Title: Missouri Sample Letter for Distribution of Estate Assets — A Comprehensive Guide Introduction: When it comes to settling an estate in Missouri, writing a well-crafted sample letter for the distribution of estate assets is crucial. This letter serves as an official document that outlines the process of distributing assets to the beneficiaries, ensuring a smooth transfer of property following a loved one's passing. In this article, we will dive into the key components of a Missouri Sample Letter for Distribution of Estate Assets, offering insights into the different types and considerations involved. 1. Basic Structure of a Missouri Sample Letter for Distribution of Estate Assets: The letter typically includes the following sections: — Opening statement ansalutationio— - Brief introduction and identification of the deceased — Acknowledgment of the estate administration process — Inventory of the estate's assets and liabilities — Identification and contact information of the beneficiaries — Method of assedistributionio— - Confirmation of executor's duties completion — Request for the beneficiaries' approval and signatures — Closing words and contact information 2. Types of Missouri Sample Letters for Distribution of Estate Assets: a) Inheritance Letter of Distribution: This type of letter focuses on distributing assets to heirs left in the last will and testament of the deceased. It outlines the specific distribution plan based on the provisions mentioned in the will and ensures the fair allocation of assets among the beneficiaries. b) Small Estate Affidavit Distribution Letter: In cases where the decedent's estate falls under the "small estate" threshold, usually up to $40,000, a simplified distribution process can take place through a small estate affidavit. This letter would outline the process of asset distribution according to Missouri's small estate laws. c) Intestate Succession Letter of Distribution: In instances where the decedent passed away without leaving a valid will, the intestate succession laws of Missouri come into play. An intestate succession letter of distribution outlines the distribution plan based on the state's predetermined order of beneficiaries. 3. Considerations for Drafting a Missouri Sample Letter for Distribution of Estate Assets: a) Consultation with Legal Professionals: Consulting with an attorney specializing in estate planning and probate can provide valuable guidance throughout the distribution process, ensuring compliance with Missouri's laws and regulations. b) Accurate Asset Valuation: It is essential to accurately assess and evaluate all assets and debts within the estate to ensure their correct distribution among the beneficiaries. c) Transparency and Communication: The letter should emphasize open lines of communication between the executor and the beneficiaries, providing an opportunity for clarification, questions, and discussions regarding the distribution plan. d) Deadlines and Compliance: Incorporate specific deadlines for beneficiaries to respond or approve the distribution plan. Ensure adherence to all legal requirements within the state of Missouri. Conclusion: A Missouri Sample Letter for Distribution of Estate Assets serves as a crucial document in the estate administration process. It establishes clear communication, outlines asset distribution plans, and ensures compliance with Missouri's laws. Understanding the different types and considering relevant factors will help simplify the process, ultimately facilitating a fair and efficient transfer of assets.

Missouri Sample Letter for Distribution of Estate Assets

Description

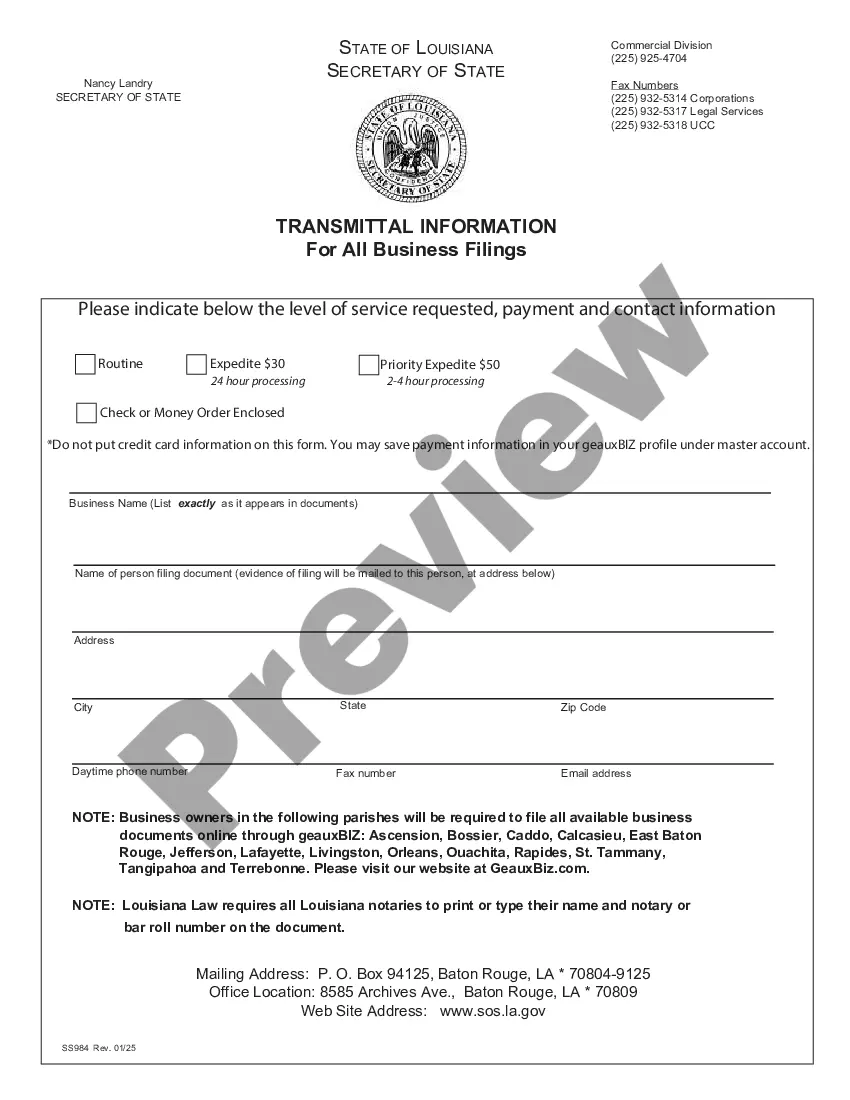

How to fill out Missouri Sample Letter For Distribution Of Estate Assets?

Are you currently in a place the place you will need files for both company or specific purposes just about every day time? There are a lot of lawful file layouts available online, but discovering types you can rely on is not simple. US Legal Forms offers a huge number of form layouts, such as the Missouri Sample Letter for Distribution of Estate Assets, that happen to be created to fulfill federal and state specifications.

In case you are already informed about US Legal Forms internet site and get a merchant account, basically log in. After that, you are able to down load the Missouri Sample Letter for Distribution of Estate Assets design.

Should you not provide an bank account and need to start using US Legal Forms, adopt these measures:

- Obtain the form you want and ensure it is to the correct town/county.

- Use the Review option to examine the form.

- Read the explanation to actually have selected the correct form.

- If the form is not what you`re looking for, utilize the Look for field to obtain the form that meets your needs and specifications.

- Whenever you find the correct form, click Acquire now.

- Choose the rates prepare you would like, submit the desired info to create your money, and purchase the transaction making use of your PayPal or charge card.

- Select a hassle-free paper structure and down load your copy.

Find each of the file layouts you have bought in the My Forms food selection. You can get a extra copy of Missouri Sample Letter for Distribution of Estate Assets whenever, if possible. Just click the essential form to down load or produce the file design.

Use US Legal Forms, one of the most comprehensive collection of lawful forms, to conserve time as well as steer clear of mistakes. The service offers professionally produced lawful file layouts that can be used for a range of purposes. Generate a merchant account on US Legal Forms and commence creating your way of life a little easier.