Missouri Nonexempt Employee Time Report

Description

How to fill out Nonexempt Employee Time Report?

Have you ever found yourself in a situation where you need documents for both business or personal purposes every single day? There are numerous legal form templates accessible online, but finding reliable versions is challenging.

US Legal Forms provides thousands of document templates, including the Missouri Nonexempt Employee Time Report, designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms site and possess a free account, simply Log In. After that, you can download the Missouri Nonexempt Employee Time Report template.

Access all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Missouri Nonexempt Employee Time Report whenever needed. Just select the desired form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create a free account on US Legal Forms and start simplifying your life.

- Select the form you need and ensure it is suitable for your specific city or county.

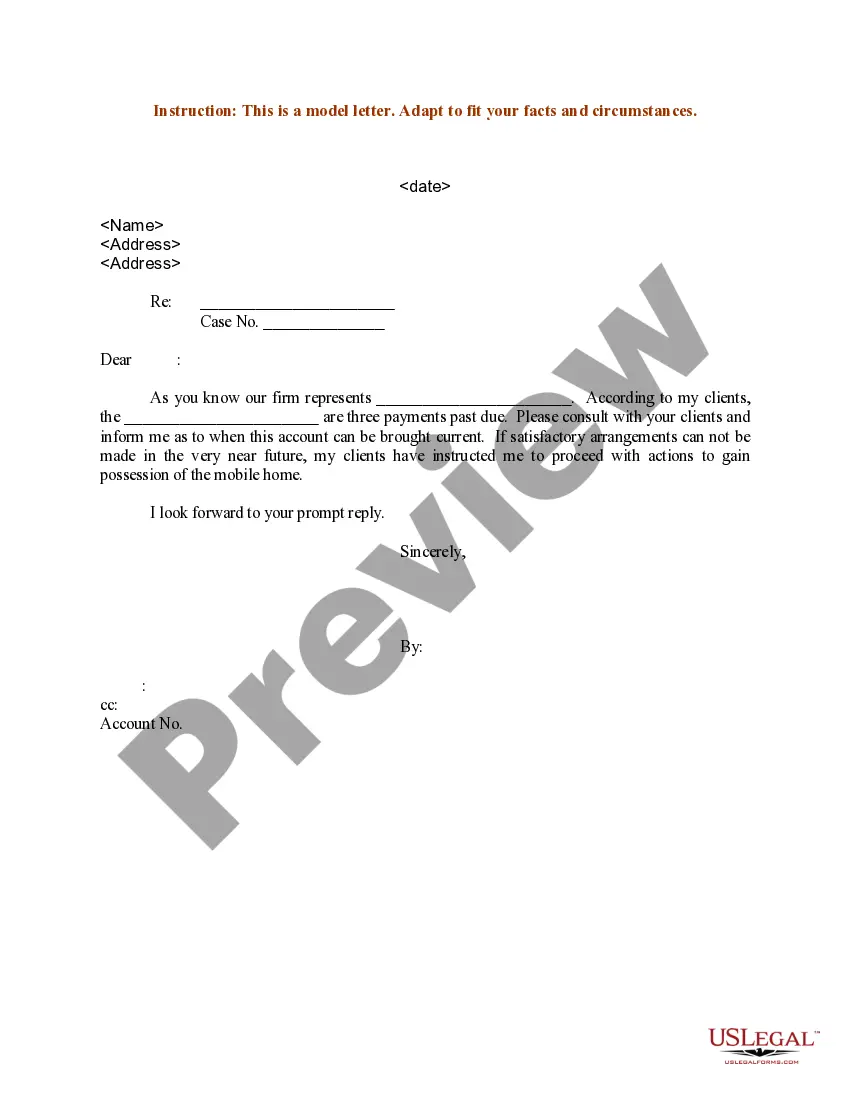

- Utilize the Preview feature to examine the document.

- Review the description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search function to find the form that fits your requirements.

- Once you find the appropriate form, click on Buy now.

- Choose the payment plan you want, complete the necessary information to create your account, and settle the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Exempt workers are exempt from overtime payso even if they work more than 40 hours in a workweek, they're not eligible for overtime pay. So, whether a salaried employee has to fill out a timesheet will come down to whether they're considered exempt or non-exempt.

History of Missouri Labor LawsThe minimum wage was $9.45 per hour in 2020, $8.60 per hour in 2019, $7.85 per hour in 2018, $7.70 per hour in 2017 and $7.65 per hour in 2016. The hourly wage will continue to increase as follows: $11.15, effective Jan. 1, 2022.

A 15-minute rest period is also granted after every two hours of work. This doesn't apply to regular employees. Since Missouri law doesn't force employers to grant breaks for their employees, a Missouri worker doesn't have a minimum or maximum of working hours before a break.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

A. Yes, you are entitled to one hour of reporting time pay. Under the law, if an employee is required to report to work a second time in any one workday and is furnished less than two hours of work on the second reporting, he or she must be paid for two hours at his or her regular rate of pay.

15 minute break for 4-6 consecutive hours or a 30 minute break for more than 6 consecutive hours. If an employee works 8 or more consecutive hours, the employer must provide a 30-minute break and an additional 15 minute break for every additional 4 consecutive hours worked.

Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

The FLSA also defines what kind of behavior can be considered working. For example, the FLSA is the reason you do not get paid for your commute to work, but you should get paid for any work you do, no matter what the time or place.

FeffThe Fair Labor Standards Act (FLSA), governs the process that Compensation Analysts use to determine whether a position is either eligible for over-time pay for hours worked in excess of 40 per week (non-exempt) or is paid a flat sum for hours worked, even if they exceed 40 hours within a workweek (exempt).

Missouri law does not require employers to provide employees a break of any kind, including a lunch hour. These provisions are either left up to the discretion of the employer, can be agreed upon by the employer and employee, or may be addressed by company policy or contract.