A Missouri Complex Guaranty Agreement is a legally binding contract between a lender and a guarantor, typically used in complex financial transactions, such as commercial real estate loans or large-scale business acquisitions. This agreement acts as an added layer of security for the lender by ensuring that the guarantor will be held responsible for the loan payment obligations in case the borrower defaults. The Missouri Complex Guaranty Agreement lays out the terms and conditions under which the guarantor agrees to personally guarantee the repayment of the loan to the lender. It is crucial for both parties to fully understand the agreement and its implications before signing. Here are a few types of Missouri Complex Guaranty Agreements that may exist: 1. Full Recourse Guaranty: This type of guaranty holds the guarantor fully responsible for any outstanding loan balance, including interest, fees, and other costs associated with the loan, in case of default by the borrower. The lender can pursue the guarantor's personal assets to recover the amount owed. 2. Limited Recourse Guaranty: In this case, the guarantor's liability is limited to a specific amount or to predetermined assets. The lender may only have access to these assets if the borrower defaults, preventing the lender from pursuing the guarantor's other personal assets. 3. Non-Recourse Guaranty: This type of guaranty restricts the lender's ability to hold the guarantor personally liable for the loan. The lender can only seek recourse against the collateral securing the loan, such as the property involved in a real estate transaction. If the collateral is insufficient to cover the outstanding amount, the lender typically cannot pursue the guarantor's personal assets. Missouri Complex Guaranty Agreements often include provisions related to events of default, remedies, indemnification, release, governing law, jurisdiction, and dispute resolution. These agreements require careful review and negotiation to protect the interests of both parties involved. With the Missouri Complex Guaranty Agreement, the lender can have greater confidence in extending financing to borrowers engaged in complex transactions, knowing that a guarantor is committed to ensuring repayment. The agreement helps to mitigate the lender's risk and provides additional security, making it an essential tool in Missouri's commercial lending landscape.

Missouri Complex Guaranty Agreement to Lender

Description

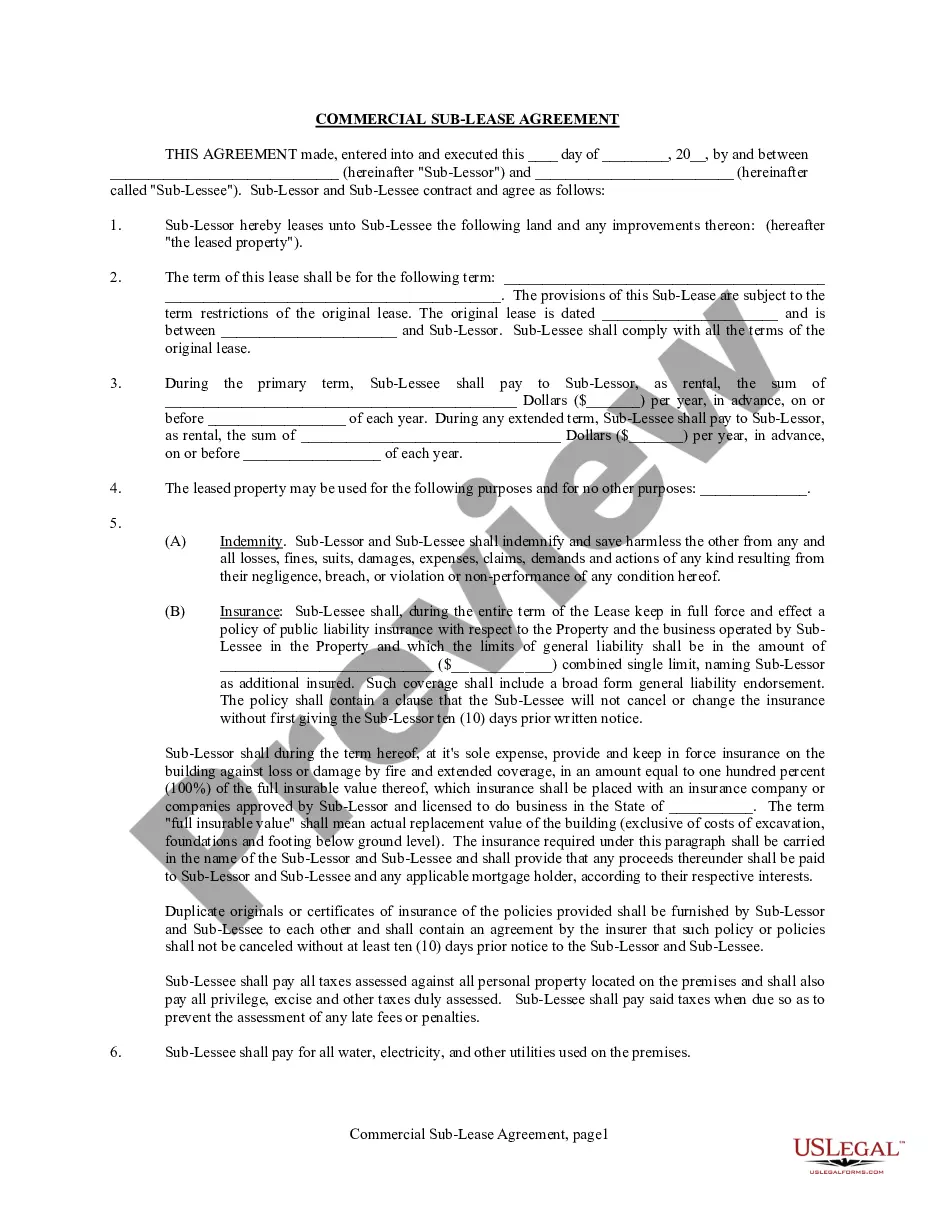

How to fill out Missouri Complex Guaranty Agreement To Lender?

Have you been within a position where you will need paperwork for both organization or personal purposes nearly every working day? There are a lot of legitimate papers templates accessible on the Internet, but getting versions you can rely is not easy. US Legal Forms gives 1000s of type templates, such as the Missouri Complex Guaranty Agreement to Lender, which can be published in order to meet federal and state needs.

If you are already acquainted with US Legal Forms website and possess your account, basically log in. Following that, you are able to acquire the Missouri Complex Guaranty Agreement to Lender template.

If you do not offer an account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the type you need and ensure it is for the correct metropolis/state.

- Take advantage of the Preview key to check the form.

- Browse the information to ensure that you have chosen the right type.

- If the type is not what you are looking for, make use of the Research discipline to find the type that fits your needs and needs.

- Once you discover the correct type, just click Acquire now.

- Select the rates plan you would like, fill out the specified information to generate your account, and pay for an order with your PayPal or bank card.

- Pick a practical data file file format and acquire your copy.

Find each of the papers templates you may have bought in the My Forms food selection. You can obtain a additional copy of Missouri Complex Guaranty Agreement to Lender anytime, if necessary. Just go through the required type to acquire or print out the papers template.

Use US Legal Forms, by far the most considerable variety of legitimate forms, to save lots of time as well as stay away from faults. The services gives appropriately manufactured legitimate papers templates that you can use for a variety of purposes. Produce your account on US Legal Forms and start generating your way of life easier.