Missouri Annuity as Consideration for Transfer of Securities: Explained in Detail Missouri Annuity as Consideration for Transfer of Securities refers to a specific arrangement in which an annuity is used as a form of consideration for the transfer of securities in the state of Missouri, United States. This type of transaction involves the transfer of securities, such as stocks, bonds, or mutual funds, in exchange for an annuity contract. Annuities are financial products typically offered by insurance companies that provide individuals with a regular income stream for a specific period or for the rest of their lives. When used as consideration for the transfer of securities, annuities can offer several benefits, including tax advantages and stable income generation. There are different types of Missouri Annuities as Consideration for Transfer of Securities, each serving unique purposes. Some notable types include: 1. Fixed Annuities: Fixed annuities provide a guaranteed rate of return over a fixed period. The interest rate is predetermined and can remain fixed for a specific term, offering stability and predictable income for investors. 2. Variable Annuities: Variable annuities allow investors to allocate their investment within various sub-accounts, typically consisting of stocks, bonds, and other investment options. The returns generated from variable annuities are based on the performance of the chosen investments, making it subject to market fluctuations. 3. Immediate Annuities: Immediate annuities provide an immediate payout after a lump-sum investment. This type of annuity is suitable for individuals seeking an immediate income stream, often used by retirees to supplement their retirement income. 4. Deferred Annuities: Deferred annuities, as the name suggests, delay the payout until a later predetermined date. This allows individuals to accumulate funds over a period, providing a source of income during retirement or at an agreed-upon future date. 5. Fixed Index Annuities: Fixed index annuities offer a combination of features from fixed and variable annuities. They provide a guaranteed minimum interest rate, along with the opportunity to earn additional returns based on the performance of a specific market index. Missouri Annuity as Consideration for Transfer of Securities can be an attractive option for investors looking to diversify their investment portfolios or secure a stable income stream. However, it's important to carefully evaluate the terms, conditions, and associated fees of the annuity contract before considering such a transfer. Note: It's always recommended seeking professional advice from a financial advisor or an insurance specialist to choose the most suitable type of annuity and to understand the legal requirements and tax implications specific to Missouri.

Missouri Annuity as Consideration for Transfer of Securities

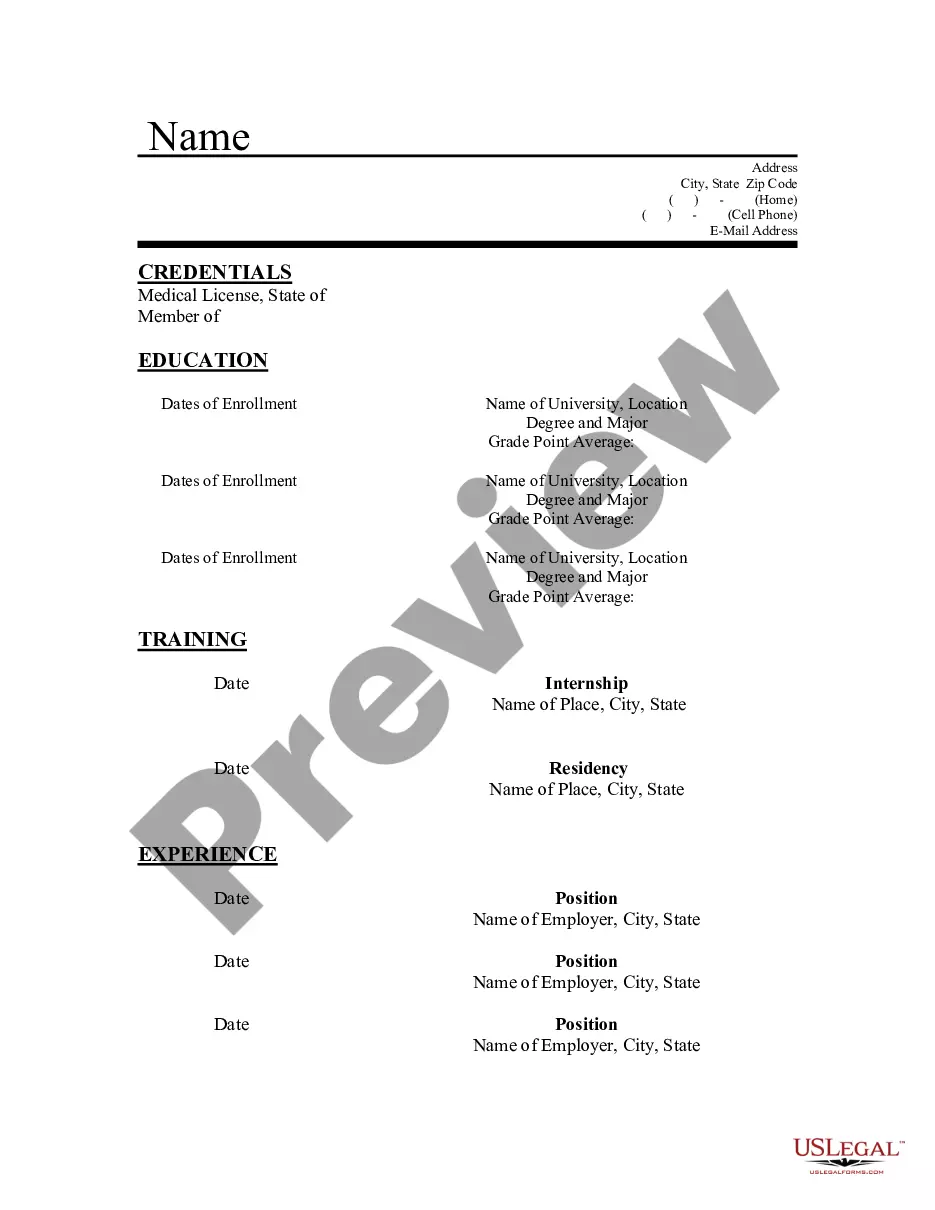

Description

How to fill out Missouri Annuity As Consideration For Transfer Of Securities?

If you wish to total, down load, or produce lawful record templates, use US Legal Forms, the most important assortment of lawful kinds, that can be found on-line. Utilize the site`s simple and handy look for to get the files you need. A variety of templates for company and person reasons are sorted by classes and says, or search phrases. Use US Legal Forms to get the Missouri Annuity as Consideration for Transfer of Securities with a handful of mouse clicks.

When you are presently a US Legal Forms buyer, log in in your bank account and then click the Download key to obtain the Missouri Annuity as Consideration for Transfer of Securities. Also you can accessibility kinds you formerly saved inside the My Forms tab of the bank account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for your appropriate town/land.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Do not forget about to learn the outline.

- Step 3. When you are not happy with all the form, make use of the Research discipline near the top of the monitor to locate other versions from the lawful form format.

- Step 4. Upon having identified the shape you need, select the Acquire now key. Opt for the pricing plan you favor and add your references to register on an bank account.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the financial transaction.

- Step 6. Select the structure from the lawful form and down load it on your system.

- Step 7. Comprehensive, modify and produce or signal the Missouri Annuity as Consideration for Transfer of Securities.

Each lawful record format you buy is your own permanently. You may have acces to every form you saved inside your acccount. Click the My Forms area and choose a form to produce or down load again.

Contend and down load, and produce the Missouri Annuity as Consideration for Transfer of Securities with US Legal Forms. There are millions of professional and state-distinct kinds you can use for your personal company or person requirements.