Title: Missouri Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Keywords: Missouri, letter, debtor, credit card company, lower interest rate, certain period of time, request, types Introduction: In Missouri, debtors have the right to request a lower interest rate from their credit card companies for a specified period of time. This type of request is typically made through a formal letter, outlining the debtor's financial situation and proposing a reasonable reduction in interest rates. This article will provide a detailed description of how to construct a Missouri letter from a debtor to a credit card company, seeking a lower interest rate for a certain period of time. Key Components of the Letter: 1. Opening and Introduction: Begin the letter with a formal salutation, addressing the credit card company by name. State the purpose of the letter clearly, expressing your desire to request a lower interest rate for a specific period of time. Include your full name, account number, and contact information for reference. 2. Explanation of Financial Situation: In the body of the letter, provide a comprehensive explanation of your current financial situation. Highlight any unforeseen circumstances, such as medical emergencies, job loss, or increased expenses, that have led to your current financial difficulties. Be honest and transparent while explaining how these circumstances have made it challenging to pay off your credit card debt. 3. Proposal for Lower Interest Rate: Clearly state your proposed interest rate reduction and the duration for which you are requesting this adjustment. It is advisable to research market interest rates and determine a reasonable percentage reduction that aligns with your financial capabilities. Providing supporting evidence, such as current interest rates from other credit card companies, can strengthen your request. Remember to emphasize that this change is temporary and seek to re-establish the original interest rate once your financial situation improves. 4. Financial Track Record: Demonstrate responsible financial behavior by describing your payment history and any efforts you have made to reduce your debt. Mention consistent on-time payments, increased payments, or any other actions you have taken to manage your credit card debt responsibly. This will show the credit card company your commitment to overcoming your financial difficulties. 5. Request for Response and Negotiation: Conclude the letter by politely requesting a timely response from the credit card company. Express your willingness to negotiate any terms or provide additional documentation that could support your request. Encourage open communication and collaboration to find a mutually beneficial solution. Types of Missouri Letters from Debtors to Credit Card Companies: 1. Missouri Letter from Debtor to Credit Card Company Requesting Temporary Interest Rate Reduction due to Unemployment. 2. Missouri Letter from Debtor to Credit Card Company Requesting Temporary Interest Rate Reduction due to Medical Emergency. 3. Missouri Letter from Debtor to Credit Card Company Requesting Temporary Interest Rate Reduction due to Increased Monthly Expenses. 4. Missouri Letter from Debtor to Credit Card Company Requesting Temporary Interest Rate Reduction after a Natural Disaster. Final Note: Remember, drafting a well-structured and persuasive letter is crucial to increasing the likelihood of a positive response from the credit card company. Be sure to customize the letter according to your specific circumstances and reasons for requesting a lower interest rate.

Missouri Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

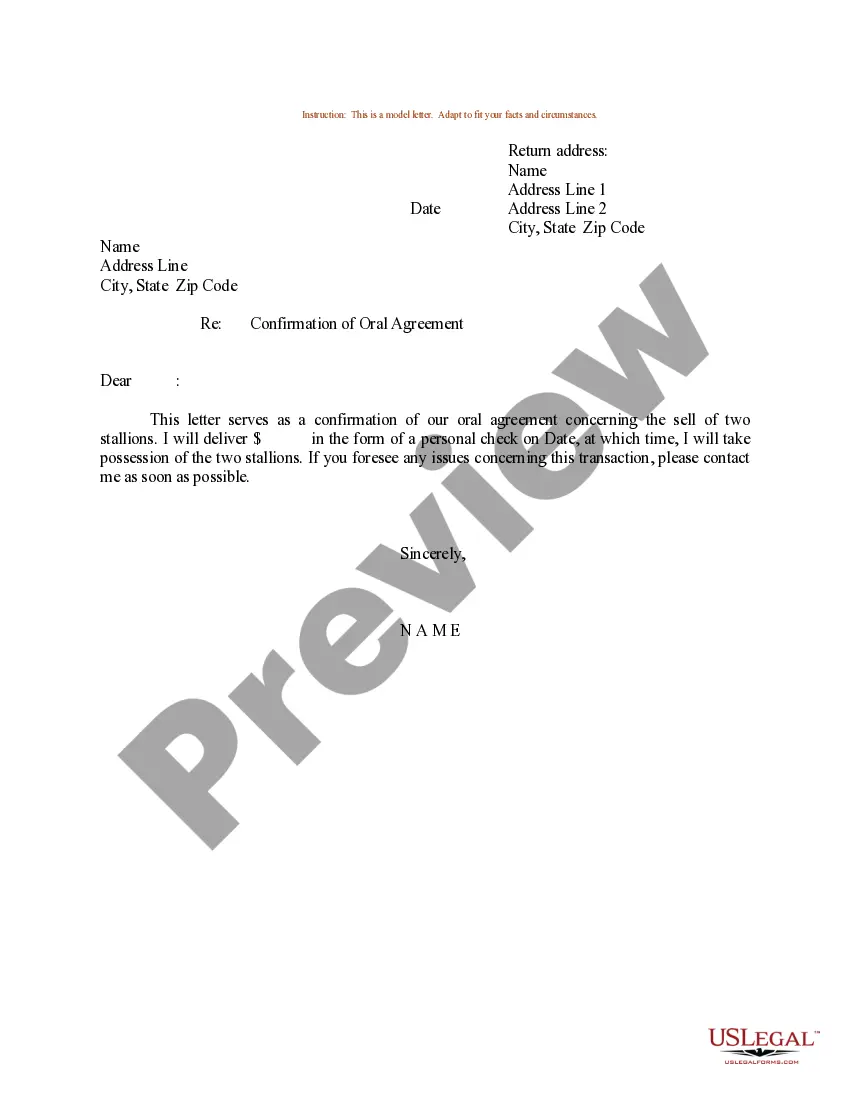

How to fill out Missouri Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

If you wish to total, obtain, or print legitimate file layouts, use US Legal Forms, the biggest assortment of legitimate forms, which can be found on-line. Take advantage of the site`s easy and practical search to obtain the files you want. A variety of layouts for business and specific uses are categorized by groups and claims, or search phrases. Use US Legal Forms to obtain the Missouri Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time in just a couple of click throughs.

When you are presently a US Legal Forms consumer, log in in your profile and click the Down load button to get the Missouri Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. You can even entry forms you previously acquired from the My Forms tab of your own profile.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for your proper area/country.

- Step 2. Utilize the Review option to check out the form`s articles. Don`t forget to learn the information.

- Step 3. When you are unhappy with the kind, use the Lookup field on top of the display screen to get other versions of your legitimate kind format.

- Step 4. Upon having located the form you want, go through the Acquire now button. Select the prices strategy you choose and include your qualifications to register for the profile.

- Step 5. Method the transaction. You can use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Find the format of your legitimate kind and obtain it in your gadget.

- Step 7. Full, edit and print or indication the Missouri Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

Each legitimate file format you purchase is your own eternally. You may have acces to every single kind you acquired within your acccount. Click the My Forms segment and choose a kind to print or obtain again.

Compete and obtain, and print the Missouri Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time with US Legal Forms. There are many professional and condition-distinct forms you can use for the business or specific demands.

Form popularity

FAQ

Writing the Settlement Offer LetterInclude your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

It's worth noting that interest rates aren't reported to credit bureaus and have no direct impact on your credit score. A hard inquiry is the only reason your credit score would drop after requesting a lower rate, and asking your card issuer for a lower rate won't always trigger a hard inquiry.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

If you're unhappy with your credit card's interest rate, securing a lower one may be as simple as asking your credit card issuer. They may decline your request, but it doesn't hurt to ask. If you've established a history of on-time payments and other responsible behavior with the issuer, your odds may be good.

Yes. You can and should negotiate mortgage rates when you're getting a home loan. Research confirms that those who get multiple quotes get lower rates.

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

State in the letter you are requesting an interest rate reduction for the following reasons and be specific. Include competitor offers with lower rates, your creditor's own new introductory rates, and state your timely payment history and length of time you've had the account.

Plan for making a realistic repayment or settlement proposalBe honest with yourself about how much you can pay each month.Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments).More items...?

Your credit card company can generally increase your interest rate for new transactions, as long it gives you notice 45-days in advance. New transactions are ones that occur more than 14 days after provision of the notice.

How to Negotiate With Debt CollectorsVerify that it's your debt.Understand your rights.Consider the kind of debt you owe.Consider hardship programs.Offer a lump sum.Mention bankruptcy.Speak calmly and logically.Be mindful of the statute of limitations.More items...