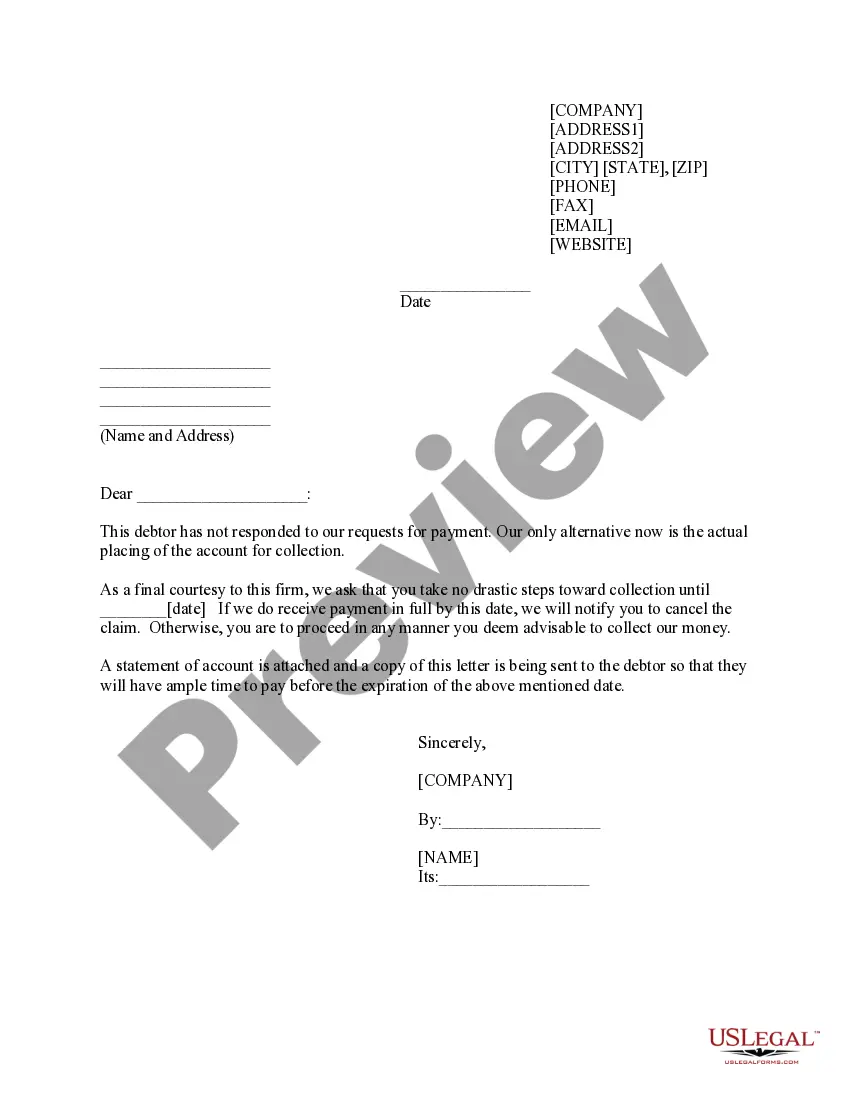

Missouri Notice of Disputed Account

Description

How to fill out Notice Of Disputed Account?

Selecting the appropriate legal document can be quite challenging.

Certainly, there are numerous templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Missouri Notice of Disputed Account, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, use the Search feature to find the correct form. Once you are certain that the form is accurate, click the Purchase now button to obtain it. Choose the pricing plan you want and enter the required details. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document to your device. Complete, edit, print, and sign the acquired Missouri Notice of Disputed Account. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- All of the forms are verified by experts and comply with both federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to acquire the Missouri Notice of Disputed Account.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines you should follow.

- First, ensure you have selected the correct form for your city/region. You can view the form using the Preview button and read the form description to confirm it is suitable for your needs.

Form popularity

FAQ

To file a complaint against a bank in Missouri, you first need to identify the specific issue at hand. You can contact the Missouri Division of Finance for assistance or use their online complaint form. Additionally, you can reach out to the FDIC if you feel your rights have been violated, especially regarding your Missouri Notice of Disputed Account. Always keep copies of your communications for your records.

The best way to complain about a bank is to clearly communicate your issue through the appropriate channels. Start by addressing your complaint directly with the bank’s customer service, ensuring you mention your concerns regarding any Missouri Notice of Disputed Account. If resolution is not reached, escalate your concern to state regulators or the FDIC. Documenting all interactions enhances the effectiveness of your complaint process.

To file a complaint against a bank in Missouri, you can start by contacting the Missouri Division of Finance. They provide resources for addressing banking issues, especially concerning your Missouri Notice of Disputed Account. You may also consider sending a written complaint directly to the bank’s customer service department or using their online complaint forms. Keeping documentation of all communications strengthens your case.

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how credit reporting agencies handle consumer information in Missouri and beyond. It aims to promote accuracy and privacy in credit reporting, giving consumers the right to dispute inaccuracies. If you have a Missouri Notice of Disputed Account, the FCRA lets you dispute information and requires agencies to investigate your claims within a set timeframe. Understanding your rights under the FCRA is vital to handling any credit-related disputes.

To file a complaint against a bank with the FDIC, you can visit their website and use the Consumer Complaint section. There, you can describe your situation, including details about your Missouri Notice of Disputed Account. Submitting your complaint online allows the FDIC to review it effectively, and they may investigate the matter or provide assistance. Always keep a record of your complaint submission for future reference.

In Missouri, the regulation of banks falls under the Missouri Division of Finance. This state agency oversees various financial institutions, ensuring compliance with state and federal laws. Additionally, the Federal Deposit Insurance Corporation (FDIC) provides federal oversight, protecting depositors and promoting sound banking practices. For issues related to your Missouri Notice of Disputed Account, reaching out to these regulatory bodies can provide guidance.

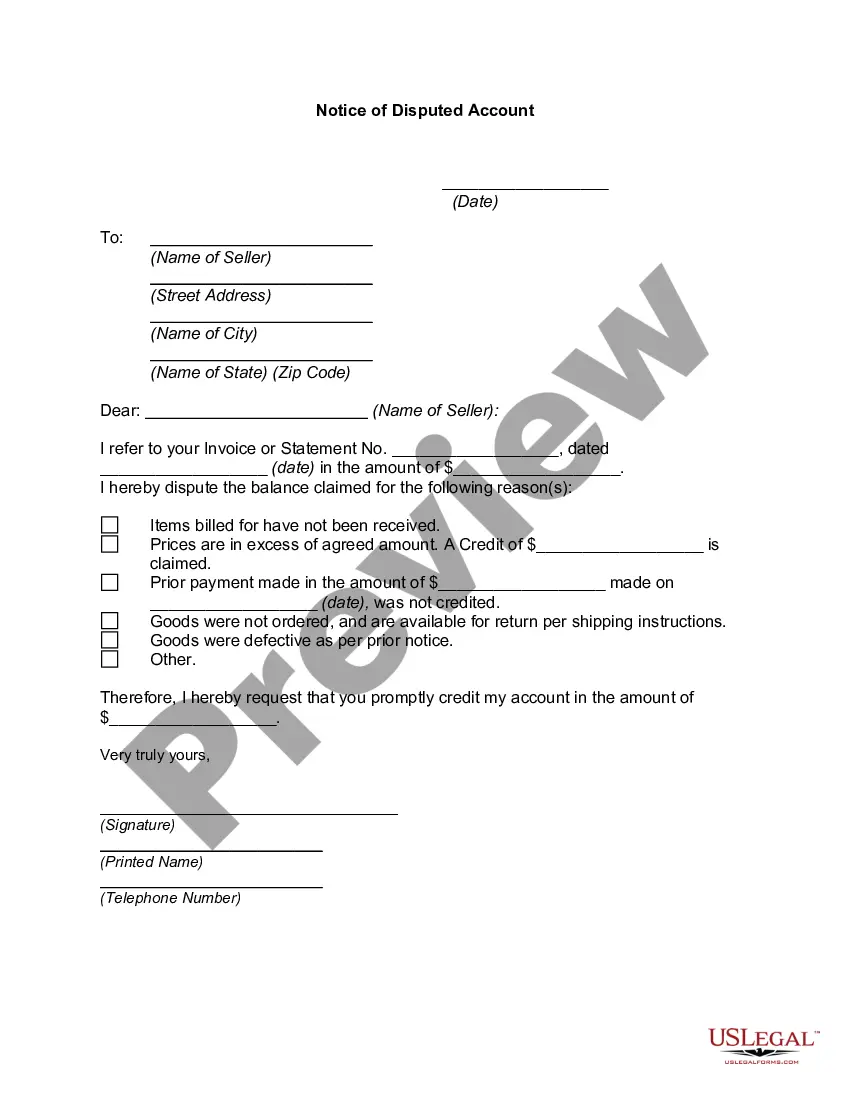

The Fair Credit Billing Act (FCBA) lays out consumers' rights to dispute credit card issuers' charges. Consumers have 60 days from the time they receive their credit card bill to dispute a charge with a card issuer. Charges must be over $50 to be eligible for dispute.

Follow these steps if you think your bill is wrong or want more info about it: Notify the creditor in writing within 60 days after the bill was mailed. How long does the creditor have if you notify an error in credit bill?

The creditor must acknowledge your complaint, in writing, within 30 days after receiving it, unless the problem has been resolved.

Follow these steps if you think your bill is wrong or want more info about it: Notify the creditor in writing within 60 days after the bill was mailed. How long does the creditor have if you notify an error in credit bill?