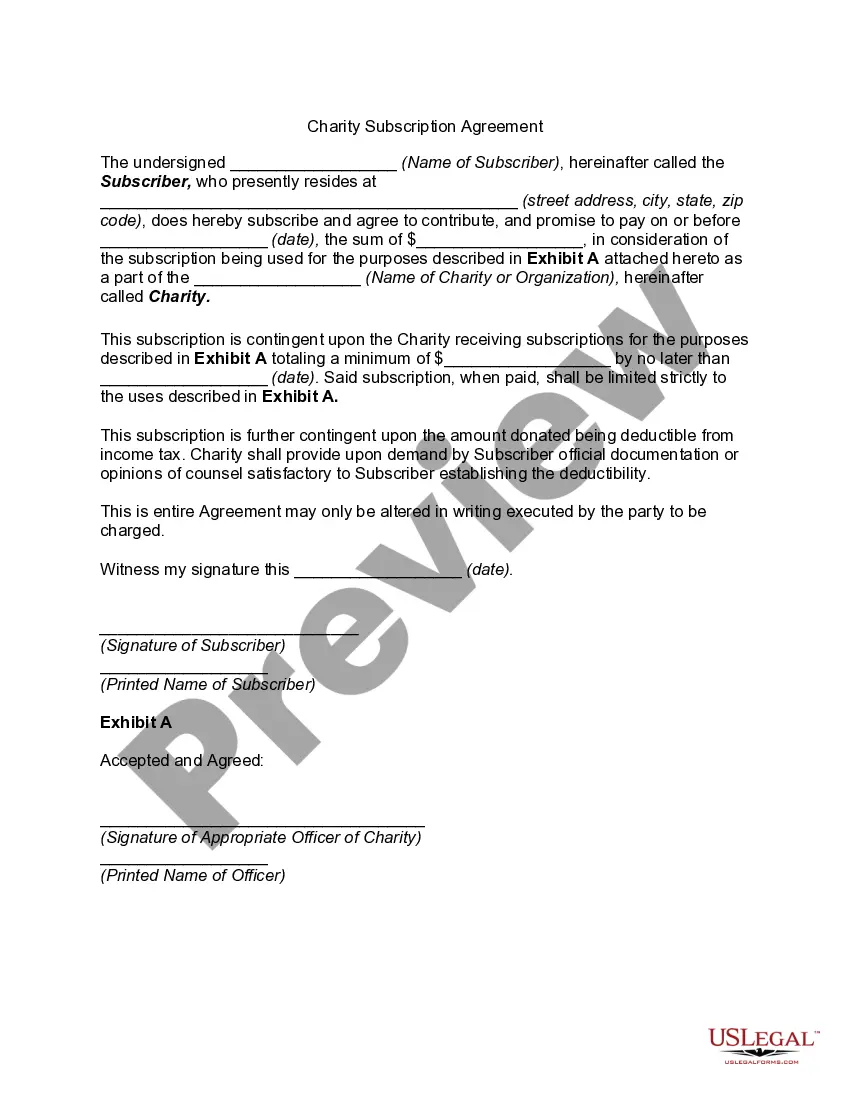

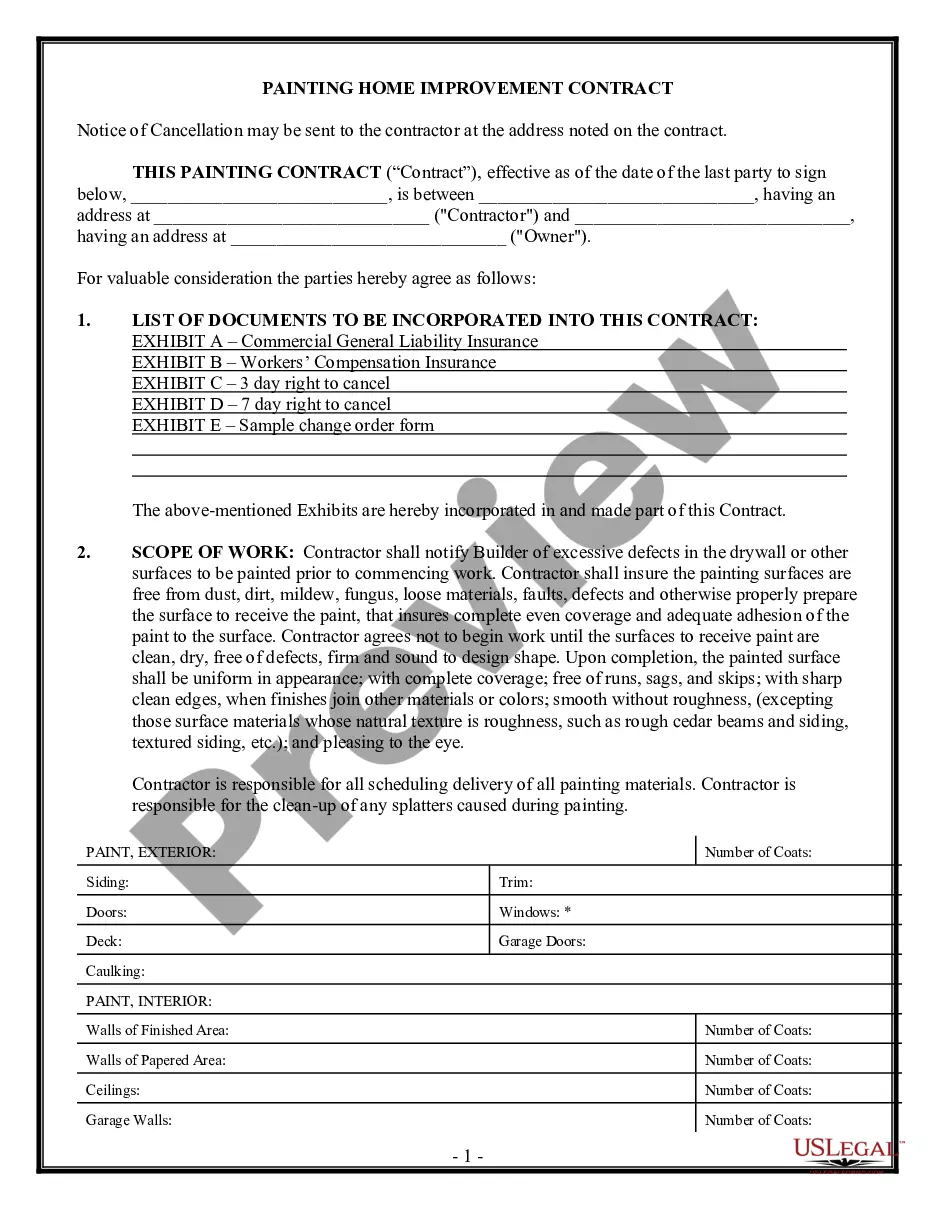

Missouri Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

You might invest numerous hours online attempting to locate the authentic file template that satisfies the state and federal requirements you have in mind.

US Legal Forms offers thousands of authentic templates that are vetted by experts.

You can effortlessly download or print the Missouri Charity Subscription Agreement from the support.

If available, utilize the Review option to preview the file template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Once done, you can complete, modify, print, or sign the Missouri Charity Subscription Agreement.

- Every authentic file template you obtain is yours permanently.

- To retrieve an additional copy of an acquired form, visit the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have chosen the correct file template for your selected state/region.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

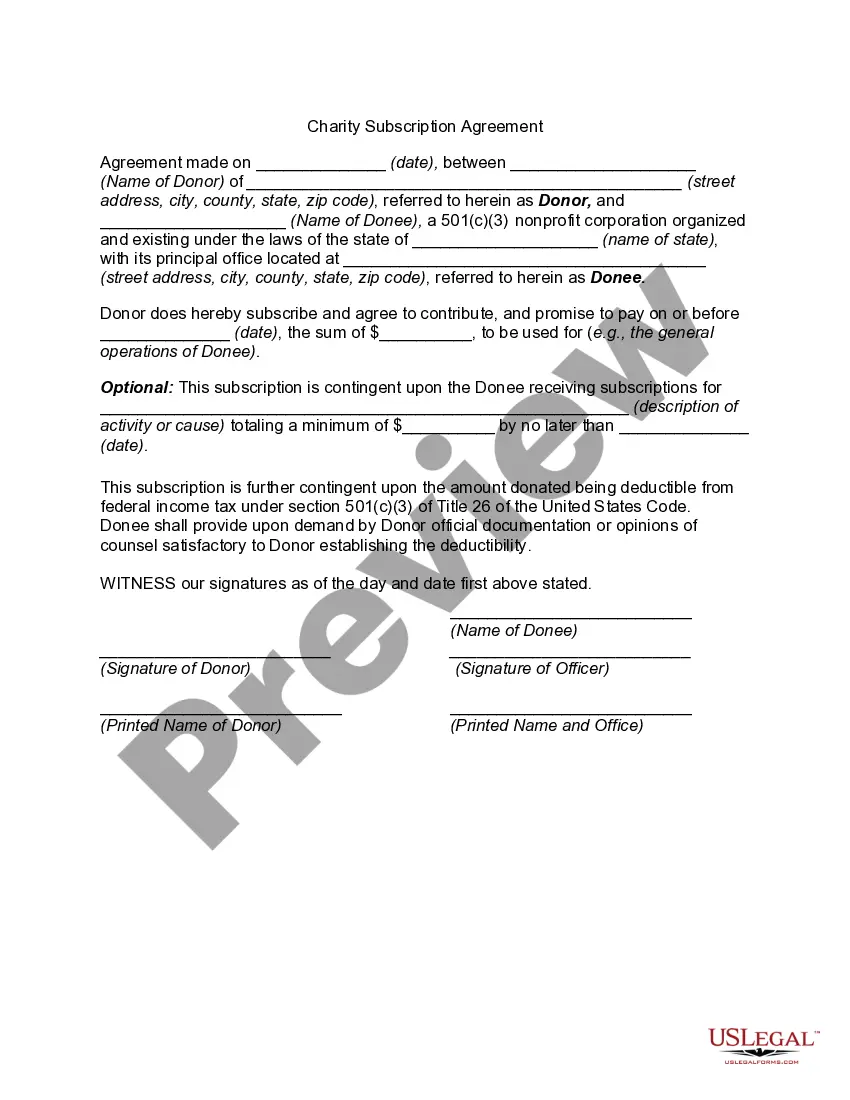

A charitable subscription, also called a charitable pledge, is a donor's written or oral promise or statement of intent to contribute money or property to a charity.

Under what situations is consideration not binding? Consideration is not binding if the promise does not create a duty or impose an obligation such as with illusory promises. Illusory promises include termination clauses in contracts and output and requirements contracts.

The most common types of contracts that must be in writing are: Contracts for the sale or transfer of an interest in land, and. A contract that cannot be performed within one year of the making (in other words, a long-term contract like a mortgage).

Within contract law, promissory estoppel refers to the doctrine that a party may recover on the basis of a promise made when the party's reliance on that promise was reasonable, and the party attempting to recover detrimentally relied on the promise.

A charitable subscription, also called a charitable pledge, is a donor's written or oral promise or statement of intent to contribute money or property to a charity.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge. These are known as the three essential elements of a contract.

Most courts view charitable pledges as legally enforceable commitments. Failure to enforce pledge collection could result in personal liability for the trustees of a non-profit. IRS rules prohibit donors from fulfilling a legally enforceable pledge from their donor advised fund.

Subscription Contracts means those written subscription and other agreements for Borrower's products and/or consulting, training, implementation and support services (Services) that: (a) have been duly and properly executed and delivered by Borrower and each account debtor party thereto; (b) have been entered into in

In California, like most other states, charitable pledges are analyzed as a matter of contract law. This means that pledges are not enforceable unless: (1) the pledgor receives consideration for making the pledge; or (2) the charity has detrimentally relied on the pledge.