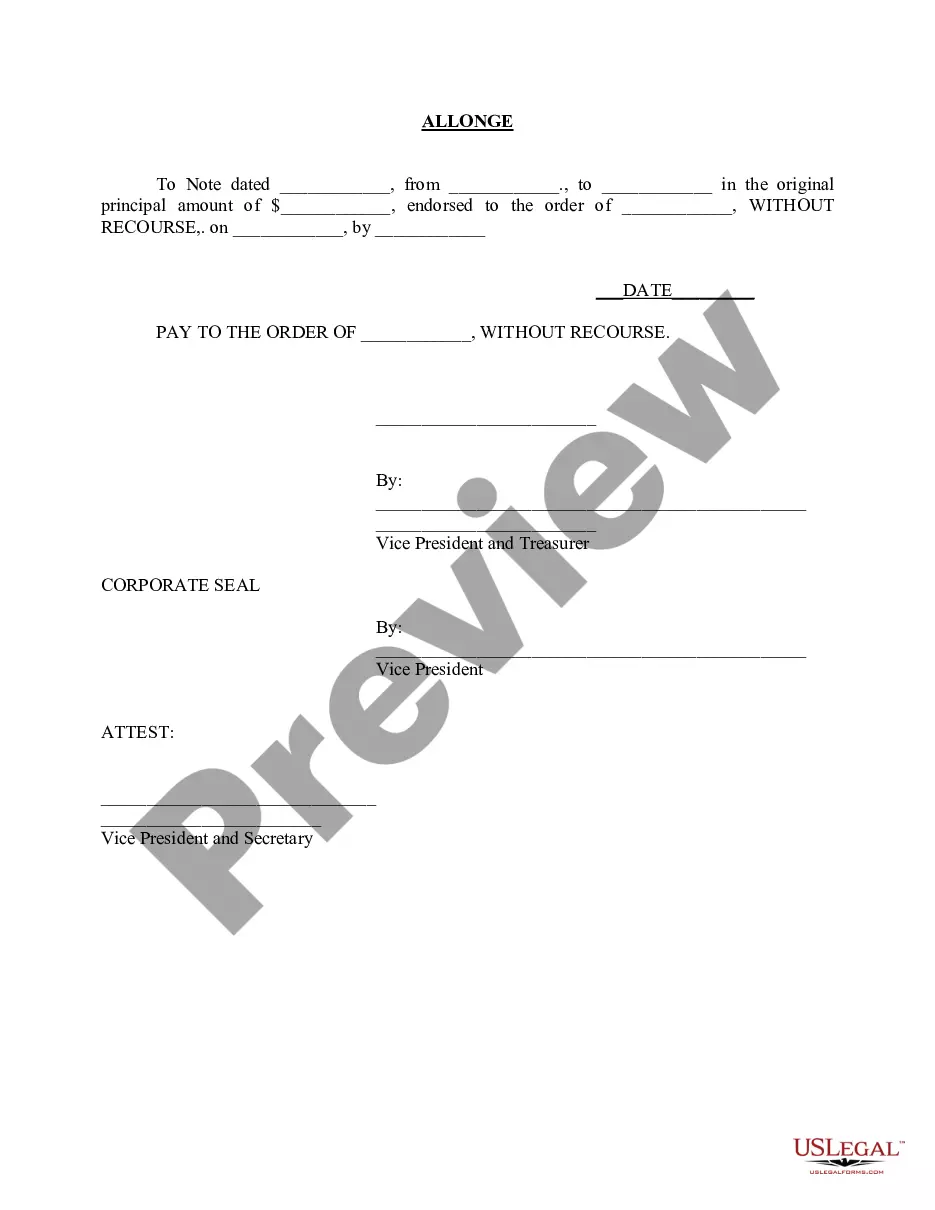

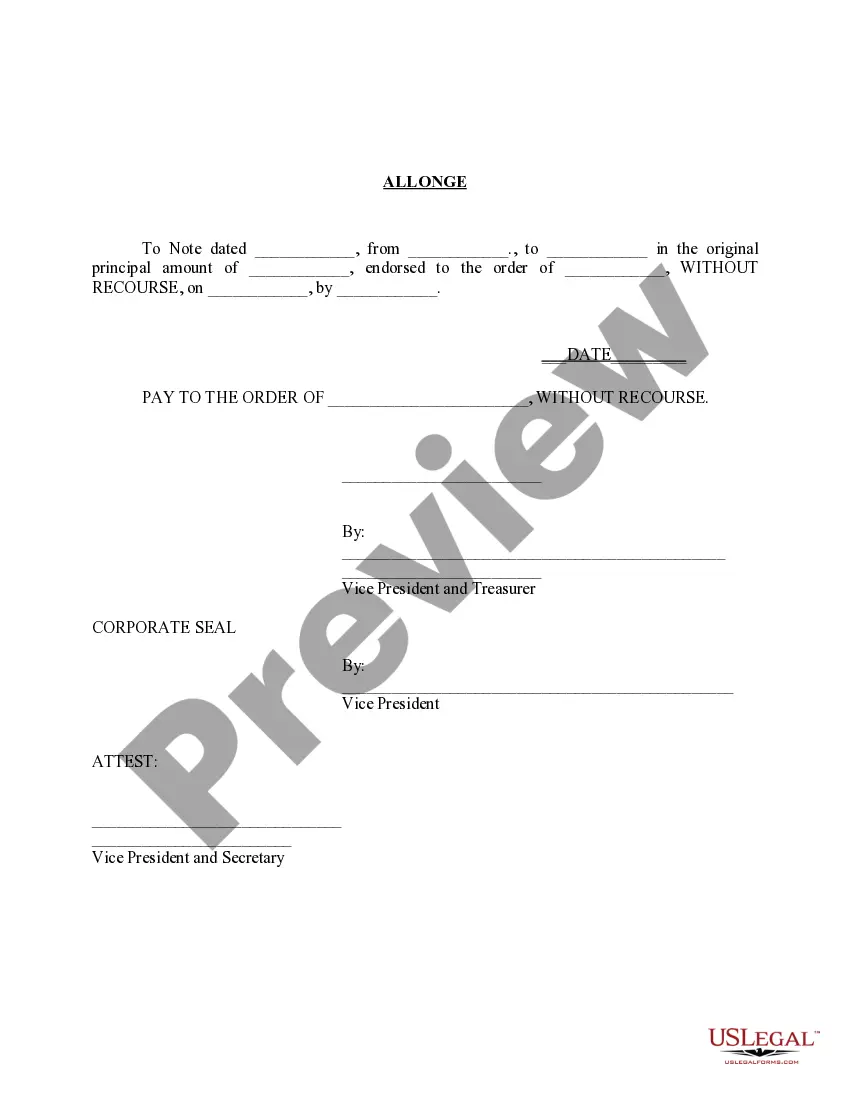

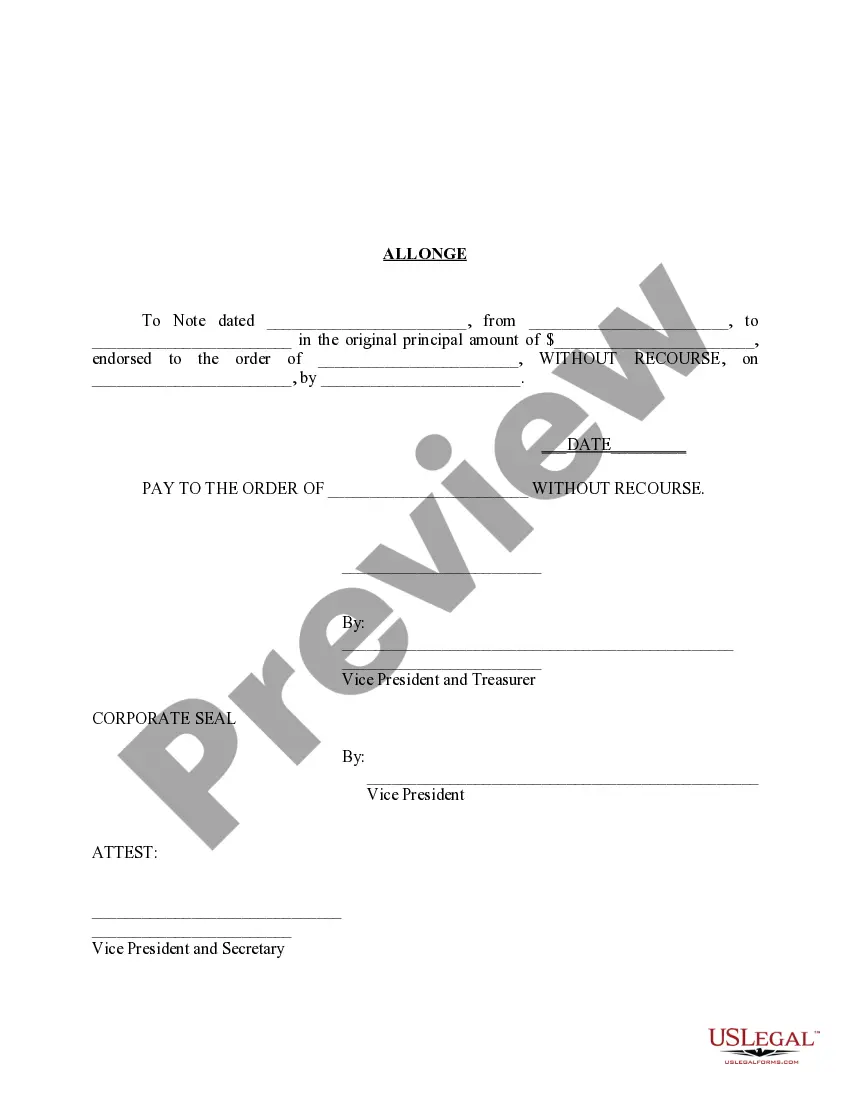

Missouri Along: A Detailed Description and Types A Missouri Along is a legal document commonly used in financial transactions, specifically in the context of promissory notes and negotiable instruments. Its purpose is to endorse or transfer the rights of a promissory note to another party, usually a lender or loan holder. This document serves as an attachment to the original note and contains essential information about the transfer of ownership. Keywords: Missouri Along, promissory note, negotiable instrument, endorse, transfer of rights, lender, loan holder. Types of Missouri Along: 1. Blank Along: A blank along is a simple form of the Missouri Along that does not contain any specific endorsement information. It provides flexibility for future endorsements or transfers, as the necessary information can be added when needed. This type of along is versatile and allows multiple endorsements or transfers in the future. 2. Special Along: A special along is used when the transfer of rights to the promissory note involves specific parties. It includes details such as the name of the endorsing party, the name of the transferee, the date of endorsement, and any additional conditions or restrictions regarding the transfer. A special along provides a more customized and precise endorsement process, ensuring clarity and legal compliance. 3. Restrictive Along: A restrictive along is utilized when the transfer of a promissory note carries specific limitations or conditions. This type of along typically includes a restrictive endorsement statement, restricting the further transfer of the note or specifying the purpose for which the note can be used. It is often used in commercial or business transactions where additional control or protection is desired. 4. Qualified Along: A qualified along is employed when the original promissory note requires specific qualifications to be met before an endorsement or transfer can occur. This could involve meeting certain financial criteria, obtaining necessary authorizations, or fulfilling contractual obligations specified within the original note. A qualified along help ensure that the transfer of a promissory note only occurs when all predetermined requirements are successfully completed. In summary, a Missouri Along is a legal document used to endorse and transfer the rights associated with a promissory note or negotiable instrument. It comes in various types, including blank alleges for future endorsements, special alleges for specific parties, restrictive alleges for limited transfers, and qualified alleges for conditional transfers. Understanding the different types allows parties involved in financial transactions to select the most appropriate form to meet their specific requirements.

Missouri Allonge

Description

How to fill out Missouri Allonge?

Discovering the right legitimate file design can be a battle. Needless to say, there are a variety of layouts available on the Internet, but how can you get the legitimate type you will need? Take advantage of the US Legal Forms website. The services offers a large number of layouts, for example the Missouri Allonge, which can be used for enterprise and private requires. Every one of the types are checked out by pros and meet state and federal needs.

When you are previously listed, log in for your account and click on the Obtain key to obtain the Missouri Allonge. Use your account to appear throughout the legitimate types you possess ordered previously. Visit the My Forms tab of your respective account and get another backup of the file you will need.

When you are a whole new end user of US Legal Forms, listed below are easy recommendations so that you can follow:

- Initial, ensure you have chosen the proper type for your personal area/state. You can look through the shape making use of the Review key and study the shape description to ensure it will be the best for you.

- If the type fails to meet your requirements, take advantage of the Seach industry to obtain the proper type.

- Once you are positive that the shape would work, click the Purchase now key to obtain the type.

- Opt for the pricing program you want and enter in the needed information. Build your account and pay money for your order with your PayPal account or credit card.

- Select the document formatting and download the legitimate file design for your system.

- Total, change and produce and sign the acquired Missouri Allonge.

US Legal Forms may be the most significant catalogue of legitimate types that you can see a variety of file layouts. Take advantage of the service to download appropriately-created documents that follow status needs.