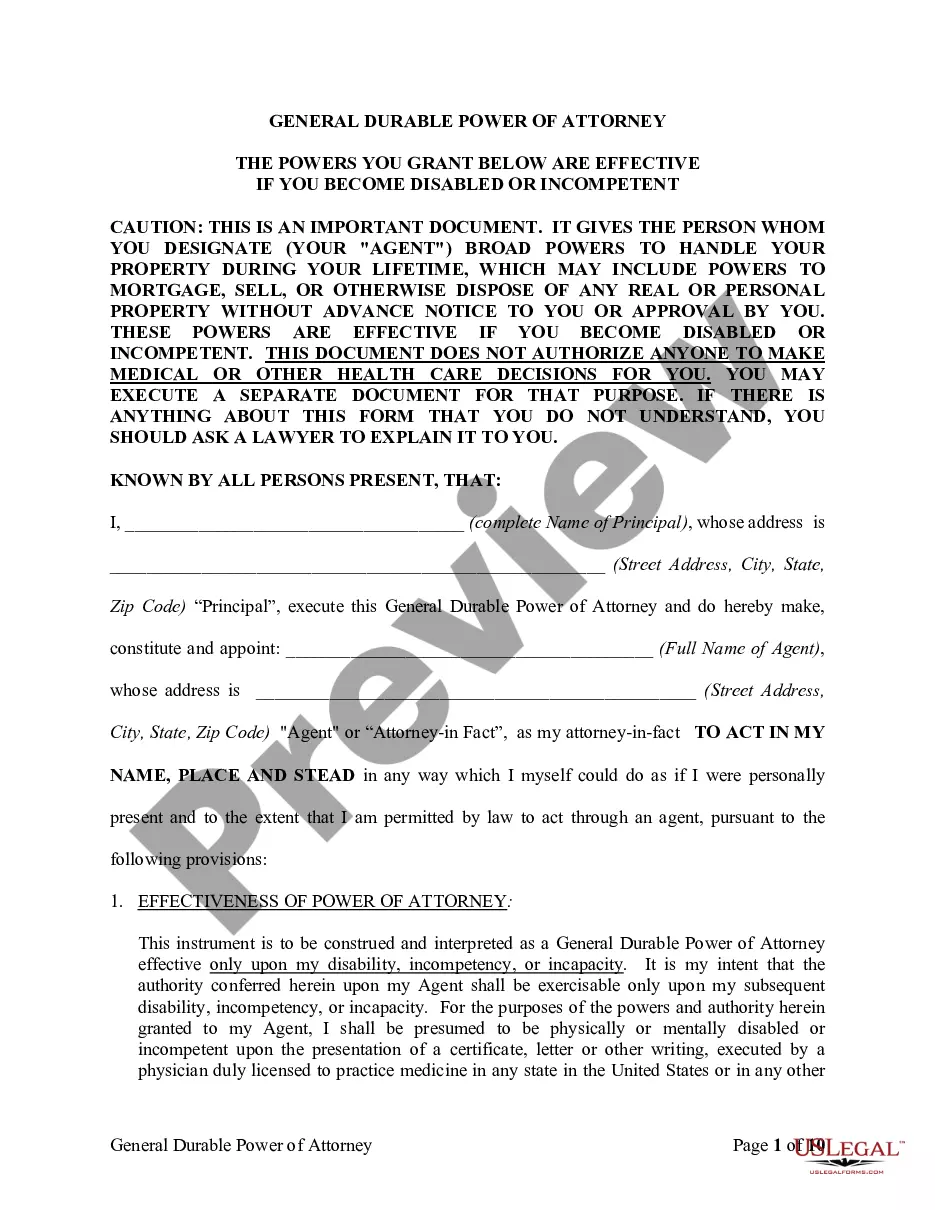

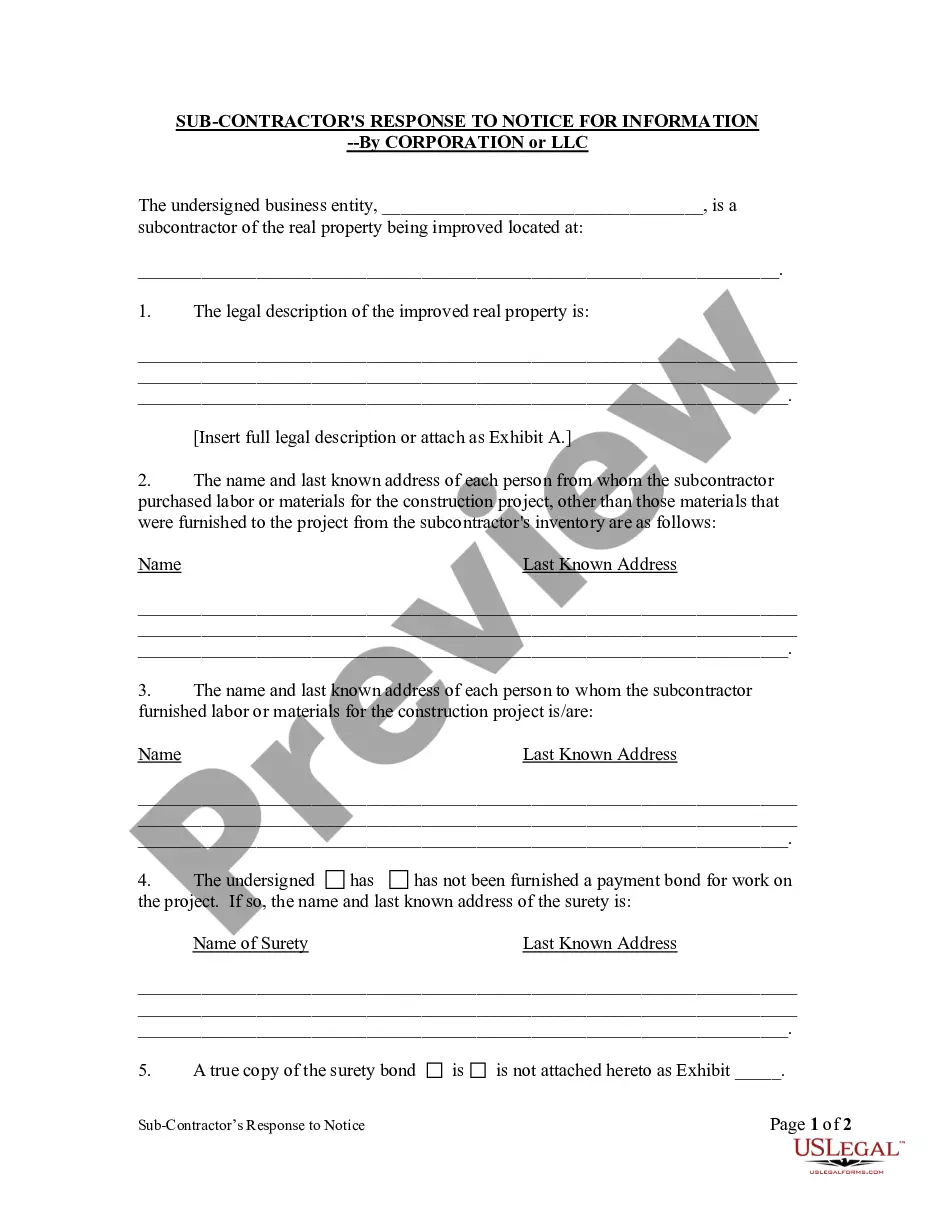

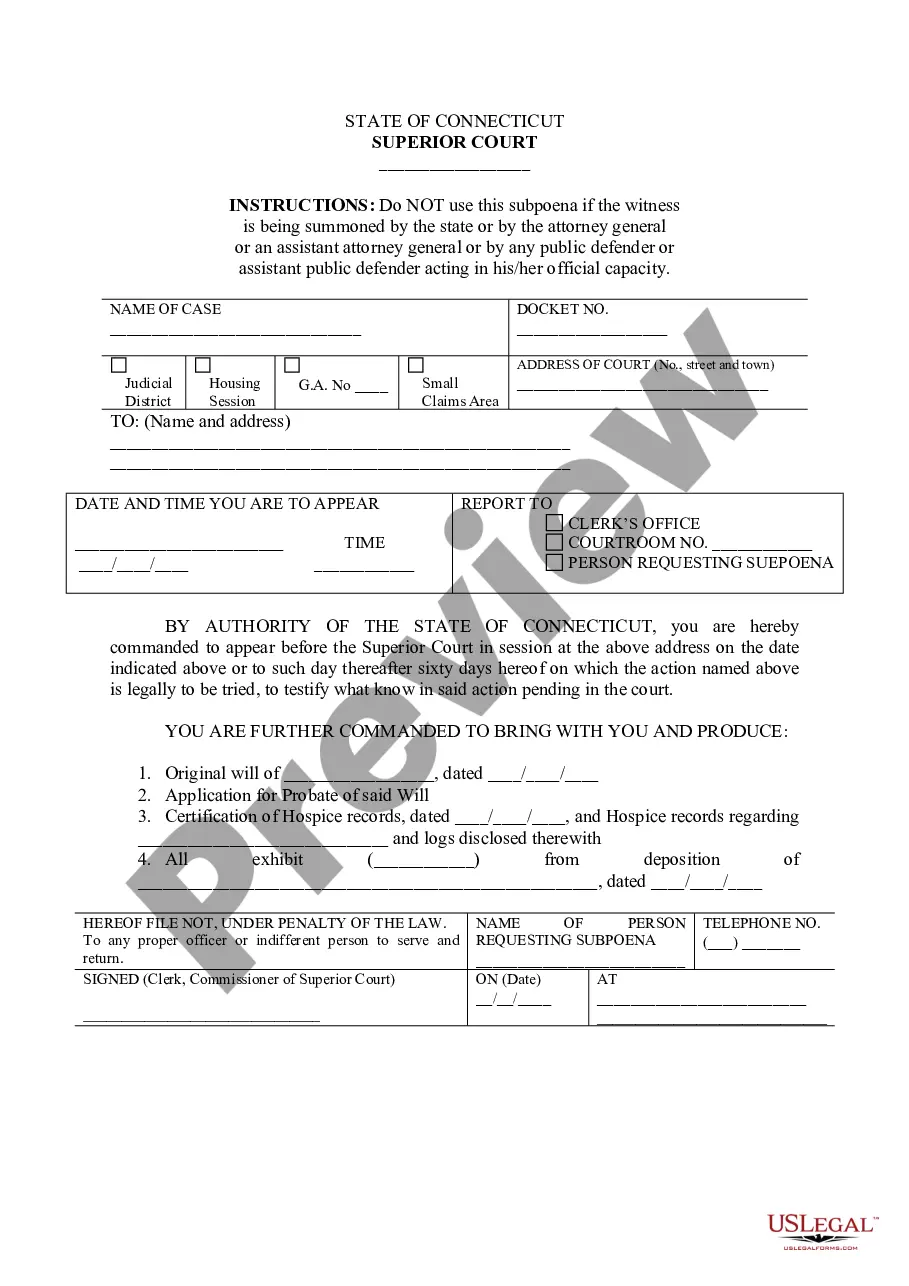

How to fill out Missouri Collateral Assignment Of Trademarks?

Are you presently in the position in which you will need paperwork for both enterprise or individual uses just about every day? There are plenty of lawful papers themes accessible on the Internet, but discovering kinds you can depend on is not effortless. US Legal Forms delivers 1000s of kind themes, much like the Missouri Collateral Assignment of Trademarks, that happen to be created to fulfill federal and state specifications.

When you are currently familiar with US Legal Forms internet site and get a merchant account, basically log in. Afterward, you can obtain the Missouri Collateral Assignment of Trademarks format.

Unless you provide an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for your appropriate area/county.

- Utilize the Review option to examine the shape.

- Browse the outline to ensure that you have selected the proper kind.

- When the kind is not what you`re seeking, take advantage of the Search area to obtain the kind that meets your needs and specifications.

- Whenever you find the appropriate kind, click Get now.

- Choose the pricing prepare you would like, submit the desired details to generate your bank account, and purchase the order utilizing your PayPal or credit card.

- Pick a hassle-free file format and obtain your duplicate.

Discover all of the papers themes you might have purchased in the My Forms food list. You can get a additional duplicate of Missouri Collateral Assignment of Trademarks at any time, if required. Just go through the required kind to obtain or print the papers format.

Use US Legal Forms, by far the most comprehensive variety of lawful types, to save lots of some time and avoid faults. The support delivers skillfully created lawful papers themes that you can use for a selection of uses. Make a merchant account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

As a result, asset-based lenders have turned to IP portfolios as another form of collateral to secure their loans. But while using IP as collateral can enhance the security of a loan, it presents banks, investors, and other lenders with unique challenges.

Section 39 stipulates that an unregistered trade mark may be assigned or transmitted with or without the goodwill of the business concerned. A request has to be made on Form TM-16 for an unregistered trademark to be assigned or transferred.

Trademarks and other intellectual property can be critical to a borrower's financial success and may represent a significant portion of the value of the borrower's business. Thus, trademarks may be an important part of the lender's collateral.

Intellectual property, including trademarks, is classified under the definition of general intangibles. One obtains a security interest in a trademark by obtaining a written grant of a security interest from the debtor.

A trademark assignment is the transfer of an owner's property rights in a given mark or marks. Such transfers may occur on their own or as parts of larger asset sales or purchases. Trademark assignment agreements both provide records of ownership and transfer and protect the rights of all parties.

Assignment of a trademark occurs when the ownership of such mark as such, is transferred from one party to another whether along with or without the goodwill of the business. In case of a registered Trademark, such assignment is required to be recorded in the Register of trade marks.

Even after your trademark application has been approved, people can challenge and steal your intellectual property, using legal means. The reasons this is possible is that approved trademarks do not come with absolute ownership.

Security interest refers to an enforceable legal right that has been pledged by the owner, usually, to a financier, to obtain a loan. In other words, a registered or pending trademark which is an intangible property can now be used as a form of collateral to secure a loan from a financier.

Instead, a trademark must be assigned through an Assignment of Rights. That Assignment must transfer not only the trademark and the registration, but must also transfer the goodwill behind the trademark to be valid.