The Missouri Fair Credit Act Disclosure Notice is a significant legal requirement aimed at protecting the rights of consumers seeking credit in Missouri. This notice is designed to inform borrowers of their rights and ensure transparency in lending practices. Under the Missouri Fair Credit Act, lenders are obligated to provide potential borrowers with certain disclosures before extending credit. These notices inform consumers about the terms and conditions of the credit agreement, enabling them to make informed decisions and understand their responsibilities. One essential aspect of the Missouri Fair Credit Act Disclosure Notice is the disclosure of interest rates. Lenders must clearly state the annual percentage rate (APR) that will be applied to the credit facility, allowing borrowers to assess the overall cost of the loan. This ensures that borrowers have a clear understanding of the financial impact and can compare different credit offers. Additionally, lenders are required to disclose any fees or charges associated with the loan. This includes origination fees, application fees, late payment fees, or any other fees that may be applicable during the course of the credit facility. By disclosing these fees, borrowers are able to assess the true cost of the loan and compare it with other credit options. Furthermore, the Missouri Fair Credit Act Disclosure Notice provides information about the borrower's rights regarding credit reporting. It highlights the consumer's ability to obtain a copy of their credit report, challenge inaccurate information, and place a security freeze on their credit report if necessary. This empowers consumers to monitor and protect their creditworthiness. It is important to note that there are no specific variations or types of the Missouri Fair Credit Act Disclosure Notice. However, the content and format of the notice may vary depending on the type of credit being offered. For example, the disclosure for a mortgage loan may include specific information relevant to mortgage financing, whereas the disclosure for a personal loan may focus on different aspects. Nonetheless, the fundamental purpose of all Missouri Fair Credit Act Disclosure Notices remains the same — to inform and protect consumers in their credit transactions. In summary, the Missouri Fair Credit Act Disclosure Notice is a critical element in protecting consumers' rights when seeking credit in Missouri. By providing comprehensive disclosures about interest rates, fees, and credit reporting rights, this notice ensures transparency and enables borrowers to make informed financial decisions.

Missouri Fair Credit Act Disclosure Notice

Description

How to fill out Missouri Fair Credit Act Disclosure Notice?

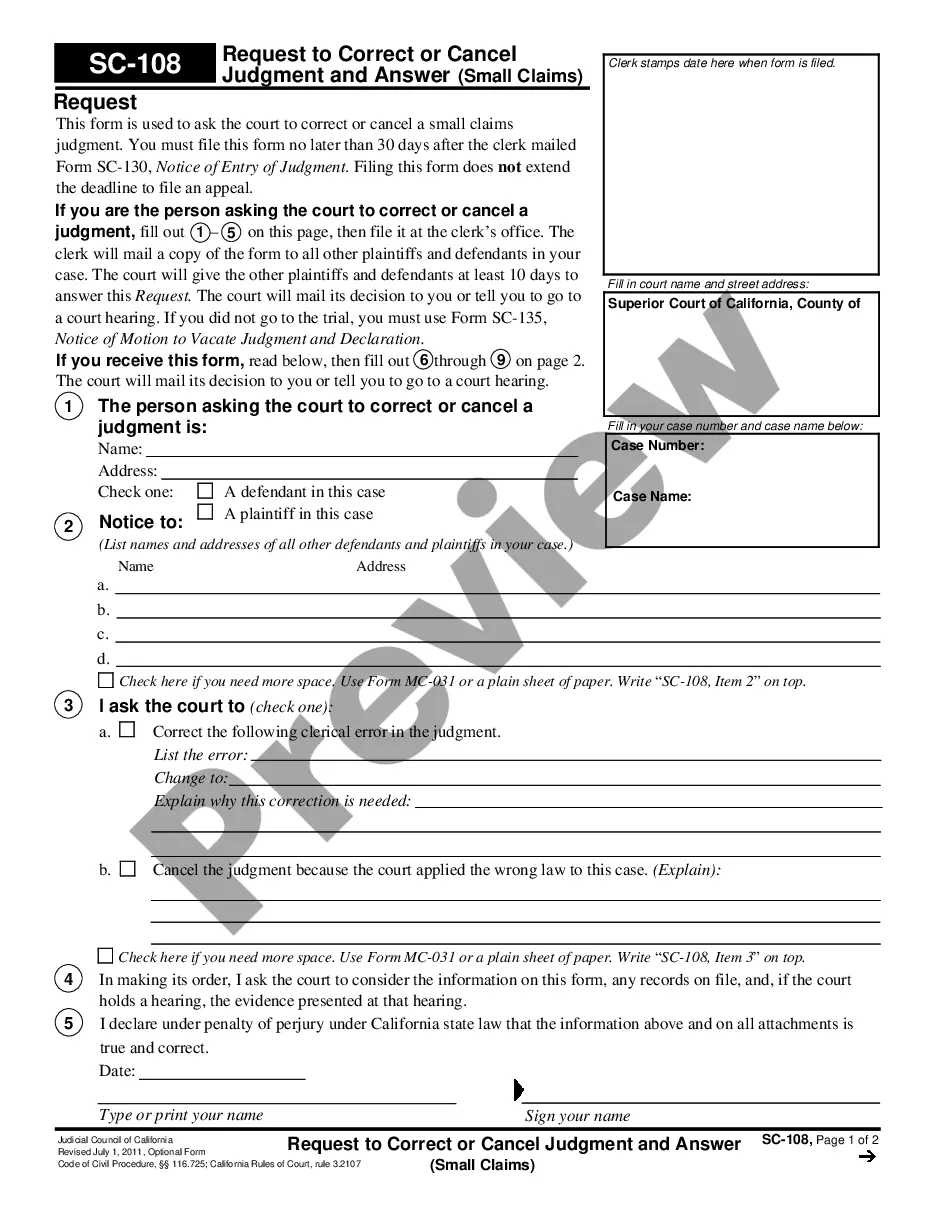

If you want to full, download, or produce lawful document templates, use US Legal Forms, the greatest variety of lawful types, that can be found on the web. Utilize the site`s simple and hassle-free search to find the paperwork you want. Numerous templates for business and person reasons are categorized by types and suggests, or keywords. Use US Legal Forms to find the Missouri Fair Credit Act Disclosure Notice within a number of mouse clicks.

In case you are already a US Legal Forms customer, log in to your accounts and click the Obtain option to find the Missouri Fair Credit Act Disclosure Notice. Also you can accessibility types you formerly downloaded inside the My Forms tab of your respective accounts.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the form for the correct town/region.

- Step 2. Make use of the Preview option to examine the form`s content. Never forget to see the description.

- Step 3. In case you are unsatisfied with all the form, take advantage of the Look for discipline on top of the monitor to locate other types in the lawful form template.

- Step 4. After you have discovered the form you want, go through the Buy now option. Opt for the costs strategy you like and add your qualifications to sign up for the accounts.

- Step 5. Procedure the transaction. You may use your charge card or PayPal accounts to finish the transaction.

- Step 6. Choose the file format in the lawful form and download it in your product.

- Step 7. Total, revise and produce or signal the Missouri Fair Credit Act Disclosure Notice.

Each lawful document template you acquire is your own property permanently. You possess acces to each form you downloaded within your acccount. Click the My Forms area and choose a form to produce or download again.

Remain competitive and download, and produce the Missouri Fair Credit Act Disclosure Notice with US Legal Forms. There are thousands of expert and state-particular types you can use for your business or person demands.

Form popularity

FAQ

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

Section 612(a) of the FCRA gives consumers the right to a free file disclosure upon request once every 12 months from the nationwide consumer reporting agencies and nationwide specialty consumer reporting agencies.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

The Dodd-Frank Act also amended two provisions of the FCRA to require the disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing. On December 21, 2011, the CFPB restated FCRA regulations under its authority at 12 CFR Part 1022 (76 Fed. Reg.

Credit Score Disclosure Section 609(g) referenced above has another requirement where a creditor must send a "credit score disclosure" to an applicant of a consumer loan secured by 1 to 4 units of residential real property.

Updated April 29, 2022. An adverse action notice is sent to an individual when rejected based on information in a credit report or background check (consumer report). It is required when a person is denied employment, housing, credit, or insurance. Federal Laws Fair Credit Reporting Act (FCRA)

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated.