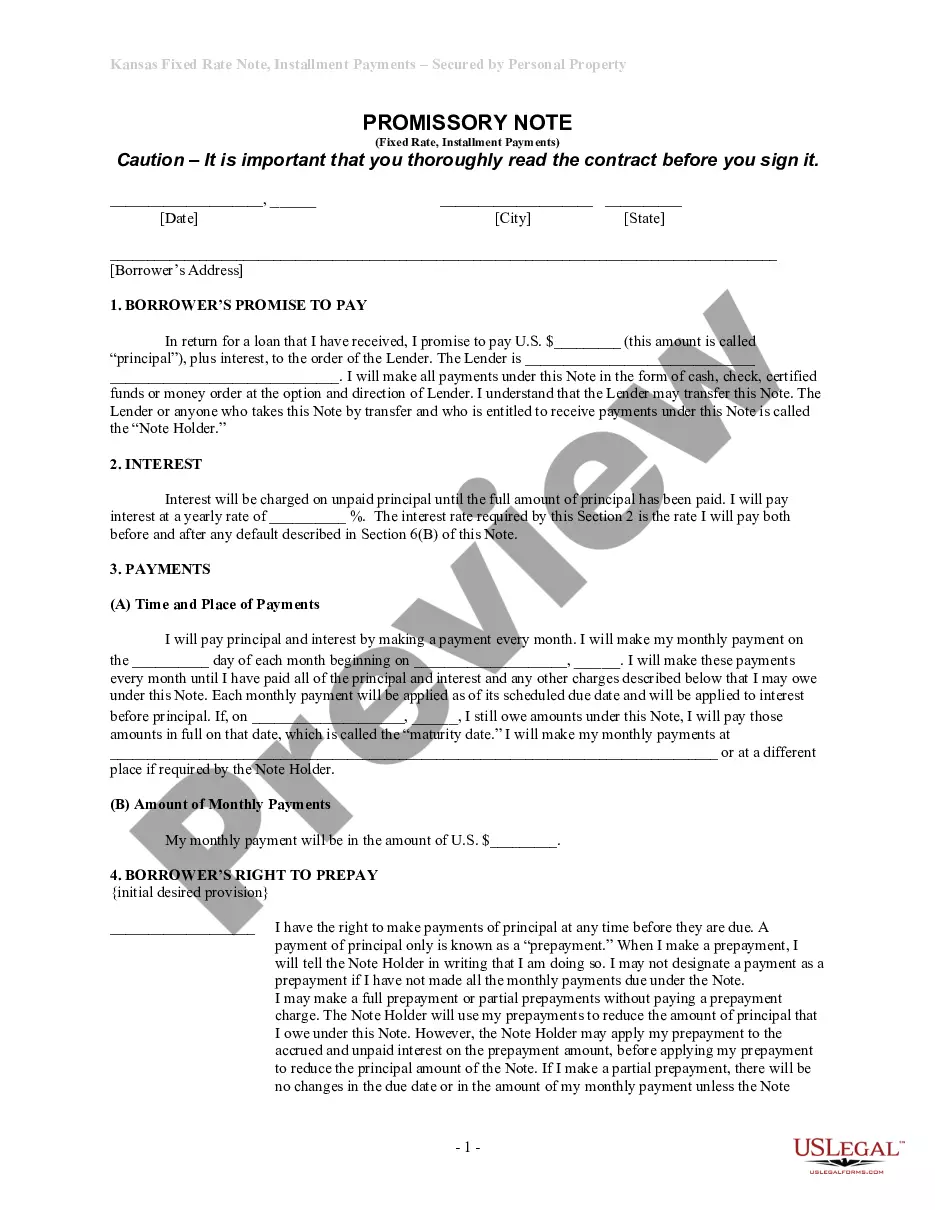

Missouri Receipt for Loan Funds is a legal document that serves as evidence of the receipt of loan funds by an individual or entity in the state of Missouri. This receipt acknowledges the receipt of the borrowed funds and states the terms and conditions of repayment as agreed upon between the lender and the borrower. The Missouri Receipt for Loan Funds contains key information such as the date of receipt, the amount borrowed, the interest rate (if applicable), the repayment terms, and any collateral provided as security for the loan. This document acts as a proof that the borrower has received the loan amount from the lender and is legally bound to repay it. There are various types of Missouri Receipt for Loan Funds depending on the purpose and nature of the loan, some of which are: 1. Personal Loan Receipt: This type of receipt is used when an individual borrows funds from another individual or entity for personal reasons such as education, medical expenses, or home improvements. 2. Business Loan Receipt: This receipt is utilized when a business entity obtains funds from a lender to finance its operations, purchase inventory or equipment, expand, or cover other business-related expenses. 3. Mortgage Loan Receipt: This receipt is used in real estate transactions when a borrower receives funds from a lender to purchase or refinance a property in Missouri. The receipt states the loan amount, interest rate, repayment terms, and details about the property being mortgaged. 4. Auto Loan Receipt: This type of receipt is issued when an individual or business borrows funds to purchase a vehicle in Missouri. It includes details about the loan amount, interest rate, repayment schedule, and information about the financed vehicle. 5. Student Loan Receipt: This receipt is used by students who borrow money to finance their education. It contains details about the loan amount, interest rate, repayment plans, and other terms and conditions specific to student loans. It is important for both the lender and the borrower to retain a copy of the Missouri Receipt for Loan Funds to ensure a clear record of the transaction and assist with any future disputes or clarifications. Legal advice may be sought to ensure compliance with Missouri state laws and regulations regarding the receipt and repayment of loan funds.

Missouri Receipt for loan Funds

Description

How to fill out Missouri Receipt For Loan Funds?

Choosing the right legitimate papers format could be a battle. Needless to say, there are a variety of themes accessible on the Internet, but how will you discover the legitimate type you will need? Make use of the US Legal Forms site. The services offers thousands of themes, including the Missouri Receipt for loan Funds, which you can use for enterprise and personal requirements. Each of the varieties are checked by pros and meet state and federal needs.

When you are already authorized, log in to the accounts and click on the Acquire option to get the Missouri Receipt for loan Funds. Utilize your accounts to check throughout the legitimate varieties you may have purchased formerly. Proceed to the My Forms tab of your respective accounts and have one more version in the papers you will need.

When you are a fresh user of US Legal Forms, here are straightforward instructions for you to comply with:

- Very first, ensure you have selected the appropriate type for your city/state. It is possible to look through the shape using the Preview option and read the shape information to make certain it will be the best for you.

- In case the type will not meet your requirements, make use of the Seach discipline to discover the proper type.

- Once you are sure that the shape is proper, go through the Get now option to get the type.

- Opt for the costs plan you need and enter in the needed information and facts. Create your accounts and purchase the transaction with your PayPal accounts or bank card.

- Pick the file format and down load the legitimate papers format to the gadget.

- Total, revise and produce and sign the received Missouri Receipt for loan Funds.

US Legal Forms is definitely the most significant collection of legitimate varieties for which you will find various papers themes. Make use of the company to down load appropriately-produced papers that comply with condition needs.

Form popularity

FAQ

Form 4809 - Notice of Lien, Lien Release, or Authorization to Add/Remove Name From Title.

Most title applications may be performed by completing and printing the Application for Missouri Title and License (Form 108) and submitting it to your local license office. You may also pick up a copy at your local license office, or use our online order form to request a copy by standard mail.

How to Fill Out Form 108 Missouri? Pick the trans type, in the right corner of the page; Fill in the information about the owner, including name, address, city, state, email, and phone; Write down the data about your vehicle, including year, color, ID, fuel, mileage, and body style;

Missouri law requires that a motor vehicle must be titled (within 30 days of the purchase date) before it is either registered for highway use or transferred to another individual.

Missouri Car Title Transfer Information On the back of the title you will fill out the upper part within the block called ASSIGNMENT. Print the purchaser's name(s) and complete address on the two lines provided. Enter the SALE PRICE. Enter DATE OF SALE. Enter MODEL (Ford, Chev, etc)

You must complete an Application for Missouri Title and License (Form 108) and submit the application by mail or at any Missouri license office. This is also a good time to add a Transfer on Death (TOD) beneficiary. Lienholder authorization is required to add or remove a name from a title if an outstanding lien exists.

What You'll Need to Do to Transfer your Vehicle Title in Missouri Visit any DOS License office near you. ... Submit the required documents, your application, ID and your payment. Receive a temporary vehicle title. Receive your vehicle title via U.S. mail.

Releasing a Lien On a motor vehicle, trailer, manufactured home, vessel, or outboard motor, Sections 301.640, 306.420, and 700.370, RSMo require the lienholder to release the lien on a separate document within 5 business days after the lien is satisfied. The release document shall be notarized.