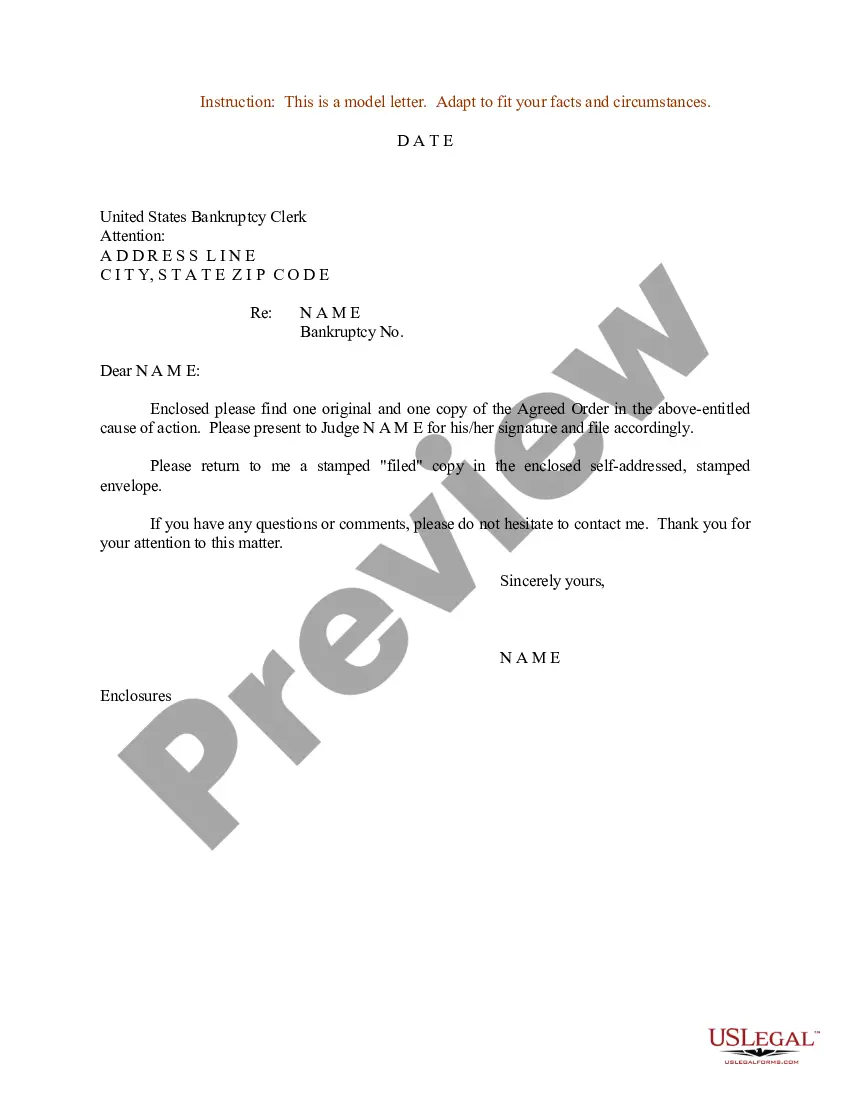

Missouri Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker

Description

How to fill out Sample Letter For Application Of Unsecured Creditors For An Order Authorizing Employment Of Investment Banker?

Discovering the right authorized papers template might be a battle. Naturally, there are plenty of layouts available on the Internet, but how can you find the authorized kind you need? Use the US Legal Forms site. The support delivers a large number of layouts, such as the Missouri Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker, that can be used for organization and personal requirements. All the forms are examined by experts and meet up with federal and state needs.

When you are previously listed, log in for your account and click the Down load switch to get the Missouri Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker. Make use of your account to search through the authorized forms you may have bought earlier. Proceed to the My Forms tab of the account and acquire an additional backup of the papers you need.

When you are a brand new user of US Legal Forms, listed below are simple guidelines that you should stick to:

- Very first, make certain you have selected the right kind for the metropolis/region. You can look through the shape using the Review switch and study the shape explanation to ensure this is the best for you.

- In case the kind will not meet up with your expectations, use the Seach field to discover the right kind.

- Once you are certain that the shape is acceptable, go through the Purchase now switch to get the kind.

- Opt for the costs plan you desire and type in the required information. Build your account and pay money for the order utilizing your PayPal account or bank card.

- Choose the document structure and down load the authorized papers template for your product.

- Full, edit and printing and indicator the obtained Missouri Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker.

US Legal Forms is definitely the largest collection of authorized forms for which you can discover different papers layouts. Use the company to down load skillfully-created paperwork that stick to status needs.

Form popularity

FAQ

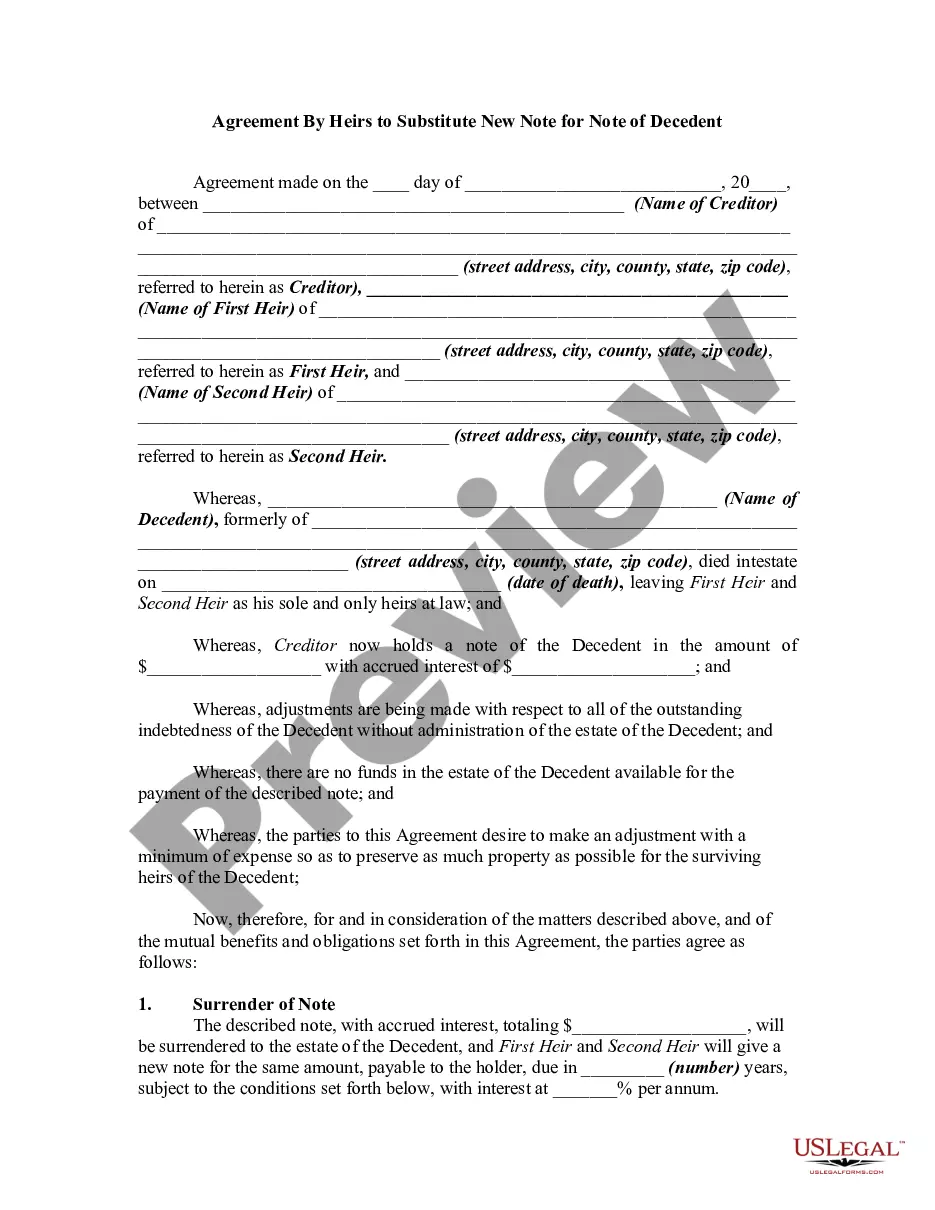

Typically, interest rates on unsecured loans are higher than rates on secured loans because the lender has a higher risk level of the loan not being repaid. Unsecured loans may be difficult to obtain if you do not have much positive credit history or don't have a regular income.

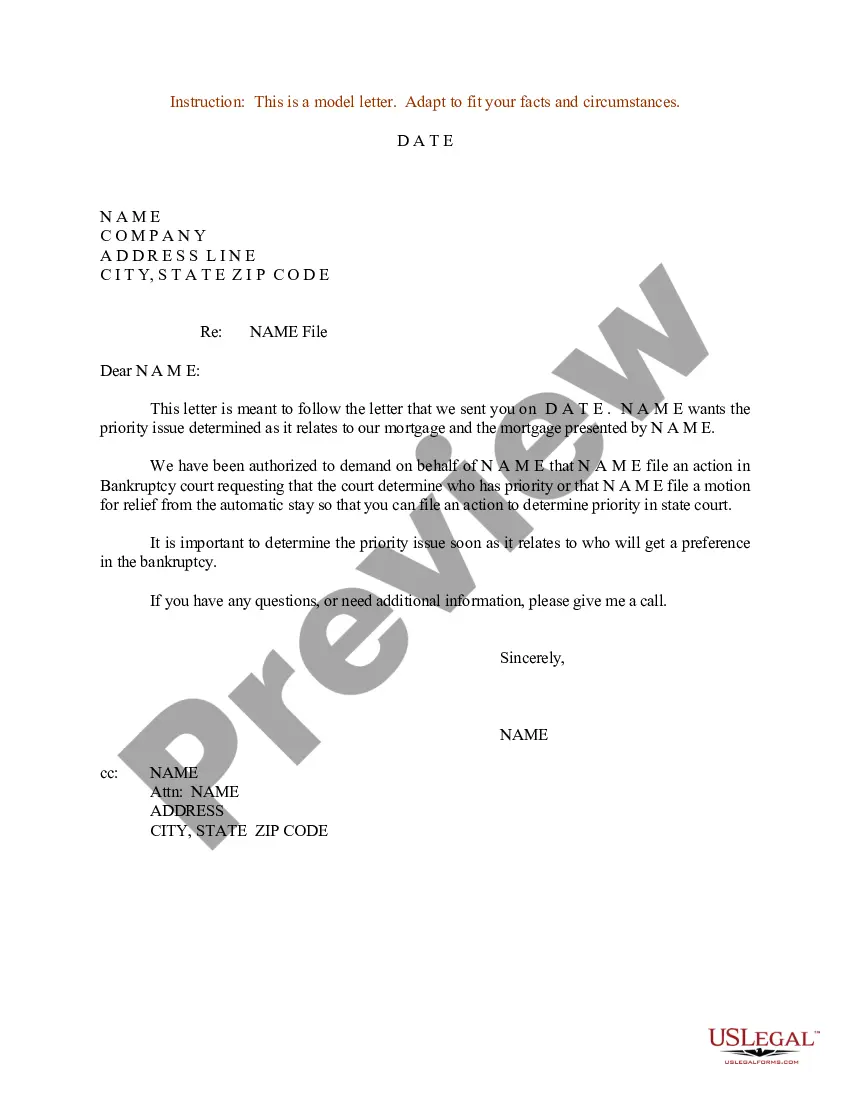

Creditors in bankruptcy cases have debts paid either by waiting for a distribution from the estate (unsecured creditors), by reclaiming property from the bankruptcy estate (secured creditors), or by obtaining a judgment that the debt is not dischargeable.

In the event of the bankruptcy of the debtor, the unsecured creditors usually obtain a pari passu distribution out of the assets of the insolvent company on a liquidation in ance with the size of their debt after the secured creditors have enforced their security and the preferential creditors have exhausted ...

Creditors' Rights for Unsecured Claims As an unsecured creditor, you can file a proof of claim, attend the first meeting of creditors, and file objections to the discharge. You can review the bankruptcy papers that were filed to determine whether there are any inaccuracies.

Creditors in bankruptcy cases have debts paid either by waiting for a distribution from the estate (unsecured creditors), by reclaiming property from the bankruptcy estate (secured creditors), or by obtaining a judgment that the debt is not dischargeable.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.

Further, the unsecured credit or debt so obtained or incurred is payable as an administrative expense in the case, which means that those creditors get paid ahead of all other unsecured creditors. Court approval is required prior to obtaining or incurring any other type of credit or debt during the case.

General unsecured creditors get paid on a pro rata basis. They'll all receive the same percentage of the balance owed. However, as long as you act in good faith, you may selectively pay nonpriority claims, in effect favoring some creditors over others.

What Is an Unsecured Creditor? An unsecured creditor is an individual or institution that lends money without obtaining specified assets as collateral. This poses a higher risk to the creditor because it will have nothing to fall back on should the borrower default on the loan.