Missouri Gift of Stock to Spouse for Life with Remainder to Children is a legal mechanism that allows individuals in the state of Missouri to transfer ownership of stocks or securities to their spouse for their lifetime while ensuring that the remaining value goes to their children upon the spouse's demise. This type of gift is commonly referred to as a "life estate with remainder interest" and can be an effective way to preserve wealth and provide for loved ones. Keywords: Missouri, Gift of Stock, Spouse, Life Estate, Remainder Interest, Children, Securities, Transfer, Ownership, Wealth Preservation. Different types of Missouri Gift of Stock to Spouse for Life with Remainder to Children: 1. Traditional Gift of Stock to Spouse for Life with Remainder to Children: In this type of gift, the donor transfers ownership of the stocks or securities to their spouse, who receives the income generated by the stocks during their lifetime. Upon the spouse's death, the remaining value is passed on to the children. 2. Charitable Gift of Stock to Spouse for Life with Remainder to Children: This variation involves the donor designating a charitable organization to receive the remaining value of the stocks upon the spouse's demise. This type of gift allows for charitable contributions while still taking care of the spouse's financial needs during their lifetime. 3. Gift of Stock to Surviving Spouse for Life with Remainder to Children: Here, instead of transferring ownership to the spouse, the donor designates the surviving spouse as the life tenant, entitling them to the income generated by the stocks or securities. After the surviving spouse's death, the remainder passes on to the children. 4. Irrevocable Gift of Stock to Spouse for Life with Remainder to Children: In this type, once the transfer has occurred, it cannot be undone or revoked. The donor relinquishes all control and ownership rights, ensuring that the stocks will pass on to the surviving spouse for their lifetime and then to the children. 5. Revocable Gift of Stock to Spouse for Life with Remainder to Children: This variation allows the donor to retain control and ownership of the stocks during their lifetime. They have the flexibility to change the designated beneficiaries, including the remainder to the children, if necessary. Missouri Gift of Stock to Spouse for Life with Remainder to Children provides individuals in Missouri with a valuable estate planning tool to secure their assets and ensure their loved ones are taken care of according to their wishes. Taking into consideration factors like tax implications and legal guidance can help individuals make informed decisions when considering this type of gift.

Missouri Gift of Stock to Spouse for Life with Remainder to Children

Description

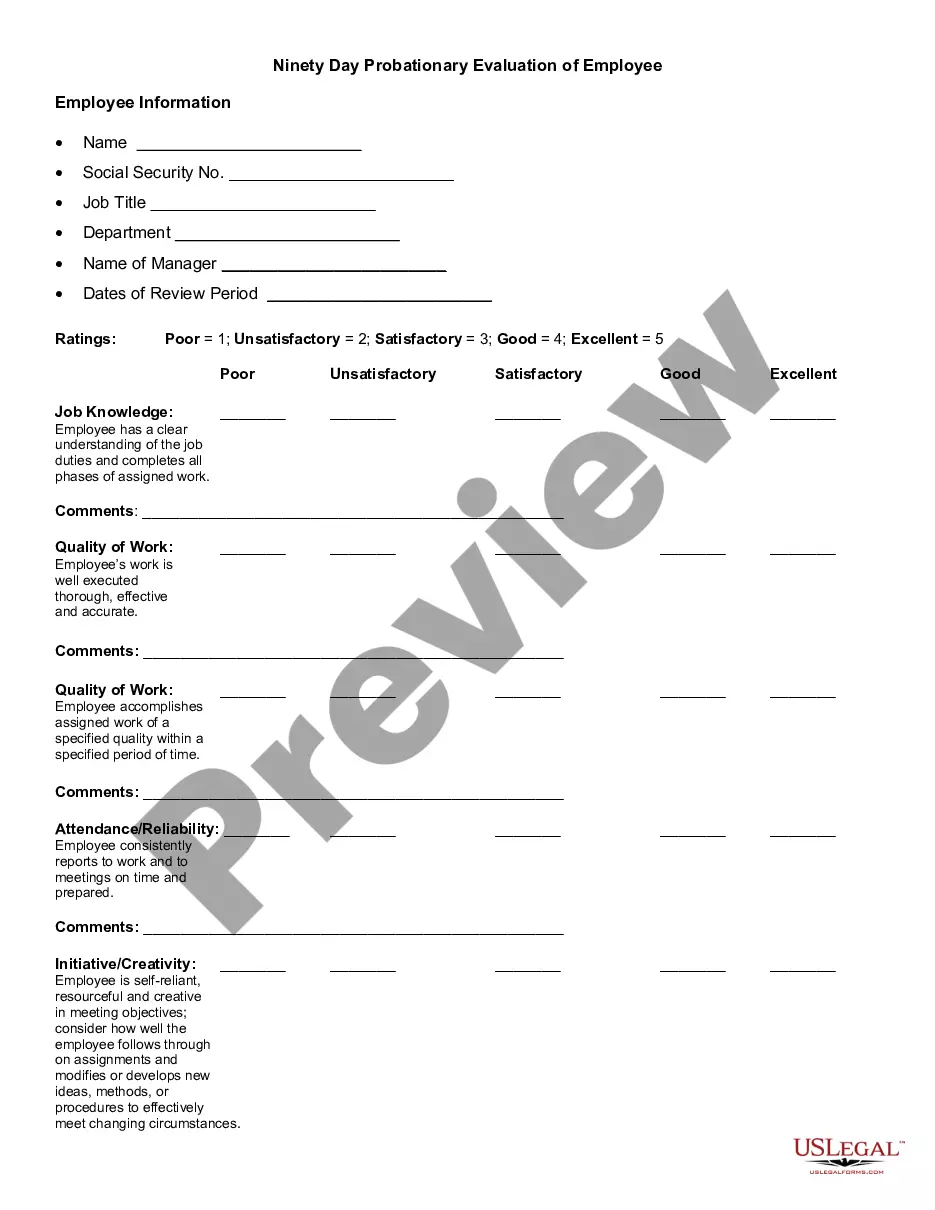

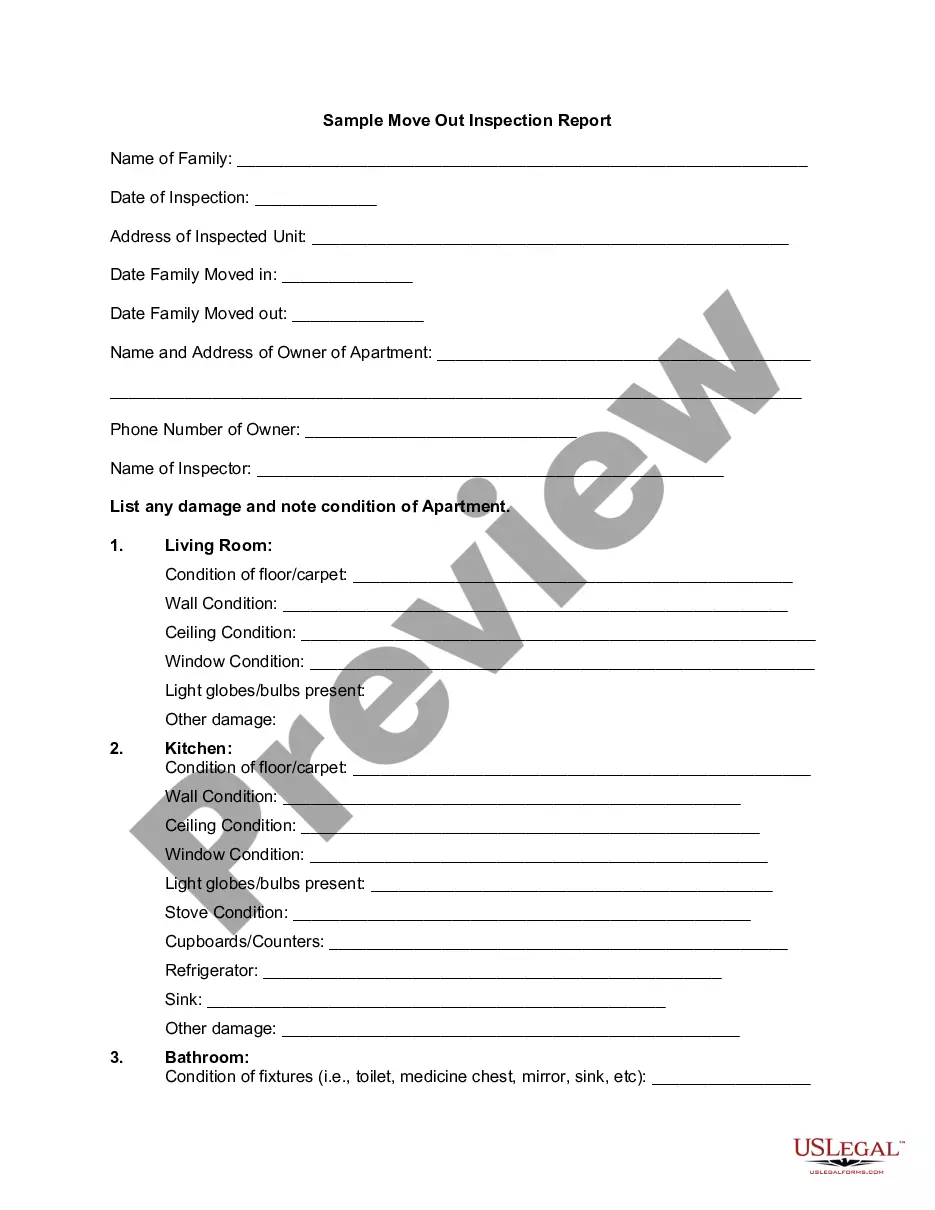

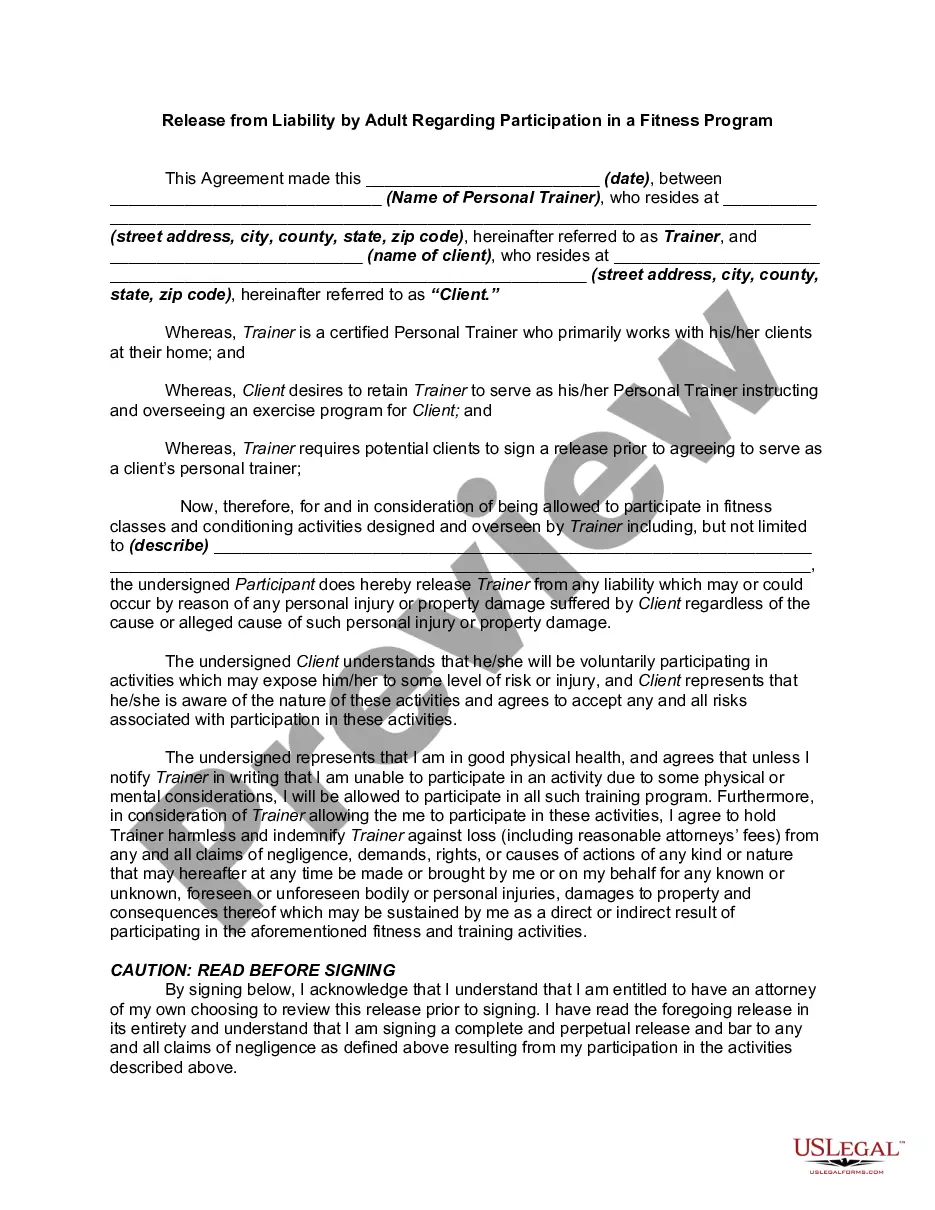

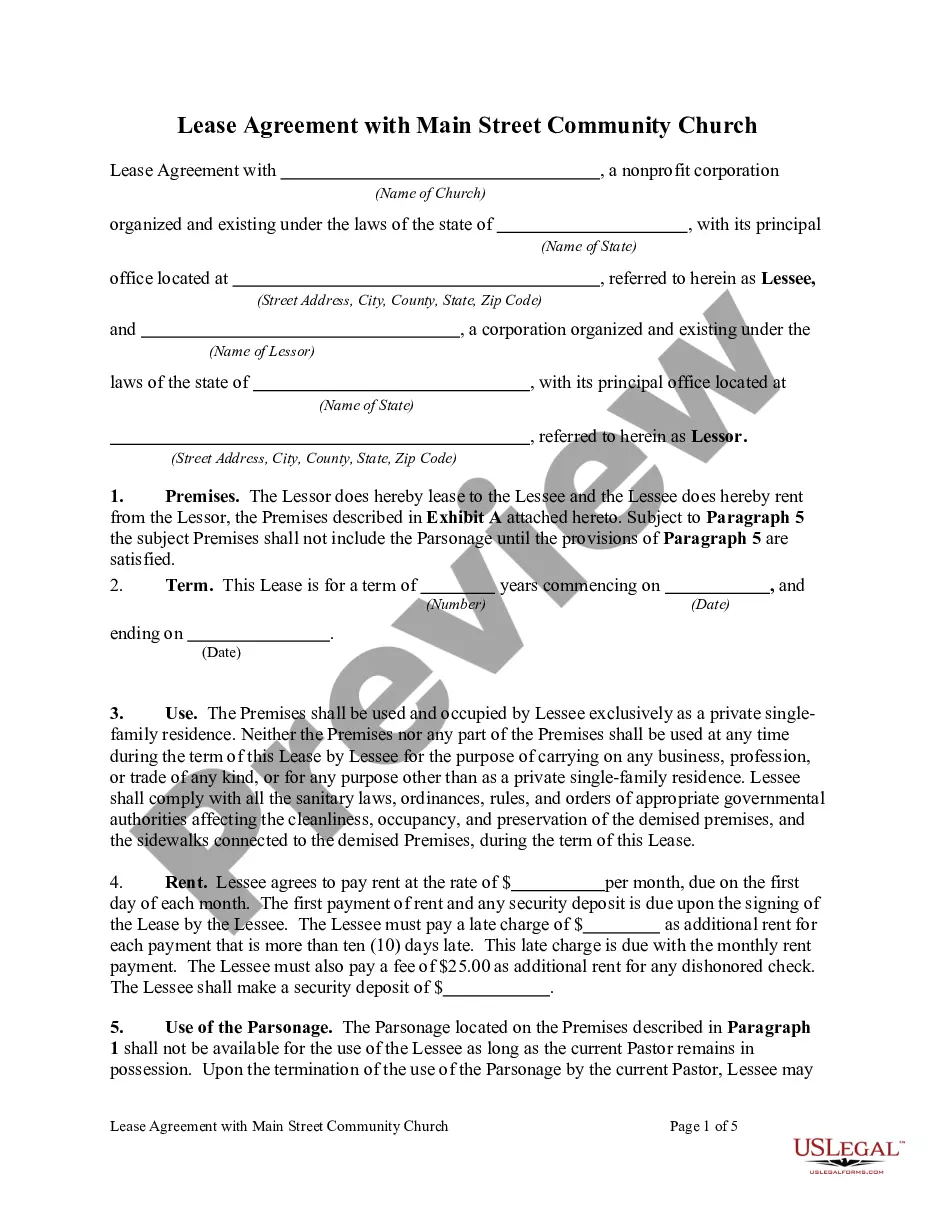

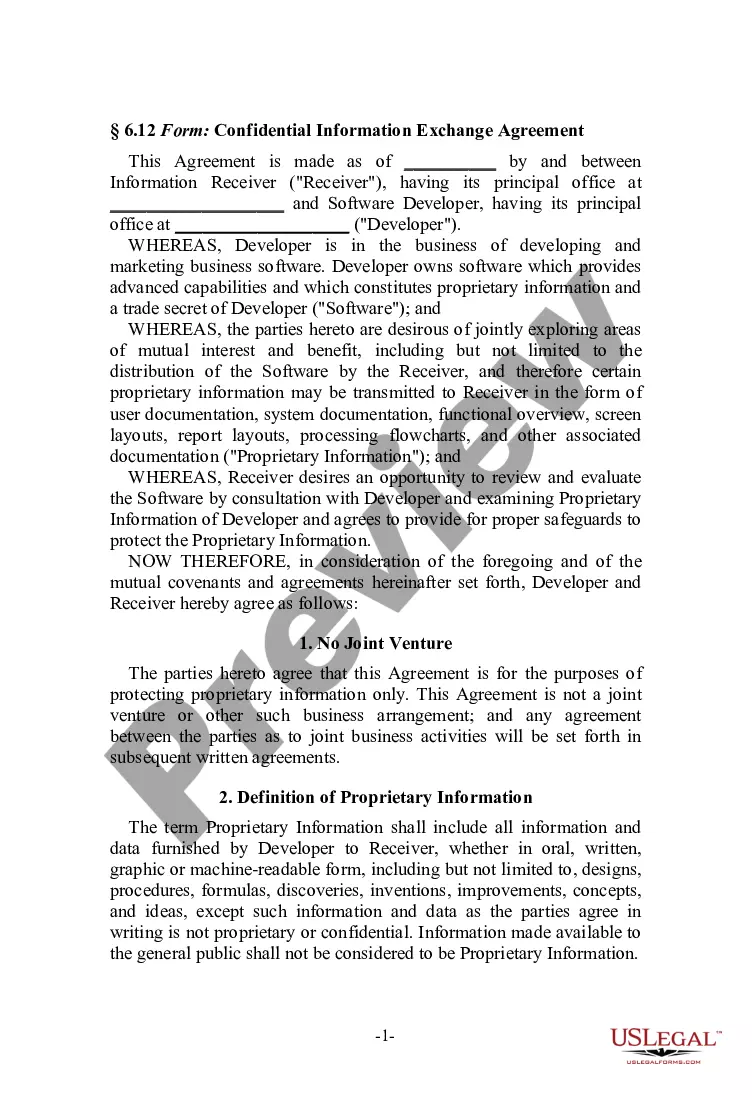

How to fill out Gift Of Stock To Spouse For Life With Remainder To Children?

If you wish to total, down load, or produce authorized file layouts, use US Legal Forms, the biggest selection of authorized types, that can be found on the web. Use the site`s basic and handy research to discover the files you will need. A variety of layouts for enterprise and personal reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to discover the Missouri Gift of Stock to Spouse for Life with Remainder to Children with a number of clicks.

When you are currently a US Legal Forms client, log in in your bank account and click on the Obtain key to find the Missouri Gift of Stock to Spouse for Life with Remainder to Children. Also you can gain access to types you formerly downloaded from the My Forms tab of your own bank account.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate city/region.

- Step 2. Utilize the Preview method to check out the form`s content material. Do not forget about to learn the information.

- Step 3. When you are not happy with the develop, utilize the Search area at the top of the display to locate other types in the authorized develop template.

- Step 4. When you have found the shape you will need, click the Buy now key. Choose the prices program you choose and add your accreditations to register for an bank account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Choose the format in the authorized develop and down load it on your device.

- Step 7. Total, modify and produce or sign the Missouri Gift of Stock to Spouse for Life with Remainder to Children.

Every authorized file template you buy is your own property for a long time. You may have acces to each develop you downloaded inside your acccount. Click the My Forms section and select a develop to produce or down load once again.

Contend and down load, and produce the Missouri Gift of Stock to Spouse for Life with Remainder to Children with US Legal Forms. There are millions of professional and state-particular types you can use to your enterprise or personal requires.

Form popularity

FAQ

200b200bAnything you leave in your will does not count as a gift but is part of your estate. Your estate is all your money, property and possessions left when you die. The value of your estate will be used to work out if Inheritance Tax needs to be paid.

According to federal tax law, if an individual makes a gift of property within 3 years of the date of their death, the value of that gift is included in the value of their gross estate. The gross estate is the dollar value of their estate at the time of their death.

Note that certain classes of Crummey powerholders will require additional planning, including: Spouses. Spouses, as trust beneficiaries, can hold Crummey powers.

A gift of Personal Property, such as money, stock, bonds, or jewelry, owned by a decedent at the time of death which is directed by the provisions of the decedent's will; a legacy. A bequest is not the same as a devise (a testamentary gift of real property) although the terms are often used interchangeably.

You can give an inheritance in the form of money, real estate, personal items, or a combination of your assets. Keep in mind, if you sell an asset for less than its value, reduce interest, or charge no interest, this may also be considered a gift.

Inter vivos is a Latin phrase which means while alive or between the living. This phrase is primarily used in property law and refers to various legal actions taken by a given person while still alive, such as giving gifts, creating trusts, or conveying property.

Generally, the Gross Estate does not include property owned solely by the decedent's spouse or other individuals. Lifetime gifts that are complete (no powers or other control over the gifts are retained) are not included in the Gross Estate (but taxable gifts are used in the computation of the estate tax).

Testamentary gift is a gift made by will. Such gifts do not become effective until the death of the donor. The ownership of the gift is transferred to the donee only after the testator's death. There are two terms used to refer testamentary gifts, a devise and a bequest.

The classification can be relevant if the estate is too small to accommodate all the bequests. The category of bequest will determine the order that the gifts are distributed, after paying the administrative expenses and creditors' claims (see abatement in the next section).

A bequest is a gift, but a gift is not necessarily a bequest. A bequest describes the act of leaving a gift to a loved one through a Will. For example, you could simply state something like I bequest my red Corvette to my son in a Will. On the other hand, a gift can be made outside of a Will.