The Missouri Qualifying Subchapter-S Revocable Trust Agreement is a legal document that establishes a trust arrangement governed by Missouri state laws. A revocable trust, also known as a living trust, allows individuals to retain control over their assets during their lifetime while providing a clear plan for the distribution of their estate upon their death. This specific type of trust agreement is designed to qualify for Subchapter-S taxation benefits under the Internal Revenue Code. By electing Subchapter-S status, the trust can pass income, deductions, and credits directly to its beneficiaries, avoiding double taxation at the trust level. There are several types of Missouri Qualifying Subchapter-S Revocable Trust Agreements, customized to meet various personal and financial situations: 1. Individual Revocable Trust: This trust is established by a single person, who acts as the granter and trustee during their lifetime. The granter can make changes or revoke the trust at any time. 2. Joint Revocable Trust: This trust is established by a married couple or partners. Both individuals serve as granters and trustees, allowing them to maintain control over their combined assets. A joint revocable trust also facilitates seamless asset transfer to the surviving spouse upon the death of the first granter. 3. AB Trust: Also known as a Marital and Family Trust or Survivor's Trust, an AB Trust is commonly used in estate planning to minimize estate taxes. It consists of two separate trusts: the A Trust and the B Trust. The Trust, also known as the Marital Trust or TIP Trust, holds the assets that qualify for the unlimited marital deduction. The B Trust, also called the Family Trust or Bypass Trust, holds assets up to the unified estate tax credit limit, protecting them from estate taxes upon the surviving spouse's death. 4. Charitable Remainder Trust: This type of trust allows the granter to receive an income stream during their lifetime while benefiting a charitable organization or cause. Upon the granter's death, the remaining assets transfer to the designated charity. 5. Generation-Skipping Trust: Aimed at avoiding estate taxes on transfers to future generations, this trust allows individuals to transfer assets directly to their grandchildren or other beneficiaries who are at least two generations below the generation of the granter. This trust ensures that the assets are not subjected to both estate taxes upon the children's death and subsequent estate taxes upon the grandchildren's death. In conclusion, the Missouri Qualifying Subchapter-S Revocable Trust Agreement provides individuals with a flexible and tax-efficient estate planning tool. Whether it's an individual, joint, AB, charitable remainder, or generation-skipping trust, each type caters to different personal circumstances and objectives, ensuring the smooth transfer of assets while minimizing tax implications.

Missouri Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Missouri Qualifying Subchapter-S Revocable Trust Agreement?

Are you inside a placement where you need papers for either organization or individual functions just about every time? There are tons of legal document web templates accessible on the Internet, but locating ones you can trust isn`t effortless. US Legal Forms delivers a large number of form web templates, such as the Missouri Qualifying Subchapter-S Revocable Trust Agreement, which can be composed to satisfy state and federal specifications.

If you are already knowledgeable about US Legal Forms internet site and get a merchant account, basically log in. Afterward, you can obtain the Missouri Qualifying Subchapter-S Revocable Trust Agreement format.

If you do not have an account and want to start using US Legal Forms, follow these steps:

- Get the form you need and ensure it is to the proper area/state.

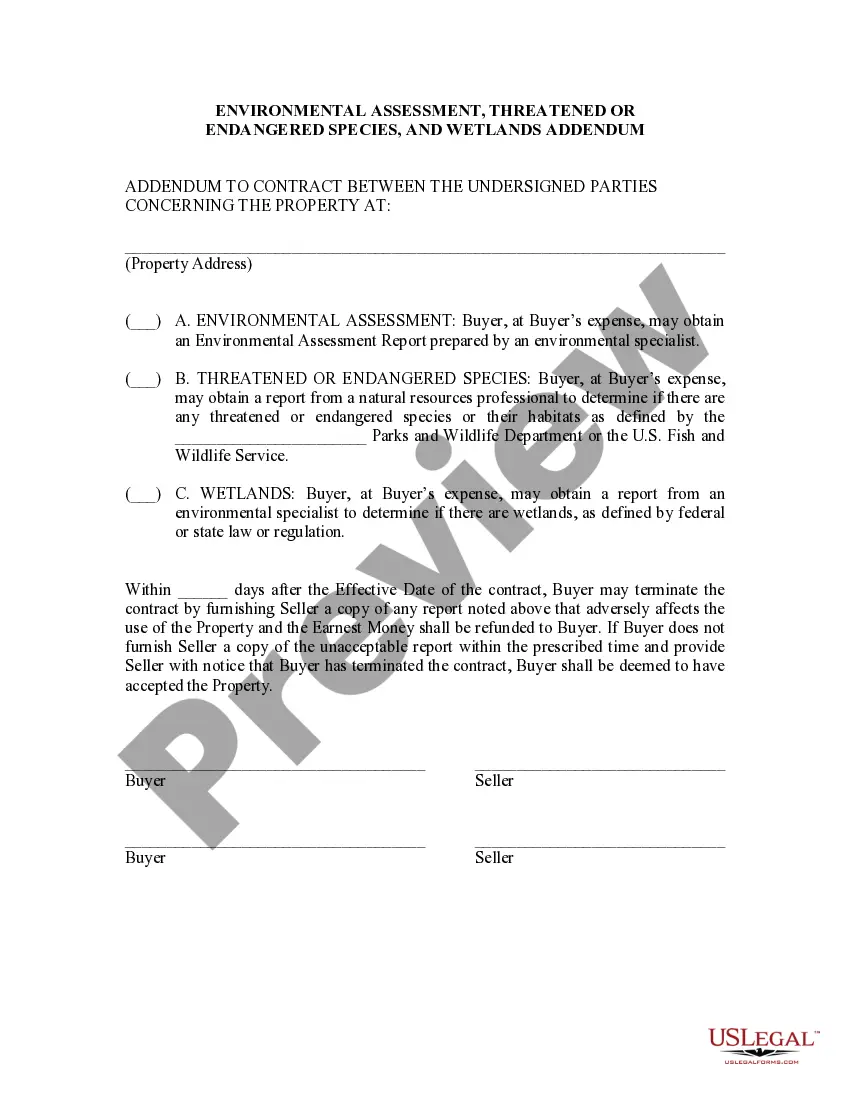

- Utilize the Review option to analyze the shape.

- Look at the outline to ensure that you have chosen the right form.

- When the form isn`t what you`re searching for, make use of the Search industry to find the form that fits your needs and specifications.

- Once you get the proper form, click Buy now.

- Select the rates plan you would like, submit the specified information and facts to create your money, and buy an order using your PayPal or credit card.

- Pick a handy paper format and obtain your version.

Discover every one of the document web templates you might have bought in the My Forms menu. You can aquire a further version of Missouri Qualifying Subchapter-S Revocable Trust Agreement whenever, if necessary. Just go through the required form to obtain or produce the document format.

Use US Legal Forms, the most comprehensive variety of legal forms, to save some time and prevent mistakes. The support delivers skillfully made legal document web templates which you can use for a range of functions. Produce a merchant account on US Legal Forms and commence generating your way of life a little easier.