Missouri Travel Expense Reimbursement Form

Description

How to fill out Travel Expense Reimbursement Form?

Are you in a situation where you require documents for either professional or personal reasons almost every day.

There are numerous legal form templates accessible on the internet, but locating reliable ones can be challenging.

US Legal Forms provides a vast array of template forms, including the Missouri Travel Expense Reimbursement Form, designed to align with federal and state regulations.

Once you find the right form, simply click Get now.

Select the pricing plan you prefer, complete the required information to create your account, and make the payment using your PayPal or Visa/MasterCard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Missouri Travel Expense Reimbursement Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it corresponds to the appropriate area/county.

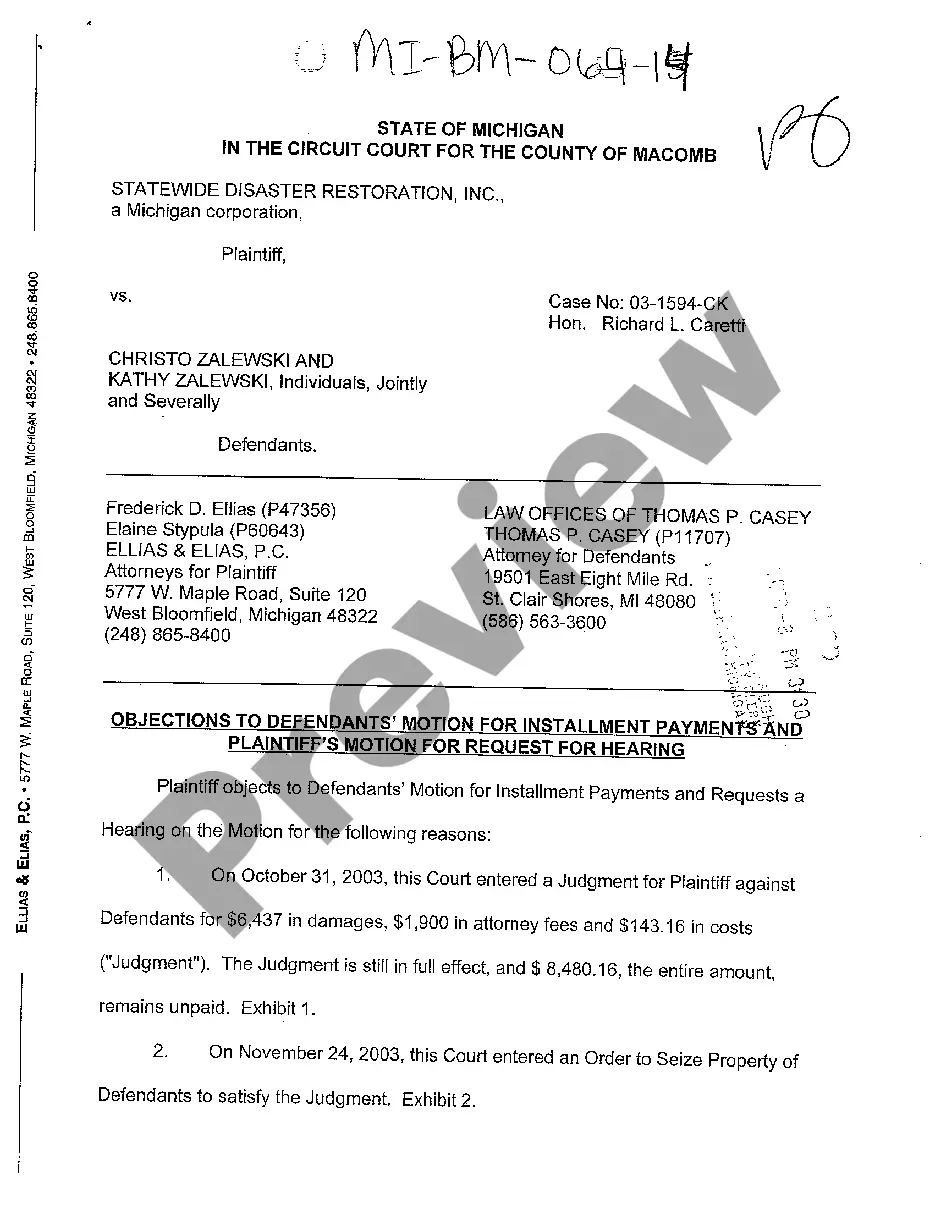

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent. I am attaching a copy of the (cab booking/ hotel reservation/ ticket/ invoice/ boarding pass) for your reference.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.

A travel and expense policy states the ethics and responsibilities of business travel. It paves the roadmap that every employee should follow to uphold the legitimacy of their business expenses. They are expected to exercise fair judgment while spending and reporting business expenses.

Reimbursement of travel expenses is based on documentation of reasonable and actual expenses supported by the original, itemized receipts where required. Reimbursements that may be paid by Company Name are shown below. Airfare.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. These expenses can include fuel costs, maintenance and vehicle depreciation. Mileage reimbursement is typically set at a per-mile rate usually below $1 per mile.

To find your reimbursement, you multiply the number of miles by the rate: miles rate, or 175 miles $0.585 = $102.4. B: You drive a company vehicle for business, and you pay the costs of operating it (gas, oil, maintenance, etc.).

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.