Missouri General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

If you need extensive, acquire, or print legal document templates, utilize US Legal Forms, the most significant collection of legal forms that are accessible online.

Employ the website's straightforward and convenient search feature to find the documents you require.

Numerous templates for business and personal uses are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You can access each form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Be proactive and download, and print the Missouri General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Missouri General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in just a few clicks.

- If you are already a US Legal Forms client, Log Into your account and then click the Download button to obtain the Missouri General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form relevant to your area/state.

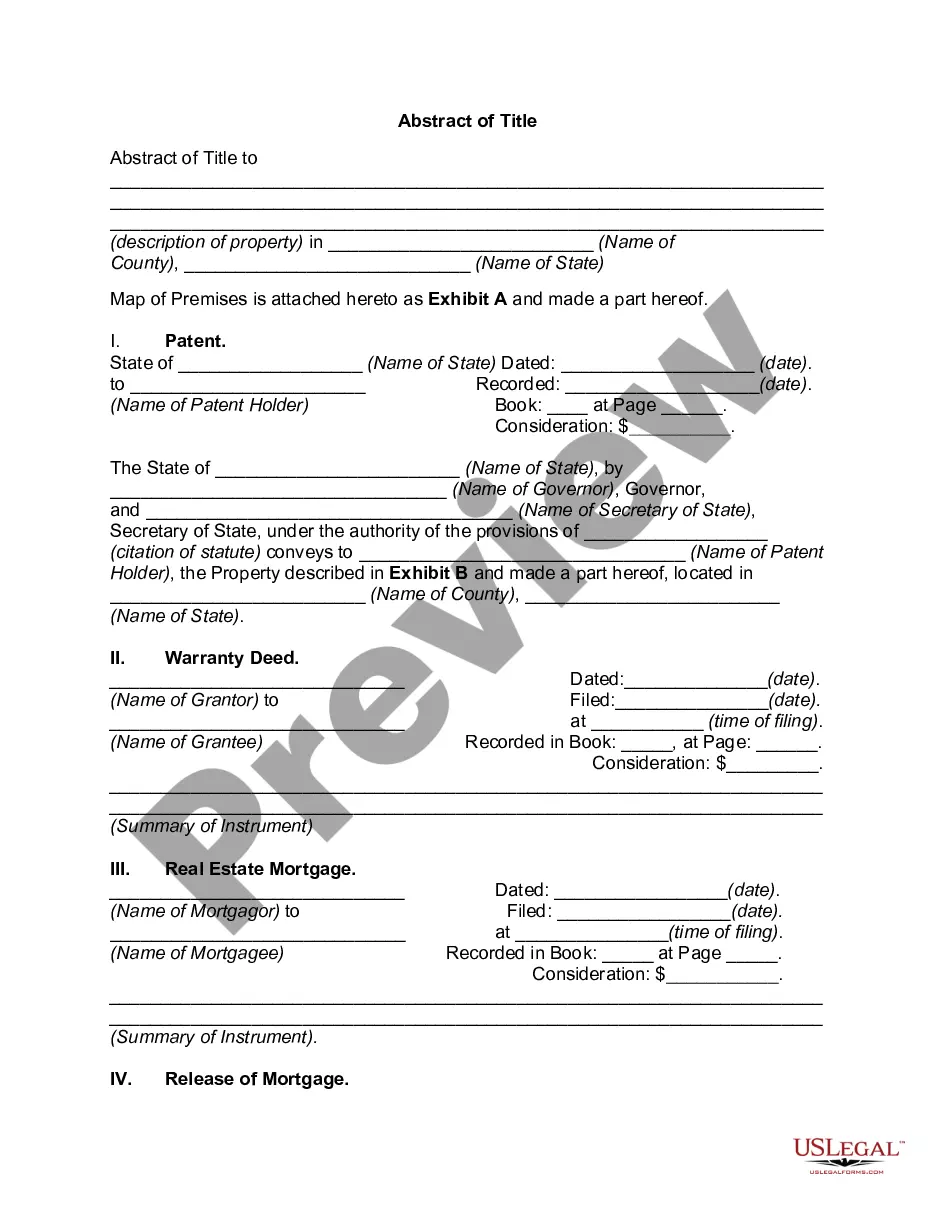

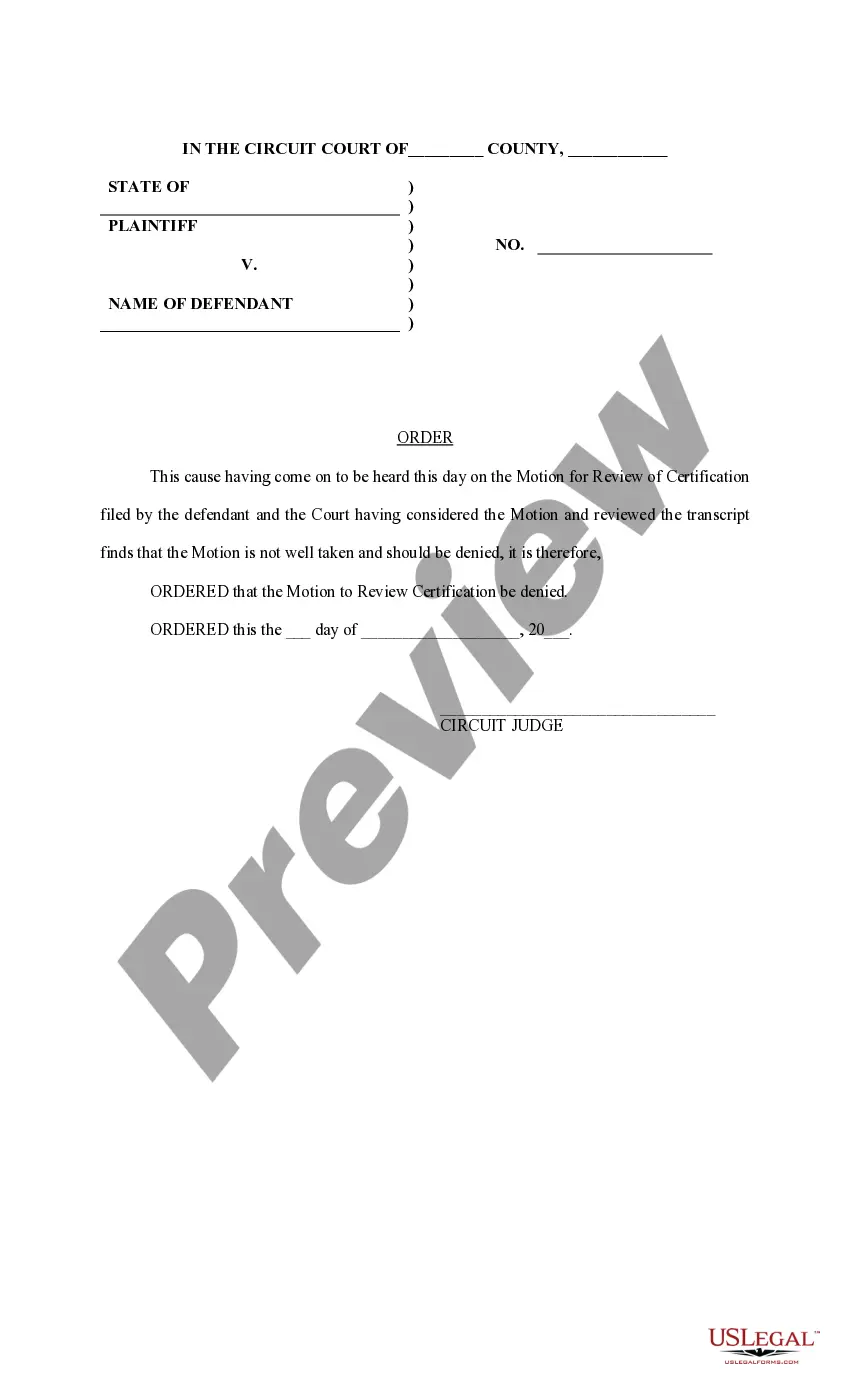

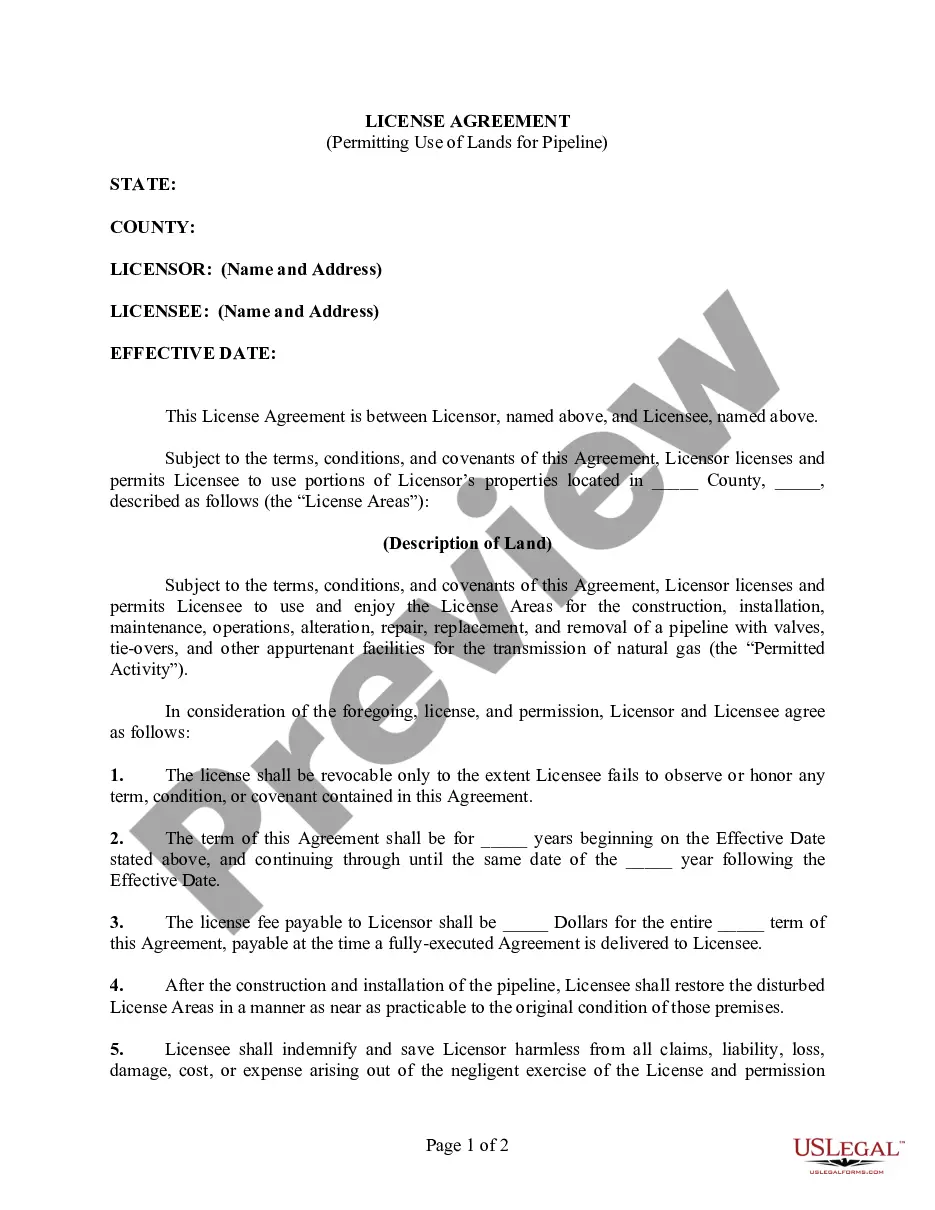

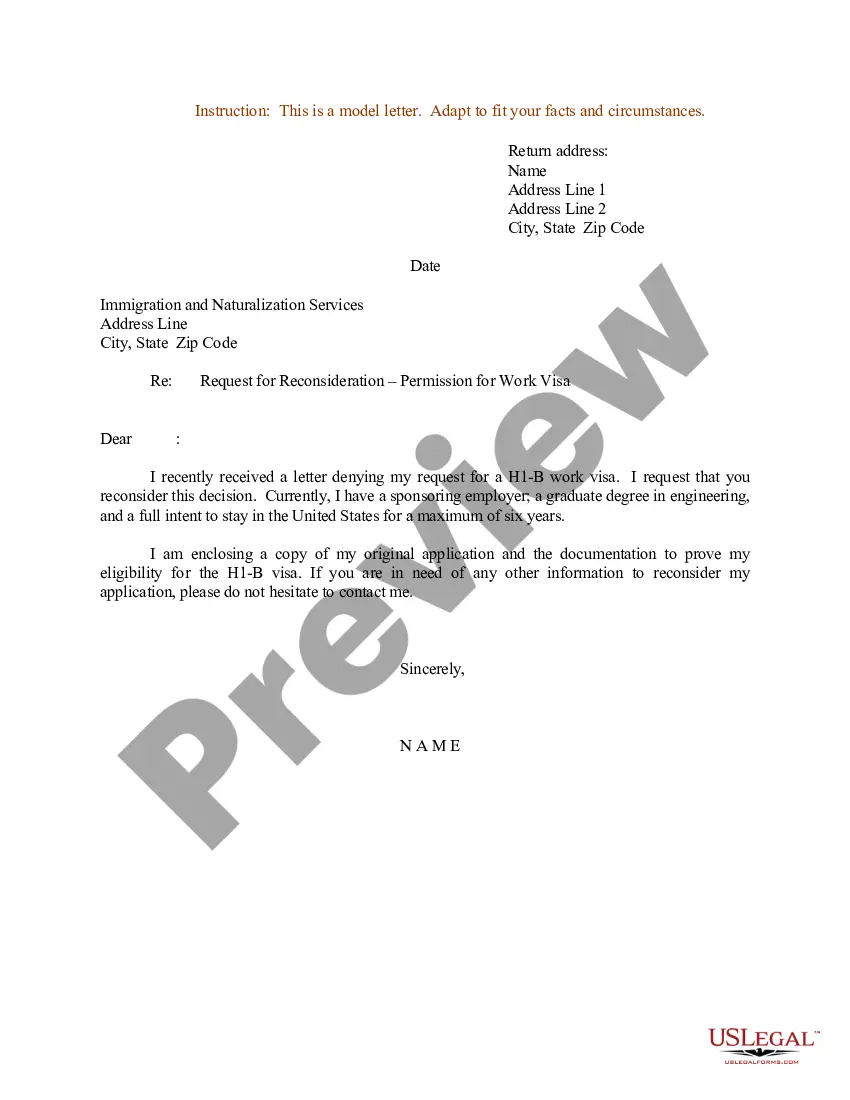

- Step 2. Use the Review option to examine the form's contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find different versions of the legal document format.

- Step 4. Once you find the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the purchase. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Missouri General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

Form popularity

FAQ

Yes, the gift made when the Missouri General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion is established can qualify for the annual exclusion. This means that the gift can be excluded from the donor's taxable gifts up to the annual limit set by the IRS. It's important to meet specific conditions, such as ensuring the trust complies with regulations. You can rely on platforms like uslegalforms to navigate these requirements easily.

A gift of a present interest is one in which the person who received the gift has the unrestricted right to the immediate possession, use, and enjoyment of the property.

The primary way the IRS becomes aware of gifts is when you report them on form 709. You are required to report gifts to an individual over $15,000 on this form. This is how the IRS will generally become aware of a gift.

Gifts are taxable in the year that you give them. For example, if you write a $25,000 check for your son in December of 2022, you have to report it on your 2022 tax refurn (filed in 2023) no matter when he deposits it.

In 2021, parents can each take advantage of their annual gift tax exclusion of $15,000 per year, per child. In a family of two parents and two children, this means the parents could together give each child $30,000 for a total of $60,000 in 2021 without filing a gift tax return.

Irrevocable Trusts Generally: There are a number of types of irrevocable trusts that can be used to make gifts to other persons with the assets under the control and management of a trustee.

WASHINGTON -- If you give any one person gifts valued at more than $10,000 in a year, it is necessary to report the total gift to the Internal Revenue Service. You may even have to pay tax on the gift. The person who receives your gift does not have to report the gift to the IRS or pay gift or income tax on its value.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want. This means that each parent can each give each of their children and grandchildren $14,000 (two parents permits a total gift per recipient of $28,000).

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Gifts in trust are commonly used to pass wealth from one generation to another by establishing a trust fund. Typically, the IRS taxes the value of a gift being transferred up to the annual gift tax exclusion amount. A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount.