Missouri Irrevocable Pot Trust Agreement

Description

A Pot Trust is a trust set up for more than one beneficiary, typically children. The purpose of a Pot Trust is to keep the funds in one pot until a later event. For example, at the death of the parents, the assets may be kept in one pot until all the children have graduated from college or reached age 21.

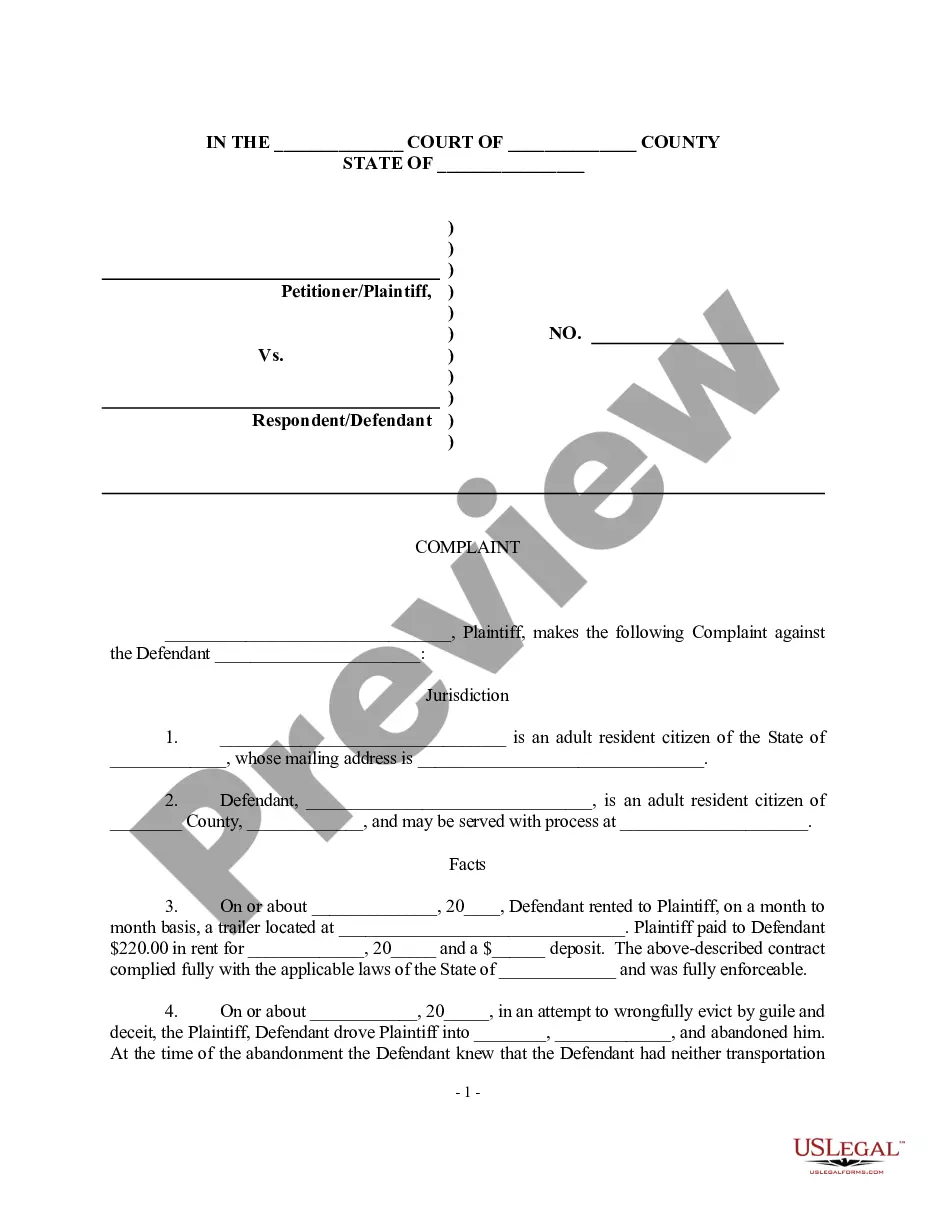

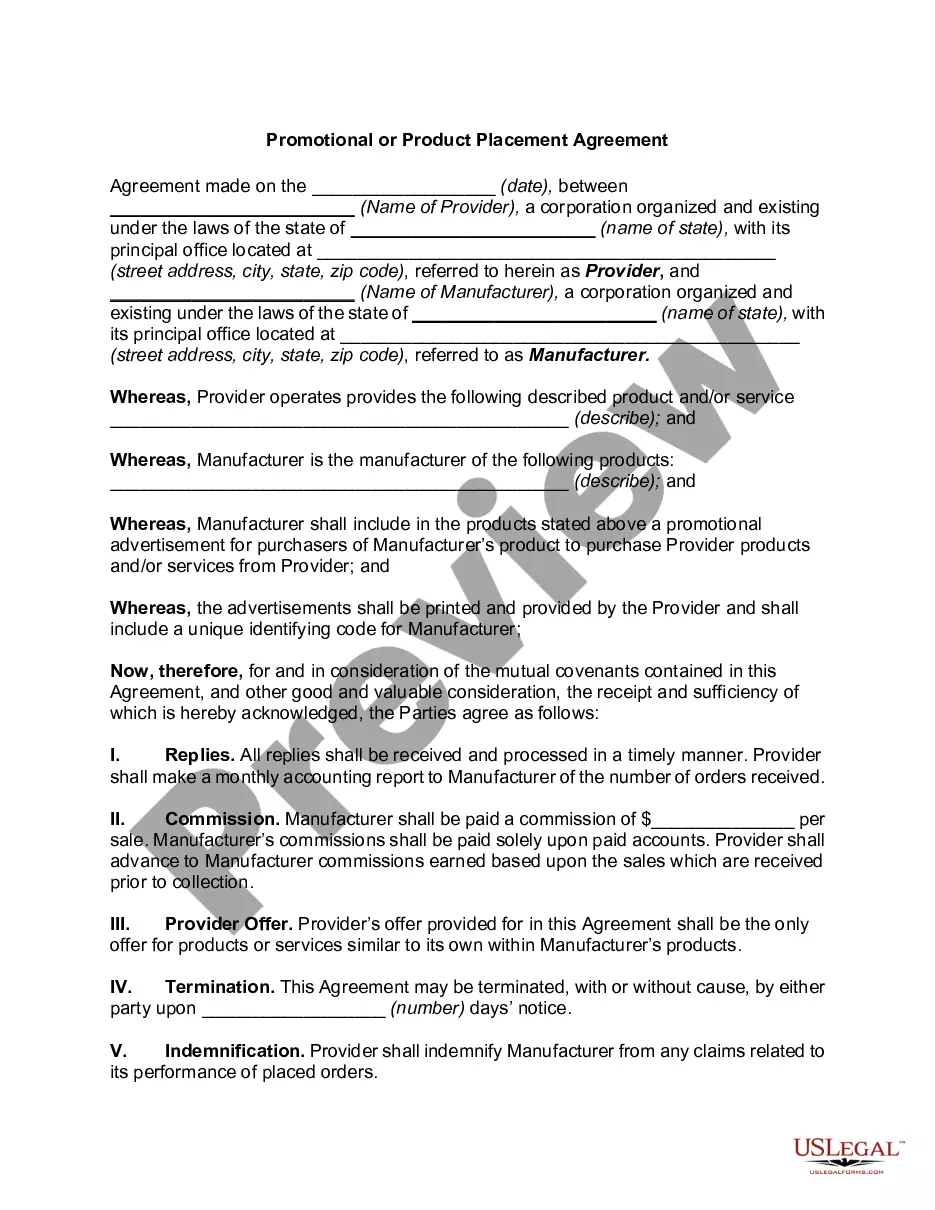

How to fill out Irrevocable Pot Trust Agreement?

US Legal Forms - one of the most extensive collections of legal documents in the USA - offers a range of legal paperwork templates that you can download or print.

By using the site, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Missouri Irrevocable Pot Trust Agreement within moments.

If you already have an account, Log In and retrieve the Missouri Irrevocable Pot Trust Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Choose the format and download the form to your device.

Make modifications. Complete, edit, print, and sign the downloaded Missouri Irrevocable Pot Trust Agreement.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the appropriate form for your region/area. Click the Preview button to review the form's content.

- Check the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you want and provide your details to create an account.

- Process the payment. Use your Visa or MasterCard or PayPal account to complete the transaction.

Form popularity

FAQ

The Missouri Uniform Trust Code provides that an irrevocable trust can be modified or terminated upon consent of the settlor and all beneficiaries, without court approval, even if the modification or termination is inconsistent with a material purpose of the trust.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

The grantor of an irrevocable trust with the following characteristics could be considered the equity owner of the trust: (1) The trust was a grantor trust for federal tax purposes. The grantor was the sole funding source of the trust.

Under an irrevocable trust, legal ownership of the trust is held by a trustee. At the same time, the grantor gives up certain rights to the trust.

Irrevocable trusts established for noncharitible purposes may be terminated by consent in Missouri. This requires unanimous agreement of the beneficiaries and the settlor, but does not require the consent of the court.

Putting your house in an irrevocable trust removes it from your estate, reveals NOLO. Unlike placing assets in an revocable trust, your house is safe from creditors and from estate tax. If you use an irrevocable bypass trust, it does the same for your spouse.

The trust belongs to all the beneficiaries. If the person selling property in an irrevocable trust uses the trust's money for his own needs in any way or transfers trust money to himself, he is considered by the law to be taking everyone's money, not just his own.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.