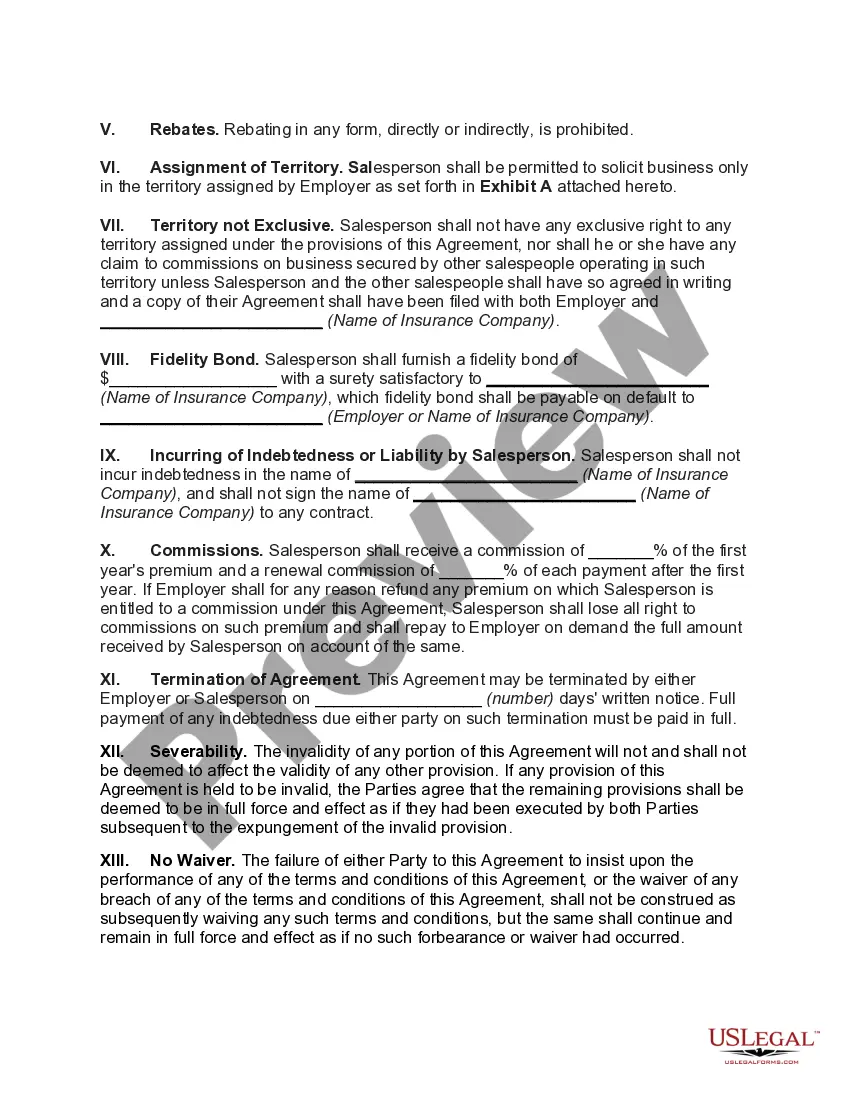

In Missouri, an employment agreement between a General Agent and a Salesperson for the sale of insurance is a legally binding contract that establishes the relationship and responsibilities between the employer and employee. This agreement outlines the terms and conditions under which the salesperson will work as an independent contractor and sell insurance products on behalf of the general agent. The Missouri Employment Agreement typically includes relevant information such as: 1. Parties involved: Clearly identifying the general agent and the salesperson by their legal names and addresses. 2. Purpose of the agreement: Clearly stating that the purpose of the agreement is to enable the salesperson to sell insurance products on behalf of the general agent. 3. Employment status: Specifying that the salesperson is an independent contractor and not an employee of the general agent. 4. Territory: Defining the geographic area within which the salesperson is authorized to sell insurance products. 5. Compensation: Outlining the commission structure, percentage of commission, and any additional incentives or bonuses earned by the salesperson based on their sales performance. 6. Training and support: Detailing the general agent's responsibilities in providing necessary training, support, and access to sales materials, software, or tools required by the salesperson to effectively perform their duties. 7. Non-compete agreement: If applicable, including clauses that restrict the salesperson from competing with the general agent during and after the termination of the agreement. 8. Renewal and termination: Identifying the duration of the agreement, renewal options, and the circumstances under which either party can terminate the agreement. 9. Confidentiality: Enforcing the salesperson's obligation to maintain the confidentiality of the general agent's trade secrets, client lists, and any sensitive business information obtained during the course of employment. 10. Governing law: Specifying that the agreement shall be governed by the laws of the state of Missouri. Different types of Missouri Employment Agreements between General Agents and Salespersons for the Sale of Insurance can include variations based on the specific nature of the insurance being sold or the sales channels used. For instance: — Life insurance saleagreementen— - Property and casualty insurance sales agreement — Health insurance saleagreementen— - Commercial insurance sales agreement — Exclusive agencagreementen— - Direct sales agreement — Independent brokerage agreement These variations can accommodate specific requirements, commissions, and responsibilities associated with different types of insurance products traded in Missouri's insurance market.

Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

Locating the correct legitimate paperwork format can be somewhat challenging.

Certainly, there are numerous templates available online, but how do you find the official document you need.

Utilize the US Legal Forms platform. This service offers a plethora of templates, such as the Missouri Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance, which you can utilize for both business and personal purposes.

If the form does not satisfy your requirements, use the Search field to find the appropriate document. Once you are convinced that the form is suitable, click the Get now button to download the form. Choose the payment plan that you prefer and input the necessary information. Create your account and finalize the purchase using your PayPal account or Visa or Mastercard. Select the document format and download the legitimate paperwork format to your device. Complete, modify, and print out the acquired Missouri Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance. US Legal Forms is the largest repository of legal documents where you can discover various document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download option to get the Missouri Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct document for your city/county. You can review the form using the Preview option and read the form details to confirm it is suitable for you.

Form popularity

FAQ

In Missouri, employers are responsible for paying unemployment taxes, which help provide financial assistance to eligible workers who have lost their jobs. This responsibility underscores the importance of a well-structured Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, as it outlines the terms and conditions related to employment and benefits. By using a reliable platform like uslegalforms, you can ensure your employment agreements are in line with state requirements, reducing potential liabilities.

The Missouri unemployment tax is a payroll tax imposed on employers to fund unemployment insurance benefits for workers who lose their jobs. This tax is essential for ensuring that employees in Missouri receive support as they transition between jobs. Under a Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, understanding this tax can help you make informed decisions regarding payroll and employee benefits. Securing a compliant employment agreement is crucial for navigating these obligations effectively.

The Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance is a formal document that outlines the terms of employment between a general agent and a salesperson in the insurance industry. It specifies duties, compensation, and conditions of employment, ensuring both parties understand their rights and responsibilities. This agreement helps to establish a clear framework for the working relationship, promoting transparency and reducing the risk of disputes. Utilizing platforms like uslegalforms can simplify the process of drafting and managing these important agreements.

Yes, Missouri does impose a state unemployment tax on employers. This tax funds the state’s unemployment insurance program, providing financial assistance to eligible workers during times of unemployment. If you are entering into a Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it’s crucial to understand your responsibilities regarding this tax. Ensuring compliance with the state’s tax regulations will help you maintain good standing as an employer and support your employees when they need it most.

In Missouri, the employer typically pays unemployment tax on behalf of their employees. This tax helps fund unemployment benefits for individuals who lose their jobs through no fault of their own. If you're forming a Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, understanding this obligation is critical for maintaining compliance and supporting your workforce.

Certain employees and employers, such as non-profit organizations and specific government workers, may qualify for exemptions from Missouri unemployment tax. Understanding these exemptions is crucial for any Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, ensuring that all parties are compliant with state regulations. Always consult a tax professional to clarify your status.

An independent contractor in Missouri is someone who provides services as an individual or through a business entity, without being classified as an employee. They often negotiate their terms and establish their work conditions. When creating a Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it's important to accurately categorize individuals to align with state laws.

An independent contractor typically manages their own business affairs and has more flexibility in how they complete their work tasks. In contrast, employees are generally entitled to benefits and follow the specific directives of their employer. Recognizing these differences is essential for drafting a Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance that protects both parties.

A key factor distinguishing an employee from an independent contractor is the level of control exercised by the employer. Employees generally work under the employer’s supervision, while independent contractors retain greater autonomy over their work processes. Clearly defining these roles in your Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance can prevent future disputes.

In Missouri, certain organizations and individuals can be exempt from state taxes. Non-profit entities, specific government employees, and charitable organizations often qualify for tax exemptions. If you're part of a Missouri Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it's wise to verify the specific exemptions relevant to your situation.

Interesting Questions

More info

1. Step — Step 2 If you have completed this step: go to next step.