Title: A Comprehensive Guide to Missouri Sample Letters for Review of Form 1210 Introduction: Missouri Sample Letters for Review of Form 1210 are essential documents that enable taxpayers to request a review and potential amendment of their tax assessment. These letters serve as a means to rectify any errors or discrepancies in the calculation of taxes owed to the Missouri Department of Revenue (FOR). In this article, we will provide a detailed description of what a Missouri Sample Letter for Review of Form 1210 entails and explore the various types available to taxpayers. Key Components of a Missouri Sample Letter for Review of Form 1210: 1. Personal and Contact Information: — Taxpayer'funnymanam— - Current address — Contact number—s) - Email address, if applicable 2. Introduction and Purpose of the Letter: — Clearly state the purpose of the letter: to request a review of Form 1210 and any associated tax assessment or penalty. — Mention the tax year(s) for which the review is sought. — Concisely describe any specific reasons for disputing the tax assessment, such as incorrect income calculation or wrong deductions. 3. Detailed Explanation and Supporting Documents: — Elaborate on the specific issues with Form 1210 and provide a comprehensive explanation of why the taxpayer believes the tax assessment is inaccurate. — Include supporting evidence and attachments, such as receipts, bank statements, or any other pertinent documentation that supports the claim and potential revision. — If relevant, mention any communication or correspondence with the FOR regarding the assessment to demonstrate that the taxpayer has made prior attempts to resolve the issue. 4. Request for the Review and Desired Outcome: — Clearly state the request for a thorough review of Form 1210 and associated tax assessment. — Specify the desired outcome, such as a correction of errors, adjustment to the tax liability, or any other specific resolution the taxpayer seeks. 5. Closing Remarks and Contact Information: — Express gratitude for the time and efforts taken to review the letter. — Request acknowledgment of receipt and confirmation of the initiation of the review process. — Provide contact information for further correspondence, including phone number(s), email address, and a preferred mode of response. Types of Missouri Sample Letters for Review of Form 1210: 1. Sample Letter for Review of Form 1210: Income Tax Assessment Discrepancies — This letter is tailored to address discrepancies in the calculation of income tax, such as incorrect reporting of salary, interest, or capital gains. 2. Sample Letter for Review of Form 1210: Sales Tax Assessment Disputes — Designed for taxpayers contesting errors in the determination of sales tax liabilities owed to the FOR, including doubts related to tax-exempt sales, taxation rates, or incorrect assessments. 3. Sample Letter for Review of Form 1210: Use Tax Assessment Challenges — This type of letter specifically targets use tax assessment issues, such as disputing incorrect attributions of taxable items or challenging the imposition of use tax where it may not be warranted. Conclusion: Missouri Sample Letters for Review of Form 1210 act as valuable tools for taxpayers seeking to address inaccuracies or disputes with their tax assessment. By providing a detailed explanation of the issues, supporting documents, and a clear request for review, individuals can potentially rectify any errors and reach a fair resolution with the Missouri Department of Revenue.

Missouri Sample Letter for Review of Form 1210

Description

How to fill out Missouri Sample Letter For Review Of Form 1210?

It is possible to commit hours on the web looking for the lawful record template that suits the federal and state needs you want. US Legal Forms offers a huge number of lawful varieties which can be examined by specialists. You can actually download or printing the Missouri Sample Letter for Review of Form 1210 from your assistance.

If you already possess a US Legal Forms account, it is possible to log in and then click the Down load option. After that, it is possible to comprehensive, modify, printing, or indication the Missouri Sample Letter for Review of Form 1210. Every single lawful record template you purchase is the one you have permanently. To acquire another backup of the bought type, proceed to the My Forms tab and then click the related option.

Should you use the US Legal Forms internet site the very first time, adhere to the simple recommendations under:

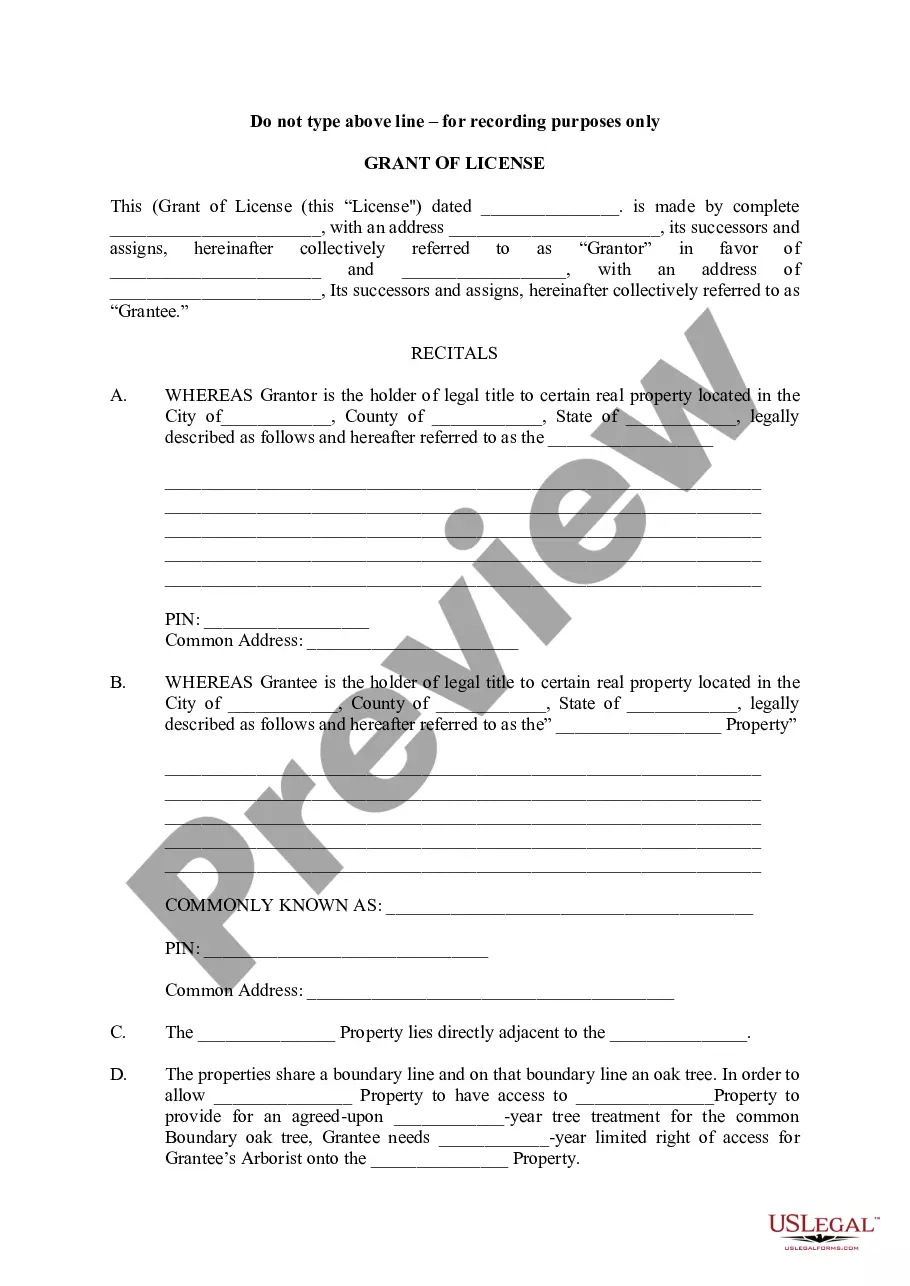

- Initially, be sure that you have selected the proper record template for that region/area of your liking. See the type explanation to make sure you have chosen the correct type. If accessible, use the Preview option to search with the record template as well.

- If you wish to find another variation of your type, use the Research area to find the template that meets your requirements and needs.

- Upon having located the template you desire, click on Buy now to proceed.

- Choose the costs plan you desire, type your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can utilize your bank card or PayPal account to cover the lawful type.

- Choose the formatting of your record and download it to the gadget.

- Make adjustments to the record if possible. It is possible to comprehensive, modify and indication and printing Missouri Sample Letter for Review of Form 1210.

Down load and printing a huge number of record layouts making use of the US Legal Forms Internet site, that provides the most important collection of lawful varieties. Use professional and condition-distinct layouts to take on your organization or individual needs.