Missouri Monthly Retirement Planning is a comprehensive financial service that assists individuals in preparing for a secure retirement in the state of Missouri. This service aims to help retirees make informed decisions about their finances, assets, and investments, ensuring a steady income and long-term financial stability during their retirement years. The Missouri Monthly Retirement Planning service offers a range of expert advice and guidance on various aspects of retirement planning. This includes assessing financial goals and creating personalized retirement plans tailored to individual needs, taking into account factors such as desired lifestyle, health care costs, and inflation rates. One essential aspect of Missouri Monthly Retirement Planning is strategizing effective ways to save and invest for retirement. This may involve discussing the advantages of contributing to retirement accounts, such as 401(k)s or Individual Retirement Accounts (IRAs), and exploring tax-efficient investment strategies to maximize returns. Moreover, Missouri Monthly Retirement Planning covers important aspects of retirement, such as effective asset allocation, risk management, estate planning, and Social Security optimization. Additionally, it helps retirees navigate complex retirement income sources, including pensions, annuities, and other investment vehicles. Different types of Missouri Monthly Retirement Planning services may include: 1. Comprehensive Retirement Planning: This service provides a holistic approach to retirement planning, considering all financial aspects and personal goals. It involves creating a detailed retirement plan encompassing various investment options and strategies. 2. Investment-focused Retirement Planning: This type of retirement planning revolves around investment management and maximizing returns. It may involve optimizing investment portfolios, conducting regular reviews, and making necessary adjustments to ensure retirees' financial goals are met. 3. Estate Planning for Retirement: This service focuses on helping retirees protect their assets and ensure their distribution according to their wishes after passing away. It involves creating wills, trusts, and other estate planning documents to address post-retirement financial concerns. 4. Tax Planning for Retirement: This specialized retirement planning service assists individuals in managing their tax obligations during retirement. It aims to minimize tax liabilities and maximize tax deductions, thereby optimizing retirees' financial resources. 5. Social Security Optimization: This type of Missouri Monthly Retirement Planning service specifically focuses on maximizing Social Security benefits for retirees. It involves analyzing different claiming strategies and determining the most favorable time and method to begin drawing Social Security benefits. No matter the specific type of Missouri Monthly Retirement Planning service chosen, the ultimate goal is to empower retirees with the knowledge and tools necessary to achieve a fulfilling and financially secure retirement in the state of Missouri. It provides peace of mind and confidence in navigating the complexities of retirement planning while aiming for a comfortable and worry-free future.

Missouri Monthly Retirement Planning

Description

How to fill out Missouri Monthly Retirement Planning?

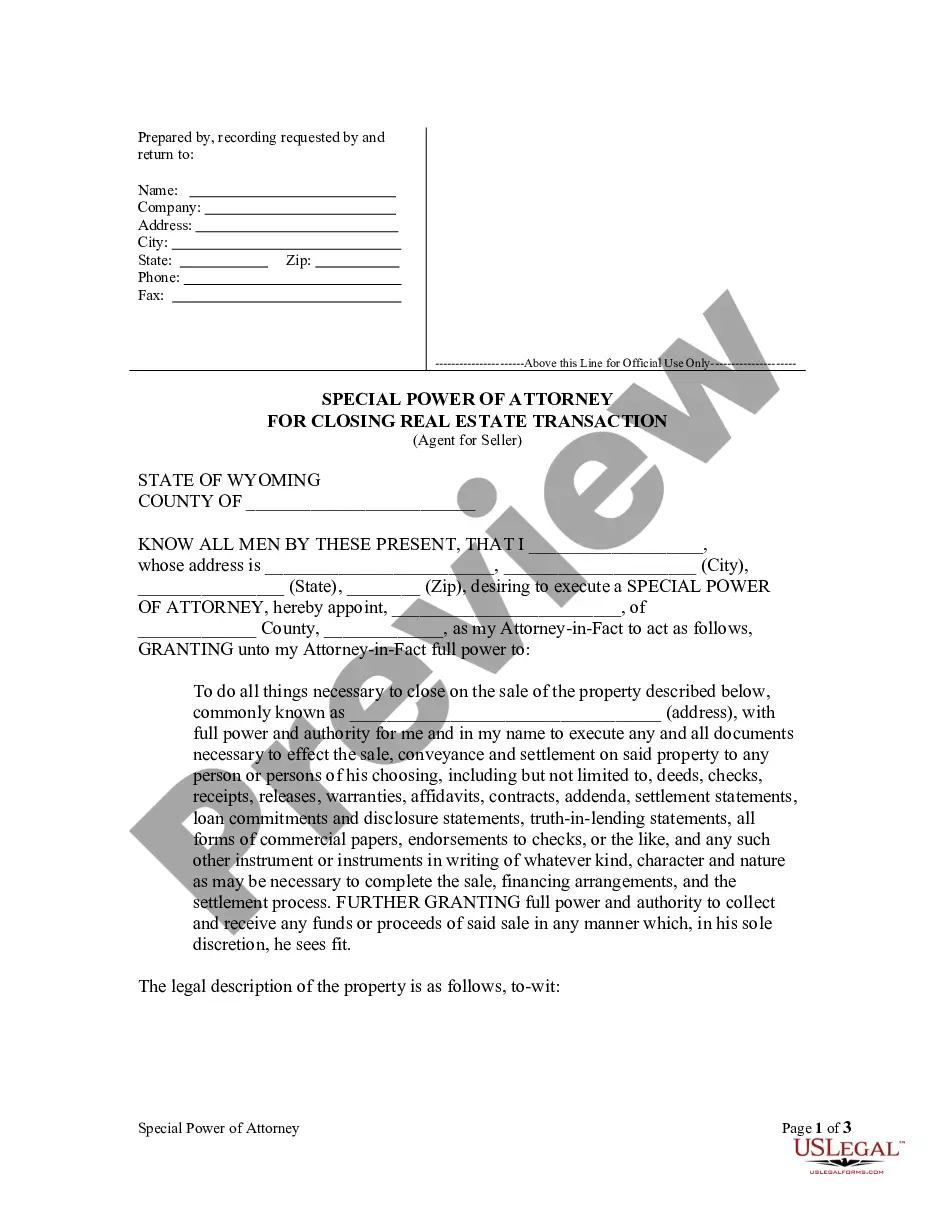

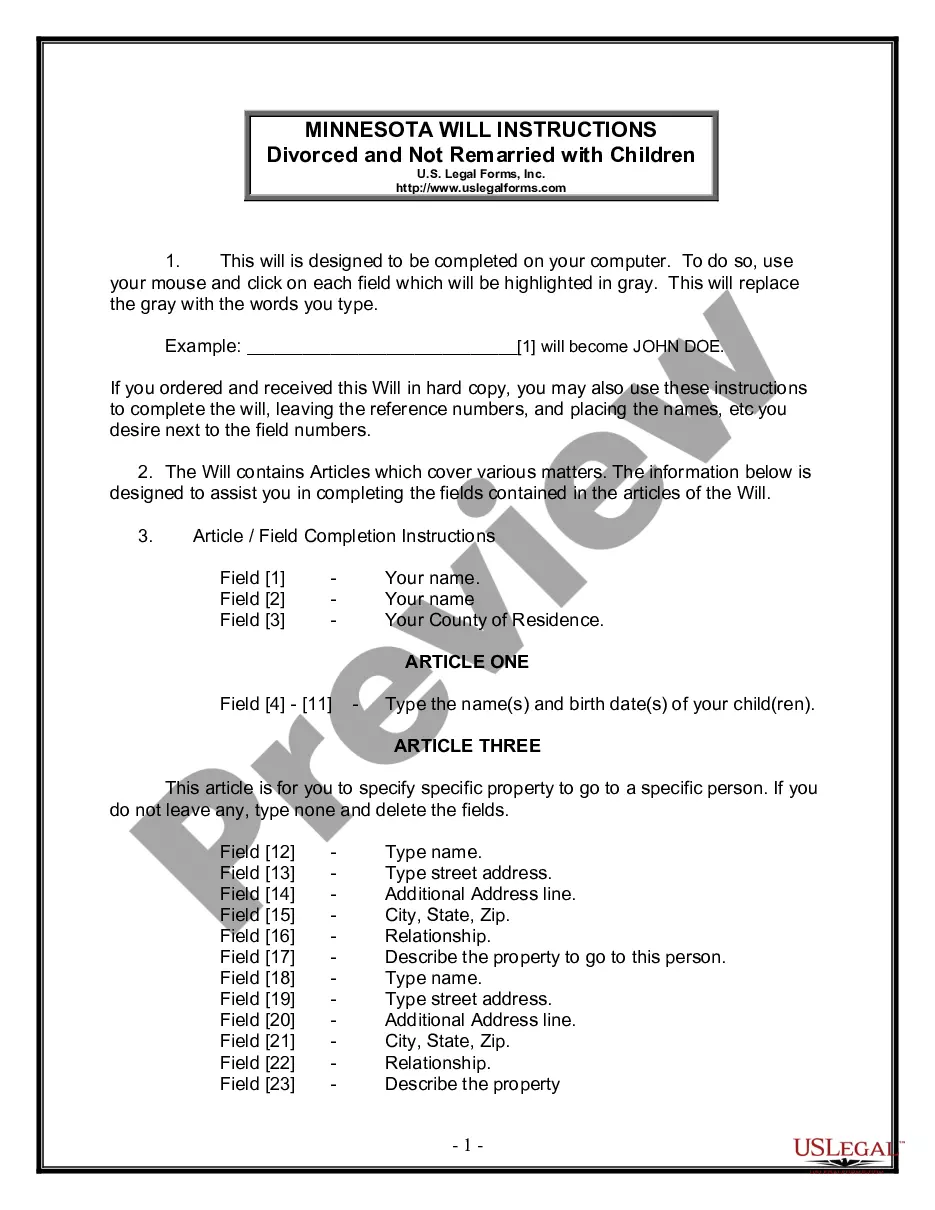

Have you been in the place where you will need documents for either enterprise or individual reasons virtually every day time? There are plenty of legal file themes available on the Internet, but finding ones you can depend on isn`t straightforward. US Legal Forms gives a large number of type themes, much like the Missouri Monthly Retirement Planning, that happen to be composed to meet federal and state demands.

If you are previously informed about US Legal Forms site and also have a merchant account, merely log in. Next, it is possible to acquire the Missouri Monthly Retirement Planning format.

Unless you offer an accounts and want to begin to use US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is for that right city/county.

- Make use of the Preview switch to check the form.

- Browse the description to ensure that you have selected the correct type.

- If the type isn`t what you are looking for, make use of the Look for discipline to obtain the type that fits your needs and demands.

- Once you obtain the right type, simply click Buy now.

- Opt for the costs strategy you need, fill in the required information and facts to create your money, and buy your order utilizing your PayPal or credit card.

- Choose a handy data file formatting and acquire your copy.

Discover all the file themes you might have bought in the My Forms menu. You can obtain a additional copy of Missouri Monthly Retirement Planning at any time, if required. Just click the needed type to acquire or produce the file format.

Use US Legal Forms, one of the most considerable assortment of legal varieties, to save lots of some time and stay away from mistakes. The service gives expertly created legal file themes that you can use for a selection of reasons. Generate a merchant account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

There is a 90-day benefit waiting period in the event you become disabled. This benefit may replace up to 60% your pre-disability earnings less any deductible income. While on long-term disability, you continue to accrue creditable service in your defined-benefit pension plan.

Assume you or your spouse are 35 years old and wish to get a monthly pension of Rs 50,000 after reaching the age of 60. In this case, you will have to deposit Rs 15,000 in this scheme on a monthly basis. You must put this money aside until you reach the age of 60.

Your traditional pension plan is designed to provide you with a steady stream of income once you retire. That's why your pension benefits are normally paid in the form of lifetime monthly payments.

Is Missouri a good state to retire in? Missouri is the 18th most tax-friendly state for retirees, and is more tax-friendly than comparable Midwestern states like Minnesota or Michigan.

If you live in Missouri and you get a government pension you can deduct up to $6,000 or 65% of your pension money from your state income taxes. The maximum amount of public pension income you can deduct in Missouri is $33,703. This amount should increase because Missouri is phasing in a new tax rate on pensions.

Typically, plans let you select an amount to receive monthly or quarterly, and you're allowed to change that amount once a year, although some plans allow you to do so far more frequently.

As a general state employee, once you have worked for 5 years in a MOSERS benefit-eligible position, you are vested.

A defined benefit pension plan guarantees an employee a specific monthly payment for life after retiring. The employee usually may opt instead for a lump-sum payment in a specific amount. A defined contribution pension plan is a 401(k) or similar retirement plan.

In Missouri, income from retirement accounts, such as an IRA or 401(k), is taxed as regular income, though some exemptions are available. Missouri has combined state and local sales tax rates that are higher than the national average and property taxes that are below the national average.

Annuity Payments. An annuity, or stream payout, is the traditional way to receive income from a defined benefit pension plan. With this option, you get a check each month for the rest of your life or another fixed period.