Description: A Missouri Independent Contractor Services Agreement with Accountant is a legally binding contract between an independent contractor and an accountant in the state of Missouri. This agreement outlines the terms and conditions under which the accountant will provide accounting services to the contractor. It is essential to have this agreement in place to ensure both parties are clear on their respective responsibilities and to protect their rights. Keywords: Missouri, Independent Contractor Services Agreement, Accountant, contract, terms and conditions, accounting services, responsibilities, rights. Types of Missouri Independent Contractor Services Agreement with Accountant: 1. General Missouri Independent Contractor Services Agreement with Accountant: This type of agreement is used when an accountant provides a range of accounting services to an independent contractor. It covers services such as bookkeeping, tax preparation, financial statement analysis, and advisory services. 2. Payroll Services Agreement: In some cases, independent contractors may require specialized payroll services. This type of agreement specifies the payroll services to be provided by the accountant, including handling payroll taxes, issuing paychecks, and maintaining payroll records. 3. Tax Services Agreement: An independent contractor may need assistance with tax-related matters, such as tax planning, filing tax returns, and resolving tax disputes. A tax services agreement outlines the scope of tax services to be provided by the accountant and the fees associated with these services. 4. Financial Consulting Agreement: Independent contractors who need comprehensive financial advice may enter into a financial consulting agreement with an accountant. This type of agreement covers services like investment analysis, financial forecasting, budgeting, and financial management consulting. 5. Audit Services Agreement: Some independent contractors may require audit services for their business operations. An audit services agreement outlines the specific scope of the audit, including financial reporting standards, audit procedures, and the accountant's responsibilities in conducting the audit. Remember, it is crucial for both the independent contractor and the accountant to thoroughly review and understand the terms and conditions of the specific agreement before signing. It is recommended to consult a legal professional to ensure the agreement complies with Missouri state laws and adequately addresses the needs of the parties involved.

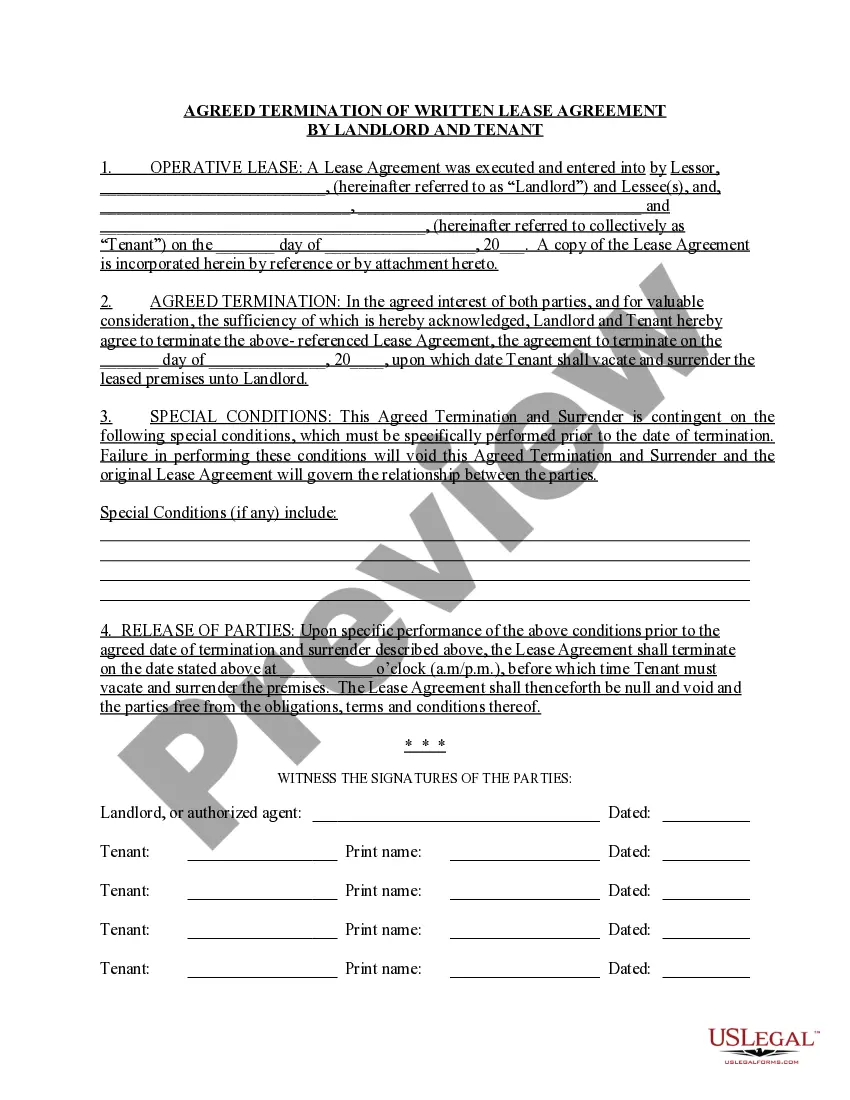

Missouri Independent Contractor Services Agreement with Accountant

Description

How to fill out Missouri Independent Contractor Services Agreement With Accountant?

If you need to complete, download, or print out legal document layouts, use US Legal Forms, the biggest assortment of legal varieties, which can be found on the web. Take advantage of the site`s basic and convenient research to discover the documents you need. Numerous layouts for business and personal reasons are sorted by types and says, or key phrases. Use US Legal Forms to discover the Missouri Independent Contractor Services Agreement with Accountant within a number of mouse clicks.

When you are currently a US Legal Forms consumer, log in for your profile and then click the Acquire key to have the Missouri Independent Contractor Services Agreement with Accountant. You can also gain access to varieties you formerly delivered electronically inside the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the right city/nation.

- Step 2. Use the Review choice to look over the form`s content material. Don`t forget to learn the explanation.

- Step 3. When you are not satisfied with the kind, make use of the Lookup area at the top of the monitor to get other versions of your legal kind template.

- Step 4. After you have identified the form you need, go through the Get now key. Pick the costs program you choose and include your accreditations to register for an profile.

- Step 5. Method the transaction. You should use your credit card or PayPal profile to complete the transaction.

- Step 6. Find the formatting of your legal kind and download it on your system.

- Step 7. Full, change and print out or signal the Missouri Independent Contractor Services Agreement with Accountant.

Every legal document template you acquire is yours eternally. You might have acces to every single kind you delivered electronically inside your acccount. Click the My Forms section and select a kind to print out or download again.

Remain competitive and download, and print out the Missouri Independent Contractor Services Agreement with Accountant with US Legal Forms. There are many skilled and state-particular varieties you can use for the business or personal requires.

Form popularity

FAQ

Accrual Method Accounting When you operate a business providing services as an independent contractor, you have the option of using the accrual method of accounting for your contractor earnings and expenses while reporting your personal income and deductions using the cash method.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

The independent contractor provision states that the relationship between the parties is that of an independent contractor, that the agreement does not create an employment relationship, and that under no circumstances is the independent contractor an agent of the company for which they provide services.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Accrual. Choosing between cash basis and accrual basis accounting should be a non-issue for many construction companies given that any firm that needs to produce GAAP financial statements must use accrual.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.