Missouri Commercial Lease Agreement for Tenant

Description

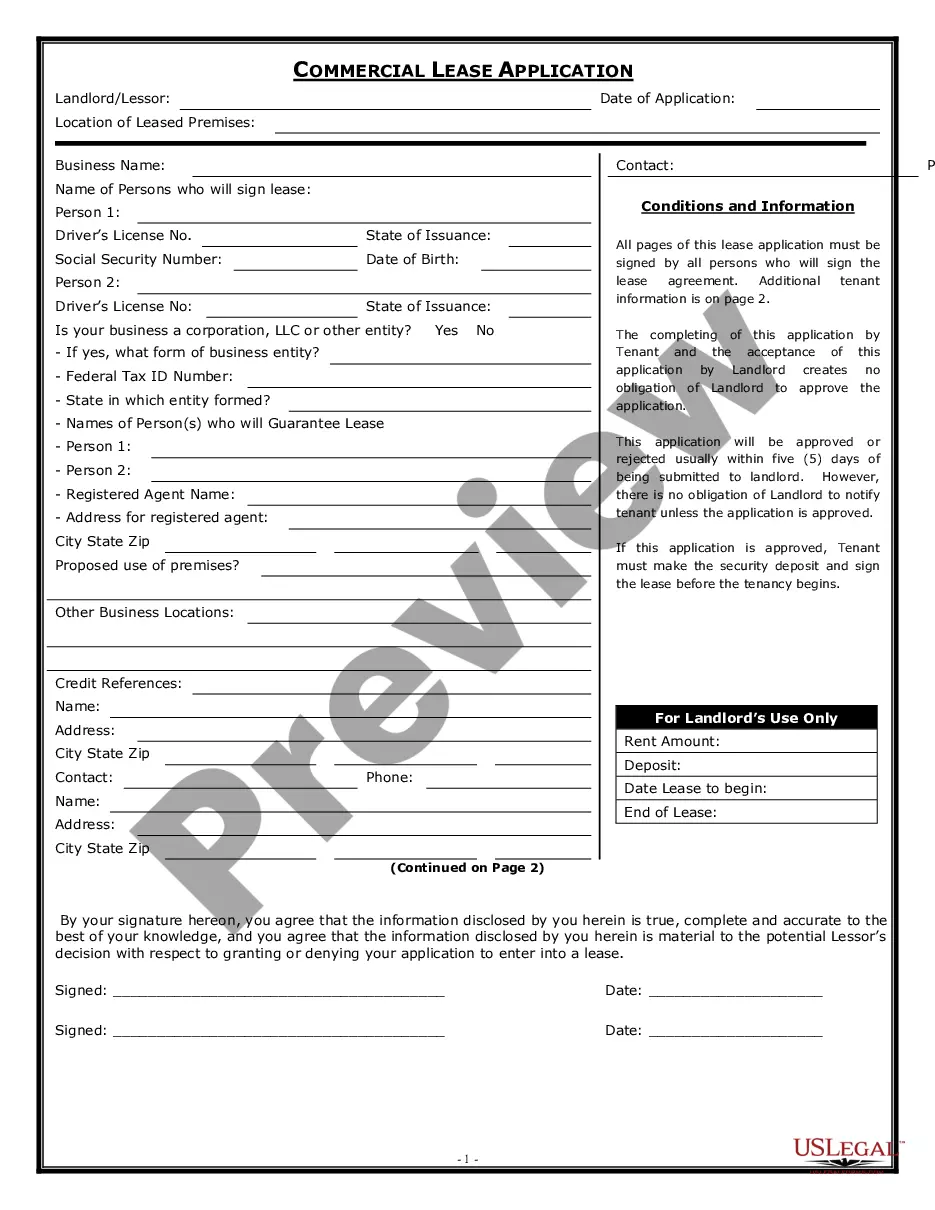

How to fill out Commercial Lease Agreement For Tenant?

You can invest hours online looking for the legitimate papers web template that meets the federal and state needs you require. US Legal Forms gives a large number of legitimate forms which can be examined by experts. You can actually down load or produce the Missouri Commercial Lease Agreement for Tenant from our service.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Obtain button. Afterward, you are able to full, revise, produce, or signal the Missouri Commercial Lease Agreement for Tenant. Each and every legitimate papers web template you purchase is your own property eternally. To have one more duplicate for any bought form, visit the My Forms tab and then click the related button.

Should you use the US Legal Forms internet site the very first time, keep to the basic recommendations beneath:

- Very first, make sure that you have chosen the right papers web template for the county/city of your choice. See the form information to make sure you have chosen the right form. If offered, take advantage of the Review button to look throughout the papers web template also.

- If you would like locate one more variation of the form, take advantage of the Lookup discipline to find the web template that meets your requirements and needs.

- Upon having identified the web template you want, click Buy now to proceed.

- Select the pricing strategy you want, key in your references, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal bank account to pay for the legitimate form.

- Select the file format of the papers and down load it to the device.

- Make adjustments to the papers if needed. You can full, revise and signal and produce Missouri Commercial Lease Agreement for Tenant.

Obtain and produce a large number of papers layouts using the US Legal Forms website, that offers the biggest selection of legitimate forms. Use professional and express-certain layouts to handle your business or individual requirements.

Form popularity

FAQ

A commercial lease is a contract made between a business tenant and a landlord. This commercial lease contract grants you the right to use the property for commercial or business purposes. Money is paid to the landlord for the use of the property.

The responsibilities of landlord and tenant will be clearly set out in the lease. Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.

No, lease agreements do not need to be notarized in Missouri. As long as the lease meets the criteria to be valid and legally binding, notarization is not necessary.

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.

Landlords are normally responsible for any structural repairs needed to maintain commercial properties. This includes exterior walls, foundations, flooring structure and the roof.

Commercial Tenants:Tenants must pay their rent on the due date agreed on in the lease with the landlord. Tenants cannot hold back rent because a landlord has failed to fulfill their obligations as outlined in the lease. Tenants must fulfill their obligations as outlined by the lease agreement.

Your landlord is responsible for any aspects of health and safety written in the lease (eg in communal areas). You must take reasonable steps to make sure your landlord fulfils these responsibilities. If you get into a dispute with your landlord, you need to keep paying rent - otherwise you may be evicted.

Commercial tenants may have the protection of the Landlord and Tenant Act 1954. The Act grants Security of Tenure to tenants who occupy premises for business purposes. The tenancy will continue after the contractual termination date until it is ended in one of the ways specified by the Act.