Missouri Shareholders Buy-Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions: A Comprehensive Overview A Missouri shareholders' buy-sell agreement of stock in a close corporation with an agreement of spouse and stock transfer restrictions is a legally binding contract that regulates the sale and transfer of shares within a close corporation. This detailed description will outline the key elements, types, and significance of such agreements, highlighting relevant keywords for better comprehension. Close corporations, also known as closely held corporations or privately held corporations, are businesses with a limited number of shareholders often comprising family members or close associates. These corporations often face unique challenges, particularly regarding the efficient transfer of stock ownership and the need to maintain control within the existing shareholder group. The shareholders' buy-sell agreement effectively addresses these concerns, providing a framework for stock transfers and sales. Key Elements of a Shareholders Buy-Sell Agreement: 1. Shareholder Rights and Obligations: The agreement clearly outlines the rights, responsibilities, and obligations of all shareholders, ensuring everyone understands their role within the corporation. 2. Triggering Events: The contract identifies specific triggering events that may necessitate the sale or transfer of shares. Common triggering events include death, disability, retirement, bankruptcy, divorce, or voluntary departure. 3. Valuation Mechanism: A valuation mechanism is incorporated to determine the fair market value of shares during stock transfers. It can involve various methods such as independent appraisals, financial statements, or mutually agreed-upon formulas. 4. Restricted Transferability: The agreement restricts the free transferability of shares to external parties, protecting the corporation from unwanted shareholders or potential disruptions. 5. Right of First Refusal: If a shareholder intends to sell their shares, the agreement often grants other shareholders the right of first refusal. This provision allows existing shareholders to purchase the offered shares in proportion to their existing ownership before they are available for sale to outsiders. 6. Agreement of Spouse: In some instances, the inclusion of spouses' consent becomes mandatory. This ensures that any stock transfers or sales also require the approval of the shareholder's spouse, safeguarding marital assets and preventing unauthorized transfers. Types of Shareholders Buy-Sell Agreements: 1. Cross-Purchase Agreement: A cross-purchase agreement allows shareholders to buy the shares of departing shareholders directly, typically in proportion to their existing ownership. This type of agreement is commonly used when there are fewer shareholders. 2. Stock Redemption Agreement: A stock redemption agreement stipulates that the corporation purchases the shares of the departing or deceased shareholder. In this scenario, the corporation becomes the buyer of shares, and the remaining shareholders' ownership proportion increases accordingly. 3. Hybrid Agreement: A hybrid agreement combines elements of both cross-purchase and stock redemption agreements, depending on the situation or the preferences of the shareholders involved. Significance and Benefits: 1. Preservation of Control: By restricting stock transfers to existing shareholders, the corporation preserves control and prevents potential disruptions that may arise from unpredictable new shareholders. 2. Stability and Continuity: The buy-sell agreement ensures the stability and continuity of the close corporation even in the face of unforeseen events such as death or disability of a shareholder. 3. Fair Valuation: By establishing a clear valuation mechanism, the agreement prevents disputes regarding the fair market value of shares during buyouts or transfers, protecting shareholders' interests. 4. Marital Asset Protection: The inclusion of spouses' consent ensures that the agreement helps safeguard marital assets and prevents unauthorized transfers that may cause financial strain or jeopardize ownership. In conclusion, a Missouri shareholders' buy-sell agreement of stock in a close corporation with an agreement of spouse and stock transfer restrictions is a vital legal instrument for close corporations. The agreement's elements, types, and benefits, as outlined above, ensure the smooth transfer and sale of shares while protecting shareholder interests and maintaining control within the corporation.

Missouri Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

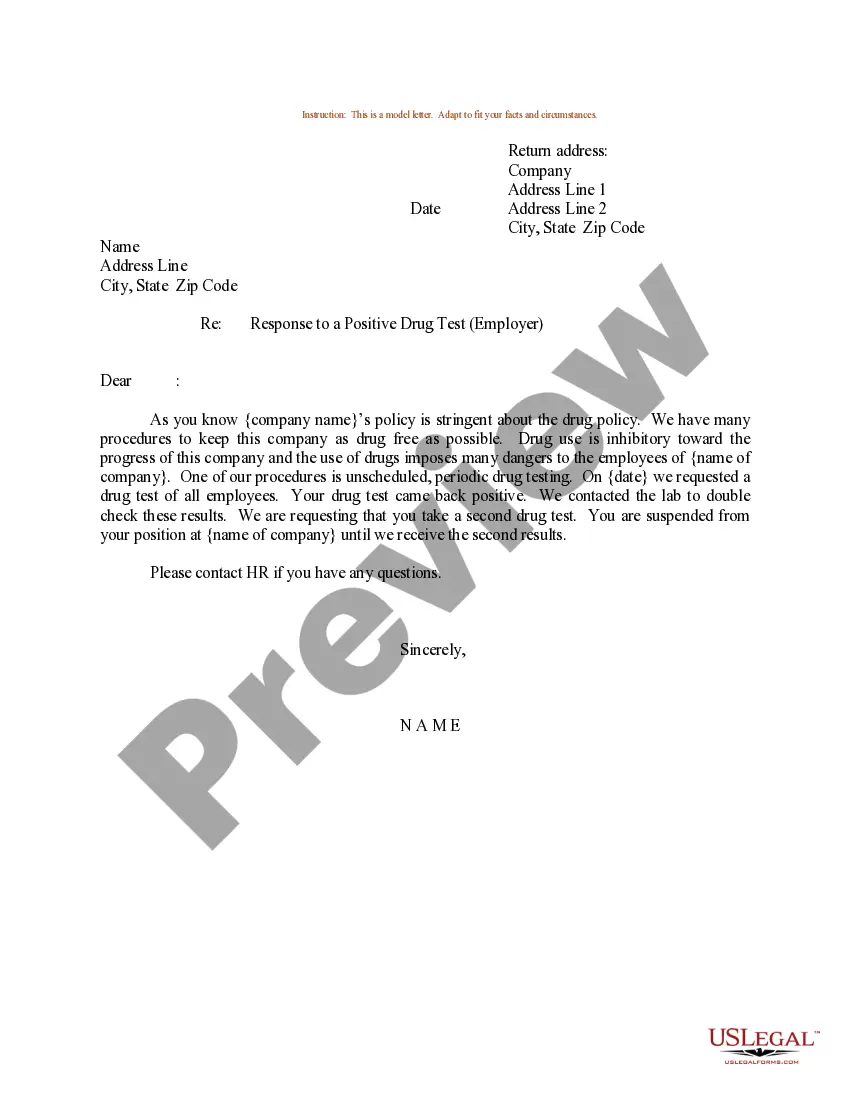

How to fill out Missouri Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

If you need to complete, down load, or printing legal record templates, use US Legal Forms, the biggest collection of legal forms, that can be found on the Internet. Use the site`s easy and practical research to get the documents you want. Various templates for business and person uses are categorized by categories and claims, or search phrases. Use US Legal Forms to get the Missouri Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions within a handful of mouse clicks.

In case you are presently a US Legal Forms customer, log in in your accounts and click on the Download key to find the Missouri Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions. Also you can entry forms you formerly saved in the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the shape for that proper town/nation.

- Step 2. Utilize the Preview method to look over the form`s articles. Do not overlook to read through the explanation.

- Step 3. In case you are not satisfied together with the type, utilize the Search field near the top of the display to find other models from the legal type web template.

- Step 4. Once you have found the shape you want, select the Get now key. Select the costs strategy you choose and put your accreditations to sign up for the accounts.

- Step 5. Method the transaction. You may use your credit card or PayPal accounts to finish the transaction.

- Step 6. Select the file format from the legal type and down load it on your own device.

- Step 7. Complete, edit and printing or signal the Missouri Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions.

Each and every legal record web template you buy is yours permanently. You have acces to every type you saved with your acccount. Go through the My Forms segment and decide on a type to printing or down load once again.

Remain competitive and down load, and printing the Missouri Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions with US Legal Forms. There are millions of professional and state-distinct forms you may use to your business or person requires.