Subject: Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses Dear [Recipient's Name], I hope this letter finds you in good health. I am writing to provide a detailed description of the process of closing an estate in the state of Missouri. This letter serves as a resource, aimed at assisting you in understanding the necessary steps involved, complete with a breakdown of assets and expenses. In Missouri, when closing an estate, there are specific procedures and legal requirements to adhere to. Ensuring compliance with these legal obligations is crucial to a smooth and efficient estate closure. To help you navigate this process, we have prepared a comprehensive Missouri Sample Letter for Closing of Estate, which includes a breakdown of assets and expenses. Types of Missouri Sample Letters for Closing of Estate: 1. Standard Missouri Sample Letter for Closing of Estate: This letter highlights the general process involved in closing an estate in Missouri, providing an overview of the necessary steps, along with important reminders and recommendations. It includes a comprehensive breakdown of assets and expenses typically encountered during the estate closure. 2. Missouri Sample Letter for Closing of Small Estate: If the estate being closed falls under the category of a small estate according to Missouri law, this letter provides information on the simplified procedure applicable to such cases. It outlines the specific requirements, limitations, and exemptions that apply when closing a small estate, as well as a detailed breakdown of the assets and expenses unique to this scenario. 3. Missouri Sample Letter for Closing of Estate with Real Estate: If the estate in question includes real estate properties, this letter caters to the additional steps and considerations involved when dealing with such assets. It addresses the specific aspects of property valuation, transfer, and potential tax implications, offering a thorough breakdown of the expenses related to real estate closing within the estate. 4. Missouri Sample Letter for Closing of Estate with Debts and Liabilities: In situations where the estate has outstanding debts and liabilities to be resolved, this letter offers guidance on managing these obligations during the estate closure process. It provides information on identifying, prioritizing, and settling outstanding debts, followed by a clear breakdown of the expenses related to resolving such financial commitments. No matter which type of letter you require, we have strived to incorporate relevant Missouri-specific keywords to enhance searchability and align the content with state laws and regulations regarding estate closure. Please let us know which specific Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses you are seeking, and we will promptly provide you with the appropriate document to assist you in this endeavor. Thank you for your attention, and we hope this resource proves beneficial to you. If you have any further queries or require additional assistance, please do not hesitate to reach out. Sincerely, [Your Name] [Your Title/Position] [Your Contact Information]

Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses

Description

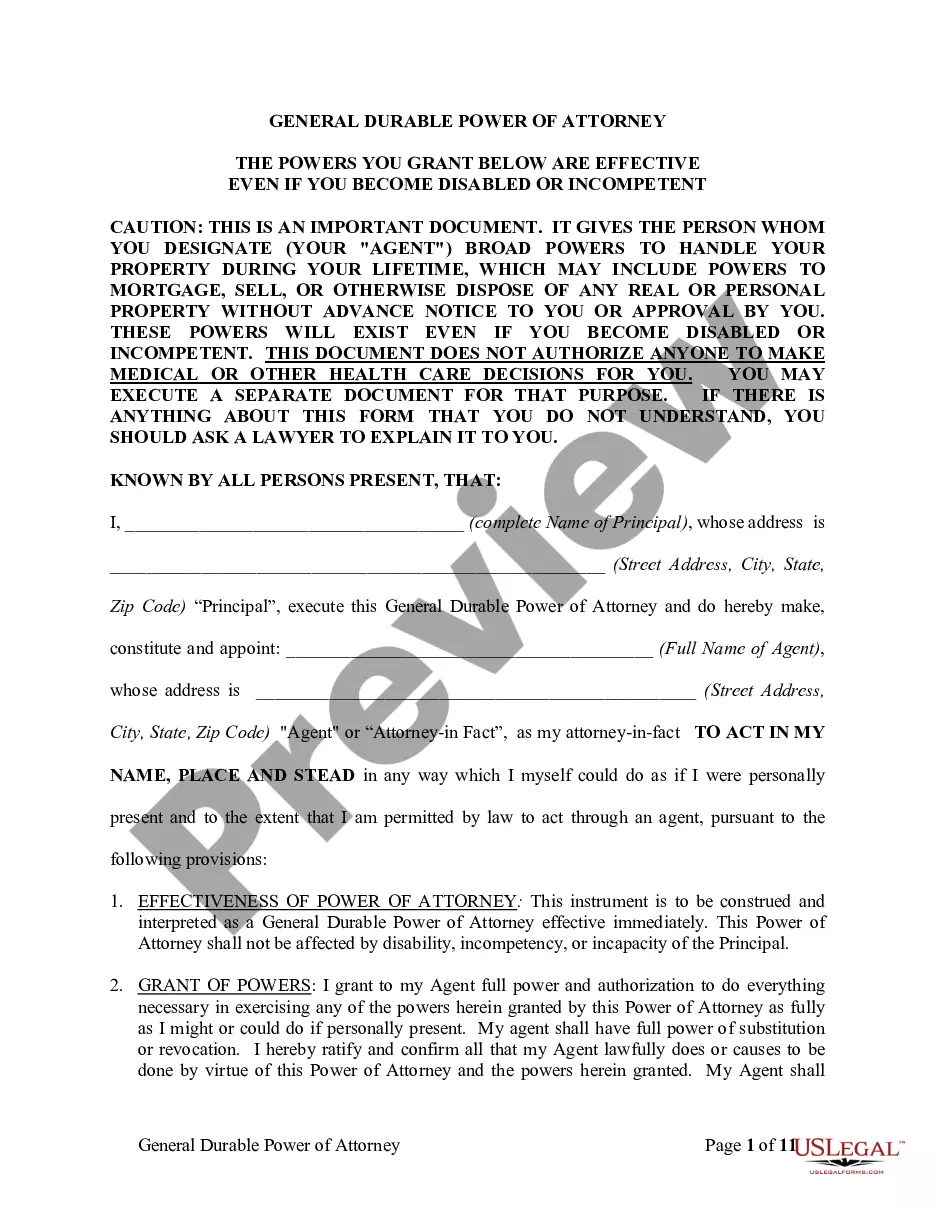

How to fill out Sample Letter For Closing Of Estate With Breakdown Of Assets And Expenses?

US Legal Forms - one of many biggest libraries of lawful types in the United States - delivers a wide array of lawful papers themes you can download or print. Utilizing the web site, you may get 1000s of types for business and personal functions, sorted by types, states, or keywords and phrases.You will find the newest versions of types much like the Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses within minutes.

If you already possess a monthly subscription, log in and download Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses from your US Legal Forms collection. The Obtain button will show up on every single develop you see. You get access to all formerly downloaded types within the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, here are straightforward guidelines to help you started out:

- Make sure you have selected the proper develop to your town/county. Go through the Review button to examine the form`s information. Read the develop outline to ensure that you have chosen the proper develop.

- In the event the develop does not satisfy your demands, take advantage of the Look for discipline near the top of the display to find the one which does.

- If you are happy with the form, validate your selection by clicking the Purchase now button. Then, select the rates program you want and give your references to sign up for the profile.

- Method the financial transaction. Use your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Select the structure and download the form on your system.

- Make changes. Fill up, edit and print and sign the downloaded Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses.

Every single web template you included with your money does not have an expiration particular date and is yours forever. So, in order to download or print one more copy, just visit the My Forms section and click on in the develop you require.

Get access to the Missouri Sample Letter for Closing of Estate with Breakdown of Assets and Expenses with US Legal Forms, by far the most extensive collection of lawful papers themes. Use 1000s of specialist and status-certain themes that fulfill your organization or personal requirements and demands.

Form popularity

FAQ

However, Missouri does offer a simplified or streamlined probate process for smaller estates. The process is initiated through the filing of a small estate affidavit. To qualify for this simplified probate process, the value of the estate can't be greater than $40,000 (less any liens, debts, or encumbrances).

Probate Estate ? real estate and personal property owned by the decedent and subject to administration supervised by the probate court, including any income after death. Publication ? notice published in a newspaper in the county where the decedent resided.

To be appointed, the personal representative needs to usually apply for ?letters testamentary? with the proper court, which in turn will authorize that person to act as personal representative and carry out the instructions contained in the decedent's will.

To be appointed, the personal representative needs to usually apply for ?letters testamentary? with the proper court, which in turn will authorize that person to act as personal representative and carry out the instructions contained in the decedent's will.

Probate is necessary when a person dies with property in his or her name or with rights to receive property. Examples of having property at death include: Bank accounts in the decedent's name with no co-owner and no beneficiary designation. A home or land that is owned by the decedent individually.

Missouri requires that an estate be over $40,000 in order to go through a standard probate process. Otherwise, it will undergo a simplified probate process. Wills and testaments must be filed within one year of death with the Probate Division of the Circuit Court.

The Estate Settlement Timeline: There isn't a specific deadline for this in Missouri law, but it's generally best to do so within 30 days to prevent unnecessary delays in the probate process.

Many problems can arise if real estate does not go through probate: if real estate remains stuck in the name of a dead person, and there is a mortgage on the property, the mortgage company could foreclose. If no one pays the real estate taxes, the county may foreclose after three years.